-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Powell's Second Term Seems Much Closer

EXECUTIVE SUMMARY

- FED CHAIR POWELL SEEN VISITING WHITE HOUSE ON THURSDAY (WSJ)

- SENATE SENSES POWELL PICK (AXIOS)

- ECB'S SCHNABEL ECB AWARE OF INFLATION FEARS; SEES POTENTIAL THREAT TO INDEPENDENCE (BBG)

- PBOC UPS GROSS LIQUIDITY INJECTION AGAIN, NET DRAIN STILL IN PLAY

- PBOC SEEN KEEPING MARKET LIQUIDITY AMPLE (FINANCIAL NEWS)

- KAISA, UNITS SUSPEND TRADING IN HONG KONG AFTER MISSED PAYMENTS (BBG)

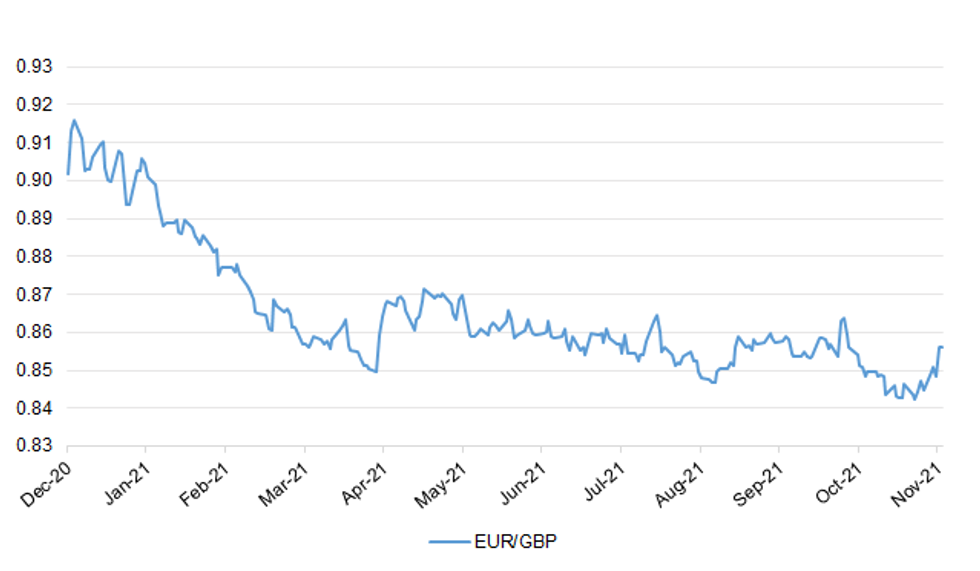

Fig. 1: EUR/GBP

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: France warned Boris Johnson yesterday that "all options" remained open to retaliate against Britain over fishing rights, after a meeting with the Brexit minister Lord Frost. Clément Beaune, the French Europe minister, said that there remained "significant differences" with the government about the process for awarding fishing licences, and retaliatory action remained a possibility. In a sign that both sides are keen to de-escalate the crisis the men agreed to meet again next week to "give a chance" for dialogue to succeed. "All the options are open and all the options are possible," Beaune said. Gabriel Attal, the French government spokesman, underlined that the threat of sanctions remained open: "We will see what comes with those meetings. (The Times)

BREXIT: Fishing is only one of the issues pitting Boris Johnson's government against France and the rest of the EU in the aftermath of Brexit. Another is the fight over the Northern Ireland protocol, under which the UK agreed to border checks in the Irish Sea to prevent a border on the island of Ireland. This meant the north would effectively remain in the EU single market and its frontier with EU member Ireland could remain open. Frost is due to discuss the issue with Maros Sefcovic, European Commission vice-president and EU Brexit negotiator, on Friday. (FT)

BREXIT: The UK government will face "significant challenges" in preparing the country's borders for the introduction of full customs controls on EU imports next year, the government spending watchdog has warned. In a report on the state of UK borders after the Brexit transition period, the National Audit Office said the government would need to work hard to make ready port infrastructure and educate EU traders on the new controls. While the EU introduced full border controls on UK exports to the bloc from January 1, the British government has three times delayed instituting its own checks in order to avoid delays at British ports. "The government has [been] prioritising [trade] flow over compliance. However, this cannot go on indefinitely. The current overall operating model for the EU-GB border is not sustainable," the watchdog warned. (FT)

