-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tech Equity Gains Aids Risk Appetite

EXECUTIVE SUMMARY

- FED’S POWELL TO DISCUSS RATE CUTS, INFLATION RISKS ON CBS SUNDAY - BBG

- US MANUFATCURING NEARING GROWTH PHASE, ISM SAYS - MNI INTERVIEW

- AMAZON AND META SURGE AFTER RESULTS, WHILE APPLE DROPS - RTRS

- BEWARE TEMPORARY INFALTION DIP - ECB's KAZAK'S - MNI INTERVIEW

- CHINA LIKELY TO GROW BY 5% In 2024 - ADVISOR - MNI BRIEF

- RBA TO CUT BY JUNE - EX STAFFER - MNI INTERVIEW

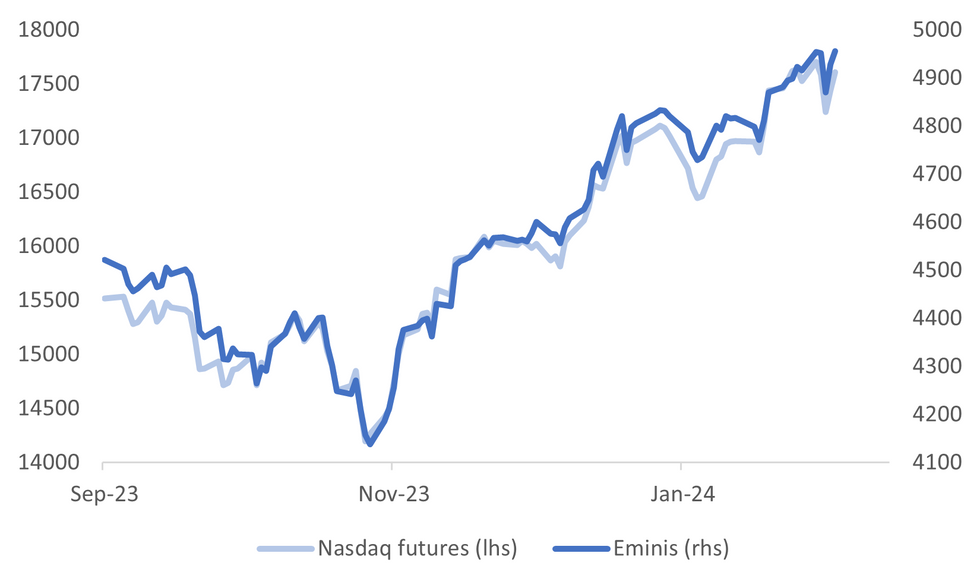

Fig. 1: US Eminis & Nasdaq Futures

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BOE WATCH): The Bank of England left interest rates unchanged at 5.25% on Thursday, but removed a reference to possible rate hikes if inflation proved more persistent than expected from its policy statement.

EUROPE

ECB (MNI INTERVIEW): The European Central Bank has to be careful not to cut rates too early in response to what may be a brief convergence of inflation towards its 2% medium-term target, Bank of Latvia governor Martins Kazaks told MNI on Thursday.

SWEDEN (MNI INTERVIEW): The Riksbank wants to avoid sending an excessively dovish signal which would undermine the krona, its Governor Erik Thedeen told MNI after Sweden’s central bank signalled that a rates cut in the first half of the year could not be ruled out.

SWEDEN (BBG): Housing prices in Sweden broke their declining trend as buyers returned to the market in January, according to data from state-owned lender SBAB.

UKRAINE (BBC): All 27 EU leaders have agreed a €50bn (£42bn; $54bn) aid package for Ukraine, after Hungary stopped blocking the deal. Ukrainian President Volodymyr Zelensky welcomed the new funding, saying it would strengthen the country's economic and financial stability.

ROMANIA (POLITICO): Romania isn't prepared for a potential war with Russia and it needs to brace, the country's defense chief said.

AGRICULTURE (POLITICO): Farmers who descended on Brussels to disrupt a leaders' summit finally got their moment with senior EU figures on Thursday evening. European Commission President Ursula Von der Leyen met with farm lobby organizations after the summit, alongside Belgian Prime Minister Alexander de Croo and Dutch Prime Minister Mark Rutte.

U.S.

FED (BBG): Federal Reserve Chair Jerome Powell will appear on CBS News’s 60 Minutes this Sunday and will discuss inflation risks, expected rate cuts and the banking system, among other topics, the network said.

