-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: Spectre Of BoJ Shock Lingers

EXECUTIVE SUMMARY

- TC ENERGY DELAYS FULL KEYSTONE PIPELINE RESTART UNTIL NEXT WEEK (BBG)

- KURODA'S LEGACY LOOMS AS LEADERSHIP RACE NARROWS (MNI)

- CHINESE LOAN PRIME RATE CUT NEEDED NEXT YEAR (CSJ)

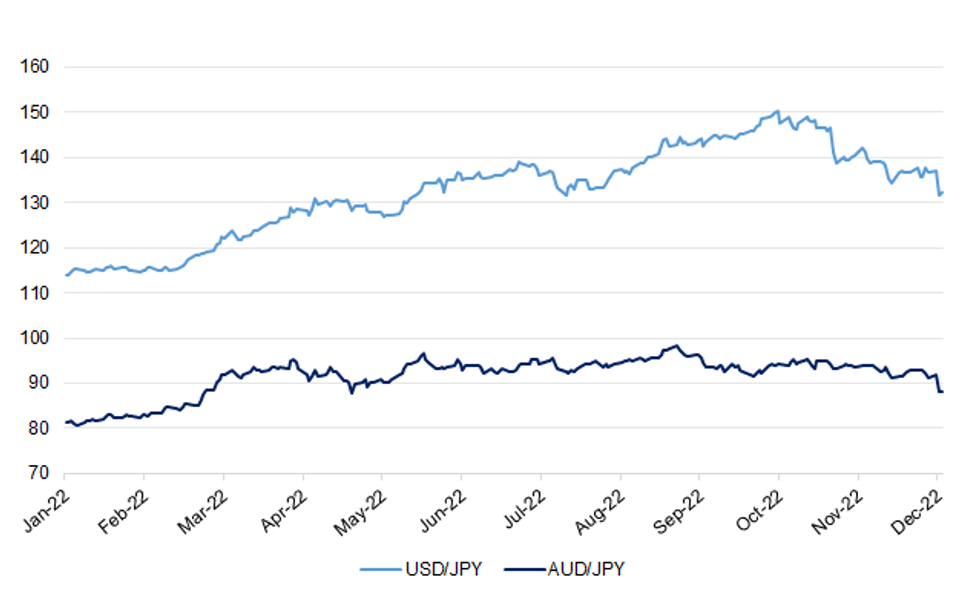

Fig. 1: USD/JPY Vs. AUD/JPY

Source: MNI - Market News/Bloomberg

EUROPE

GERMANY: The European Commission said on Tuesday it had approved Germany's 34.5 billion euro ($36.60 billion) plan to recapitalise German natural gas trader Uniper, subject to future state divestment, management pay and acquisitions. (RTRS)

PORTUGAL: Portugal’s parliament on Tuesday approved a 33% tax on the windfall profits that energy companies and food retailers may be bringing in with inflation at a near three-decade high. (RTRS)

U.S.

ECONOMY: The U.S. economy is "already being impacted" by China's latest COVID developments and energy shortages in Europe, Deputy Treasury Secretary Wally Adeyemo said on Tuesday, but it is in better shape than in the past to withstand such pressures. (RTRS)

FISCAL: A $1.66 trillion bill to fund the U.S. government secured enough support to advance in the Senate's first procedural vote on the matter on Tuesday. (RTRS)

POLITICS: The Democratic-led House Ways and Means Committee voted Tuesday to publicly release six years of former President Trump's tax returns. (Axios)

EQUITIES: Elon Musk has said he will resign as Twitter's chief executive officer when he finds someone "foolish enough to take the job". (BBC)

EQUITIES: Elon Musk’s Twitter-related headaches multiplied Tuesday, with the US Federal Trade Commission widening an investigation into the company’s handling of user data and police in Southern California seeking information about an alleged vehicle assault that might involve a member of his security detail. (BBG)

EQUITIES: FedEx Corp. reported fiscal second-quarter earnings that beat analysts’ estimates, lifted by price increases and cost cuts that helped make up for a decline in package volume. (BBG)

OTHER

U.S./CHINA: The Biden administration is closely monitoring the rising rates of COVID infections in China in the wake of relaxed rules, White House National Security Council spokesman John Kirby said in a call with reporters on Tuesday. (RTRS)

