-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Speculation Surrounding Looser COVID Restrictions In China Runs Rife

EXECUTIVE SUMMARY

- FED’S BARKIN URGES SLOWING RATE HIKES BUT HIGHER DESTINATION (BBG)

- ECB'S NAGEL: UNCLEAR WHEN INFLATION BACK TO TARGET (RTRS)

- CHINA’S COVID INFECTIONS DROP FOR THE FIRST TIME IN MORE THAN A WEEK (CNBC)

- CHINA TO HOLD COVID PRESS BRIEFING AT 3PM TUESDAY (BBG)

- CHINA’S NEW VIRUS PLAYBOOK SUPPORTS COVID ZERO (PEOPLE’S DAILY)

- OPEC+ SEEN CONSIDERING DEEPER OUTPUT CUTS AS OIL MARKET FALTERS (BBG)

- EU DEBATES RUSSIAN OIL PRICE CAP AS LOW AS $62 AS TALKS SLOW (BBG)

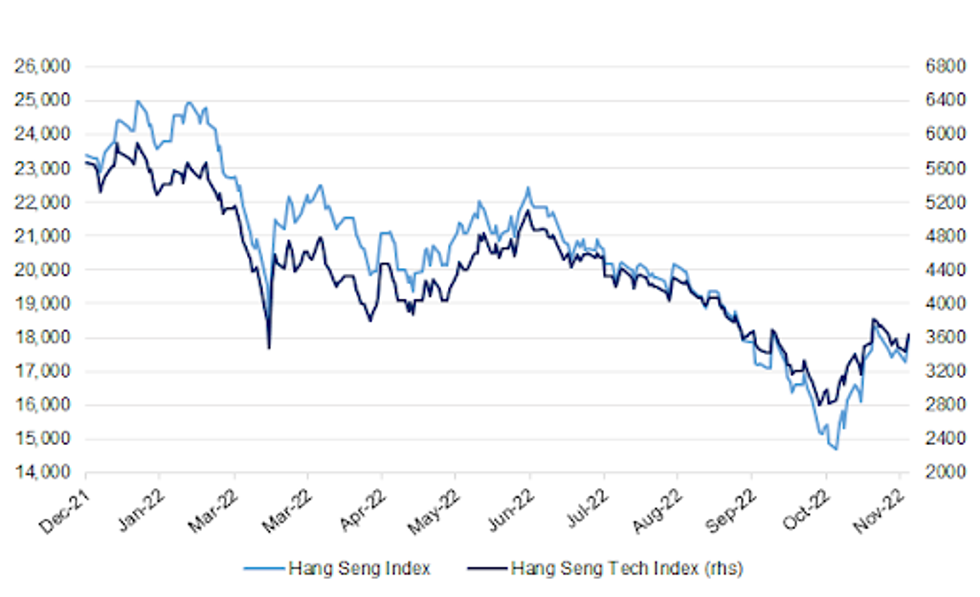

Fig. 1: Hang Seng & Hang Seng Tech Indices

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The volume of payments made in Britain on so-called Cyber Monday was up 5.0% compared to the same point in 2021, data from Barclaycard Payments showed. (RTRS)

EUROPE

ECB: Bundesbank President Joachim Nagel said on Monday inflation would likely remain above 7% next year in Germany and it was unclear when price rises in the broader euro zone would drop back to the European Central Bank's 2% target. (RTRS)

U.S.

FED: A long series of supply shocks call for tighter monetary policy to keep inflation expectations anchored, and longer run shifts in demographics, supply chains and Earth's climate may mean inflation will be more volatile in the future, Federal Reserve governor Lael Brainard said Monday. (MNI)

FED: New York Fed President John Williams said Monday tighter monetary policy has begun to cool demand and reduce inflationary pressures, though the central bank still has more work to do. (MNI)

FED: New York Fed President John Williams said Monday higher underlying inflation suggests the need for a "modestly higher" path for the fed funds rate than previously indicated in September. (MNI)

FED: Federal Reserve Bank of Richmond President Thomas Barkin said he favored slowing the pace of interest rate hikes in recognition of past aggressive moves, while adding that the peak of rates may need to be held for longer at potentially higher levels to dampen inflation. (BBG)

