-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

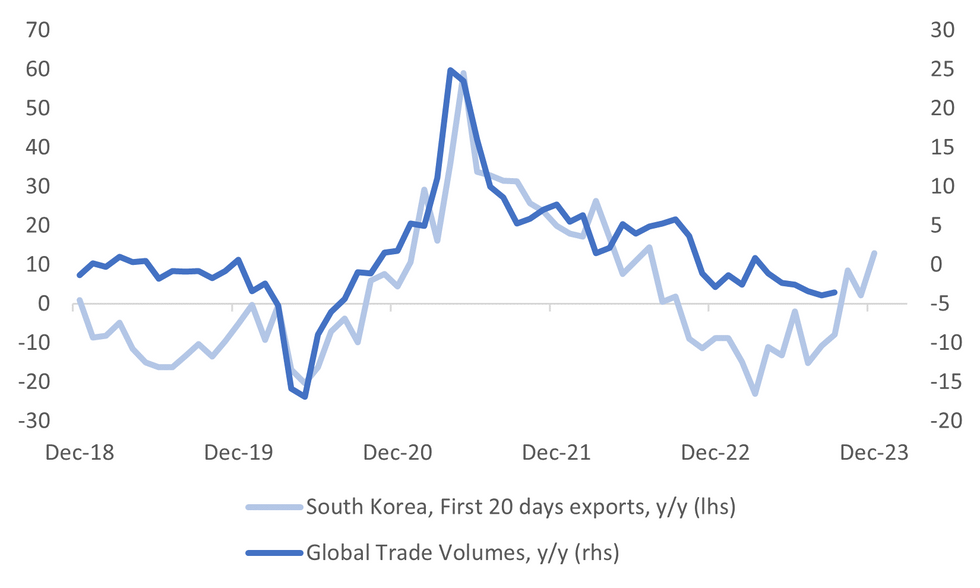

Free AccessMNI EUROPEAN OPEN: South Korean Exports Point To Improving Global Trade

EXECUTIVE SUMMARY

- FED’S HARKER SAYS RATES SHOULD MOVE DOWN BUT NOT IMMEDIATELY - BBG

- NEW FISCAL RULES READY FOR 2025 EU FISCAL GUIDANCE - MNI BRIEF

- US MULLS RAISING TARIFFS ON SOME CHINESE GOODS INCL. EVS - WSJ

- SOUTH KOREA’S EARLY EXPORTS SHOW RECOVERY MOMENTUM PICKS UP - BBG

- JAPAN GOVERNMENT SEES INCOME GROWTH BEATING INFLATION NEXT YEAR - BBG

Fig. 1: South Korea Preliminary Export Growth Y/Y & Global Trade Volumes Y/Y

Source: MNI - Market News/Bloomberg

EUROPE

FISCAL (MNI BRIEF): A deal on new European fiscal rules agreed unanimously among 27 member states on Wednesday should be agreed with the European Parliament before June 2024 elections, allowing the European Commission to issue fiscal guidance for 2025 budgets with the new framework, Commission Executive Vice President Valdis Dombrovskis told reporters.

ECB (BBG): The European Central Bank needs to keep interest rates where they are for some time yet but a cut could come around the mid-2024 — later than investors are pricing, according to Governing Council member Martins Kazaks.

FISCAL (BBG): European Union finance chiefs ended months of wrangling over fiscal rigor to agree on new rules that will aim to rein in debt and define the bloc’s ability to invest in key sectors such as defense for years to come.

ITALY (BBG): The Italian government is reviewing the planned acquisition of Prelios SpA by Andrea Pignataro’s Ion group, as Rome steps up its scrutiny of the tycoon following a string of high-profile deals.

U.S.

FED (BBG): Federal Reserve Bank of Philadelphia President Patrick Harker said the central bank should begin to reduce interest rates — though not immediately — offering a softer pushback against widespread market expectations of early-2024 cuts than some of his peers.