BOJ: The Bank of Japan's shock move to lift the upper limit of its 10-year yield target has sharpened focus on the race to replace Governor Haruhiko Kuroda, with a key selection criteria being a commitment to maintaining low interest rates to support fragile growth and limit the government's borrowing costs, MNI understands. (MNI)

BOJ: The International Monetary Fund said the Bank of Japan’s surprise decision to double the cap on benchmark bond yields is a sensible step, while calling on policymakers to clearly communicate adjustments. (BBG)

JAPAN: Japan's government maintained its assessment of the domestic economy for the sixth straight month but lowered its view on the global economic outlook for the first time since August, the Cabinet Office said on Wednesday. (MNI)

AUSTRALIA/CHINA: China's President Xi Jinping said he will work with Australia to promote a comprehensive strategic partnership between the two countries, Chinese state media reported on Wednesday. (RTRS)

SOUTH KOREA: South Korea's economic growth next year will slow to 1.6% from an estimated 2.5% this year as the world economy loses momentum and pent-up domestic consumption after COVID-19 curbs were lifted fades, the finance ministry said on Wednesday. (RTRS)

USMCA: The Biden administration said on Tuesday it was requesting new dispute settlement consultations under the U.S.-Mexico-Canada Agreement (USMCA) trade deal related to Canadian dairy import tariff policies. (RTRS)

BRAZIL/RATINGS: Fitch affirmed Brazil at BB-; Outlook Stable

RUSSIA: President Joe Biden and Ukrainian President Volodymyr Zelensky are planning to meet at the White House on Wednesday, according to two sources familiar with the planning, in a Washington visit that is tentatively scheduled to include an address to a joint session of Congress. (CNN)

RUSSIA: Russian banks snapped up 90% of the 1.3 trillion roubles ($18.7 billion) worth of OFZ treasury bonds sold at finance ministry auctions in November, the central bank said on Tuesday. (RTRS)

SOUTH AFRICA: Eskom has, once again, moved to plunge South African businesses into darkness. (EWN)

COLOMBIA: Colombia’s central bank published the minutes of its December meeting on its website, where policymakers decided to hike interest rates in a three-way decision, with three bank board members voting to lift the key rate by 100bps to 12%, while one voted for 125bps and the remaining for 25bps. (BBG)

PERU: Peru’s congress approved a constitutional reform to hold early presidential elections in a second bid to alleviate a political crisis that’s seen widespread unrest since former President Pedro Castillo was removed from office Dec. 7. (BBG)

PERU/MEXICO: In a roller-coaster day for Mexico’s relations with Peru, Mexico announced Tuesday it had granted asylum for the family of ousted Peruvian president Pedro Castillo. (AP)

METALS: Indonesia will impose a ban on bauxite exports from the middle of next year, the latest measure aimed at boosting domestic processing of the nation’s mineral resources. (BBG)

OIL: OPEC+ members leave politics out of the decision making process and out of their assessments and forecasting, Saudi energy minister Prince Abdulaziz bin Salman said in an interview with the Saudi state news agency on Tuesday. (RTRS)

OIL: TC Energy Corp. pushed back the full return of its Keystone oil pipeline by a week after a 14,000-barrel oil spill shut the critical conduit, according to people familiar with the matter. (BBG)

OIL: TC Energy Corp., the operator of the Keystone pipeline, raised the volume of oil flowing through it before the system suffered its worst leak on record. (BBG)

OIL: The government funding bill U.S. lawmakers are trying to pass cancels "certain" congressionally mandated sales of oil from the Strategic Petroleum Reserve, a summary showed on Tuesday. (RTRS)

OIL: Dan Yergin predicts oil prices could hit $121 a barrel when China fully reopens, but warned there are three major uncertainties looming over the market. (CNBC)

CHINA

PBOC: Experts believe China’s loan prime rates need to be cut next year despite quotations remaining unchanged in December, according to the China Securities Journal. (MNI)

FISCAL: Local governments are issuing consumer coupons to boost year-end spending, but the key to expanding domestic demand lies in increasing income, Yicai.com reported. (MNI)

INFLATION: Pork prices in China have cooled to CNY17 per kg in December, down from around CNY30 per kg two months ago, according to the Securities Times. (MNI)

CAPITAL FLOW: China’s policies aimed at accelerating a low-carbon transition could see it emerge as the world’s largest source of green assets, a lure for additional capital inflows from global investors hungry for higher yields, said Ma Jun, chair of the Green Finance Committee (GFC) of the China Society for Finance and Banking and Co-Chair of the G20 Sustainable Finance Working Group, in an interview with MNI. (MNI)