MANUFACTURING (MNI INTERVIEW): The U.S. manufacturing sector is gradually stabilizing and edging closer to a new phase of expansion as new orders posted their strongest reading since May 2022, Institute for Supply Management chair Timothy Fiore told MNI.

CORPORATE (WSJ): Intel is delaying the construction timetable for its $20 billion chip-manufacturing project in Ohio amid market challenges and the slow rollout of U.S. government grant money to grow the domestic industry.

CORPORATE (RTRS): Meta Platforms (META.O), opens new tab and Amazon.com (AMZN.O), opens new tab added a combined $280 billion in stock market value late on Thursday after the Big Tech duo reported quarterly results that impressed investors, while Apple's (AAPL.O), opens new tab value shrank by $70 billion after its results.

OTHER

MIDEAST (BBG): Negotiations are advancing for an agreement to pause the Israel-Hamas war and free civilian hostages captured by Hamas, people familiar with the matter said, in a deal that those involved believe could be a crucial step toward ending the four-month conflict.

JAPAN (RTRS): Japan faces more than a two-fold increase in annual interest payments on government debt to 24.8 trillion yen ($169 billion) over the next decade, draft government estimates seen by Reuters showed on Friday.

AUSTRALIA (MNI INTERVIEW): The Reserve Bank of Australia may cut the cash rate by June to stay ahead of the curve as inflation falls faster than expected, driven by eased supply-side constraints, a former RBA economist told MNI.

NEW ZEALAND (BBG): New Zealand residential building consents fell to a five-year low in 2023, pointing to a slowdown in construction that may cool economic growth in coming quarters.

MEXICO (S&P): On Feb. 1, 2024, S&P Global Ratings affirmed its 'BBB' long-term foreign currency and 'BBB+' long-term local currency sovereign credit ratings on Mexico. The outlook remains stable. We also affirmed our short-term ratings at 'A-2'. Our transfer and convertibility (T&C) assessment is unchanged at 'A'.

CHINA

GROWTH (MNI BRIEF): The Chinese economy is expected to grow by 5% in 2024, as consumption and manufacturing investment will likely further recover amid more proactive macroeconomic policies, and upcoming new reforms will help lift expectations, said a policy advisor in an interview with the PBOC-run magazine China Financialyst.

LOAN (SECURITIES DAILY): New yuan loans are expected to exceed CNY4 trillion in January, which would be the second highest level on record, Securities Daily reported citing analysts. Wang Qing, chief analyst at Golden Credit Rating estimated new loans will reach about CNY4.6 trillion, slightly lower than the historical high of CNY4.9 trillion over the same period last year, as banks, driven by regulators, decentralized lending in November and December last year.

BANKS (YICAI): Authorities should guide banks to support the real economy after becoming increasingly cautious lenders, according to Yi Gang, former governor at the People’s Bank of China. Yi, speaking at a recent seminar, said officials need to increase capital investment in society, promote the use of long-term funds such as insurance, pensions, corporate annuities, and further develop equity investment.

PRICES (21st Century Business Herald): Farmers in China are expecting a short-term increase in pork prices during the Chinese New Year festival, according to the 21st Century Herald. The news outlet said Wumart supermarket had seen pork sales up 10% m/m last week, and analysts reported a decrease of supply due to logistic difficulties during recent bad weather.

MARKETS (BBG): Tencent Holdings Ltd. and Nexon Co. surged after Chinese regulators approved their Mobile DnF game, green-lighting a long-anticipated marquee title that had failed to pass regulatory muster for years.

CHINA MARKETS

MNI: PBOC Drains Net CNY364 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY83 billion via 7-day reverse repo and CNY14 billion via 14-day reverse repo on Friday, with the rates unchanged at 1.80% and 1.95% respectively. The reverse repo operation has led to a net drain of CNY364 billion reverse repos after offsetting CNY461 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8313% at 10:01 am local time from the close of 1.8354% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Thursday, compared with the close of 47 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1006 on Friday, compared with 7.1049 set on Thursday. The fixing was estimated at 7.1670 by Bloomberg survey today.

