-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Appetite Tentatively Firmer To Start The Week

EXECUTIVE SUMMARY

- ISRAEL POUNDS GAZA’S NORTH AS IT STEPS UP GROUND ASSAULT - RTRS

- ECB IS FINISHED WITH RATE HIKES ‘FOR NOW’ VUKCIC TELLS HRT1

- CHINA’S TOP ENVOY WARNS OF BUMPY ROAD TO PLANNED BIDEN-XI SUMMIT - BBG

- PM KISHIDA’S APPROVAL RATING HITS NEW LOW - PRESS - MNI BRIEF

- AUSTRALIA WALKS AWAY FROM EU TRADE TALKS OVER AGRICULTURE - BBG

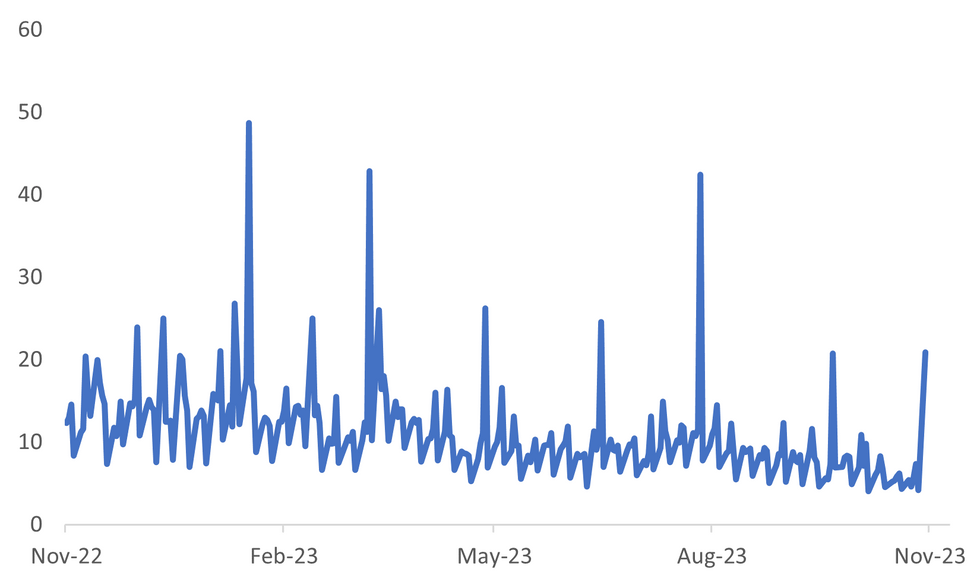

Fig. 1: USD/JPY Overnight Implied Vol Pushing Higher Ahead of Tomorrow's BoJ Meeting

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): The Bank of England this week is likely to forecast a bleak period for the UK economy in the months leading up to the next general election, adding to worries for Prime Minister Rishi Sunak’s government.

HOUSE PRICES (BBG): House prices are declining in the overwhelming majority of the UK, as stubbornly high mortgage costs start to bleed into values.

BANKING (BBG): HSBC intends to initiate a further share buy-back of as much as $3b.

EUROPE

ECB (HRT1/BBG): The European Central Bank is done with interest-rate increases for the time being, Governing Council member Boris Vujcic said. “We have finished with the process of raising interest rates for now,” Vujcic told Croatian state broadcaster HRT1 in a TV interview on Sunday. “At this moment we see that inflation is falling, we have a disinflation process. And after we conducted a series of measures to dampen lending, it has fallen.”

SNB (RTRS): The Swiss National Bank may need to tighten its monetary policy further depending on how inflation develops in the country, Vice-Chairman Martin Schlegel said in an interview published on Saturday in Swiss newspaper SonntagsBlick.

EU/RUSSIA (RTRS): Russia will confiscate assets belonging to European Union states it deems unfriendly if the bloc "steals" frozen Russian funds in a drive to fund Ukraine, a top ally of President Vladimir Putin said on Sunday.

ITALY (BBG): Italy’s credit rating was confirmed at three steps above junk at DBRS Morningstar as Premier Giorgia Meloni’s government weathers the second in a slew of upcoming assessments.

GERMANY: (The Economist) Inflation data for October, released on Monday, should come in at around 4%. Data from the states of Berlin and Brandenburg showed inflation there coming down by roughly a percentage point from September.