FUNDS: China plans to tighten rules to regulate environmentally friendly, or so-called green funds, as part of its efforts to rein in 'greenwashing' in the world's second-largest climate fund market, sources with direct knowledge of the matter said. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY158 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY19 billion via 7-day reverse repos, and CNY141 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY158 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operations aim to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6774% at 9:30 am local time from the close of 1.7692% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9650 WEDS VS 6.9861 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9650 on Wednesday, compared with 6.9861 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA NOV WESTPAC LEADING INDEX -0.13% M/M; OCT +0.02%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, fell from -0.84% in October to -0.92% in November. (Westpac)

NEW ZEALAND DEC ANZ CONSUMER CONFIDENCE INDEX 73.8; NOV 80.7

The ANZ-Roy Morgan Consumer Confidence Index fell 7 points in December to 73.8, its lowest level since the data began in 2004. Just like our Business Outlook survey, there appears to some post-MPS shock value in these figures. (ANZ)

NEW ZEALAND NOV TRADE BALANCE -NZ$1.863BN; OCT -NZ$2.298BN

NEW ZEALAND NOV EXPORTS NZ$6.68BN; OCT NZ$5.96BN

NEW ZEALAND NOV IMPORTS NZ$8.54BN; OCT NZ$8.26BN

NEW ZEALAND NOV 12-MONTH YTD TRADE BALANCE -NZ$14.632BN; OCT -NZ$13.855BN

NEW ZEALAND NOV CREDIT CARD SPENDING -2.6% M/M; OCT +1.0%

NEW ZEALAND NOV CREDIT CARD SPENDING +16.0% Y/Y; OCT +24.6%

SOUTH KOREA DEC FIRST 20 DAYS TRADE BALANCE -US$6.427BN

SOUTH KOREA DEC FIRST 20 DAYS EXPORTS -8.8% Y/Y

SOUTH KOREA DEC FIRST 20 DAYS IMPORTS +1.9% Y/Y

UK DEC LLOYDS BUSINESS BAROMETER +17; NOV +10

MARKETS

SNAPSHOT: Spectre Of BoJ Shock Lingers

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 179.43 points at 26387.23

- ASX 200 up 90.833 points at 7115.1

- Shanghai Comp. down 0.781 points at 3072.985

- JGB 10-Yr future down 27 ticks at 145.87, yield up 6.2bp at 0.47%

- Aussie 10-Yr future unch. at 96.255, yield down 0.2bp at 3.725%

- U.S. 10-Yr future down 12.5 ticks at 113.40625, yield up 2.6bp at 3.7085%

- WTI crude down $0.01 at $76.22, Gold down $3.88 at $1814.04

- USD/JPY up 46 pips at Y132.19

- TC ENERGY DELAYS FULL KEYSTONE PIPELINE RESTART UNTIL NEXT WEEK (BBG)

- KURODA'S LEGACY LOOMS AS LEADERSHIP RACE NARROWS (MNI)

- CHINESE LOAN PRIME RATE CUT NEEDED NEXT YEAR (CSJ)

US TSYS: JGB Spill Over Weighs

The previously alluded to Tokyo morning weakness in broader JGBs (and continued pressure for JGBs out to 10s in late Tokyo trade) provided a cheapening impulse for U.S Tsys in a news light Asia-Pac session.

- The space heads into London a little off worst levels, with the wider cash Tsy benchmarks running 1.0-3.0bp cheaper across the curve, with 10s leading the weakness, while TYH3 is -0-05+ a 113-11+, 0-02 off the base of its 0-07+ range with volume sitting at ~63K.

- The early cheapening impulse ran out of steam as bears only failed to force an incremental and short-lived look below Tuesday’s base in TYH3. Some oscillation has been seen thereafter, albeit within contained ranges after 7+-Year paper bested Tuesday’s highs in yield terms.

- There wasn’t anything to note in the way of major market flow during Asia-Pac hours, given the proximity to the Christmas break and lack of meaningful headline drivers.

- Looking ahead, consumer confidence and existing home sales data headlines in NY hours, with 20-Year Tsy supply also due.

