-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Schnabel Stresses Sticky Inflation

EXECUTIVE SUMMARY

- POWELL POINTS REPUBLICANS TO FORECASTS SHOWING ONE MORE RATE HIKE (BBG)

- FDIC FACES $23 BILLION IN COSTS FROM BANK FAILURES. IT WANTS BIG LENDERS TO PAY (BBG)

- ECB’S SCHNABEL:EURO ZONE UNDERLYING INFLATION STICKY (RTRS)

- ECB’S SCHNABEL SAYS EUROZONE BANKS NOT SEEN DEPOSIT OUTFLOWS (BBG)

- BOE'S MANN: FALLING HEADLINE INFLATION, HIGH CORE, MAKE POLICY DIFFICULT (RTRS)

- CHINA'S ECONOMY IMPROVES IN MARCH, WILL CONSOLIDATE RECOVERY, SAYS PREMIER LI (RTRS)

- WHITE HOUSE TO CHINA: DON'T USE TAIWAN VISIT AS 'PRETEXT' (RTRS)

- ALIBABA CEO SAYS MAY CEDE CONTROL OF SOME BUSINESSES OVER TIME (BBG)

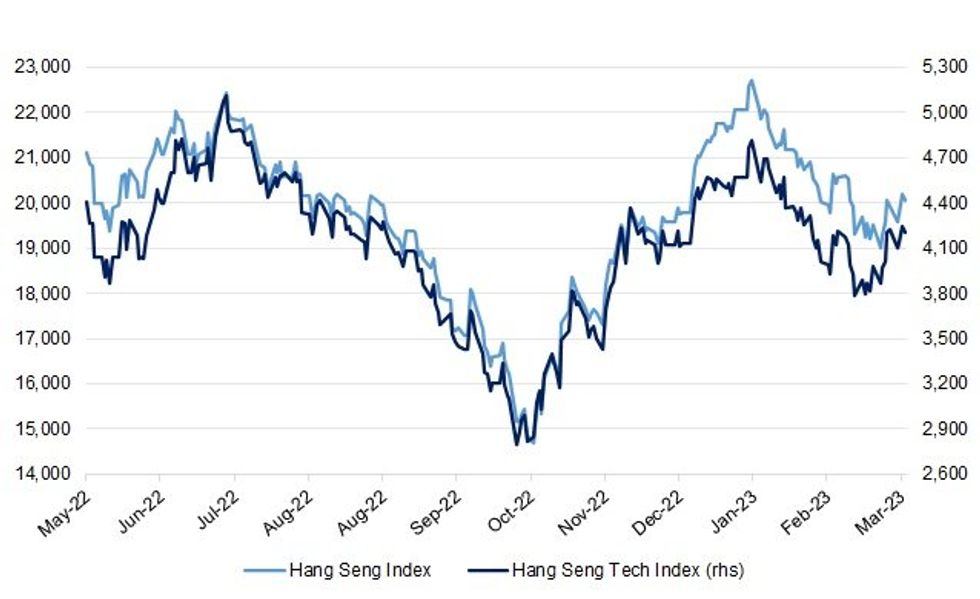

Fig. 1: Hang Seng & Hang Seng Tech Indices

Source: MNI - Market News/Bloomberg

UK

BOE: Falling energy prices will lower headline inflation towards the Bank of England's 2% target, but persistent underlying inflation will make it hard for the Bank of England to set monetary policy as the year progresses, Bank of England monetary policy committee member Catherine Mann said on Wednesday. (RTRS)

EUROPE

ECB: Underlying inflation in the euro zone is proving sticky and the recent fall in energy costs may not pull it down as fast as some expect, European Central Bank board member Isabel Schnabel said on Wednesday, highlighting the bank's chief concern. (RTRS)

ECB/BANKS: European Central Bank Executive Board member Isabel Schnabel said that eurozone banks have not seen a loss of deposits despite the recent financial stability concerns. (BBG)

BANKS: Swiss regulators encouraged UBS Group AG’s move to bring back Sergio Ermotti as chief executive officer to ensure a smooth integration of the bank’s recent takeover of rival Credit Suisse Group AG, people familiar with the talks said. (BBG)

BANKS: Swiss regulators that engineered the marriage of UBS Group AG and Credit Suisse Group AG succeeded in stabilizing the nation’s financial system, Vontobel Holding AG Chief Executive Officer Zeno Staub said. (BBG)

