-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI EUROPEAN OPEN: RBNZ Delivers Expected Hike, Signals More To Come

EXECUTIVE SUMMARY

- BIDEN’S FED VICE CHAIR SEARCH SEEN FOCUSING ON THREE EX-TREASURY OFFICIALS UNDER OBAMA (BBG)

- RISHI SUNAK WEIGHS 5% PUBLIC-SECTOR PAY OFFER TO END WAVES OF STRIKES (FT)

- NEW ZEALAND RAISES RATE BY HALF-POINT, STILL SEES 5.5% PEAK (BBG)

- BIDEN: UKRAINE WILL NEVER BE A VICTORY FOR RUSSIA - NEVER (ET)

- FIRE-DAMAGED FREEPORT LNG GETS U.S. APPROVAL FOR PARTIAL RESTART (RTRS)

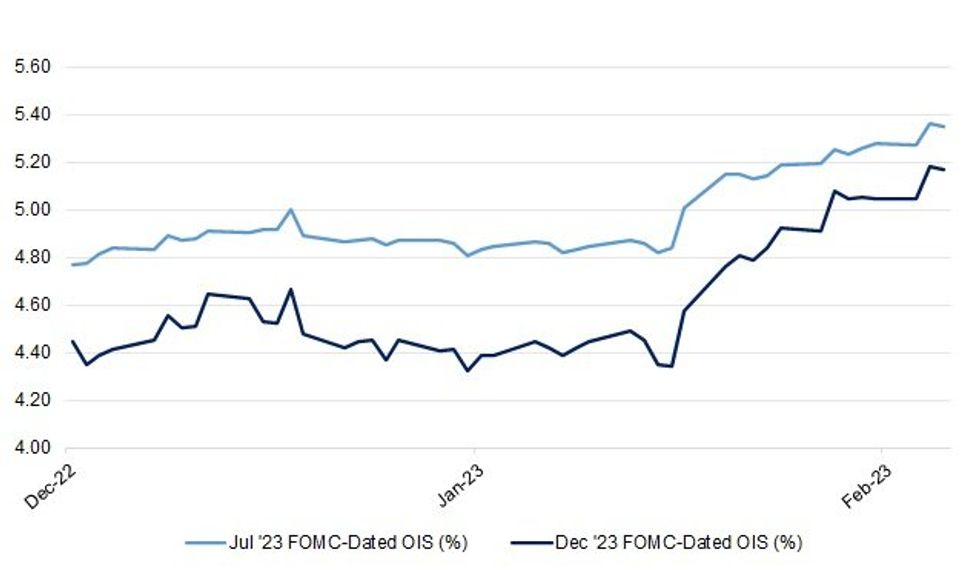

Fig. 1: Jul & Dec '23 FOMC-Dated OIS (%)

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British employers offered the biggest annual pay rises in 32 years during the three months to the end of January, but these increases are still a long way behind double-digit inflation, industry data showed on Wednesday. (RTRS)

FISCAL/ECONOMY/POLITICS: The government has recommended offering millions of public sector workers below inflation pay increases. Judges, police officers, teachers, nurses doctors and dentists in England will be offered a 3.5% pay increase under proposals. (BBC)

FISCAL/ECONOMY/POLITICS: UK prime minister Rishi Sunak is exploring a 5 per cent pay rise for public sector workers to end an escalating wave of strikes after the Treasury was given an unexpected £30bn windfall. (FT)

FISCAL/ECONOMY/POLITICS: Nurses in the UK suspended further strikes, saying they’re entering intensive talks with ministers in a move to unlock a dispute over pay, even as the government suggested it has limited scope to raise wages next fiscal year. (BBG)

BREXIT: Prime minister Rishi Sunak has secured the backing of two key senior Brexiter cabinet ministers as he attempts to face down Tory critics of a deal to settle the row over Northern Ireland’s post-Brexit trading rules. (FT)

BREXIT: Rishi Sunak faced down threats of dissent over his post-Brexit Northern Ireland plans as the UK and EU inched closer to a deal to end the current stalemate. (iNews)

U.S.