ECONOMY: The odds of a US recession next year is “better than 50-50” at this point and the economy is showing signs of slowing, Maurice Obstfeld, who left the IMF at the end of 2018, says in an interview with Bloomberg Television’s “Balance of Power with David Westin." (BBG)

ECONOMY: U.S. President Joe Biden on Monday called on Congress to intervene to avert a potential rail strike that could occur as early as Dec. 9, warning of a catastrophic economic impact if railroad service ground to a halt. (RTRS)

OTHER

GLOBAL TRADE: US trade chief Katherine Tai discussed France’s concerns about parts of a key Biden administration climate law with French Finance Minister Bruno Le Maire, with the two agreeing to “deepen bilateral understanding of the legislation.” (BBG)

GLOBAL TRADE: Microsoft is likely to offer remedies to EU antitrust regulators in the coming weeks to stave off formal objections to its $69 billion bid for "Call of Duty" maker Activision Blizzard (ATVI.O), people familiar with the matter said. (RTRS)

GLOBAL TRADE: Quanta Computer, Apple’s major contract maker of MacBook, is considering setting up factories in Vietnam as Apple is diversifying production lines, Taipei-based DigiTimes reports, without saying where it got information. (BBG)

U.S/CHINA: The United States backs the right of people to peacefully protest in China, the White House said on Monday, but stopped short of criticizing Beijing as protesters in multiple Chinese cities have demonstrated against heavy COVID-19 measures. (RTRS)

U.S/CHINA: China's military said on Tuesday a U.S. cruiser "illegally intruded" into waters near the South China Sea Spratly Islands and that it monitored and then drove away the guided missile cruiser. "The actions of the U.S. military seriously violated China's sovereignty and security," said Tian Junli, spokesman for the Southern Theatre Command of the People's Liberation Army. (RTRS)

UK/CHINA: Rishi Sunak has said the so-called "golden era" of relations with China is over, as he vowed to "evolve" the UK's stance towards the country. (BBC)

BOJ: The Bank of Japan's next policy move will unwind, rather than strengthen, its massive monetary easing, according to more than 90% of economists polled by Reuters, though most said the change was unlikely before the latter half of 2023. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida instructed his defense and finance ministers to increase national-security related expenditures to 2% of gross domestic product by fiscal 2027, putting a figure on the planned expansion for the first time. (BBG)

RBNZ: The New Zealand Institute of Economic Research warns the Reserve Bank might go too far in raising interest rates to contain inflation. In its latest quarterly predictions, NZIER said inflation pressures remained intense a year after the Reserve Bank started raising the official cash rate. (NBR)

SOUTH KOREA: South Korea's government and the central bank should pay greater focus on addressing any financial instability as the economy is headed for slower inflation, President Yoon Suk-yeol told Reuters. (RTRS)

SOUTH KOREA: The South Korean government on Tuesday ordered cement industry truck drivers to return to work after a six-day strike. (Nikkei)

NORTH KOREA: China not only has the responsibility but the capability to influence North Korea's behaviour, South Korean President Yoon Suk-yeol said, calling on Beijing to dissuade Pyongyang from pursuing banned development of nuclear weapons and missiles. (RTRS)

BOC: The Bank of Canada will pause interest-rate hikes early next year to assess the drag from past tightening, academic and former BOC adviser Thorsten Koeppl told MNI. (MNI)

MEXICO: The United States on Monday threatened legal action against Mexico's plan to ban imports of genetically modified corn in 2024, saying it would cause huge economic losses and significantly impact bilateral trade. (RTRS)

BRAZIL: Brazil’s incoming government is seeking to exempt the equivalent of 175 billion reais ($32.6 billion) per year from the country’s fiscal cap to spend it on social programs through 2026, according to a constitutional reform proposal filed in congress Monday. (BBG)

BRAZIL: Proposal for a constitutional amendment to remove Brazil’s social program from the spending cap is the most viable measure from a political standpoint, said former finance minister and member of the new govt’s economic transition team Nelson Barbosa told journalists. (BBG)