IRELAND: The Irish government moved to reassure US multinationals that the country can address its chronic housing shortage, after American firms identified it as the biggest obstacle to further investment in the country. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell, asked in a private meeting with US lawmakers how much further the central bank will raise interest rates this year, pointed to policymakers’ latest forecasts showing they anticipate one more increase, according to Republican Representative Kevin Hern. (BBG)

FED: U.S. lawmaker Kevin Hern said on Wednesday that Federal Reserve Chair Jerome Powell told a meeting of the Republican Study Committee that insurance limits on banking deposits would be a great topic for Congress to weigh. Hern said Powell told Republicans that he believed supply chain inflation had mostly been mitigated. (RTRS)

FED: The Federal Reserve down the road needs to reconsider the longer-term goal of the overnight reverse repo facility that appears to no longer serve its original purpose and has seen trillions of dollars of usage on a regular basis, former Vice Chair Richard Clarida said Wednesday. (MNI)

FED/BANKS: The Federal Reserve’s top bank regulator on Wednesday said that supervisors could have done more to keep tabs on Silicon Valley Bank before it collapsed earlier this month. (BBG)

BANKS: Officials testifying at the hearing also appeared open to the prospect of raising the current $250,000 cap on insuring deposits, but said congressional action would be needed. Treasury Undersecretary Nellie Liang said that she’d support proposals for reform, citing a rise in uninsured deposits in recent years. (BBG)

BANKS: The Federal Deposit Insurance Corp., facing almost $23 billion in costs from recent bank failures, is considering steering a larger-than-usual portion of that burden to the nation’s biggest banks, according to people with knowledge of the matter. (BBG)

BANKS: As the Federal Reserve’s interest-rate hikes sent bond prices plunging last year, some of the country’s largest banks used a simple accounting maneuver to help keep billions of dollars of losses from piling up on their books. (WSJ)

FISCAL: “Extraordinary measures” used by the Treasury Department will likely be exhausted by the middle of August, the Chief Economist of Moody’s Analytics tells the House Budget Committee. (BBG)

FISCAL/POLITICS: West Virginia Senator Joe Manchin ramped up criticism of the US Treasury Department over its upcoming interpretation of content rules for electric vehicle tax credits, which he suspects will be too broad and generous to foreign suppliers. (BBG)

FISCAL/POLITICS: Congressional Republicans said billions of dollars in US assistance for Ukraine risks being misspent and could be better used for domestic priorities, a fresh sign of the party’s growing ambivalence regarding American support for the war. (BBG)

POLITICS: The Manhattan grand jury examining Donald Trump’s alleged role in a hush money payment to a porn star isn’t expected to hear evidence in the case for the next month largely due to a previously scheduled hiatus, according to a person familiar with the proceedings. (POLITICO)

RATINGS: Moody’s Investors Service sees only “limited” credit risk to the US sovereign from the current banking turmoil that’s caused upheaval in markets, although that could change if the situation worsens. (BBG)

OTHER

U.S./CHINA: Republican Senator Rand Paul on Wednesday opposed efforts in Congress to ban popular Chinese-owned social media app TikTok, which is used by more than 150 million Americans. (RTRS)

U.S./CHINA/TAIWAN: The White House urged China on Wednesday not to use a "normal" stopover in the United States by the Taiwan president as a pretext to increase aggressive activity against Taiwan. (RTRS)

NATO: Turkey’s parliament will vote to approve Finland’s membership in NATO on Thursday, following through on President Recep Tayyip Erdogan’s promise to let the Nordic nation into the defense alliance. (BBG)

GEOPOLITICS: The US is urging the European Union and other allies to sanction a Chinese satellite company for allegedly supporting Russia’s military operations in Ukraine, according to people familiar with the matter. (BBG)

GEOPOLITICS: Chinese Premier Li Qiang sought to rally Asian countries behind China in his first public address to an international audience as premier. (CNBC)

RBA: Australian Treasurer Jim Chalmers will publicly release findings from an independent review of the central bank mid-next month, with some of its recommendations expected to require changes to the Reserve Bank Act. (BBG)