ECONOMY: A shortage of candidates is hitting firms' recruitment plans and starting salaries for full-time and temporary staff have hit record levels, according to a report. Hiring has continued in recent weeks, although the availability of candidates fell sharply, a survey by the Recruitment and Employment Confederation (REC) and KPMG suggested. Strong demand for staff and a fall in labour supply drove the sharpest increases in starting pay since the survey began in 1997, said the report. Many of the 400 recruiters surveyed said a shortage of candidates affected their ability to fill vacancies. (The Times)

POLITICS: Boris Johnson's personal judgment was publicly questioned by senior Tories last night after he abandoned attempts to block the suspension of a senior MP for breaching lobbying rules. Owen Paterson, a former Conservative cabinet minister, resigned as an MP yesterday, blaming the "cruel world of politics" after the government dropped plans to pause his case and convene a new select committee to overhaul the standards system. (The Times)

POLITICS: Tory Party chiefs have been handed the initial findings of the Electoral Commission's probe into the luxury refurbishment of Boris Johnson's Downing Street flat, The Telegraph can reveal. Conservative Party headquarters now has the opportunity to respond to the body's ruling on whether donation rules were broken when Mr Johnson received financial support for the upgrades. The approaching end of the Electoral Commission's probe raises the possibility that Kathryn Stone, the Parliamentary Commissioner for Standards, could launch a third investigation into the issue. The Prime Minister has three times been the subject of investigations by Ms Stone, whose conclusion that the Tory MP Owen Paterson had broken lobbying rules led to a parliamentary battle over the standards system. But Downing Street sources on Thursday night categorically rejected the suggestion, made by Dominic Cummings, that Mr Johnson's support of changes to the system this week was a "preemptive strike" against Ms Stone. (Telegraph)

EUROPE

ECB: The European Central Bank is aware of people's fears about high inflation but is very unlikely to raise interest rates next year, and it is concerned that excessive criticism of its policies may endanger its independence, ECB board member Isabel Schnabel said on Thursday. The comments come just days after Germany's biggest tabloid Bild criticised the bank and its president, Christine Lagarde, over perceived insensitivity to the plight of ordinary people. Acknowledging inflation fears, Schnabel said tightening policy prematurely risked choking off growth. (RTRS)

ITALY: The Italian government on Thursday approved a bill that aims to boost competition in key sectors, a cornerstone of Prime Minister Mario Draghi's plan to streamline the country's sluggish bureaucracy. "We are starting a project of transparency," Draghi said during the cabinet meeting. The so-called Competition Decree seeks to reorganize waste management, public transportation, energy and telecoms, with new regulations making it easier to appoint some civil servants. The process of installing high-speed fiber optic infrastructure, a key investment area for the government, will be simplified. Draghi said the government is "mapping" all concessions, including those for beaches, mineral and thermal waters. (BBG)

ITALY: Italy's Banca Monte dei Paschi di Siena SpA posted its third straight quarterly profit and said it's ruling out a capital shortfall on a one-year horizon. (BBG)

PORTUGAL: Portugal's president has announced plans to dissolve parliament and call a snap election on 30 January. Marcelo Rebelo de Sousa cited the national assembly's rejection of the government's draft budget for 2022 - the first such occurrence in decades. He said the budget would be crucial as Portugal tries to exit the pandemic and an "economic and social crisis". The early election comes after a period of relative political stability under Prime Minister António Costa. (BBC)

GREECE: Greece recorded a new high of daily Covid-19 cases Thursday, reporting 6,808 infections in the past 24 hours, the most since the beginning of the pandemic. It was the fourth record high in the last five days, while the government announced Tuesday a number of restrictive measures targeting the unvaccinated people. Greece will open Nov. 5 the platform for everyone above 18 years old to get their booster shot, provided that it has been at least six months from the second one. (BBG)

SWEDEN: Swedish apartment prices rose by 7% in October from a year earlier, while house prices increased by 15%, according to statement from Svensk Maklarstatistik. Apartment prices rose 2% on a 3-month basis and 1% m/m. House prices were unchanged on both a 3-month basis and m/m. (BBG)

RATINGS: Potential sovereign rating updates of note scheduled for after hours on Friday include:

- Fitch on France (current rating: AA; Outlook Negative)

- Moody's on Italy (current rating: Baa3; Outlook Stable)

U.S.