EU (BBC) UK government ministers "need to be careful" when discussing possible changes to the terms of a referendum on Irish unity, Micheál Martin has said. The tánaiste (Irish deputy prime minister) was speaking after Northern Ireland Office Minister Steve Baker reportedly said such a vote should need a "super-majority" for it to succeed. At present, such a referendum requires a simple majority of 50% plus one.

MIDEAST (LE MONDE): “Sunak and Macron stress need for urgent humanitarian aid in Gaza”

GERMANY (DER SPIEGEL) “Gas imports to Germany: Scholz pushes for gas from Nigeria”

U.S.

POLITICS (RTRS): Newly installed U.S. House Speaker Mike Johnson said on Sunday he expects floor action this week to advance a funding bill to support Israel exclusively, even though President Joe Biden is pushing for a $106 billion aid package for Israel and Ukraine combined.

POLITICS (BBG): Former Vice President Mike Pence suspended his presidential campaign Saturday, ending his quest to unseat former running mate Donald Trump as the Republican standard-bearer and return the party to a more traditional brand of conservatism.

OTHER

ISRAEL (RTRS): Palestinians in northern Gaza reported fierce air and artillery strikes early on Monday as Israeli troops backed by tanks pressed into the enclave with a ground assault that drew increased international calls for the protection of civilians.

JAPAN (MNI BRIEF): Support for Japan's Prime Minister Fumio Kishida has fallen further, a weekend poll by Nikkei and TV Tokyo finds, after the leader floated a tax cut to ease the pain of high prices, the Nikkei reported on Monday.

AUSTRALIA/EU (BBG): Australia has walked away for the second time in three months from talks with the European Union toward a free trade deal, almost certainly pushing any agreement into next year or beyond.

CHINA

FINANCE (SCMP): China’s key financial conference to focus on resolving debt, strengthening supervision amid property crisis. National financial work conference set to start on Monday, with debt risks and strengthening the supervision of the Communist Party to be top of the agenda.

LIQUIDITY (YICAI): Authorities must use monetary policy in Q4 to deal with tighter liquidity caused by the planned CNY1 trillion treasury bond issuance, according to Zhong Zhengsheng, chief economist at Ping An Securities

CHINA/US (BBG): Chinese Foreign Minister Wang Yi said the road to an expected meeting between Presidents Joe Biden and Xi Jinping will not be smooth, requiring effort from both sides to reach consensus.

EQUITIES (CSJ/BBG): A slew of mutual fund companies have announced plans to purchase their own fund products recently, signaling their confidence in China’s markets, China Securities Journal says in a report on Monday.

YUAN (PBOC): The People's Bank of China will promote the internationalisation of the yuan based on market drive and independent choices of enterprises, according to a report published on its website.

PROPERTY (BBG): China Evergrande Group, the world’s most indebted developer, got a final chance to get what could be the nation’s biggest ever restructuring back on track, as a Hong Kong court adjourned a winding-up hearing.

CHINA MARKETS

MNI: PBOC Drains Net CNY150 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY658 billion via 7-day reverse repo on Monday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY150 billion after offsetting the maturity of CNY808 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9357% at 10:03 am local time from the close of 2.0897% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Friday, compared with the close of 44 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1781 Monday vs 7.1782 Friday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1781 on Monday, compared with 7.1782 set on Friday. The fixing was estimated at 7.3169 by Bloomberg survey today.

MARKET DATA

AUSTRALIA SEP RETAIL SALES 0.9% Y/Y; MEDIAN 0.3%; PRIOR 0.3%

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 106-07, -0-06+, a 0-08+ range has been observed on volume of ~80k.

- Cash tsys sit 3-4bps cheaper across the major benchmarks, the belly is leading the cheaps.

- Tsys ticked lower in early trade alongside Oil in early trade as demand for safe haven assets after Israel's military action in Gaza was moving more cautiously than expected.

- The move lower didn't follow through and Tsys ticked away from session lows dealing in narrow ranges for the remainder of the Asian session.

- On the wires today we have the Dallas Fed Mfg Activity Index. Further out the latest monetary policy decision from the Fed provides the highlight of this week's docket.