RBA: The Reserve Bank is facing its biggest shake-up since the early 1990s, with the institution’s first review in four decades poised to recommend changes to the way it operates and communicates with the public. Interest rates set by a committee of economic specialists rather than the current board, fewer meetings to discuss rate settings and regular press conferences by the bank governor to explain monetary policy settings are all expected to be canvassed in the final report from an independent panel of experts that have spent the past six months reviewing the RBA. But an overhaul of its use of interest rates to target the rate of inflation is unlikely amid concerns any radical change would become embroiled in a political fight that could undermine the bank’s independence from the government of the day. (Sydney Morning Herald)

AUSTRALIA: Unions will push for a record 7 per cent increase in award wages for 2.6 million workers right up the pay scale, despite business warning that inflation-linked increases will add to prices growth and keep interest rates up. (AFR)

BOC: Bank of Canada Deputy Governor Toni Gravelle said Wednesday hot inflation makes it premature to consider lowering interest rates to more regular levels, adding so far there's little evidence of major domestic distress from the collapse of Silicon Valley Bank and Credit Suisse. (MNI)

BOC: Bank of Canada Deputy Governor Toni Gravelle said government bond purchases deployed during the Covid pandemic could wrap up around the end of next year or the first half of 2025 while the ample reserves policy may keep up to an extra CAD60 billion of settlement balances in the system. (MNI)

TURKEY: Turkish President Recep Tayyip Erdogan blamed interest rate increases for the current turmoil in developed markets, saying that monetary tightening risks dragging the global economy into recession. (BBG)

BRAZIL: President Luiz Inacio Lula da Silva’s administration is proposing a fiscal plan that seeks to shore up public finances by eliminating Brazil’s primary budget deficit next year and delivering growing surpluses until the end of his term, according to an official familiar with the proposal. (BBG)

BRAZIL: Brazilian former president Jair Bolsonaro said on Wednesday he will not lead an opposition against President Luiz Inacio Lula da Silva, but he will collaborate with his political party, the Liberal Party. Bolsonaro's spoke to a CNN Brasil journalist in the airport's boarding area, moments before traveling to Brazil. (RTRS)

RUSSIA: International Atomic Energy Agency now focused on improving physical security around Russian-occupied nuclear plant in Ukraine, Director General Rafael Mariano Grossi tells reporters. (BBG)

RUSSIA: Russia's GDP fell by 3.1% on an annual basis in February, the country's economy ministry said on Wednesday, up slightly from a 3.2% year-on-year contraction recorded in January. (RTRS)

RUSSIA: Russia's weekly consumer price rise eased slightly in the week to March 27, data from state statistics service Rosstat showed on Wednesday, as authorities seek to bring down inflation which was almost 12% for 2022. (RTRS)

ARGENTINA: Argentine President Alberto Fernandez said Wednesday that US President Joe Biden committed to supporting Argentina at the International Monetary Fund and other multilateral institutions during their meeting at the White House. (BBG)

ARGENTINA: Argentina's grains inspectors union URGARA said it will launch a strike starting after midnight on Thursday in protest over the harm high inflation is having on their salaries. (RTRS)

ISRAEL: President Biden urged Prime Minister Benjamin Netanyahu in a strong private message to halt his government's judicial overhaul just hours before Netanyahu went on television and announced the suspension of the controversial plan, according to two U.S. sources briefed on the issue. (Axios)

IMF: Countries in a relatively stronger position should help vulnerable nations especially those under debt distress, International Monetary Fund managing director Kristalina Georgieva said on Thursday. (RTRS)

WORLD BANK: Ajay Banga, the US pick to head the World Bank, appears almost certain to become the anti-poverty lender’s next president after nominations closed Wednesday with no country publicly proposing an alternative candidate. (BBG)

ENERGY: Russia's oil and gas condensate production was down 0.2% on an annual basis in February at 42.1 million tonnes, the Rosstat state statistics service said on Wednesday. Russia's natural gas output was down 13.5% year-on-year at 46.8 billion cubic metres (bcm) during the month, Rosstat said. (RTRS)

OIL: More than 10m bbl of oil — mostly refined petroleum product — has been released from France’s strategic stockpiles as refinery and port workers continue to strike, according to a person familiar with the matter. (BBG)

FOREX: US sanctions against Russia have undermined the US dollar's integrity and caused a crisis of trust around the world, according to Zhu Min, former vice president of the International Monetary Fund. (MNI)