FED: Federal Reserve Chairman Jerome Powell was seen visiting the White House on Thursday, according to people familiar with the matter. Mr. Powell's term leading the central bank is set to expire next February. President Biden told reporters on Tuesday that he would announce decisions "fairly quickly" on whether he was offering Mr. Powell another term or tapping someone else to succeed him. (WSJ)

FED: The White House is asking Democratic senators to meet with Federal Reserve chair Jerome Powell before Thanksgiving — leading some to believe President Biden will renominate him this month, people familiar with the matter tell Axios. (Axios)

FISCAL: The House plans to vote Friday on President Joe Biden's $1.75 trillion economic package and a separate infrastructure bill, after intense 11th-hour negotiations by Speaker Nancy Pelosi appeared to settle lingering differences. A vote on the massive tax and spending measure follows months of intra-party tension and disputes that carried into late Thursday night. Although much of the bill had been written, there were last- minute changes on modifying the state and local income tax deduction and a provision allowing Medicare to negotiate drug prices. Approval of the infrastructure measure, already passed by the Senate, will send it directly to Biden's desk. (BBG)

FISCAL: President Joe Biden's $1.75 trillion social-policy and climate-change legislation would raise less than $1.5 trillion in revenue, nonpartisan tax experts said on Thursday, but Democrats argued that the bill they aim to pass by Thanksgiving is paid for. The official U.S. Joint Committee on Taxation issued a report scoring the "Build Back Better" legislation's tax revenue provisions at $1.48 trillion over the next decade, some $270 billion short of the top-line spending figure. But House of Representatives Speaker Nancy Pelosi and Ways and Means Committee Chairman Richard Neal said the difference would be made up by provisions intended to enhance the Internal Revenue Service's tax collection and to lower the cost of prescription drugs for the Medicare healthcare program for the elderly. (RTRS)

FISCAL: U.S. Treasury Secretary Janet Yellen said on Thursday that investments and revenue provisions of President Joe Biden's social policy and climate change package would raise more than $2 trillion in offsets. That would make the entire package paid for over 10 years and reduce deficits over the long term, Yellen said in a statement. (RTRS)

CORONAVIRUS: Arizona, Florida, and Missouri have vowed to sue the Biden administration Friday to block an emergency rule mandating workplace Covid-19 vaccination or testing, with more lawsuits expected from Republican-led states and industry groups. Attorneys general in those three states said they'll file lawsuits early Friday, when the rule is officially published and will take effect. Ohio and Indiana's attorneys general also have pledged to challenge the regulation in court. Alabama and Georgia are expected to join Florida's suit. (BBG)

POLITICS: A White House aide who accompanied Joe Biden to international summits in Europe last week tested positive for coronavirus infection before the president returned to the U.S. Biden himself tested negative on Tuesday, the official said Thursday evening. (BBG)

POLITICS: The Manhattan district attorney has convened a second long-term grand jury to hear evidence about the Trump Organization's financial practices and potentially to vote on criminal charges, according to people with knowledge of the matter. (Washington Post)

OTHER

GLOBAL TRADE: The White House said on Thursday that it doesn't think the COVID-19 vaccine mandate they pushed will have an impact on supply chain issues affecting the U.S. economy. (RTRS)

GLOBAL TRADE: China will not allow global chipmakers to violate Chinese laws and regulations, whether forced or not, which may put Chinese technology companies at risk, the Global Times said in an editorial in response to reports that South Korean chipmakers may be the latest yielding to U.S. requests for sensitive business for boosting supply-chain transparency, which the government-run newspaper said is a disguise. U.S. access to sensitive data, which may seriously harm the interests of Chinese semiconductor-related industries, is a red flag for relevant firms to become more vigilant, the newspaper warned. China is the largest semiconductor market with significant chip application manufacturing capacity, so China should use its large size and manufacturing strength to gain more strategic initiative in the semiconductor supply chain by better organizing and coordinating downstream markets and manufacturing activities, the newspaper said. (MNI)

GLOBAL TRADE: The UK wants the U.S. to remove all tariffs on goods, and wants to start talks on dropping duties on steel and aluminum soon, London's ambassador to Washington said. "We very much look forward to starting our own talks with the administration on these issues," Karen Pierce said Thursday in an interview on Bloomberg Television's "Balance of Power With David Westin," adding that the U.K. hasn't put a timeline on the discussions. "We want to see all tariffs removed." (BBG)

GLOBAL TRADE: Britain could revive domestic production of super strong magnets used in electric vehicles and wind turbines with government support, to cut its reliance on China and achieve vital cuts in carbon emissions, two sources with direct knowledge said. (RTRS)

CORONAVIRUS: The case surge in Europe despite its access to vaccinations should be a warning shot for the world, a World Health Organization official said at a media briefing Thursday. Amid a wrong perception that the pandemic is moving toward the end, governments may be hesitant to make moves that seem like steps backward to their populations, according to Mike Ryan, head of the WHO's health emergencies program. "Every country needs to look at its strategic preparedness and response plan and look at the gaps in the system that exist right now and plug those holes," Ryan said. "Every country needs to ensure they can get through the next few months without systems going into collapse again. In many countries, that will require a course correction and a real focus on ensuring every person has had full vaccination." (BBG)