BRAZIL: Brazil's government-elected transition team asked state-run oil company Petrobras' Chief Executive, Caio Mario Paes de Andrade, to suspend the company's divestment plan so they have time to decide which asset sales would go ahead in the coming years, transition team member Mauricio Tolmasquim told Reuters on Monday. (NASDAQ)

RUSSIA: A communications line created between the militaries of the United States and Russia at the start of Moscow's war against Ukraine has been used only once so far, a U.S. official told Reuters. (RTRS)

METALS: The London Metal Exchange has defended its controversial decision to cancel billions of dollars of nickel trades in March as necessary to avoid a $20 billion margin call that would have sent the market into a “death spiral.” (BBG)

ENERGY: Nord Stream AG, the operator of the Russia-led Nord Stream 1 gas pipeline, on Monday updated the end date of the unplanned outage at the Greifswald exit in Germany to April 1, next year. (RTRS)

ENERGY: Europe is importing a record amount of seaborne Russian gas, highlighting how the region has not completely shaken off its dependence on the country for the key fuel even as flows through pipelines have all but stopped. (FT)

OIL: OPEC and its allies are expected to consider deeper supply curbs when they meet this weekend against the backdrop of a faltering global oil market. (BBG)

OIL: European Union states debated whether to set a price cap as low as $62 a barrel on exports of Russian crude oil after several countries demanded a level that could put more pressure on Moscow, but the talks remain stuck, diplomats said. (BBG)

OIL: India bought about 40% of all Urals seaborne export volumes loading in November, outperforming other states as buyers, Reuters calculations based on Refinitiv and traders' data showed on Monday. (RTRS)

OIL: The Biden administration plans to offer hundreds of thousands of acres off the coast of Alaska for new oil and gas drilling next month, a sale mandated in Democrats’ Inflation Reduction Act to win the support of holdout West Virginia Senator Joe Manchin. (BBG)

OIL: A White House spokesperson on Monday said talks with the European Union about a Russian oil price cap are going well. (RTRS)

CHINA

CORONAVIRUS: Mainland China reported the first decline in daily Covid infections in more than a week on Monday. (CNBC)

CORONAVIRUS: China will hold a briefing with officials from various health bodies to discuss Covid prevention and control measures Tuesday, as protests against the country’s zero-tolerance Covid approach fuel speculation the government needs to change course. (BBG)

CORONAVIRUS: The 20-point playbook on virus controls that China released earlier this month supports the Covid Zero policy and should not be seen as a sign of “opening up” or “lying flat” on prevention and control efforts, People’s Daily said in a commentary on the second page of its Tuesday edition. (BBG)

CORONAVIRUS: Global Times commentator Hu Xijin tweeted the following on Monday: “The new Omicron variant is spreading fast, pushing adjustment in COVID response in many parts of China. China's current rate of severe cases is about 0. 025%. Most Chinese people are no longer afraid of being infected. China may walk out of the shadow of COVID-19 sooner than expected.” (MNI)

YUAN: The yuan is expected to maintain its stable two-way movement as the Chinese economy continue to improve, while a possibly lower U.S. Dollar Index and weaker U.S. economic performance next year will help yuan regain the seven level against the dollar, 21st Century Business Herald reported citing analysts. (MNI)

PENSIONS/MARKETS: China's recently launched individual pension system will help transform its financial markets by developing long term investment products and management skills, according to Dong Dengxin, Director of the Institute of Financial Securities, writing for the 21st Century Business Herald late on Monday. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY78 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY80 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY78 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8424% at 9:27 am local time from the close of 1.8366% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1989 TUES VS 7.1617 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1989 on Tuesday, compared with 7.1617 set on Monday.

