-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: RISK RESILIENT AFTER RUSSIAN UNREST

EXECUTIVE SUMMARY

- EERIE CALM FALLS ON RUSSIA AFTER DRAMTIC END TO WAGNER REBELLION - BBG

- UK GOVERNMENT LOOKS TO TAME SOARING INFLATION - BBG

- BIDEN LEADS TRUMP IN 2024 REMATCH POLL - BBG

- JAPAN MAY SERVICES PPI RISES 1.6% AGAINST APR’S 1.6% - MNI BRIEF

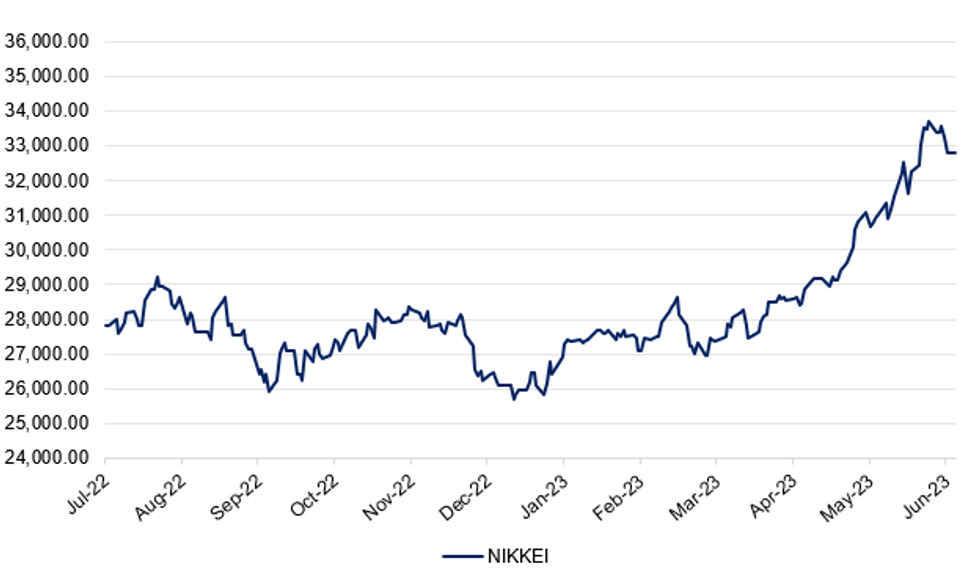

Fig. 1: NIKKEI Index

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: The UK government is stepping up efforts to tame soaring inflation by threatening both a crackdown on corporate profiteering and another round of deep real terms cuts to public sector pay. (BBG)

POLITICS: Prime Minister Rishi Sunak said he fully supports the Bank of England, days after a larger-than-expected rate increase by the central bank sent new shockwaves through the UK economy. The BOE’s track record “is that inflation has been managed appropriately,” Sunak said in an interview with the BBC. “Inflation is the enemy that we need to conquer.” (BBG)

EUROPE

UKRAINE: An adviser to Ukrainian President Volodymyr Zelenskiy said there have been no indications the Wagner mercenary group is retreating from conflict areas in the country after its leader Yevgeny Prigozhin agreed to go into exile. (BBG)

RUSSIA: An eerie calm fell on Russia after the dramatic end to an armed uprising that posed the greatest threat to Vladimir Putin’s almost quarter-century rule. The man who led the insurrection has gone uncharacteristically quiet. The president hasn’t been seen in public since denouncing the mutiny as “treason” and threatening “harsh” punishment that never transpired. (BBG)

GREECE: Greece’s Kyriakos Mitsotakis scored a landslide victory in Sunday’s general election — the country’s second vote in just over a month — giving the former prime minister a comfortable majority in parliament to allow him to form a single-party government. (BBG)

ECONOMY: Recession alarms are ringing around Europe’s bond markets, replacing the previous panic over inflation as investors come to terms with the threat to economic growth of increasingly tight monetary policy. (BBG)

ENERGY: Europe’s liquefied natural gas imports surpassed those coming to the continent via pipelines for the first time last year, according to data from the Energy Institute. The shift signals that the continent is rebuilding its energy infrastructure quickly while breaking ties with Russia after the invasion of Ukraine. The reversal is even more meaningful since global gas production remained relatively constant in 2022, compared with a year earlier, the EI’s annual statistical review of world energy shows. (BBG)

U.S.