RBA: MNI BRIEF: RBA Keeps To 2024 Rate Rise On Inflation Outlook

- The Reserve Bank of Australia has updated its economic outlook, with new forecasts showing the bank does not see inflation moving into its target range before late 2023, which would be consistent with a 2024 interest rate rise - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's largest state said it would open domestic and international borders for fully vaccinated arrivals once 90% of the population aged over 12 had received two shots, in a shift away from one of the world's strictest Covid-Zero approaches. Western Australia Premier Mark McGowan on Friday said that reopening wouldn't be likely until around late January or early February when the target is expected to be achieved, dashing hopes that border restrictions might ease before Christmas. The current double dose level for the state is 63.7%. (BBG)

JAPAN: Japan is mulling 100,000 yen ($880) handouts for each young person or child aged 18 and under in its upcoming stimulus package, Finance Minister Shunichi Suzuki tells reporters Friday. Suzuki says he'll continue to consider the handouts while cooperating with the country's ruling parties. Handout funding is still under consideration. Fiscal health remains important for Japan and it's vital to keep striving for a balanced budget by the year ending March 2026. Prime Minister Fumio Kishida has instructed us to look at tax breaks for firms that hike wages, and details are still being hashed out. Hope planned 30-minute extension of the Tokyo Stock Exchange's trading hours will contribute to improving market functioning and Japan's competitiveness. (BBG)

RBA: MNI INTERVIEW: Households Can Manage Higher Rates-RBA's Harper

- Higher interest rates in Australia are unlikely to create significant problems for mortgage serviceability because household assets had grown sharply alongside debt levels, according to Reserve Bank of Australia Board member, Professor Ian Harper - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: The Commonwealth Bank has followed Westpac in hiking mortgage rates shortly after the Reserve Bank dumped its yield curve target this week. The three-year fixed home loan rate for owner-occupiers is now 40 basis points higher at 2.69 per cent at CBA, while the four-year fixed rate is up by 50 basis points to 2.89 per cent. CBA lifted the five-year fixed mortgage rate 10 basis points to 3.09 per cent. "These changes reflect the steep increase in funding costs over the past few weeks as well as upgraded economic forecasts. These changes are effective November 5, 2021," a CBA spokesman said. It follows Westpac's rate hike last night and the RBA's decision earlier this week to abandon its yield curve target after a sell-off that thrust the yield on the April 2024 bond several times higher than its target of 0.1 per cent. (AFR)

AUSTRALIA: Australia's largest state said it would open domestic and international borders for fully vaccinated arrivals once 90% of the population aged over 12 had received two shots, in a shift away from one of the world's strictest Covid-Zero approaches. Western Australia Premier Mark McGowan on Friday said that reopening wouldn't be likely until around late January or early February when the target is expected to be achieved, dashing hopes that border restrictions might ease before Christmas. The current double dose level for the state is 63.7%. (BBG)

CANADA: Ontario's budget deficit is on pace to narrow significantly this fiscal year as it collects billions of dollars in additional tax revenues from economic growth, inflation and the return of workers to the labor force. The government of Canada's most populous province sees a budget shortfall of C$21.5 billion ($17.3 billion) for the fiscal year ending March 31, the Ministry of Finance said in an economic update Thursday. That compares to C$32.4 billion in the most recent projection. The next two fiscal years are also expected to see fiscal improvement, with deficits expected to decline to C$19.6 billion and C$12.9 billion in fiscal 2023 and 2024, respectively. Key to the improving outlook is a flood of new revenue. Ontario is raising its revenue projections to C$168.6 billion, up about C$12 billion from its most recent estimate. (BBG)

CANADA: MNI BRIEF: Canada Regulator Cites Supply In Home Price Surge

- Canada's top bank regulator linked the surge in the country's housing prices to a lack of supply, noting that past efforts at regulation have focused on reining in demand - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CANADA: MNI BRIEF: Canada Lifts Freeze on Bank Dividends and CEO Pay