CHINA

ECONOMY: China's economic performance has improved in March from the first two months and the country will expand domestic demand and consolidate its economic recovery, Premier Li Qiang said on Thursday at an economic forum in Boao. (RTRS)

MACRO/PBOC: World monetary authorities should jointly consider if raising interest rates by a further 25-50bp is appropriate in a highly volatile global environment, according to Lu Lei, deputy director of the State Administration of Foreign Exchange. Speaking at the Boao Forum, Lu said liquidity secures economic stability, along with growth and inflation. In China, the central bank uses its open market operation to adjust liquidity needs of the financial system, he adds. When good banks and financial institutions run into difficulty due to liquidity issues, central banks should provide relevant support, he noted. (MNI)

MARKETS: China's financial market will support the green transition by balancing long- and short-term goals, and through the development of derivatives products, according to Zhou Xiaochuan, ex-governor of the People’s Bank of China. (MNI)

FDI: China is set to roll out more measures to attract foreign investment as the Ministry of Commerce has set 2023 as the “year of investing in China”, according to the Shanghai Securities News. (BBG)

EQUITIES: Alibaba Group Holding Ltd. will consider gradually giving up control of some of its main businesses, after completing a major overhaul to create six new companies that may debut on public markets. (BBG)

PROPERTY/CREDIT: Chinese property developers’ dollar bonds gained for a second day on Thursday after a state-backed builder reversed course on its decision to defer a coupon payment. (BBG)

BANKS: China could cut its reserve requirement ratio (RRR) by another 50bp this year as banks remain at risk from the troubled property sector and a squeeze on net interest margins despite proving resilient against U.S. and European banking turmoil, leading China banking analyst Charlene Chu told MNI. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY175 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY239 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY175 billion after offsetting the maturity of CNY64 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0551% at 09:26 am local time from the close of 2.1369% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday, compared with the close of 44 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8886 THURS VS 6.8771 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8886 on Thursday, compared with 6.8771 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA FEB JOB VACANCIES -1.5% Q/Q; JAN -4.6%

NEW ZEALAND MAR ANZ BUSINESS CONFIDENCE -43.4; FEB -43.3

NEW ZEALAND MAR ANZ BUSINESS OUTLOOK -8.5; FEB -9.2

March Saw a mix of small rises and falls across activity indicators. Most Indicators remain at very subdued levels compared to historical averages. (ANZ)

NEW ZEALAND FEB BUILDING PERMITS -9.0% M/M; JAN -5.2%

SOUTH KOREA APR MANUFACTURING BUSINESS SURVEY 69; MAR 66

SOUTH KOREA APR NON-MANUFACTURING BUSINESS SURVEY 75; MAR 74

MARKETS

US TSYS: Modest Cheapening In Asia, Tight Ranges In Play Alongside Low Volume

Cash Tsys are marginally cheaper on the day as we work towards the end of the Asia-Pac session, running 0.5-2.0bp cheaper across the cash curve, with the belly leading the weakness at the margin. TYM3 is -0-05 at 114-12, on light volume of ~51K, printing just above the base of its contained 0-06+ Asia-Pac range.

- Wednesday’s (relatively limited) weakness in the front end of the Tsy & UK Gilt curves, as well as the wider pressure seen on the German curve and general bid for broader equities (the major Asia-Pac benchmark indices are mixed) since Wednesday’s Asia-Pac close were the likely sources of underlying pressure for the space, while a leg of cheapening in JGBs (which moderated from extremes) will have done the move no harm.

- There wasn’t anything in the way of tier 1 event risk slated during Asia-Pac hours and we didn’t get any meaningful macro news flow.

- Looking ahead, inflation data from Germany (state & national) and Spain will provide some interesting reference points in European hours. Further out, weekly jobless claims data and final Q4 GDP & PCE prints provide the highlights of a limited NY data docket, while Fedspeak will come from Kashkari, Collins & Barkin.

JGBS: Futures Lower & Swap Spreads Wider, Although Moves Back From Extremes

JGB futures sit 10 ticks away from their Tokyo session low, -33, with some light weakness seen as we head into the last hour of trade. Cash JGBs are mixed, with 7s running ~2.5bp cheaper given the weakness in futures since yesterday’s close (related to moves in wider core global FI markets), while the remainder of the curve sits little changed to 1.5bp richer.