FED: The White House is eyeing three former Obama administration Treasury officials as potential nominees for Federal Reserve vice chair, according to an Evercore ISI analyst with past ties to President Joe Biden. (BBG)

POLITICS: The forewoman of the Georgia grand jury that investigated former President Donald Trump and allies for election interference in the 2020 presidential race said jurors recommended a prosecutor charge multiple people with a range of crimes, according to a new report Tuesday. (CNBC)

OTHER

GLOBAL TRADE: Germany is planning to introduce tax credits for solar, wind and grid investments in response the US Inflation Reduction Act. (BBG)

U.S./CHINA/TAIWAN: Taiwan’s Foreign Minister Joseph Wu and National Security Council Secretary-General Wellington Koo met with US officials in Washington area, Taiwan’s official Central News Agency reports. (BBG)

U.S./CHINA/TAIWAN: It’s reasonable and legitimate to punish foreign entities involved in arms sales to Taiwan, which undermines China’s sovereignty and territorial integrity, Zhu Fenglian, a spokeswoman with Taiwan Affairs Office of the State Council, says at a briefing in Beijing. (BBG)

NATO: President Joe Biden said on Tuesday the United States will host a NATO summit next year as the defense alliance turns 75 years old. "Let there be no doubt, the commitment of the United States to our NATO alliance and Article 5 is rock solid, Biden said in a speech in Warsaw, referring to NATO tenet that an attack on one member is an attack on all. "Every member of NATO knows it. And Russia knows it as well: an attack against one is an attack against all." (RTRS)

BOJ: Bank of Japan board member Naoki Tamura said on Wednesday that the BOJ will need to review its policy framework and inflation target in due course and assess favorable and unfavorable impacts of easy policy. (MNI)

BOJ: Bank of Japan board member Naoki Tamura said on Wednesday that he cannot rule out the possibility that Japan’s inflation rate will be stronger than expected as the pace of services price rises are accelerating. (MNI)

BOJ/JAPAN: For more than half a century, Japan’s corporate giants have held annual negotiations with labor unions to decide pay increases for the year ahead. Never have those talks meant so much to so many beyond the workers themselves. (BBG)

JAPAN: Toyota Motor Corp, the world's biggest automaker, will accept a union demand in full for a rise in wages and bonus payments for a third consecutive year, the Asahi newspaper reported on Wednesday. (RTRS)

AUSTRALIA: Australia’s plan to channel its vast pool of pension savings towards “nation-building” investments in clean energy and social care need not come at the expense of returns, Treasurer Jim Chalmers has insisted in an interview with the Financial Times. (FT)

RBNZ: New Zealand’s central bank raised interest rates by half a percentage point, slowing its pace of tightening, but signaled further hikes will be needed to tame inflation. (BBG)

NEW ZEALAND: The Government will open the books and release Budget 2023 on May 18, Finance Minister Grant Robertson says. “This year’s budget will be delivered in the shadow of Cyclone Gabrielle and will be focused on cost of living and cyclone and flooding recovery,” Robertson announced on Wednesday. ”Budget 2023 will also focus on what matters most to New Zealanders, with the cost of living a top priority. (Stuff NZ)

SOUTH KOREA: South Korean Finance Minister Choo Kyung-ho says a “considerably difficult” environment is likely to continue in the economy through at least 1H, speaking at a parliament subcommittee. (BBG)

NORTH KOREA: North Korea could test-fire intercontinental ballistic missiles at a normal angle and conduct its seventh nuclear test this year to perfect its nuclear and missile capabilities, South Korean lawmakers said on Wednesday, citing intelligence officials. (RTRS)

HONG KONG: Hong Kong’s finance chief on Wednesday revealed his latest budget blueprint, with the goal to boost recovery momentum in the aftermath of the Covid-19 pandemic. (SCMP)

TURKEY: Turkey bans layoffs throughout the 3-month state of emergency in quake-hit provinces, according to official gazette. (BBG)

RUSSIA: Russia carried out a test of an intercontinental ballistic missile that appears to have failed while President Joe Biden was in Ukraine on Monday, according to two US officials familiar with the matter. (CNN)