- Canada's bank regulator on Thursday lifted a freeze on increases to dividends, executive compensation and share buybacks, saying the emergency conditions of the pandemic have subsided - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BRAZIL: Brazilian parties that are part of the opposition to Jair Bolsonaro's government are putting pressure on their congressmen to kill a bill that loosens the country's spending cap. The proposal that helps fund Bolsonaro's new signature social program, providing cash handouts of 400 reais ($72) to poor families in the run-up to next year's elections, passed a first-round vote early Thursday with 312 votes, just four over the 308 needed. Another 144 lawmakers voted against the bill. Because the bill changes the constitution, it still needs to go through a second vote in the lower house, which was scheduled for next Tuesday. If it's approved, it will then be sent to the Senate, where it will undergo a similar process. (BBG)

SOUTH AFRICA: The governing African National Congress (ANC) has dipped below 50% of the vote for the first time in South Africa's democratic history. Results from Monday's local elections have left the party of Nelson Mandela politically wounded. "We are eating this elephant bit by bit," were the words echoed by Julius Malema, the leader of third biggest party the Economic Freedom Fighters, as a clear picture emerged that the ANC was losing support across the country. Yet there is no anti-ANC majority coalition, because South Africa's opposition parties are ideologically very divided. (BBC)

OIL: Any decision on whether the United States will tap its emergency oil reserve in order to lower crude prices is up to President Joe Biden, a senior Department of Energy official told reporters on Thursday. "We're looking at all tools, and at the end of the day the president is going to decide what we end up doing," said the official when asked if the administration was going to tap the Strategic Petroleum Reserve, or SPR. The White House on Thursday criticized a decision by top oil producers to stick to plans to only raise output gradually even as demand recovers as the COVID-19 pandemic eases. (RTRS)

OIL: The White House said on Thursday OPEC and its allies had the power to put more oil on the market and influence gasoline prices while the United States operated on a system in which oil producing companies made their own decisions on supply. (RTRS)

OIL: Oil demand may grow by 5-6 million bpd in 2021, Russian Deputy Prime Minister Alexander Novak said in a televised interview with Russia-24 news channel on Thursday. "At present, we see the market recover. This year we expect demand to surge by about five to six million barrels per day," he said. (TASS)

OIL: Kuwait has nominated its former OPEC governor, Haitham al-Ghais, to serve as the organization's secretary general, according to sources -- the first contender to succeed Mohammed Barkindo, whose term expires in July. (Platts)

CHINA

PBOC: PBOC has boosted liquidity injection via reverse repos since Nov. 3, which shows the central bank aims to keep liquidity at reasonably ample level, Financial News reports, citing unidentified analysts. Worries on liquidity impact from maturities of large amounts reverse repos are unnecessary as the PBOC has managed to stabilize market expectation with liquidity operations, report cites Everbright Securities analyst Zhang Xu as saying. Money market interest rates are expected to fluctuate steadily around rates of PBOC's open-market operations, according to the PBOC-backed paper. (BBG)

PBOC: PBOC Deputy Governor Chen Yulu says China must prevent systemic financial risks when further opening up the financial sector, Jiemian reports, citing Chen's speech at the China International Import Expo in Shanghai. China will make financial supervisions more effective and set up firewalls, the report says, without giving details. China will push forward opening and cooperation in the financial sector via negative lists in future free-trade negotiations. (BBG)

MONEY SUPPLY: China's growth rate of aggregate finance is expected to bottom out, with analysts expecting aggregate finance to increase by over CNY1.6 trillion in October, due to the accelerated release of loans for developers and home buyers as well as high level of government bond issuance, the Securities Times reported citing analysts. Real estate financing has become an important factor constraining the rebound in aggregate finance given to less property loans, declining developers' bond sales and sharply falling trust funds to the sector, the newspaper said. Though the financing environment for developers has relaxed, credit growth in the sector will still lag the overall credit growth as the cooling housing market is discouraging mortgage loans, the Times said citing Wang Qing, chief analyst at Golden Credit Rating. (MNI)

PROPERTY: Shares of Kaisa Group Holdings Ltd. and several units were suspended from trading in Hong Kong on Friday morning, a day after the Chinese developer flagged liquidity pressure and said it missed payments on wealth products it guaranteed. Kaisa Capital Investment Holdings Ltd., Kaisa Health Group Holdings Ltd. and Kaisa Prosperity Holdings Ltd. were also halted. No reason was given for the suspension. Kaisa shares and bonds tumbled Thursday after the company said it has faced "unprecedented pressure on its liquidity" due to unfavorable factors such as credit rating downgrades and a challenging property market environment. Kaisa became a focus of investor concern after it canceled meetings with investors in October, triggering doubts about its liquidity and sending its dollar bonds lower. (BBG)