MARKET DATA

AUSTRALIA 4Q PRODUCER PRICES RISE 0.9% Q/Q; PRIOR 1.8%

AUSTRALIA 4Q PRODUCER PRICES RISE 4.1% Y/Y; PRIOR 3.8%

AUSTRALIA DEC. HOME-LOAN VALUES FALL 4.1% M/M; EST. +1.0%; PRIOR +0.7%

AUSTRALIA DEC. OWNER-OCCUPIED HOME LOAN VALUES FALL 5.6% M/M; PRIOR +0.3%

AUSTRALIA DEC. INVESTOR LOAN VALUES FALL 1.3% M/M; PRIOR +1.4%

NZ JAN. ANZ CONSUMER CONFIDENCE RISES 0.5% M/M; PRIOR +1.3%

NZ JAN. ANZ CONSUMER CONFIDENCE INDEX RISES TO 93.6; PRIOR 93.1

NZ DEC. HOME-BUILDING APPROVALS RISE 3.7% M/M; PRIOR -10.6%

JAPAN JAN. MONETARY BASE RISES 4.8% Y/Y; PRIOR 7.8%

SOUTH KOREA JAN. CONSUMER PRICES RISE 0.4% M/M; EST. +0.4%; PRIOR 0.0%

SOUTH KOREA JAN. CONSUMER PRICES RISE 2.8% Y/Y; EST. +2.9%; PRIOR 3.2%

SOUTH KOREA JAN. CPI EX FOOD & ENERGY RISES 2.5% Y/Y; PRIOR 2.8%

MARKETS

US TSYS: Yields Drift Higher Ahead of US Payroll Data Tonight

TYH4 is trading at 112-22+, - 06 from NY closing levels.

Tsys futures have been grinding lower in Asia trading today ahead of US payroll data out later tonight, Cash yields higher by 1-2bp across the curve.

- Overnight TYH4 hit highest levels since late Dec at 113-06.5 (+28), this was well through initial resistance of 112-26.5, however we have failed so far to stay above these levels.

- Cash yields opened unch-0.5bp higher, and yields have continued to move higher throughout the day currently 1-2bps higher, the 2Y is trading at 4.221% (1.9bps higher), while the 10Y is 3.889% (1bp higher)

- JP Morgan was out earlier calling for investors to take profit on their long 5y treasury position, as the 5y surged this week amid regional banking concerns.

- Fed chair, Powell will appear on 60 Minutes Sunday evening at 7pm ET

- Data Tonight: Jan Employ Report, UofM Inflation Expectations, Dec Factory and Durable Goods orders.

JGBS: Futures Holding In Positive Territory, Int. Payments On Govt. Debt Set To Double

JGB futures are holding richer, +17 compared to settlement levels, after rejecting an attempt to push lower early in the afternoon session. With the domestic calendar light (Monetary Base data as the only release), local participants have been largely sitting on the sidelines ahead of US Non-Farm Payrolls later today.

- Cash US tsys have also been trading in narrow ranges in today’s Asia-Pac session. Currently, they are dealing 1-2bps cheaper across benchmarks after being slightly richer earlier in the session.

- (RTRS) Japan faces more than a two-fold increase in annual interest payments on government debt to 24.8 trillion yen ($169 billion) over the next decade, draft government estimates seen by Reuters showed on Friday.

- The cash JGB curve has maintained its bull-flattening, but early yield declines have been slightly pared. Yields currently sit flat to 3bps lower. The benchmark 10-year yield is 2.3bps lower at 0.682% versus the Nov-Dec rally low of 0.555%.

- The BoJ Rinban Operations covering 1-10-year JGBs showed mixed results.

- The swaps curve is little changed. Swap spreads are wider.

- Next week, the local calendar sees Jibun Bank PMI Services & Composite and 10-year linkers supply on Monday, ahead of Labour and Real Cash Earnings on Tuesday.

AUSSIE BONDS: Subdued Trading Ahead Of US Payrolls, RBA Policy Decision On Tuesday

ACGBs (YM +2.0 & XM +2.5) remain richer. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Producer Prices and Home-Loan Values. Neither were market-moving. Ranges have been relatively narrow in the session as local participants await US Non-Farm Payrolls data later today.

- Cash US tsys have also been trading in narrow ranges in today’s Asia-Pac session. Currently, they are dealing 1-2bps cheaper across benchmarks.

- Cash ACGBs are 2-3bps richer, with the AU-US 10-year yield differential 3bps wider at +9bps.

- The May-34 ACGB auction went smoothly. The more dovish assessment of the RBA’s policy outlook, combined with a still elevated outright yield, a steeper curve, a low level of issuance, and the line’s inclusion in the XM basket all look to have contributed to today’s bidding.

- Swap rates are 2-4bps lower, with the 3s10s curve flatter.

- Bills are flat to +2, with the strip flatter.