OVERNIGHT DATA

JAPAN OCT UNEMPLOYMENT RATE 2.6%; MEDIAN 2.5%; SEP 2.6%

JAPAN OCT JOB-TO-APPLICANT RATIO 1.35; MEDIAN 1.35; SEP 1.34

JAPAN OCT RETAIL SALES +0.2% M/M; MEDIAN +1.0%; SEP +1.5%

JAPAN OCT RETAIL SALES +4.3% Y/Y; MEDIAN +5.1%; SEP +4.8%

JAPAN OCT DEP’T STORE & SUPERMARKET SALES +4.1% Y/Y; MEDAN +4.5%; SEP +4.1%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 83.1; PREV 81.6

Consumer confidence increased 1.8% last week, with a cumulative gain of 5.6% over the past three weeks. Confidence is at its highest since early October but is still at exceptionally weak levels. (ANZ)

SOUTH KOREA OCT RETAIL SALES +7.3% Y/Y; SEP +7.5%

SOUTH KOREA OCT DEPARTMENT STORE SALES +8.0% Y/Y; SEP +8.5%

SOUTH KOREA OCT DISCOUNT STORE SALES -0.5% Y/Y; SEP -0.3%

MARKETS

SNAPSHOT: Speculation Surrounding Looser COVID Restrictions In China Runs Rife

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 124.94 points at 28037.84

- ASX 200 up 24.159 points at 7253.3

- Shanghai Comp. up 72.863 points at 3151.412

- JGB 10-Yr future down 28 ticks at 148.74, yield up 0.3bp at 0.256%

- Aussie 10-Yr future down 8.5 ticks at 96.400, yield up 8.4bp at 3.599%

- U.S. 10-Yr future down 0-01 at 112-28+, yield up 2.59bp at 3.7071%

- WTI crude up $1.45 at $78.69, Gold up $12.27 at $1753.68

- USD/JPY down 44 pips at Y138.50

- FED’S BARKIN URGES SLOWING RATE HIKES BUT HIGHER DESTINATION (BBG)

- ECB'S NAGEL: UNCLEAR WHEN INFLATION BACK TO TARGET (RTRS)

- CHINA’S COVID INFECTIONS DROP FOR THE FIRST TIME IN MORE THAN A WEEK (CNBC)

- CHINA TO HOLD COVID PRESS BRIEFING AT 3PM TUESDAY (BBG)

- CHINA’S NEW VIRUS PLAYBOOK SUPPORTS COVID ZERO (PEOPLE’S DAILY)

- OPEC+ SEEN CONSIDERING DEEPER OUTPUT CUTS AS OIL MARKET FALTERS (BBG)

- EU DEBATES RUSSIAN OIL PRICE CAP AS LOW AS $62 AS TALKS SLOW (BBG)

US TSYS: Hope Surrounding The Chinese COVID Situation Applies Light Pressure

TY futures deal a little off the base of their overnight range, while cash Tsys run 2-3bp cheaper as the curve bear flattens.

- Optimism surrounding the Chinese COVID situation biased Tsys lower in Tuesday’s Asia-Pac session, with a modest downtick in the number of new daily COVID cases in the country and speculation surrounding an impending press conference which will be held by the Chinese health authorities applying pressure.

- As we have noted elsewhere, speculation surrounding the potential for a complete re-opening of China seems a bit misplaced to us, although there may be further tweaks to China’s ZCS announced at the press conference.

- Richmond Fed President Barkin seemingly OK’d a slowdown to 50bp rate hike increments, although pointed to a longer hiking cycle with a potentially higher end point vs. previous expectations, as he stressed that the central bank will do what it needs to do, echoing the central Fed message.

- A block buy in TY futures (+1.3K) helped the space find a bit of a base after the China induced sell off.

- Looking ahead German state and national inflation data will provide interest in London hours, as will the aforementioned Chinese press conference re: COVID. Further out, NY hours will see the release of some of the house price metrics and Conference Board consumer confidence data.

JGBS: Mix Of Inputs Promotes Steepening Of Curve

The impetus derived from core global FI markets since Monday’s Tokyo close, firstly on hawkish ECB & Fed commentary, then on increased optimism surrounding the COVID situation in China (discussed elsewhere) biased JGBs lower on Tuesday.

- This allowed futures to extend through their overnight base, printing -26 ahead of the close, a little above worst levels of the day. Meanwhile, the major cash JGB benchmarks run 1bp richer to 4.5bp cheaper as the curve twist steepens

- 2s outperform on the back of a solid round of 2-Year JGB supply (the only benchmark running firmer on the day), while 10s are capped by their proximity to the upper boundary of the BoJ’s permitted YCC.