PROPERTY: MNI: China Property Calm May Precede More Dollar Defaults

- Chinese property developers are scrambling to regain investor confidence in the wake of the Evergrande scare, but further defaults may be inevitable as tens of billions of dollars in debt come due over the next year and authorities insist on longer-term plans to reduce leverage in property sector, policy advisors and industrial experts told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

WEALTH MANAGEMENT: Regulators in several Chinese provinces ordered city commercial banks to cap their wealth management assets at current levels, Caixin learned Thursday from industry insiders. Authorities issued the order in verbal guidance to the banks, the industry insiders said, without offering a reason. China's $13 trillion asset-management industry is nearing a year-end deadline for complying with sweeping new rules. Under the overhaul, commercial banks are required to set up separate units to conduct business related to wealth management products (WMPs). Financial institutions that aren't in position to do so for the time being are supposed to establish special wealth management departments. (Caixin)

CORONAVIRUS: China's latest Covid-19 outbreak continues to grow as it shifts east through the nation's rust belt, prompting officials to implement increasingly stringent prevention measures in an effort to control it. The country's health commission reported 68 local confirmed cases on Friday, plus 22 additional infections that didn't cause any symptoms. Heilongjiang province in the northeast, which accounted for more than one-third of the total, has become the latest epicenter as a mysterious cluster that emerged in the northern border town Heihe ballooned despite a city-wide lockdown. (BBG)

ENERGY: China's daily coal output hit 11.2 million tonnes on Nov. 3, rising around 1 million tonnes from early October, close to a record high this year amid a raft of measures to ramp up production. Coal inventories at power houses across the country had exceeded 112 million tonnes as of Wednesday, up by more than 31 million tonnes from end-September, and have clawed back to the "normal level" in the previous years, the NDRC said. It also said that with production boost measures to be implemented continually and more coal mines resuming operation after overhauls, China's daily coal output is expected to continue increasing and could break above 12 million tonnes. (RTRS)

OVERNIGHT DATA

JAPAN SEP HOUSEHOLD SPENDING -1.9% Y/Y; MEDIAN -3.5%; AUG -3.0%

AUSTRALIA OCT FOREIGN RESERVES A$76.0BN; SEP A$82.1BN

SOUTH KOREA SEP BOP CURRENT ACCOUNT BALANCE +$10.0677BN; AUG +$7.5123BN

SOUTH KOREA SEP BOP GOODS BALANCE +$9.4542BN; AUG +$5.6357BN

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Friday. The operation led to a net drain of CNY100 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1714% at 09:25 am local time from the close of 2.1129% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3980 FRI VS 6.3943

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3980 on Friday, compared with the 6.3943 set on Thursday.

MARKETS

SNAPSHOT: Powell's Second Term Seems Much Closer

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 179.71 points at 29612.42

- ASX 200 up 28.911 points at 7456.9

- Shanghai Comp. down 15.972 points at 3510.01

- JGB 10-Yr future up 23 ticks at 151.83, yield down 1.3bp at 0.060%

- Aussie 10-Yr future up 2.0 ticks at 98.165, yield down 1.9bp at 1.813%

- U.S. 10-Yr future -0-04 at 131-06, yield up 0.89bp at 1.535%

- WTI crude up $0.56 at $79.38, Gold up $4.43 at $1796.45

- USD/JPY down 8 pips at Y113.68

- FED CHAIR POWELL SEEN VISITING WHITE HOUSE ON THURSDAY (WSJ)

- SENATE SENSES POWELL PICK (AXIOS)

- ECB's SCHANBEL ECB AWARE OF INFLATION FEARS; SEES POTENTIAL THREAT TO INDEPENDENCE (BBG)

- PBOC UPS GROSS LIQUIDITY INJECTION AGAIN, NET DRAIN STILL IN PLAY

- PBOC SEEN KEEPING MARKET LIQUIDITY AMPLE (FINANCIAL NEWS)

- KAISA, UNITS SUSPEND TRADING IN HONG KONG AFTER MISSED PAYMENTS (BBG)

BOND SUMMARY: Mixed Trade for Core FI

With oil futures back from their early Asia highs and ACGBs bid post-SOMP, the U.S. Tsy space regained some ground after a soft start to Asia-Pac trade. Note that a tweak to the PBoC's daily OMOs also provided a helping hand. TYZ1 last -0-04 at 131-06, while cash Tsys run 0.5-1.0bp cheaper across the curve, as the belly provides some incremental underperformance. Odds of Fed Chair Powell being nominated to serve a second term rose after the WSJ reported that he was seen at the White House on Thursday, while Axios sources noted that "the White House is asking Democratic senators to meet with Federal Reserve chair Jerome Powell before Thanksgiving - leading some to believe President Biden will renominate him this month." NFPs headline the local docket on Friday, with Fedspeak from Geroge & Quarles also due. BoE speak is also set to provide some interest (and potential cross-market impact) in the wake of yesterday's inaction on Threadneedle Street.