JGBS: Poor 2Y Supply Weighs Ahead Of BOJ Policy Decision Tomorrow

JGB futures are weaker and near session lows, -11 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, with the data calendar empty ahead of the BOJ policy decision tomorrow.

- As for the decision expected tomorrow, our analysis aligns with the prevailing consensus, which foresees the BOJ maintaining its existing policies in the upcoming announcement.

- Regarding the BOJ's YCC policy, most market participants do not foresee any changes this week, although many hesitate to completely rule out the possibility. See the MNI BOJ Preview here.

- Cash JGBs are at or near Tokyo session cheaps across the curve following poor demand metrics observed at today’s 2-year supply. It was notable that today’s cover ratio was the lowest for a 2-year auction since 2010. Yields are 0.3bp lower (40-year) to 1.5bps higher (20-year). The benchmark 10-year yield is 1.1bps higher at 0.892% versus the cycle high of 0.897% set today.

- The 2-year is 1.0bp higher at 0.103% versus Friday’s close of 0.093%.

- Swap rates are slightly higher across maturities. Swap spreads are mixed across the curve.

- Tomorrow, the local calendar sees Jobless Rate, Retail Sales, Dept. Store and Supermarket Sales and Industrial Production data, ahead of the BOJ Policy Decision.

AUSSIE BONDS: At Session Cheaps After Retail Sales Beat, 70% Chance Of A Nov Hike

ACGBs (YM -5.0 & XM -7.5) are sitting weaker, at or near the Sydney session’s worst levels, after Retail Sales for September printed much stronger than expected. That said, the strength was due to a number of special factors (e.g. warmer spring boosting clothing) so is unlikely to be repeated in October. The Q3 average rose a 3-month annualised rate of 3.4% up from 1.7% in Q2. Sales were positive in every month in Q3 signalling resilience in consumption.

- Cash ACGBs are 5-7bps cheaper on the day, with the AU-US 10-year yield differential 6bps higher at +1bp. The last time the differential was in positive territory was in mid-August.

- Swap rates are 5-7bps higher on the day, with EFPs little changed.

- The bills strip is cheaper, with pricing -3 to -8, late whites/early reds the weakest.

- RBA-dated OIS pricing is 1-8bps firmer across meetings, with late’24 leading. The market is attaching a 71% chance of a 25bp hike from the RBA at next week’s policy meeting. Terminal rate expectations have jumped to 4.51% (+44bps), the highest level since mid-July.

- Tomorrow, the local calendar sees Private Sector Credit, CoreLogic House Prices and Judo Bank PMIs data.

NZGBS: Closed Slightly Weaker, Focus Abroad

NZGBs closed 1-3bps cheaper, at session worst levels, with the 2/10 curve steeper. With the local calendar empty today, local participants have been guided from abroad ahead of this week's policy meetings for the BOJ (tomorrow), FOMC (Wednesday) and the BOE (Thursday). Although no substantial changes in policy are anticipated at these meetings, their potential to influence the market still looms large. Notably, there is a level of uncertainty surrounding the possibility of the BOJ making further adjustments to its yield curve control.

- Cash US tsys are 3-4bps cheaper so far in the Asia-Pac session. There has been little by way of newsflow today.

- Swap rates closed with a twist-steepening, rates 1bp lower to 2bps higher.

- RBNZ dated OIS pricing closed little changed across meetings, with terminal OCR expectations at 5.61%.

- Tomorrow, the local calendar sees Building Permits and ANZ Business Confidence.

- The US calendar sees the US Treasury's quarterly borrowing estimates later today. Wednesday sees the FOMC policy announcement along with ADP Private Employment data, ahead of Friday’s Non-Farm payrolls.

FOREX: Antipodeans Firm In Asia

The Antipodeans have firmed in the Asian session today, a strong Retail Sales print in Australia and firmer US Equity Futures are aiding the bid.

- AUD/USD is up ~0.3% at $0.6355/60, Fridays high remains intact for now. September Retail Sales printed at 0.9% M/M vs 0.3% expected. Technically the trend remains bearish, support comes in at $0.6270 Oct 26 low. Resistance is at $0.6411 the 50-day EMA.

- Kiwi is ~0.2% firmer, NZD/USD last prints at $0.6820/25. AUD/NZD is consolidating in a narrow range above the $1.09 handle.