- This comes after solid enough pricing at the latest 2-Year JGB auction built on a light late morning rebound for the space, allowing it to regain some ground after a pick-up in cheapening momentum related to futures breaching their overnight low was seen.

- Elsewhere, swap spreads are wider across the curve, as they have been all day, albeit with swap rates back from session highs.

- There haven’t been any signs of meaningful repatriation of Japanese capital ahead of the turn of the Japanese FY, at least via the weekly MoF flow statistics (although Dai-Ichi Life recently outlined their intention to reshore capital, with a preference for deployment in the super-long end of the JGB curve). Meanwhile, last week saw international investors register the largest round of net weekly sales of Japanese bonds since the run up to the BoJ’s January meeting, although they got nowhere near reversing the prior week’s record net purchases.

- Tokyo CPI data headlines tomorrow’s month-end data deluge, with the monthly labour market report, retail sales and industrial production prints also slated for release ahead of the weekend. Elsewhere, the BoJ will release its quarterly bond purchase plan after the close on Friday.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2704tn 2-Year JGBs:

- Average Yield -0.031% (prev. -0.046%)

- Average Price 100.074 (prev. 100.103)

- High Yield: -0.027% (prev. -0.042%)

- Low Price 100.065 (prev. 100.095)

- % Allotted At High Yield: 41.4205% (prev. 3.2510%)

- Bid/Cover: 4.155x (prev. 4.779x)

AUSSIE BONDS: At Cheaps, Underperforming U.S. Tsys

ACGBs sit near session cheaps (YM -9.0 & XM -7.5) ahead of the bell with local headlines light and U.S Tsys modestly softer in Asia-Pac trade. Cash benchmark yields are 7-8bp higher with the 3/10 curve 1bp flatter and the AU/US 10-year yield differential +4bp at -22bp.

- Swaps are 4-6bp cheaper with EFPs 2-3bp tighter.

- Bills strip pricing is -7 to -11 with late whites/early reds leading.

- With the local focus likely to have already shifted to next Tuesday’s RBA decision the question for the market is whether this week’s CPI and retail sales data has been enough to offset resilient business conditions and robust jobs data and deliver a pause.

- RBA dated OIS pricing suggests it is with only an 18% chance of a 25bp hike priced. Interestingly, May meeting pricing hit its highest level since 15 March with cumulative tightening over April and May meetings at 10bp.

- The local calendar is light tomorrow with Private Sector Credit (Feb) as the highlight.

- Elsewhere, Treasurer Chalmers announced that he will release the findings from the independent review of the RBA in mid-April.

- With the global calendar relatively light today, the markets will be closely watching to see if the recent improvement in risk sentiment can extend further.

NZGBS: Closed At Cheaps, Led By Short-End

NZGBs closed at cheaps, underperforming its $-Bloc peers. NZGB supply appeared to weigh relatively on short-end pricing with yields 3bp higher post-auction versus unchanged to lower for longer-dated bonds. Cash benchmark yields closed 6-12bp higher with the 2/10 curve 6bp flatter.

- Swaps weaken through the session to close with rates 7-9bp higher, implying tighter short-end but wider long-end swap spreads.

- On the local data front, building consents printed a weak -9.0% M/M in February after a downwardly revised -5.2% in January. The ANZ Business Confidence Survey, however, delivered a modestly more favourable message of slightly improved confidence and lower inflationary pressures. For the RBNZ, today’s data shouldn’t move the dial with respect to next week’s rate decision.

- RBNZ dated OIS closed 1-6bp firmer across meetings with April priced for a 25bp hike. Terminal OCR expectations firmed to 5.26%.

- The Antipodean calendar is light until next week with Australian Private Sector Credit tomorrow as the highlight.

- Further afield, regional European CPI data is out today ahead of the Eurozone CPI tomorrow. U.S. PCE deflator is also released tomorrow.

- Until then, the market’s focus will be on risk appetite and equity indices, especially banking indices, to see if recent gains can be extended.

EQUITIES: Mixed Trends Despite Positive Offshore Lead, Japan & HK Underperform

Asia Pac equities are mixed, underperforming the better trend from US/EU equities seen through Wednesday's session. US futures have been slightly negative during today's session, but haven't been a strong negative headwind. Eminis sit close to highs for the week. Weakness has been notable in Japan and Hong Kong stocks today.