- JGB extended their overnight gains as local participants reacted to the BoE-driven overnight bid, before paring back from best levels into the lunch break. A bid then came back in during the afternoon session, with a lack of meaningful fiscal upheaval clearly evident in the latest round of communique from both the Finance & Economy Minister. The major cash JGB benchmarks run little changed to 1.5bp richer, with bull steepening in pay as the long end lags. We also saw Japanese Finance Minister Suzuki confirm earlier speculation re: the government considering Y100K handouts for under 18s, while underlining the need for fiscal discipline.

- There was a sharp move lower in Aussie bond futures into the close, leaving YM +4.0 and XM +2.0 come the bell. The former broke its early Sydney low, while the latter tested its own Sydney low. There was no headline flow to account for the move, perhaps a case of locals undertaking some pre-NFP book squaring. The space had moved away from early Sydney lows on the back of the RBA SoMP, which saw a slightly harder lean towards the RBA maintaining '24 as the timing of the first cash rate hike as its base case vs. Tuesday's communique, although there is clearly some optionality embedded. PBoC OMO liquidity dynamics also provided some support. The cover ratio at the latest ACGB Apr-25 auction wasn't particularly firm, with the recent vol. and removal of micro curve interest likely resulting in a much less aggressive stance when it came to capital deployment. Still, the pricing on the auction was far more encouraging, with the weighted average yield printing 0.87bp through prevailing mids (per Yieldbroker). The well-documented supportive factors and hedgability of the line (flagged ahead of the auction) ultimately prevailed, providing smooth passage.

JGBS AUCTION: Japanese MOF sells Y3.4980tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.4980tn 3-Month Bills:

- Average Yield -0.1213% (prev. -0.1143%)

- Average Price 100.0326 (prev. 100.0307)

- High Yield: -0.1172% (prev. -0.1117%)

- Low Price 100.0315 (prev. 100.0300)

- % Allotted At High Yield: 24.9513% (prev. 62.4950%)

- Bid/Cover: 4.602x (prev. 4.974x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 3.25% 21 Apr '25 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 3.25% 21 April 2025 Bond, issue #TB139:

- Average Yield: 1.0468% (prev. 0.2696%)

- High Yield: 1.0500% (prev. 0.2700%)

- Bid/Cover: 3.2500x (prev. 8.0786x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 37.2% (prev. 79.5%)

- Bidders 30 (prev. 51), successful 16 (prev. 9), allocated in full 11 (prev. 2)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 9 November it plans to sell A$150mn of the 0.75% 21 November 2027 Indexed Bond.

- On Wednesday 10 November it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

- On Thursday 11 November it plans to sell A$1.0bn of the 11 February 2022 Note & A$1.0bn of the 22 April 2022 Note.

- On Friday 12 November it plans to sell A$1.0bn of the 0.25% 21 November 2025 Bond.

EQUITIES: Equities Marginally Mixed In Asia

There was a lack of uniformity in equity trade during Asia-Pac hours, with the Nikkei 225 ticking lower after the JPY regained some poise over the last 24 hours on cross-market yield dynamics post-BoE. The Hang Seng also lost ground, with Chinese tech names under the microscope as we grind towards earnings reports from Tencent & Alibaba. Chinese property developers also continue to be scrutinised, with Kaisa Group suspending trade in Hong Kong after it missed payments on wealth management products. Another uptick in PBoC gross liquidity injections via OMOs allowed the CSI 300 to register incremental gains, although CNY780bn has been drained out of the market over the last 5 days, as the PBoC removed the bulk of its month-end liquidity provisions. Still, the major regional indices sit within 1.0% of Thursday's closing levels as we head towards the weekend. U.S. e-mini futures are virtually unchanged ahead of Friday's NFP print.

OIL: A Touch Higher Overnight, But Comfortably Away From Recent Peak

WTI & Brent futures sit ~$0.80 above their respective settlement levels, after shedding ~$2.00 & $1.50 respectively on Thursday. Yesterday's losses were spurred by news that Saudi crude production will soon top 10mn bpd (for the first time since it was impacted by the pandemic), while a firmer USD also applied pressure. In other news, the OPEC+ group stuck to its guns, deciding to boost its output by the previously outlined cumulative 400K bpd in December, ignoring the calls of oil consuming nations re: larger boosts of supply.