- Yen is marginally firmer as USD/JPY consolidates below the ¥150 handle. Technically bulls remain in the drivers seat, resistance is at ¥151.09 2.764 projection of the Jul 14-21-28 price swing. Support comes in at the 20-Day EMA (¥149.46).

- Elsewhere in G-10 ranges have been narrow with little follow through on moves.

- Cross asset wise, WTI is down ~1.4% and e-minis are ~0.4% firmer. US Tsy Yields are ~3bps higher across the curve.

- Regional German CPI and National GDP provide the highlight in Europe today.

EQUITIES: Mixed Start To The Week For Asia Pac, US Futures Higher

Regional Asia Pac equities have started Monday trade in a mixed fashion. Japan markets and parts of SEA are softer, while China and South Korean markets are trading more resiliently. US equity futures have started the week higher. Eminis last near 4152, +0.33%, while Nasdaq futures are outperforming modestly, last up 0.51%.

- Oil prices are lower, with some reports (BBG) suggesting the Israel ground invasion into Gaza was not as strong as feared. The move lower in oil has aided risk appetite more broadly, including curbing USD sentiment.

- In China markets, the CSI 300 is up a further 0.67%, tracking above 3586 in index terms. The ChiNext is also up strongly (+2%). A key financial forum kicks off today in China, where LGFV's and property market risks will be discussed. China's number 2 military head also stated that the country will develop military ties with the US (RTRS), which may be signs of a further thawing in tensions with the US. Hong Kong markets are down, but away from session lows (HSI last -0.28%).

- Japan markets are weaker, off -0.85% for the Topix as tomorrow's BoJ meeting comes into view. No major policy changes are expected, although it is likely to be a close call.

- South Korea's Kospi is higher, +0.55%, in line with higher beta markets outperforming. The Taiex is +0.20%.

- In SEA, Indonesia and Malaysian shares are lower. Thailand and Singapore are modestly higher.

OIL: Crude Lower But Watching And Waiting

Oil prices are down over a percent during APAC trading following Friday’s rally. Stronger-than-expected US data at the end of last week ahead of the November 1 Fed meeting, and the restrained start to the ground offensive into Gaza have meant that there has been payback for the sharp rise in prices. The USD index is flat.

- WTI is down 1.5% to $84.24/bbl and off the intraday high of $85.30. Brent fell 1.2% to $88.10 after a low of $87.51. It approached $89 earlier but reached a high of $88.94.

- Bloomberg is reporting that Israel is taking the offensive into Gaza one day at a time rather than making one large incursion. Markets are watching closely for signs that the conflict is spreading outside of Israel/Gaza.

- Physical indicators are showing the market is easing. And net futures positions as reported by CFTC fell almost 6k contracts to 300.8k in the latest week.

- Later US October Dallas Fed manufacturing, euro area October confidence, Q3 German GDP and September CPI are released. Also ECB’s de Guindos speaks. The Fed meeting on Wednesday and payrolls on Friday are the key events this week for oil markets.

GOLD: Holding Above $2000 For The First Time Since May

Gold is 0.2% lower in the Asia-Pac session, after closing 1.1% higher at $2006.37 on Friday as Israel expanded its military operations in Gaza. Tel Aviv sent troops and tanks into the northern Gaza Strip in what it called the second and longer phase of its war against Hamas.

- Friday’s move marked the first time since May that bullion had traded above $2000.

- The yellow metal now sits more than 9% higher, fueled by haven demand, since the Hamas attack on Israel.

- The Middle East conflict has taken over the path of US interest rates as the main driver of gold. Nevertheless, the market will closely watch this week’s FOMC policy decision on Wednesday.

- According to MNI’s technicals team, Friday’s move cleared resistance at $2003.4 after which lies $2022.2 (May 15 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/10/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/10/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/10/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/10/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/10/2023 | 0930/1030 | *** |  | DE | Baden Wuerttemberg CPI |

| 30/10/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/10/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 30/10/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 30/10/2023 | 1300/1400 |  | EU | ECB's De Guindos speech at Leadership forum | |

| 30/10/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/10/2023 | 1930/1530 |  | CA | BOC's Macklem testifies at House committee. | |

| 31/10/2023 | 2330/0830 | * |  | JP | labor force survey |

| 31/10/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.