- Elsewhere, comments from Japanese Finance Minister Suzuki, pointing to defence spending that equates to 2% of Japanese GDP, may have provided additional bearish impetus, although this was in the range of spending outcomes that had been outlined by media source reports.

- Local data had no tangible impact on the space.

- Looking ahead, the release of the BoJ’s monthly Rinban outline will generate some attention after hours. This comes in the wake of tweaks to this month’s schedule as the BoJ looked to contain the latest meaningful challenge of its YCC settings, although there isn’t much speculation re: tweaks this time around.

- Flash industrial production data headlines the domestic docket on Wednesday.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.3019tn 2-Year JGBs:

- Average Yield -0.029% (prev. -0.031%)

- Average Price 100.070 (prev. 100.074)

- High Yield: -0.024% (prev. -0.027%)

- Low Price 100.060 (prev. 100.065)

- % Allotted At High Yield: 6.4613% (prev. 41.4205%)

- Bid/Cover: 4.028x (prev. 4.155x)

AUSSIE BONDS: Chinese COVID Matters Front & Centre

A greater degree of optimism re: the Chinese COVID situation was evident on Tuesday, which biased the ACGB space lower.

- The run of fresh record daily new COVID cases in the country was halted, with speculation surrounding the potential content of an impending COVID-related press conference being held by the Chinese health authorities fuelling speculation of fresh movement in COVID restrictions.

- As we have noted elsewhere, speculation surrounding the potential for a complete re-opening seems a bit misplaced to us, although there may be further tweaks to China’s ZCS announced at the press conference.

- The space finished a little above its Sydney base after futures extended on their overnight downtick, leaving YM -4.0 & XM -9.0. Cash ACGBs were 4-9bp cheaper across the curve, with the 10- to 12-Year zone leading the weakness.

- EFPs were a touch narrower on the day, pointing to a bond-driven move.

- Bills saw some light bear steepening pressure, running flat to 3bp cheaper through the reds at the close

- Looking ahead, Wednesday’s domestic docket is bursting at the seams. It includes Q3 capex data, monthly CPI, building approvals & private sector credit, as well as A$700mn of ACGB Apr-33 supply and an address from RBA Head of Domestic Markets Kearns in front of the 2022 Australian Securitisation Conference.

NZGBS: Bear Flattening On Wider Impetus

The overnight, central bank rhetoric-driven moves in core global FI markets promoted bear flattening of the Aussie bond futures curve, although both YM and XM managed to finish post-Sydney dealing off of their respective overnight lows, with U.S. Tsys operating off of worst levels.

- The major contracts operate marginally below late overnight levels shortly after the re-open, with YM -7.5 and XM -4.5.

- Bills sit 5-11 ticks lower through the reds, with the front end of the IR strip leading the way lower, once again aided by hawkish global central bank rhetoric in post-Sydney dealing.

- Flash PMI data and the release of the weekly AOFM issuance slate headline the domestic docket on Friday, although participants will likely focus on headlines and wider macro flows when it comes to drivers of market activity.

EQUITIES: China Covid Hopes & Property Stocks Drive Gains

Focus has rested on strong gains seen for China/HK bourses. These gains have dragged other parts of the region higher, while US futures are also firmer by 0.30%-0.45% at this stage, reversing some losses from the NY session.

- The CSI 300 is up close to 3%, while the Shanghai Composite is +2.20%. Early gains were supported by no escalation in onshore social unrest, while a slight downtick in covid cases also helped. Later this afternoon the National Health Commission holds a briefing (3pm local time), with the focus on Covid prevention and control measures.

- The other benefit for local equities has been further support for the property sector, as the authorities announced late yesterday, whereby developers will be allowed to raise funds through share listings (among other things). The Shanghai Property sub-index is up 7.23% so for the session.

- The HSI is slightly down from best levels, last up 3.85%, while the Kospi (+0.80%) and Taiex (+0.75%) have made gains as the session.

- Japan stocks are laggards, down 0.53% for the Nikkei 225, the firmer yen trend likely not helping.