JGBS: Post-BoJ Pressure Continues, Market Moves Toward Test Of BoJ’s Resolve After YCC Reset

Tokyo faded the overnight uptick in JGB futures from the off, with the contract closing -38, at worst levels, with the post-BoJ impulse still being felt.

- A lack of unscheduled BoJ Rinban operations helped the space to cheapen beyond the initial bias lower during the morning session.

- The BoJ did step in with some paltry purchases in the 3- to 10-Year zone, but is more and more cognisant of market functioning issues, given that it now owns over 50% of outstanding JGBs and is set to upsize Rinban purchases in Q123. The limited size of the off-schedule operations meant that the relief rally in paper out to 10s was very shallow and short lived, with futures going on to make fresh session lows later in the day (albeit failing to test yesterday’s post-BoJ base).

- The cheapening wasn’t uniform, with the narrowing of the spreads at the latest liquidity enhancement auction covering off-the-run 15.5- to 39-Year JGBs supporting the long end.

- The broader cash JGB curve twist flattened as a result, with 5s & 7s leading the weakness, running ~8.5bp cheaper, while 20s through 40s firmed by ~1.5bp. 10-Year JGB yields moved towards the new YCC cap, last ~0.485%, as the kink in the curve and recent breaking of the BoJ’s will emboldened participants.

- There hasn’t been much in the way of domestic headline flow to note, outside of Economy Minister Goto trying to reaffirm the message provided by BoJ Governor Kuroda, in that yesterday’s YCC adjustment doesn’t represent a tweak, nor an exit from monetary easing.

- Weekly international security flow prints and lower tier data headline locally on Thursday, with the outdated minutes from the BoJ’s Oct meeting also slated.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 15.5- to 39-Year Results

The Japanese Ministry of Finance (MOF) sells Y499.5bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.022% (prev. +0.060%)

- High Spread: +0.027% (prev. +0.067%)

- % Allotted At High Spread: 75.2021% (prev. 19.8770%)

- Bid/Cover: 2.886x (prev. 2.897x)

AUSSIE BONDS: Steeper On The Day, Front End Underpinned

Follow through from a bit of an overnight session recovery in futures aided ACGB bulls in early Sydney trade, with notable screen lifts in YM futures further underpinning the front end.

- Still, the post-Sydney high in YM futures provided some resistance, halting the richening, before a subsequent round of cheapening in broader core global FI markets applied some pressure to ACGBs.

- That pushed the space away from best levels of the Sydney session, with some oscillation observed thereafter.

- YM finished +7.0 as a result, while XM was flat, with the steepening theme ever present through Wednesday dealing (whether it was in bull or twist fashion), leaving wider cash ACGBs running flat to 8.5bp richer at the bell.

- Bills finished 4-10bp richer through the reds, with some bull flattening apparent, while RBA dated OIS was little changed to a touch softer vs. late Tuesday levels, pricing 18bp of tightening for the Feb ’23 meeting and a terminal cash rate of ~3.70%.

- Local headline flow didn’t move the needle, with the continued thawing of Sino-Aussie relations and a soft Westpac leading index print observed.

- The domestic docket is now empty in the run up to Christmas.

NZGBS: Curve Steeper On Global Spill Over, Soft Data Noted

Post-BoJ catch up and spill over from Wednesday’s global core FI impulse (at least that observed during Asia-Pac hours) biased NZGB yields higher, leaving the major benchmarks sitting 4-12bp cheaper at the close.

- Swap rates were 3bp lower to 4bp higher, with the curve twist steepening, once again dragging the 2-/10-Year swap spread further away from its post-GFC lows.

- RBNZ dated OIS was essentially unchanged on the day.

- Local data wasn’t reassuring, as the expedited RBNZ tightening cycle continues to heap pressure on the economy (by design). M/M credit card spending was on the soft side, while there was another record low in the monthly ANZ consumer confidence headline print. The collator of the latter noted that “just like our Business Outlook survey, there appears to some post-MPS shock value in these figures. The RBNZ came out guns blazing in the November MPS, signalling further aggressive OCR hikes in 2023 and a technical recession. That’s clearly spooked the horses, but it’s not yet clear exactly how far they have bolted. All eyes are now on the degree of follow-through from businesses reporting negative employment intentions, and consumers saying they will significantly tighten their belts.”

- The soft data domestic probably aided the steepening impulse.

- The domestic docket is now empty into the Christmas break.