RUSSIA: Russia will continue to observe limits on the number of nuclear warheads it can deploy as outlined in the New START treaty despite President Vladimir Putin's decision to suspend Moscow's participation in the landmark agreement, the foreign ministry said on Tuesday. (RTRS)

RUSSIA: The Russian Duma, the lower house of parliament, will on Wednesday consider President Vladimir Putin's draft law on suspending participation in the New START treaty and immediately make a decision on it, speaker Vyacheslav Volodin said on Tuesday. The Duma will then send the draft law to the Federation Council upper house, he said in a statement. (RTRS)

RUSSIA: Russia and the United States should resume full implementation of the landmark nuclear arms control New START treaty, United Nations spokesman Stephane Dujarric said on Tuesday. "A world without nuclear arms control is a far more dangerous, unstable one, with potentially catastrophic consequences. Every effort should be taken to avoid this outcome, including an immediate return to dialogue," he said. (RTRS)

RUSSIA: President Volodymyr Zelenskiy said on Tuesday that Ukrainian forces were maintaining their positions on the front line in the east after Russia reported it was advancing on its main target in the area. (RTRS)

RUSSIA: US President Joe Biden on Tuesday said wartorn Ukraine would "never be a victory for Russia" as he delivered a speech in Poland ahead of the first anniversary of Russia's invasion. (Economic Times)

RUSSIA: The United States is still hoping for a quick end to Russia's war in Ukraine, but stands ready to support Ukraine over the long term, Deputy Treasury Secretary Wally Adeyemo told Reuters on Tuesday, when asked if Ukraine faced a "long war. (RTRS)"

RUSSIA: The US is providing Ukraine a long-range GPS-guided bomb made by Boeing Co. that’s capable of hitting targets 45 miles away, industry officials said. (BBG)

RUSSIA: Italy's far-right Prime Minister Giorgia Meloni arrived in Ukraine on Tuesday morning as the latest Western ally to meet with President Zelenskyy and discuss military aid. (Deutsche Welle)

RUSSIA: The Biden administration is expected to impose fresh sanctions on about 200 Russian individuals and entities this week, according to people familiar with the matter, in a push to tighten the sanctions net around the country a year after its invasion of Ukraine. (WSJ)

RUSSIA/CHINA: Top Chinese diplomat Wang Yi arrived in Moscow, where he is expected to meet with Russian President Vladimir Putin and reaffirm the two countries' relationship in the face of heightened tensions with the U.S. (Nikkei)

EQUITIES: Hong Kong Exchanges & Clearing Ltd. is exploring arrangements to continue trading under severe weather in a bid to facilitate investor transactions amid wider trends of remote working in the finance industry. (BBG)

ENERGY: Freeport LNG, the second largest U.S. liquefied natural gas exporter, said on Tuesday that federal regulators had approved it to partially restart commercial operations at its Texas plant after an outage that lasted more than eight months. (RTRS)

CHINA

PBOC: The PBOC will maintain a prudent policy stance in 2023 as it uses targeted policy tools to provide precision support to specific industries, according to the 21st Century Herald. (MNI)

FDI: China is a hot spot for foreign investment as January data showed an increase in foreign investment, Vice Minister of Commerce Guo Tingting said in a recent interview with state media. (MNI)

ECONOMY: Retail sales of passenger cars in February are expected to be up 0.7% y/y and 2.4% m/m, according to a statement from the Passenger Car Association. (MNI)

INFRASTRUCTURE: China’s infrastructure investment growth could reach 10% in the first quarter partly on acceleration of public-private partnership projects, Securities Daily reported Wednesday, citing analysts. (BBG)

POLICY: China plans to ramp up basic technological and scientific research to solve key technical problems, according to state media on Wednesday. (RTRS)

POLICY: China should prioritise investment in infrastructure and next generation industries to drive the structural reform needed to deliver long-term growth and productivity gains at a time when the property market is dragging on growth, former People’s Bank of China adviser Huang Yiping told MNI. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY97 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY300 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY97 billion after offsetting the maturity of CNY203 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable towards the end of month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 9:28 am local time from the close of 2.1523% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday, compared with the close of 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8759 WEDS VS 6.8557 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8759 on Wednesday, compared with 6.8557 set on Tuesday.