US/CHINA (WSJ): The Biden administration is discussing raising tariffs on some Chinese goods, including electric vehicles, in an attempt to bolster the U.S. clean-energy industry against cheaper Chinese exports, people familiar with the matter said.

US/CHINA (BBG): Senator Lindsey Graham said he’ll help draft sanctions to impose on China if it tried invading Taiwan. The Republican said Wednesday he’d work with lawmakers from both parties to “create a robust defense supplemental for Taiwan and second, draft pre-invasion sanctions from hell to impose on China if they take action to seize Taiwan.”

US/CHINA (RTRS): Republican lawmaker Marco Rubio on Wednesday urged the Biden administration to sanction Chinese chip design firm Brite Semiconductor over its ties to China's top sanctioned chipmaker and its work for Chinese military suppliers.

CORPORATE (BBG): Warner Bros. Discovery Inc. held talks on a possible merger with Paramount Global, potentially combining two of the biggest media companies in the world, according to people with knowledge of the matter.

OTHER

MIDEAST (BBG): Yemen’s Houthi rebels vowed to continue targeting ships in the Red Sea despite a US move to compile an international naval task force to protect maritime trade in one of the world’s most important waterways. The Iran-backed group also warned Washington it’s willing to retaliate if the US opts for military attacks on Houthi bases.

SHIPPING (BBG): An escalation of attacks on marine vessels in the Red Sea is causing widespread trade disruption as the world’s biggest vessel owners take alternative longer routes, sending shipping rates soaring.

MIDEAST (RTRS): The U.S. said "very serious" negotiations were taking place on a new Gaza ceasefire and release of more Israeli hostages, but prospects for a deal remained uncertain as Hamas insisted it would not discuss anything less than a complete end to Israel's offensive in the Palestinian enclave.

JAPAN (BBG): The Japanese government expects inflation to stay well above the Bank of Japan’s target level next fiscal year, in an upward revision highlighting the stickiness of price increases.

JAPAN (BBG): Japan’s government expects per capita income growth to outpace inflation next fiscal year for the first time in three years. Per capital income, including wage gains and tax cuts scheduled to take effect in June, will increase by 3.8%, exceeding the government’s 2.5% inflation forecasts, according to calculations released Thursday by the Cabinet Office.

SOUTH KOREA (BBG): South Korea’s early trade data indicated that export growth momentum will carry through the end of the year, adding to optimism for the 2024 economic outlook.

TAIWAN (BBG): China will end tariff concessions on 12 Taiwan chemical imports such as propylene and paraxylene, said the Ministry of Finance in a statement published on Thursday on its website.

CHINA

LOCAL DEBT (YICAI): The government will increase use of refinancing bonds next year to address local government debt risk, according to analysts interviewed by Yicai.com. Given local governments will likely face declining revenue from land transfers next year, authorities will issue CNY2-2.5 trillion special refinancing bonds, according to Wang Qing, chief macro researcher at Golden Credit Rating.

POLICY (CSJ/BBG): There is still some room for China’s banks to cut loan prime rates as authorities are promoting “steady and moderate reduction” in overall borrowing costs, China Securities Journal says in a front-page report, citing analysts.

FISCAL (SECURITIES TIMES/BBG): China is expected to “moderately” ramp up fiscal stimulus “at an appropriate pace” next year to drive economic growth, Securities Times reports, citing analysts.

PROPERTY (BBG): China Aoyuan Group Ltd. filed for Chapter 15 bankruptcy in New York on Wednesday, a move by the defaulted property developer to seek US court recognition for its offshore debt restructuring and ward off litigation.

CHINA/PHILIPPINES (BBG): China’s Foreign Minister Wang Yi told his Philippine counterpart that relations between the two countries are now facing “serious difficulties” amid increased tensions in the South China Sea.