SEMICONDUCTORS: A group of lenders led by Apollo Global Management Inc. is providing as much as $2 billion to Wolfspeed Inc. to support the semiconductor maker’s expansion in the US, according to a statement seen by Bloomberg. (BBG)

POLITICS: President Joe Biden led Republican front-runner Donald Trump in a hypothetical 2024 election rematch in an NBC News poll, though his edge is within the survey’s margin of error. Biden has 49% support in the poll of registered voters and the former president garnered 45%. Biden’s widest edge is among Black voters, while Trump’s biggest advantage is among rural voters, according to the poll published Sunday. (BBG)

CORPORATE BORROWING: U.S. companies borrowed 1% more in May compared to a year earlier to finance equipment investments, industry body Equipment Leasing and Finance Association (ELFA) said on Friday. The companies signed up for new loans, leases and lines of credit worth $9.5 billion last month, up from $9.4 billion a year ago. (RTRS)

OTHER

JAPAN: Japan's services producer price index rose 1.6% y/y in May, marking the 27th straight rise following April's 1.6%, with the severe labor shortage and wage increases driving the elevated level, preliminary data released by the Bank of Japan on Monday showed. (BBG)

BOJ: A Bank of Japan board member noted the need to review yield curve control due to its high costs, although the member saw that the cost of waiting to achieve the 2% price target was not high at the June 15-16 meeting, the summary of opinions released Monday showed. (MNI)

BOJ: Some Bank of Japan board members expect stronger prices, while one member saw greater chance that the y/y rise in the core consumer price index will not fall below 2%. One member said, while overseas factors largely drove price rises, the contribution of domestic factors – such as consumer prices of services, or the y/y change in the GDP deflator, had increased. A different member said, despite the softening of raw material prices, firms' pass-through of cost increases had intensified, while the employment and income situation had improved and inbound tourism demand recovered. (MNI)

BIS: Central banks must keep tight policy longer than many investors expect amid the risk stubborn inflation turns into a wage-price spiral, the BIS said Sunday in its annual report, one of the starkest official warnings yet about the end of low-for-long rates. (MNI)

OIL: Oil edged higher as investors weighed the potential for more civil unrest in Russia after the dramatic but short-lived rebellion in the major OPEC+ producer over the weekend. (BBG)

CHINA

CONSTRUCTION: Two more Chinese developers have failed to meet dollar-bond payments, occurring amid renewed home-sales softness and a lack of aggressive stimulus. Central China Real Estate Ltd. said it didn’t pay interest on a note before the end of a grace period on Friday and that it would suspend payments on all offshore debt. Smaller peer Leading Holdings Group Ltd. disclosed in its own exchange filing Friday night that it hadn’t paid the entire $119.4 million of principal plus interest due on a dollar bond issued a year ago as part of a debt swap. (BBG)

VEHICLES: China will extend tax cuts for new energy vehicles (NEV) until the end of 2027, according to a statement from the Ministry of Finance. Authorities will allow car buyers to deduct up to 30,000 yuan per car until the end of 2025, and up to 15,000 yuan until December 31, 2027. Xu Hongcai, vice finance minister, said taxpayers will claim a total of CNY520 billion from 2024-2027 under the scheme. Compared to previous programmes, the government will loosen the technical requirements needed for cars to qualify for the exemption. (MNI)

GREEN ENERGY: China will work with the international community to establish partnerships in green energy and carbon-emission reduction, according to Premier Li Qiang. Speaking at the New Global Financing Summit in Paris, Li said China views technological innovation as the core driving force in creating global clean energy partnerships, and would oppose trade protectionism in its various forms. China will work towards improving cooperation between multilateral development banks and commercial creditors, to better guarantee the financing needs of developing countries. (MNI)