OVERNIGHT DATA

JAPAN JAN SERVICES PPI +1.6% Y/Y; MEDIAN +1.5%; DEC +1.5%

AUSTRALIA Q4 WAGE PRICE INDEX +0.8% Q/Q; MEDIAN +1.0%; Q3 +1.1%

AUSTRALIA Q4 WAGE PRICE INDEX +3.3% Y/Y; MEDIAN +3.5%; Q3 +3.2%

AUSTRALIA Q4 COMPLETED CONSTRUCTION WORK -0.4% Q/Q; MEDIAN +1.5%; Q3 +3.7%

AUSTRALIA JAN WESTPAC LEADING INDEX -0.08 M/M; DEC -0.19%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, was -1.04% in January, largely unchanged on the -1.09% read in December. (Westpac)

NEW ZEALAND JAN TRADE BALANCE -NZ$1.954BN; DEC -NZ$636MN

NEW ZEALAND JAN EXPORTS NZ$5.47BN; DEC NZ$6.52BN

NEW ZEALAND JAN IMPORTS NZ$7.42BN; DEC NZ$7.16BN

NEW ZEALAND JAN TRADE BALANCE 12-MONTH YTD -NZ$15.477BN; DEC -NZ$14.630BN

NEW ZEALAND JAN CREDIT CARD SPENDING +17.9% Y/Y; DEC +12.4%

NEW ZEALAND JAN CREDIT CARD SPENDING +4.4% M/M; DEC -1.6%

SOUTH KOREA MAR MANUFACTURING BUSINESS SURVEY 66; FEB 65

SOUTH KOREA MAR NON-MANUFACTURING BUSINESS SURVEY 74; FEB 70

SOUTH KOREA Q4 SHORT-TERM EXTERNAL DEBT US$166.7BN; Q3 US$170.9BN

MARKETS

US TSYS: Marginally Richer In Asia, Regional Matters Dominate

TYH3 deals at 111-03+, -0-01+, in the middle an 0-08 range on elevated volume of ~183K.

- Cash Tsys sit 1-2bps richer across the major benchmarks.

- Weakness in JGBs weighed on Tsys in early dealing, TY futures briefly looked below Tuesday's low.

- Spillover from ACGBs in lieu of Australian Q4 wage data aided a recovery from session cheaps in Tsys.

- Tsys were able to marginally extend gains post the RBNZ rate decision, as there was a lack of hawkish surprise in the post-meeting statement and press conference, with unscheduled BoJ Rinban operations also adding support at the margins.

- The richening largely held although Tsys did tick away from best levels.

- In Europe today we have regional and national CPI from Germany. Further out, minutes of the February FOMC meeting headline today’s NY docket. We also have the latest round of 5-Year Tsy supply.

JGBS: Curve Twist Flattens, BoJ Defends Breach Of YCC Band

Pressure from the spill over stemming from Tuesday’s moves in wider core global FI markets lingered in the belly of the JGB curve, with limited reaction to the BoJ deploying an unscheduled round of Rinban purchases covering 5- to 25-Year paper as it looked to fend off the latest upside breach of its YCC band (which has lingered, although the 0.51% level has not been touched as of yet, with 10-Year JGB yields operating between there and 0.50% for almost all of the session, last printing in that range ahead of the close).

- Futures edged away from session lows alongside wider core global FI markets, before another modest uptick was seen after the Rinban purchases were announced. The contract is -13 at the bell, while wider cash JGBs were 1bp cheaper to 5bp richer as the curve twist flattened. There wasn’t an overt driver for the super-long end bid, with some pointing towards potential purchases from domestic life insurers (after they sold super-long paper in Jan) and/or BoJ YCC tweak speculation via flatteners.

- Details of the unscheduled Rinban ops revealed an uptick in cover ratios, although the offers that the operations attracted weren’t larger in nominal terms, with cover impacted by the downsizing of the operations vs. scheduled purchases.

- BoJ’s Tamura added little fresh to the policy debate.

- Marginally firmer than expected services PPI data will have added to the pressure in early Tokyo trade.