CHINA MARKETS

MNI: PBOC Injects Net CNY159 Bln Via OMO Thur; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY195 billion via 7-day reverse repo and CNY226 billion via 14-day on Thursday, with the rates unchanged at 1.80% and 1.95%, respectively. The reverse repo operation has led to a net injection of CNY159 billion reverse repos after offsetting CNY262 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7958% at 09:37 am local time from the close of 1.8046% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Wednesday, compared with the close of 48 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1012 Thursday vs 7.0966 on Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1012 on Thursday, compared with 7.0966 set on Wednesday. The fixing was estimated at 7.1396 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA NOV PPI Y/Y 0.6%; PRIOR 0.7%

SOUTH KOREA DEC FIRST 20 DAYS EXPORTS Y/Y 13.0%; PRIOR 2.2%

SOUTH KOREA DEC FIRST 20 DAYS IMPORTS Y/Y 13.0%; PRIOR 2.2%

CHINA NOV SWIFT GLOBAL PAYMENTS CNY 4.61%; PRIOR 3.60%

MARKETS

US TSYS: Muted Session In Asia

TYH4 deals at 112-28, +0-03, a 0-04+ range has been observed on volume of ~64k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have had a muted session in Asia on Thursday, there has been little follow through on moves and no meaningful macro headline flow.

- A slight downtick at the open was observed as Asia-Pac participants perhaps used Wednesday's richening as an opportunity to close long positions/add fresh shorts. Losses were pared and Tsys sat in narrow ranges for the remainder of the session.

- The docket is thin in Europe today, further out we have Weekly Jobless Claims and the third read of Q3 GDP.

JGBS: Futures Hold Sub Recent Highs, National CPI Out Tomorrow

JGB futures have mostly been range bound this session. We sit comfortably off recent highs (147.00), but dips have also been supported. We currently track at 146.82, -.21 in terms of JBH4. Lows for the session rest at 146.74.

- The impulse from US Tsy futures has been limited, with range bound trends and remaining sub Wednesday highs.

- The Japan government nudged higher its growth and inflation projections for next year, but its inflation forecast remains below the BoJ's outlook. The government also expects income growth to beat inflation next year (see this BBG link).

- Headlines also crossed earlier of trade union minimum wage demands out to 2035 at ¥1600 per hour. This is above the government's target (NHK/BBG).

- Cash JGB yields sit higher for the most part. The 10yr yield is back at 0.574%, +2bps for the session. This puts us back close to the 200-day MA. 10yr swap rates are back near 0.80%.

- Tomorrow, we have the Nov National CPI print on tap, as well as a 3 month bill sale and an enhanced liquidity auction.

AUSSIE BONDS: Richer, Curve Marginally Steeper

ACGBs sit 1-4bps richer across the major benchmarks, the curve has bull steepened. The support seen early in the session from Wednesday's US Tsy rally gradually faded through the session however ACGBs did hold richer.

- Futures have trimmed gains through the session, dealing in narrow ranges for the most part. XM sits +0.02 and YM +0.04.

- RBA dated futures see the cash rate steady in Feb 24 at 4.35%, there are ~60bps of cuts by Dec 24.

- There was little domestic news flow today.

- Looking ahead, due tomorrow November Private Sector Credit rounds off the week's docket.

NZGBS: Richer, Narrow Ranges On Thursday

NZGBs have finished dealing 2-8bps richer across the major benchmarks, the belly lead the bid. The support to the space seen early in the session, from Wednesday's bid in US Tsys, marginally extended through the session however narrow ranges persisted for the most part.

- 10-Year NZ US Swaps have been stable today and sit at +57bps, as have RBNZ dated OIS. There are ~100bps of cuts in the OCR priced by Nov 24.

- NZ Tsy plans two bond auctions in January, each auction will offer NZ$500m bonds and the dates are 18 and 25 Jan (BBG).

- A reminder that the local data docket is empty tomorrow.

FOREX: USD Trims Wednesday's Gain

The greenback has trimmed some of Wednesday's gain in Asia today, the risk-off move seen in the NY session has moderated. US Equities are higher and US Tsys a touch lower.

- The Yen is the strongest performer in the G-10 space today as post BOJ losses continue to be trimmed, USD/JPY is ~0.5% lower and sits below the ¥143 handle. The pair does remain well within recent ranges. Technically support comes in at ¥142.25 Low Dec 19, resistance is at ¥145.26 76.4% retracement of the Dec 11 - 14 sell-off.