TOURISM: Tourists made 106 million domestic trips during the dragon boat festival, a y/y increase of 32.3%, and up 12.8% from the same period in 2019, according to the Ministry of Culture and Tourism. Tourists attending night time attractions were up 8% y/y, with the Ministry noting a large increase in outdoor tourism such as camping and rafting, alongside usual activities such as visiting Hainan and cultural sites. (MNI)

CHINA MARKETS

PBOC Injects Net CNY143 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY244 billion via 7-day reverse repos on Monday, with the rates at 1.90%. The operation has led to a net injection of CNY155 billion after offsetting the maturity of CNY89 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8520% at 10:18 am local time from the close of 1.9704% on Wednesday before Dragon Boat Festival.

- The CFETS-NEX money-market sentiment index closed at 44 on Sunday, compared with the close of 47 on Wednesday before public holiday.

PBOC Yuan Parity Higher At 7.2056 Monday VS 7.1795 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2056 on Monday, compared with 7.1795 set on Wednesday before Dragon-boat festival.

OVERNIGHT DATA

JAPAN MAY SERVICES PPI 1.6% Y/Y; PRIOR 1.6%

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 113-05+, +0-03, a 0-04+ range has been observed on volume of ~60k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys richened in early dealing as participants digested news of the political unrest in Russia over the weekend.

- Gains were marginally pared, there was little follow through on the move and tsys observed narrow ranges for the majority of the session.

- Little meaningful macro news flow crossed in Asia today.

- There is a thin data calendar in Europe on Monday. Further out Dallas Fed Mfg Activity is due. We also have the latest 2 Year supply.

JGBs: Futures Stronger, Light Calendar Today, 20-Year Supply Tomorrow

JGB futures are trading on a high note in the Tokyo afternoon session at 148.94, +19 compared to the settlement levels.

- Apart from the previously mentioned Summary of Opinions from the BoJ's June meeting, which included a board member's suggestion to discuss a potential revision to the treatment of yield-curve control (See link ICYMI), there have been minimal domestic factors worth highlighting.

- Given the absence of significant local news, it appears that the domestic market has been impacted by the slight uptick in US tsys during Asia-Pac trading, which was triggered by the political unrest in Russia over the weekend.

- The cash JGB curve bull flattens beyond the 1-year zone in Tokyo afternoon trade. Beyond the 1-year zone, yields are 0.3-1.8bp lower with the 30-year zone as the best performer. The benchmark 10-year yield is 0.5bp lower at 0.364%, below the BoJ's YCC limit of 0.50%. The 20-year is 1.1bp lower at 0.960%, showing no concession on the curve, ahead of tomorrow’s supply.

- Swap rates are lower beyond the 2-year with swap spreads wider across the curve.

- The local calendar tomorrow sees the release of Coincident & Leading Indicators for April (final), along with 20-year supply.

AUSSIE BONDS: Showing Strength, Watching Russian Headlines, CPI Monthly On Wednesday

ACGBs showed strength in the Sydney session (YM +6.0 & XM +4.0). The trading range remained relatively narrow, lacking significant domestic catalysts. Instead, the movements in the local market seemed to be influenced by the slight upward trajectory of US tsys, which responded to the political unrest that occurred in Russia over the weekend. Asia-Pac trading saw cash US tsy yields 1-2bp lower. It is worth highlighting, however, that global markets, including commodities like oil and gold, as well as stocks and currencies, demonstrated a notable sense of stability throughout Monday's Asian trading session.

- Cash ACGBs are 4-7bp richer with the 3/10 curve steeper and the AU-US 10-year yield differential +4bp at +24bp.

- Swap rates are 4-7bp lower with the 3s10s curve steeper.

- The bills strip bull flattens with pricing +5 to +9.

- RBA-dated OIS pricing is 3-7bp softer across meetings.