- JGBs will be closed on Thursday the country observes a national holiday (this may have triggered some short cover in futures into the close).

AUSSIE BONDS: AU/US Yield Differentials Narrow After Wages Data

ACGB yields reverse sharply after Q4 WPI undershoots expectations (3.3% Y/Y Vs. 3.5% Y/Y) and defies RBA business liaison intelligence that suggested a near-term pick-up in wage growth. YM and XM close -3.0 and -6.0 respectively after being down 16bp. Cash ACGB yields print 2-6bp cheaper with the 3/10 curve 4bp steeper. The AU-US yield differential narrows to -7bp.

- Swap rates close 2-6bp higher led by the 10-year.

- Bills close up 2-5bp, well off session cheaps.

- RBA-dated OIS gaps lower with WPI data for all meetings beyond April led by September which declines by 12bp. Terminal rate expectations close at 4.22%.

- Pricing for the near-term meetings was however little changed with the market convinced that the wage data was unlikely to force an RBA rethink of the "further increases in interest rates" message in the February Decision Statement. With the current government sympathetic to the unions and the Secretary of the ACTU on the newswires today saying “more needs to be done to get wages moving”, the RBA is unlikely to abandon its forecast for higher wages growth ahead.

- With U.S. Tsys heavy and WPI data providing a domestic catalyst, the recent bout of ACGB outperformance may have further to run.

- Australian Q4 Capex data is out tomorrow.

AUSSIE BONDS: ACGB May-34 Auction Results

The Australian Office of Financial Management (AOFM) sells A$900mn of the 3.75% 21 May 2034 Bond, issue #TB167:

- Average Yield: 3.9713% (prev. 3.5911%)

- High Yield: 3.9725% (prev. 3.5925%)

- Bid/Cover: 2.6278x (prev. 5.1171x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 82.2% (prev. 47.2%)

- Bidders 47 (prev. 47), successful 20 (prev. 7), allocated in full 8 (prev. 1)

NZGBS: RBNZ Fails To Spark A Meaningful Post-Decision Reaction

NZGBs had a subdued reaction to the RBNZ policy decision as the central bank delivered on the expected 50bp rate hike and left its peak OCR projection at 5.50%, albeit now seen slightly later. While the RBNZ noted tentative signs of easing price pressures, they still saw higher rates as necessary with demand outpacing supply and labour shortages contributing to heightened wage inflation.

- NZGB yields close 9-11bp higher. After yesterday’s outsized short-end NZGB response to NZ Treasury comments on RBNZ policy (re: the impact of the cyclone), there was the risk of a ‘sell the rumour, buy the event’ reaction today given the RBNZ’s non-committal response to the issue. That clearly wasn’t the case with 2-year yields holding close to 20bp higher than Monday’s close.

- Swap rates move 3bp lower post-decision, closing 9-10bp higher.

- RBNZ-dated OIS pricing declines 1-2bp for the further out meetings. Terminal rate expectations currently sit just below ~5.40%, 15bp higher than the level prevailing at the end of last week.

- With the RBNZ failing to surprise, the market guidance may have to come from abroad with Australia the most likely candidate after the lower-than-expected Q4 WPI print sparked a stellar outperformance vs. NZ. AU-NZ 2-year swap differential narrowed 14bp on the day.

EQUITIES: Tracking Lower, HSI Recovers, As HK Budget Supports Households

(MNI Australia) Regional equities are mostly tracking lower, in line with sharp falls on Wall St from Tuesday's session. US futures are slightly higher so far today (+0.20% for eminis, +0.25% for the Nasdaq) but this hasn't aided sentiment.

- HK stocks have recovered from earlier losses, the headline index back to around flat currently. Headwinds persist as the index flirts with correction territory, but sweeteners in the HK budget, announced today, around consumption vouchers and homebuyer tax cuts, have turned sentiment around.

- China shares are tracking lower, the CSI 300 off by a little over 0.65% at this stage. Onshore China media reported China President Xi Jinping calling for more homegrown equipment and software, as well as basic subject research. Market concern around US-China tensions likely remains in the background.