- AUD/USD is up ~0.3%, the pair last prints at $0.6750/55. Technically the uptrend remains intact, resistance is at $0.6776 High Dec 20 and $0.6821 High Jul 27. Support comes in at $0.6655 Low Dec 14.

- AUD/NZD has firmed above the $1.08 handle as Trans-Tasman technical flows come to the fore. NZD/USD has observed narrow ranges for the most part and is a touch firmer than opening levels.

- Elsewhere in G-10 there have been no moves of note in Asia.

- The docket is thin in Europe today.

EQUITIES: Asia Pac Markets Mostly Lower, Japan Equities Underperform

Regional Asia Pac equities are mostly in the red for Thursday trade. Japan markets have been the weakest performers. This follows strong US cash losses late in Wednesday trade. US futures have crept higher through the first part of Thursday trade. Eminis last +0.30% to 4764, but this is still nearly 1.4% off intra-session highs from Wednesday. Nasdaq futures are +0.40% higher.

- At this stage the Topix is off by 1%, while the Nikkei 225 is down nearly 1.6%. US losses from Wednesday have weighed, while a vehicle recall (on safety concerns) from Toyota has also been a weight on aggregate performance. Shares in the company down the most since May 2022 at one stage.

- China markets are higher at the break, the CSI 300 up nearly 0.50% and back above the 3300 level. This has bucked the broader trends in Asia Pac markets. Headlines crossed from the WSJ that the US is considering raising some tariffs on some China products, including EVs, so that may impact sentiment after the break.

- In HK, the HSI is off 0.24% at the break.

- Tech sensitive plays South Korea (Kospi -0.80%) and Taiwan (-0.60%) are both weaker as well.

- In SEA trends are mixed, but only the Singapore bourse and Thailand are modestly positive at this stage.

OIL: Edges Up From Recent Lows

Brent crude sits a touch above recent session lows (near $79/bbl). The benchmark last near $79.35/bbl. Oil wasn't immune from the risk off in equity markets late in US trade on Wednesday. Earlier highs came in at $80.60/bbl. For WTI we last tracked near $73.85/bbl, down from earlier session highs above $74/bbl, but also above Wednesday lows. Some USD weakness has helped at the margins (BBDXY -0.18%).

- Outside of equity market risk jitters on Wednesday we saw US supply temper bullish oil sentiment.

- EIA Weekly US Petroleum Summary - w/w change week ending Dec 15: Crude stocks +2,909 vs Exp -2,355, Crude production +200, SPR stocks +629, Cushing stocks +1,686

- Still, oil benchmarks are comfortably tracking higher for the week at this stage.

- Elsewhere, focus will remain on tensions in the Red Sea. Yemen’s Houthi rebels have vowed to continue targeting ships in the Red Sea despite the planned US-led naval task force to secure the area, according to Bloomberg.

GOLD: Pares Wednesday Losses On USD Weakness

Gold is tracking higher in the first part of Thursday trade. The precious metal currently sits near $2037, clos to session highs. This puts us +0.30% firmer versus end Wednesday levels in NY, not quite unwinding the -0.44% pull back for that session.

- The gold rebound is in line with weaker USD trends against the majors. The BBDXY is off close to 0.2% at this stage, unwinding part of Wednesday's risk induced bounce.

- We are sub highs above $2045 this week, while resistance at $2054.3 (50% retrace of Dec 4-13 bear leg) or support at $1973.2 (Dec 13 low), remain comfortably in tact.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/12/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2023 | 0900/1000 | ** |  | IT | PPI |

| 21/12/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 21/12/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 21/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/12/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 21/12/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2023 | 1330/0830 | *** |  | US | GDP |

| 21/12/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 21/12/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 21/12/2023 | 1600/1700 |  | EU | ECB Lane Participates In Workshop Panel | |

| 21/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/12/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.