- RBA-dated OIS pricing is 1-3bps softer for meetings beyond June, with a cumulative 63bps of easing priced by year-end.

- Next week, the local calendar sees Judo Bank PMI Services & Composite, MI Inflation Gauge, Trade Balance and ANZ-Indeed Job Advertisements on Monday. The week’s highlight is however the RBA Policy Decision on Tuesday.

NZGBS: Little Changed, Narrow Ranges Ahead of US NFP Data, Q4 Jobs & Wages Data On Wednesday

NZGBs closed near session cheaps, with benchmark yields flat to 1bp lower after being 4bps lower earlier in the session following the positive lead-in from US tsys. With the local data drop failing to provide a domestic catalyst, trading ranges have been narrow ahead of US Non-Farm Payrolls data later today.

- The NZ-US 10-year yield differential ended the session 4bps wider, settling at +63bps. This places it near the midpoint of the range observed over the last 12 months, which has fluctuated between +40 and +85bps.

- In contrast, the NZ-AU 10-year yield differential is currently positioned towards the upper end of its recent trading range, registering at +54bps. Over the past three months, this differential has hovered within a range of +30 to +60bps. However, it's worth noting that the 12-month high for this differential stands at approximately +100bps.

- Cash US tsys have also been trading in narrow ranges in today’s Asia-Pac session. Currently, they are dealing ~1bp cheaper across benchmarks after being slightly richer earlier in the session.

- Swap rates are 2-4bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 1-2bps softer across meetings beyond May. A cumulative 96bps of easing is priced by year-end.

- The local calendar sees ANZ Commodity Price on Monday, ahead of 4Q Employment and Wages data on Wednesday.

FOREX: USD Off Slightly, A$ Recovers Some Ground, Despite Iron Ore Dip

The USD sits modestly lower in terms of the BBDXY, which last tracks near 1231.5. Earlier the index got sub the 1231 level and close to Jan 24 lows, but there was no follow through. Outside of an AUD rebound moves have been modest across the G10 space, as the market awaits NFP later.

- The A$ rebound has been aided by a better equity tone led by US futures in the tech space. China markets have been less supportive though. The active Iron ore contract in Singapore is back to a $126/ton handle, but this is above mid Jan lows.

- AUD/USD sits near 0.6600, which keeps us within recent ranges. After underperforming through Thursday today's moves may reflect some catch up.

- We had PPI and housing finance data earlier for AU but sentiment in the FX space didn't move on the prints.

- NZD/USD is also slightly higher, but hasn't rallied strongly past 0.6150. The 20 and 50-day EMAS sit near current spot levels, which may be acting as a near term resistance point.

- USD/JPY sits back in the 146.40/45 region and little changed for the session. The better US futures equity tone and slight uptick in US yields likely seeing some underperformance in yen relative the likes of AUD.

- The focus later will be on the January US non-farm payrolls which are expected to post a 185k increase with the unemployment rate rising 0.1pp to 3.8%. There are also final readings for Uni of Michigan consumer sentiment and durable goods orders. The BoE’s Pill and ECB’s Centeno speak.

CHINA EQUITIES: China Equities Mixed, Ahead Of US Payrolls

Hong Kong stocks are up today, but off highs from earlier, while China Mainland stocks have lagged the move and are now trading in the red. Early gains were spurred on by strong earnings from US Tech giants, pushing Heng Sang up as much as 1.5%. The PBoC has pledged 150b yuan worth of low-cost funds for lending to housing and infrastructure in the past month, this brings the outstanding amount of the program to 3.4 trillion yuan, according to the central bank statement.

- Hong Kong indices are still trading in the green today, however far from the highs in early morning trading. The Mainland housing index was up as much as 4.6% on the back of the central bank statement overnight, we have drifted lower throughout the day to trade up 2.6% higher. Elsewhere the tech index was pushed higher this morning on the back of strong earnings from US Tech giants and news that Tencent has been given regulatory approval for their DnF game, the index at one point was 2.35% higher, traders have looked to lock in profit prior to US payroll tonight, and we currently trade just 0.44% higher.

- China Mainland indices lagged the move higher this morning, briefly trading in the green, before we saw traders look to book profits and we now trade down for the day, the CSI300 is -0.70% lower while the ChiNext lower by 2.00%. Investors are still cautious around recently policy announcements about supporting the markets, while China Evergrande ordered liquidation weighs of the minds of investors.