- Tech sensitive plays are under pressure. The Kospi off by 1.60%, with offshore investors selling $339.2mn of local shares so far today. The Taiex is slightly better, at 0.87%, while the Nikkei 225 is down by 1.25%. This follows sharp moves lower in tech indices for Tuesday, as core yields rose.

- Other major markets are mostly tracking lower. The JCI and PSEI off by around 1.25% at this stage. NZ stocks also close slightly lower, as the RBNZ stayed the course raising rates by 50bps and keeping the terminal rate expectations at 5.50%.

GOLD: Bullion Close To 2023 Lows As Waits For FOMC Minutes

Gold prices were down 0.3% on Tuesday due to a rise in Treasury yields and have been zig-zagging during APAC trading as the market waits for the FOMC minutes. It has been trading narrowly between $1834.97 and $1838.48 and is current around $1836.40/oz. The USD index is flat today.

- Trend conditions remain bearish as the Fed is expected to remain hawkish for now. Gold prices are currently close to the early January lows

- Gold will be focused on the FOMC meeting minutes released later and Fed Williams’ discussion of inflation. There is little in the way of data.

OIL: Crude Waiting On Direction From Fed Minutes

MNI (Australia) - Oil prices have been range trading today after falling on Tuesday. The market is waiting for direction on Fed policy from the minutes published later. A more hawkish tone to the Fed has been weighing on crude this month. Brent is down 0.2% to $82.85/bbl and WTI -0.2% to $76.20. The USD index is flat.

- Both Brent and WTI have been trading in a range of less than a dollar and below their 50-day simple moving averages. The oil price outlook is neutral for now.

- Data showed that Russian exports have been strong over the last 4 weeks despite its announcement to cut output by 500kbd. 3.2mbd are being shipped to China, India, Turkey and others, which is the highest since data began being recorded at the start of 2022, according to Commerzbank (DJ). It appears that the increased demand for oil by China since it reopened is being met by Russia, thus limiting the upside for prices.

- The market will be focused on the FOMC meeting minutes released later and Fed Williams’ discussion of inflation for some direction on policy. There is also the delayed API inventory data but there is little in the way of economic data.

FOREX: USD Consolidates, AUD/NZD Off Recent Highs

AUD is the weakest performer in the G-10 space at the margins, weaker than expected wages prints have weighed on the Aussie. Elsewhere moves have been limited as the USD consolidates, NZD was volatile around the RBNZ rate decision however the Kiwi is now little changed.

- AUD/USD is ~0.3% softer today, last printing at $0.6830/35. Australian WPI printed at 3.3 YoY vs exp 3.5%. Terminal RBA cash rate projections ticked lower after the data release. Downside support sits at $0.6812 the low from Feb 16.

- NZD/USD is little changed from yesterday's closing levels. The pair rallied ~0.6% from session lows in the aftermath of the RBNZ decision before paring gains. The lack of hawkish surprise and the bank leaving its terminal rate forecast unchanged, albeit slightly later, contributed to the lack of follow through.

- AUD/NZD now sits below the $1.10 handle, 2-Year AU-NZ rate differentials widened post Australia WPI and the RBNZ decision weighing on the pair. The cross is down ~1% from Monday's high.

- Elsewhere, USD/JPY is dealing at ¥134.90/95. Jan PPI Services printed at 1.6% marginally firmer than the estimated 1.5%.

- EUR is marginally firmer and GBP is little changed.

- Cross asset flows are mixed, e-minis are ~0.2% firmer and 10 Year US Treasury Yields are ~1bp lower. BBDXY is flat.

- In Europe today we have regional and national CPI from Germany as well as MBA Mortgage Applications. Minutes of the February FOMC meeting headline today’s docket.

FX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.3bln), $1.0635-50(E571mln), $1.0670-75(E833mln)

- USD/JPY: Y134.00($599mln), Y134.25($715mln)

- AUD/USD: $0.7000(A$828mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 22/02/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 22/02/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/02/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2023 | 0900/1000 | *** |  | DE | Hesse CPI |

| 22/02/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 22/02/2023 | 0900/1000 |  | DE | Destatis Press Conference on Updated CPI Weights | |

| 22/02/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.