- This has resulted in the U.S. DoE noting that it is looking at "all tools," while the White House flagged the power to put more oil onto the market if required.

- Goldman Sachs noted that their "bullish view remains unchanged: the oil deficit remains unresolved, the current strength in oil demand remains a near-term tailwind and the increasingly structural nature of the deficits will require much higher long-dated oil prices. The now open disagreement between OPEC and the US administration, the threat of an SPR release and the potential resumption in negotiations with Iran will nonetheless increase the volatility in oil prices in coming weeks, especially as trading liquidity falls into year-end."

GOLD: NFPs In View

Spot gold has hugged a tight range during Asia-Pac hours, last dealing virtually unchanged, just above $1,790/oz. The BoE driven bid allowed gold to firm on Thursday, with the impetus from lower U.S. real yields outweighing the uptick in the DXY, although bulls were not able to force their way through $1,800/oz in spot trade, leaving the recently observed range (and technical overlay) well and truly intact. A softer than expected U.S. labour market report may be the catalyst to facilitate a test of key resistance at the Oct 22 high ($1,813.8/oz), while notable near-term support, located at the Oct 6 low ($1,746/oz) may prove a little too far out of reach on a stronger than expected labour market report.

FOREX: Yen Poised To Finish Week Atop G10 Pile

Defensive feel dominated in Asia, as Kaisa Group's troubles with liquidity reignited concerns about a deepening crisis in China's property sector. USD/CNH edged higher, even as the PBOC put an end to a multi-day streak of softer than expected yuan fixings.

- Risk-off flows were evident in G10 FX space, with the yen garnering most strength. A correction in global monetary policy outlook may have played a role, after the BoE's surprise decision to leave interest rates unchanged fuelled reassessment of tightening prospects. The yen had earlier underperformed on expectations of a growing policy divergence, as the BoJ have been expected to continue pumping stimulus maintain accommodative policy settings.

- Antipodean currencies brought up the rear. In their latest Statement on Monetary Policy, the RBA said that their central scenario "could be consistent with the first increase in the cash rate being in 2024."

- U.S. NFPs headline the global data docket today. Also coming up are German industrial output & Canadian jobs data. In addition, we will hear from several ECB, BoE & Norges Bank policymakers.

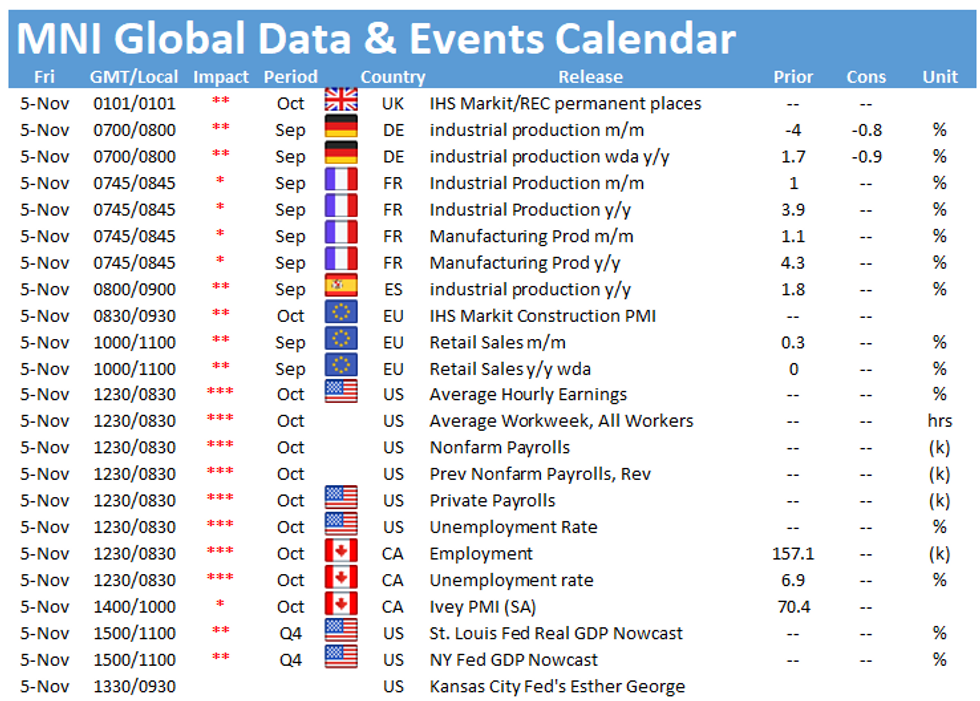

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.