- The local calendar is light tomorrow with the weekly highlights being Wednesday’s CPI Monthly and Thursday's Retail Sales releases. CPI monthly is expected to print at 6.1% y/y, after the unexpected jump to 6.8% in April. Meanwhile, retail sales are expected to provide further confirmation that the consumer slowdown is underway.

NZGBs: Richer, Narrow Range, Global Markets Calm Despite Russian Unrest

NZGBs closed 5-6bp richer after trading in a relatively narrow range in local trade. With a lack of significant local news, it seems that the domestic market has been influenced by the slight strengthening of US tsys during Asia-Pac trade, triggered by the political unrest in Russia over the weekend. However, it is worth noting that global markets, including commodities such as oil and gold, as well as stocks and currencies, displayed a sense of stability during Monday's Asian trading session.

- Swap rates closed 4-6bp lower with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-4bp softer for meetings beyond July with terminal OCR expectations at 5.64%.

- The local calendar is light until Thursday when the latest ANZ Business Outlook survey is to be released. On Friday, consumer sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

OIL: Crude Loses Early Gains From Russian Unrest

Oil prices are currently close to unchanged during APAC session although they have been trading in a range of about a dollar. Earlier in the session they received some support from the failed uprising in Russia, as it remains a major oil producer. But WTI is flat now at around $69.18/bbl, close to the intraday low of $69.01. Brent is marginally higher at $73.92, close to the low of $73.76. The USD index is down 0.1%.

- WTI breached $70 early in APAC trading but couldn’t hold it and has trended down since. Brent approached $75 but stopped at $74.80. Technicals remain bearish.

- The unrest in Russia over the weekend is generally not expected to impact output. According to Bloomberg, Goldman Sachs thinks the market will remain focussed on fundamentals but RBC believes that the risk of further trouble “must be factored into our oil analysis”.

- Later there is the German IFO survey for June and the US Dallas Fed June manufacturing index. ECB President Lagarde will give opening remarks at the ECB Forum.

GOLD: Stronger On Russian Unrest & Recessionary Fears

Gold edges higher to 1925.71 (+0.25%) in Asia-Pac trading as geopolitical uncertainty increases following the weekend’s attempted mutiny by Russian mercenary group Wagner. The upside for gold may however prove limited after Wagner leader Yevgeny Prigozhin suddenly halted his dramatic advance toward Moscow.

- Ahead of the weekend, bullion closed 0.4% higher as the market weighed recessionary signals that came from the latest round of PMI data. Advance PMIs for June suggested that the Eurozone economy had slowed sharply with the service sector PMI dropping more than expected and the manufacturing PMI falling further into contractionary territory. In the US, the manufacturing PMI fell more than expected into contractionary territory and sat just above the lows from December of last year.

- Nonetheless, gold closed 1.9% lower last week as hawkish commentary from global central banks weighed.

FOREX: USD Moderately Pressured In Asia

The greenback is moderately pressured in Asia today, risk sentiment remains resilient after Russian political instability over the weekend.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD is up ~0.4% and last prints at $0.6165/70. The pair has firmed above the 20-Day EMA ($0.6161). AUD/NZD is down ~0.3%, falling below the 200-Day EMA. The cross last prints at $1.0835/45.

- AUD is a touch firmer however ranges have been narrow with little follow through.

- The Yen is firmer after comments from vice finance minister Kanda that FX intervention can't be ruled out. The BOJ Summary of Opinions noted that one member asked for an early revision of YCC. USD/JPY is ~0.2% lower.

- Elsewhere in G-10 GBP and EUR were ~0.1% firmer.

- Cross-asset wise; BBDXY is down ~0.2% and e-minis are up ~0.2%. 2 Year US Treasury Yields are down ~1bp.

- There is a thin data docket in Europe today.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2023 | 0700/0900 | ** |  | ES | PPI |

| 26/06/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/06/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/06/2023 | 1730/1930 |  | EU | ECB Lagarde Opens ECB Forum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.