EQUITIES: Mixed Trends, Japan Markets Continue To Correct Lower

Asia Pac equity trends are mixed. Japan stocks continued to weaken, but sentiment was somewhat more positive elsewhere. US equity futures have spent much of the day in the green, last around +0.30/+0.35%.

- The Nikkei 225 is off a further 0.65%, which comes after yesterday's 2.46% drop in the aftermath of the BoJ YCC shift. The index has now weakened for the past 5 sessions. Dips below 26000 have been supported in the Index since April of this year (last levels 26392).

- The HSI is a touch higher, last around +0.10%, while onshore China shares are mixed. The Shanghai property sub-index is down a touch further after yesterday's 2.86% fall. The CSI aggregate index is a touch higher though.

- The ASX 200 is +1.20% higher, led by resource names. A firmer commodity price backdrop has helped, particularly firmer base metal and gold prices over the past 24 hours.

- The Kospi is down slightly (-0.15%), but the Taiex is up 0.30% at this stage. Philippine equities are +0.84%, continuing to recover from the sharp pull back at the start of the week.

GOLD: Bullion Holds Onto Its Tuesday’s Gains, Watch Friday’s PCE Price Data

Gold prices rose 1.7% on Tuesday to close to its December 13 high, as the JPY rallied and the USD fell after the surprise BoJ YCC adjustment. It has held onto those gains only falling 0.2% during today’s session. Bullion is now trading around $1814.90/oz.

- Gold has been in a very narrow range today reaching a high of $1819.82 and a low of $1813.79. If it clears the December 13 high of $1824.50, then it would be at its highest since the end of June.

- In the US today, December consumer confidence and existing home sales for November print. The focus is likely to be on Friday’s personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index.

OIL: Range Trading In Thin Liquidity

Oil prices have continued range trading today in a band of close to half a dollar in thin liquidity as we approach year end. Brent is trading around $80/bbl and WTI $76.20.

- US API data showed a 3.1mn bbl drawdown in crude inventories after a 7.82mn build the week before, which has helped to support prices during the APAC session. There was a 4.5mn bbl build in gasoline stocks and 3.4mn of distillate. US EIA inventory data is released later today.

- US inventory data added to supply concerns after Russia’s seaborne oil exports sank in the first week after the G7 price cap came into effect. But recession fears continue to weigh on crude prices.

- The focus later is on Canadian inflation and US consumer confidence and home sales. US EIA inventory data is also released. On Friday, US personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index, prints.

FOREX: USD Finds Some Support, NZD Testing Uptrend Channel Support Again

The USD regained some ground today, with the BBDXY index back near 1256. USD/JPY has been the main focus point, moving back above 132.00, but NZD has been on backfoot for much of the session, last near 0.6300.

- Firmer US cash Tsy yields have supported the USD, although there hasn't been much follow through to earlier moves. The 10yr last close to 3.71% (+2.5bps for the session). Equities are more mixed, while US/EU futures are higher this hasn't done much to support risk appetite.

- USD/JPY tried to break sub 131.50 close to the Tokyo fix but ran out of momentum and climbed back above 132.00, touching a high of 132.37, before settling back at 132.20.

- NZD/USD is off 0.75% for the session, last near 0.6300. This is below uptrend channel support and the 20-day EMA (0.6311). NZ survey data has been quite poor this week, with ANZ's consumer sentiment index falling sharply in December. The trade position also remain comfortably in deficit.

- AUD/USD is off 0.25% to 0.6660, outperforming the NZD. Support is evident sub 0.6660 at this stage, while the AUD/NZD cross climbed back to 1.0575. Higher iron ore prices, back above $110/tonne, has helped A$ sentiment at the margin.

- Coming up is German consumer confidence, Canadian CPI and in the US, consumer confidence and existing home sales.

FX OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400-10(E890mln), $1.0450(E726mln), $1.0660-75(E744mln), $1.0700(E655mln)

- USD/JPY: Y132.00-25($696mln), Y134.00-05($560mln), Y134.84-00($555mln)), Y136.00-15($1.1bln), Y140.00($1.1bln)

- AUD/USD: $0.6800(A$613mln), $0.6900(A$1.2bln)

- USD/CNY: Cny6.9500($675mln), Cny7.0100($789mln), Cny7.1500($930mln)

UP TODAY (TIMES GMT/LOCAL

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 21/12/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 21/12/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.