ASIA EQUITIES: Tech Earnings Spur Stocks Higher, As We Await Payrolls Tonight

Asia equities are higher today, supported by moves higher overnight in US stocks. Earnings out post US close for some US tech Giants have helped push futures higher, with the Nasdaq up 1.00%, while Eminis trade 0.55% higher. There has been some selling, as indices are off highs from earlier as traders look to book profits ahead of US payrolls later tonight.

- Japan equities indices are all higher today, largely in part from moves higher in the US overnight. Still some trouble in Japan's banking sector as Aozora fell as much as 18% this morning on losses on their US property exposure. Nikkei currently 0.80% higher, while the Topix trade 0.55% higher.

- Australian Equities move higher after yesterday's fall, PPI data for 4Q came out earlier at 4.1%, up from 3.8%. Currently the ASX200 is trading 1.40% higher led by Real Estate and tech stocks.

- South Korea is up 2.20% today with $820m in equity inflows today after expectations of a regulatory change will boost their valuations, after the Finance Minister yesterday spoke about resolving the "Korea Discount", bumper earnings from Naver this morning coupled with strong earnings from US giants Amazon and Meta earlier spurred a moved higher in tech names. South Korean CPI was also out before, showing inflation had eased more than expected coming in at 2.8% vs 2.9% exp.

- Taiwan equities move higher largely being led by tech names, Taiex up 0.30%

- In India the benchmarks have opened higher, the Nifty up over 1% at this stage. Positive reception around yesterday's interim budget aiding sentiment. Lower fiscal borrowing is expected to aid the private sector

- Elsewhere in SEA, there is little in way of Data, markets are moving higher in unison mostly on the back of higher US stocks.

OIL: Crude Tentatively Rises After Sinking On Gaza Ceasefire Reports

Oil prices are moderately higher during APAC trading today after falling over 2% on Thursday. The greenback is slightly lower and risk sentiment has improved but the focus is on US payrolls due later and any developments in the Middle East. Brent is up 0.7% to $79.25/bbl but off the intraday high of $79.44. WTI is 0.7% higher at $74.30/bbl off the $74.47 high but is currently down 4.8% on the week.

- Oil fell sharply on Thursday following mixed reports that progress is being made on a ceasefire deal between Israel and Hamas brokered by the US, Qatar and Egypt. The market remains on edge re any further Houthi strikes on Red Sea shipping and how the US will respond to an attack on its troops which killed three. CBS News reported that there will be a number of strikes against Iranian facilities in Syria and Iraq.

- OPEC+ met yesterday and said that it will decide in early March whether to extend its production cuts into Q2. According to Bloomberg output was reduced 490kbd in January. Non-OPEC supply remains robust keeping a lid on price rises from geopolitical incidents.

- The focus later will be on the January US non-farm payrolls which are expected to post a 185k increase with the unemployment rate rising 0.1pp to 3.8%. There are also final readings for Uni of Michigan consumer sentiment and durable goods orders. The BoE’s Pill and ECB’s Centeno speak.

GOLD: Sharply Higher Ahead Of US Payrolls, Regional Bank Concerns Helped Rally

Gold is little changed in the Asia-Pac session, after closing 0.8% higher at $2054.99 on Thursday.

- Bullion was supported by a slide in the USD and lower US Treasury yields, which came following friendly economic data.

- Initial Jobless Claims unexpectedly rose by 9k last week to 224k, while Q4 Non-Farm Productivity growth exceeded expectations. It showed a robust annualised increase of 3.2%. Consequently, unit labour costs, at an annualised rate of 0.5%, turned out to be weaker than anticipated. This marks the second consecutive quarter of subdued performance in unit labour costs.

- Focus now turns to Non-Farm Payrolls data later today.

- US regional bank concerns with respect to commercial property losses also helped the precious metal by spurring traders to price in a more rapid pace of Federal Reserve interest-rate cuts. Lower borrowing costs are positive for the non-yielding metal.

- TD Securities noted that macro traders in gold are historically underinvested for a cutting cycle. “In fact, our estimates of discretionary trader positioning points to notable short acquisitions over the last weeks, which could suggest that macro traders have been caught in a bear trap following the slew of hot data releases. This sets the stage for substantial outperformance in the yellow metal on the horizon, and our simulations of future price action suggest that imminent CTA buying activity could potentially kick off the start of a pain trade for macro traders.”

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 02/02/2024 | 1215/1215 |  | UK | BOE's Pill- MPR National Agency briefing | |

| 02/02/2024 | 1330/0830 | *** |  | US | Employment Report |

| 02/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 02/02/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.