- South East Asia has been more mixed, Philippines down 0.90%, following a recent strong run higher, while the JCI is off a touch (-0.15%).

GOLD: Prices Rise As Risk Sentiment Improves, China Covid Briefing Ahead

Gold prices are up 0.5% to around $1750/oz as the DXY has declined 0.4% since the NY close as risk appetite improved on sharply higher equity markets in Hong Kong and China. China is to hold a Covid press conference later today.

- Gold reached a low of $1741.36 early in today’s session and a high of $1750.60 recently. Any further improvement in risk sentiment that weighs on the USD could push bullion higher.

- Gold remains in a bullish trend and the latest pullback is seen as corrective. Today bullion moved away from the initial support at $1729.20, the 20-day EMA. The bull trigger is at $1786.50, the November 15 high.

- There is very little overnight except for some US house price data and US November consumer confidence. The focus of the week will be Friday’s payrolls.

OIL: Supply And Demand Reports Positive For Crude Prices

Supply and demand news has been positive for oil prices today, which are up over a percent. There are reports that OPEC+ will cut output at its December 4 meeting and China is to hold a press conference later regarding Covid prevention measures.

- WTI is currently trading close to its intraday high around $78.25/bbl after a low earlier of $76.29. Brent has been playing some catch up after diverging from WTI overnight and is also close to its intraday high at around $84.60. The USD weakened as risk sentiment improved and is now down 0.4%.

- Initial resistance for WTI is at $79.90/bbl, the November 25 high, and support at $73.38. It has been trading today in the upper part of this range.

- The EU price cap on shipments of Russian oil comes into effect on December 5, a day after the OPEC+ meeting. As of last night, the EU had not yet decided what the cap would be but a level as low as $62/bbl was discussed.

- There is very little overnight except for some US house price data and US November consumer confidence. The US API also publishes its latest inventory numbers. Last week it showed a drawdown of 4.8mn barrels.

FOREX: USD Unwinds Most Of Monday's Gains On China Optimism

The BBDXY has given up a good chunk of its gains from Monday's session. The index was last -0.50% and sitting just under 1274.50 (Monday saw a 0.63% gain). Risk appetite has been supported by strong gains across China/HK equities, which has weighed on the USDs safe haven appeal.

- A slight downtick in Covid cases, no escalation in social unrest and a press briefing later today from the China National Health Commission (NHC) is spurring re-opening hopes. Our first instinct is that today would be far too soon to announce anything like a mass re-opening in China, but markets are trading like there will be at least another tweak to the country’s COVID restrictions.

- High beta plays AUD, NZD and NOK lead the moves higher. AUD/USD is back above 0.6700, +0.80% for the session, while NZD has lagged somewhat this afternoon, last above 0.6200. Note CNH is up over 1%, with USD/CNH sub 7.1700.

- JPY is a lagged, with USD/JPY down 0.30% and the pair last around 138.50. EUR and GBP are up around 0.50% against the USD.

- Coming up is the German CPI for November, while in the US house price data and US November consumer confidence are due.

FOREX OPTIONS: Expiries for Nov289 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0450 (324mln).

- EURGBP: 0.8600 (500mln).

- USDJPY: 139 (435mln).139.70 (277mln), 140 (244mln).

- USDCAD: 1.3500 (295mln).

- USDCNY: 7.1992 (500mln), 7.20 (851mln).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/11/2022 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2022 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2022 | 0800/0900 | *** |  | CH | GDP |

| 29/11/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2022 | 0810/0910 |  | EU | ECB de Guindos Opens Encuentro Financiero Event | |

| 29/11/2022 | 0900/1000 | *** |  | DE | Hesse CPI |

| 29/11/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/11/2022 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2022 | 1235/1235 |  | UK | BOE Mann Panels The Conference Board Conference | |

| 29/11/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2022 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/11/2022 | 1330/1430 |  | EU | ECB Schnabel Speech at Frankfurter Konjunkturgespraech | |

| 29/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/11/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/11/2022 | 1500/1500 |  | UK | BOE Bailey at Lords Economic Affairs Committee | |

| 29/11/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 30/11/2022 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.