- The Japan Topix is off around 1% at this stage, although part of this appears technical in nature. The majority of stocks traded on the index have gone ex-dividend.

- The HSI is down around 0.70% at the stage, despite further gains by Alibaba. The Tech index is off by 1.1%, unwinding some of the recent outperformance.

- China stocks are modestly lower (CSI 300 -0.18% at this stage), even Premier Li delivered an upbeat speech (economy better in March compared to January/February).

- The Kospi and Taiex are both higher, following the positive tech lead from Wednesday's US session.

- The ASX 200 has outperformed, up close to 1%, while NZ stocks gained 1.67%.

GOLD: Tracking Lower As The USD Edges Higher

Gold has tracked lower through the first part of Thursday's session. The precious metal is off a further 0.25% at this stage. We were last around $1960, albeit above session lows near $1955.50. Gold continues to take its cues from broader USD sentiment, with today's trough roughly coinciding with USD indices peaking.

- We remain some distance away from key MA and EMA levels. On Tuesday we saw a low close to $1950, while on Monday it was around the $1945 region. On the topside recent highs sit between $1975 and $1980, beyond that is the $2000 level.

OIL: Edging Away From Recent Highs

Brent crude has continued to edge away from recent highs. We were last just under $78/bbl, down -0.41% for the session so far, which comes after Wednesday's -0.47% drop. We have lost some momentum over the past 24 hours, but remain comfortably above recent lows. WTI is following a similar trajectory, last near $72.70/bbl.

- Focus remains on the supply side, amid the on-going dispute in Iraq, involving the Kurdistan regional government and Turkey, which is reportedly disrupting around 400k barrels per day from the Turkish Ceyhan terminal.

- US inventory data showed a sharp drop during Wednesday's session, but this didn't provide a boost to crude sentiment. Some focus has been on weakness in terms of distillates demand from the report, as a sign of lackluster overall demand conditions in the US.

- Tomorrow, note we get official China PMI prints, which will provide an update on the demand picture.

- For Brent, resistance is set at the intraday high of $79.64 after which sits the 50-day EMA of $80.81, whilst support is seen at $72.68 (Mar 24 low).

FOREX: USD Can't Maintain Early Gains

USD indices are back close too flat to the session. The BBDXY is not too far away from 1232.00, the DXY is under 102.70. Dollar gains earlier in the session had little follow through.

- JPY has generally traded on a firmer footing, we currently close to the bottom end of the range for the session so far, last near 132.55/60 (range 132.46-132.86). The 20-day EMA sits at 132.82, so may be acting as a constraint on the topside.

- NZD/USD has slightly underperformed, down 0.15% to 0.6215/20, but we saw some demand evident ahead of the 0.6200 level. Earlier data showed a further slump in building permits and business confidence levels still consistent with a challenging demand backdrop.

- The A$ has followed a similar trajectory, although slightly outperformed NZD. AUD/USD was last around 0.6685, unchanged for the session (earlier lows were at 0.6662) with the AUD/NZD cross a touch higher, around 1.0750/55 currently. AU Job vacancies fell -1.5% (-4.6% prior)

- Elsewhere EUR/USD is a touch lower for the session, under 1.0840 currently. USD/NOK is up by 0.20%, but away from highs above 10.4500.

- Looking ahead, inflation data from Germany (state & national) and Spain will provide some interesting reference points in European hours. Further out, weekly jobless claims data and final Q4 GDP & PCE prints provide the highlights of a limited NY data docket, while Fedspeak will come from Kashkari, Collins & Barkin.

FX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-80(E1.3bln), $1.0700(E2.8bln), $1.0825-40(E784mln), $1.0950(E1.5bln), $1.1000(E1.9bln)

- USD/JPY: Y130.00($1.1bln), Y130.40-50($658mln), Y131.00($1.6bln), Y131.50($1.2bln), Y132.00($1.4bln), Y132.90-10($1.1bln), Y134.19-20($647mln)

- AUD/USD: $0.6600(A$834mln), $0.6650(A$850mln), $0.6745(A$530mln)

- USD/CAD: C$1.3312($1bln)

- USD/CNY: Cny6.8630($601mln), Cny6.8805($568mln)

UP TODAY (TIMES GMT/LOCAL

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/03/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2023 | 0800/1000 |  | DE | CPI Hesse | |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.