-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: The Powell Effect Ripples Through Asia

EXECUTIVE SUMMARY

- POWELL: PEAK US RATE 'SOMEWHAT HIGHER' THAN SEPT FORECAST (MNI)

- COOK SAYS PRUDENT FOR FED TO MOVE IN SMALLER STEPS (MNI)

- BEIJING SEES RECORD COVID CASES AS CHINA VOWS SMALL EASING STEPS (BBG)

- BEIJING EASES COVID CURBS, LETTING SOME PATIENTS ISOLATE AT HOME (BBG)

- KEY EU STATES MULL LOWER RUSSIA OIL PRICE CAP LEVEL OF $60 (BBG)

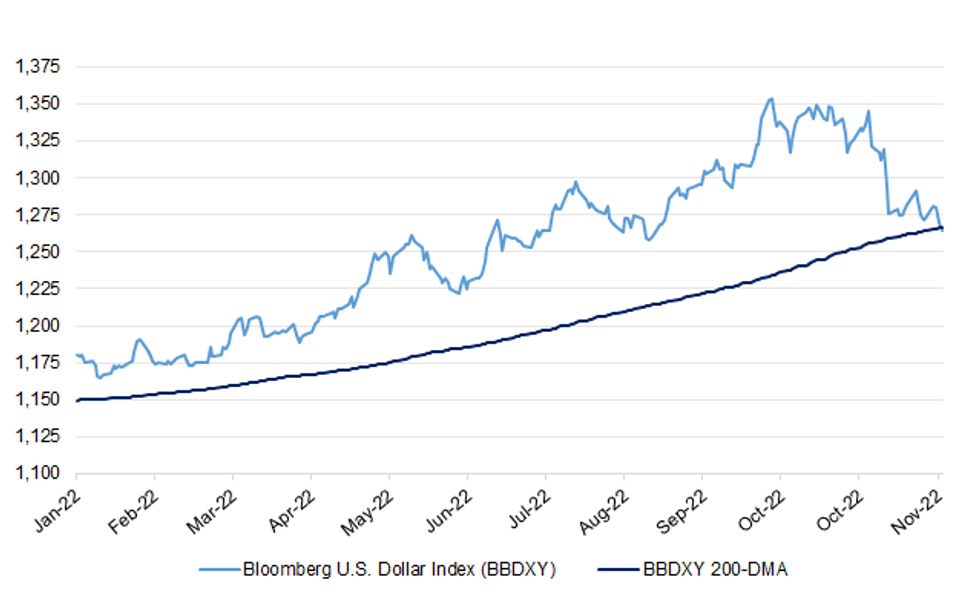

Fig. 1: BBDXY Below 200-DMA

Source: MNI - Market News/Bloomberg

UK

BREXIT: The EU fears the UK’s new freeport regime could lure investment away from the bloc in the latest clash between the two over London’s post-Brexit policies. (FT)

EUROPE

GERMANY: Germany faces a prolonged period of slow growth and declining market shares, but core inflation is likely to remain high as supply- and energy-driven price rises give way to an upward trend in domestic demand pressures, senior German Economics Institute (IW Koeln) economist Markus Demary told MNI. (MNI)

U.S.

FED: Peak U.S. interest rates next year are likely to be "somewhat higher" than the FOMC projected in September and stay restrictive "for some time" as the Federal Reserve seeks to cool demand and restore balance in the overheated labor market, Fed Chair Jerome Powell said Wednesday. (MNI)

FED: Federal Reserve Governor Lisa Cook said Wednesday it would be prudent for the central bank to start moving in smaller steps, given the monetary tightening already in the pipeline and that policy works with long lags. (MNI)

FED: U.S. economic activity and the pace of price increases slowed in November, the Federal Reserve said Wednesday in a report summarizing recent conversations with businesses and community groups. (MNI)

FISCAL: A federal appeals court on Wednesday declined to put on hold a Texas judge's ruling that said President Joe Biden's plan to cancel hundreds of billions of dollars in student loan debt was unlawful. (RTRS)

EQUITIES: Elon Musk is under renewed pressure from the US and EU over his ownership of Twitter, as regulators clamp down on the billionaire’s push to transform the social network into a freewheeling haven of free speech. (FT)

EQUITIES: Elon Musk has said he and Apple boss Tim Cook have "resolved the misunderstanding" over Twitter possibly being removed from the app store. (BBC)

OTHER

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co. will offer advanced 4-nanometer chips when its new $12 billion plant in Arizona opens in 2024, an upgrade from its previous public statements, after US customers such as Apple Inc. pushed the company to do so, according to people familiar with the matter. (BBG)

GLOBAL TRADE: U.N. aid chief Martin Griffiths said on Wednesday a deal is close on resuming Russian ammonia exports through a pipeline to a Ukrainian Black Sea port. "I think we're quite close, we're edging towards it this week," Griffiths told a Reuters NEXT event. (RTRS)

U.S./CHINA: It’s now clear to U.S. officials that China, once considered a possible economic and political ally, has become an emerging threat to national security, U.S. companies and American workers, Commerce Secretary Gina Raimondo said Wednesday. (CNBC)

U.S./CHINA/TAIWAN: US lawmakers are poised to back as much as $10 billion to bolster Taiwan’s defenses against growing tensions and threats from China as part of a compromise annual defense authorization bill, according to a congressional aide familiar with the deliberations. (BBG)

EU/CHINA: China’s President Xi Jinping met European Council President Charles Michel in Beijing on Thursday, state-run CCTV reports. (BBG)

BOJ: Bank of Japan policy board member Asahi Noguchi said Thursday that the central bank must maintain its ultraeasy monetary policy to promote wage growth. (Dow Jones)

BOJ: Bank of Japan officials have grown more concerned that financial institutions will be hit harder by slower global growth and prolonged high U.S. interest rates, a shift in focus from worries about the pace of rate hikes highlighted in October’s Financial System Report, MNI understands. (MNI)

JAPAN: Tokyo’s Covid monitoring panel is making final preparations to raise the warning level for strain on the medical system as coronavirus cases continue to surge, NHK reports, citing an unidentified person. (BBG)

SOUTH KOREA: Finance Minister Choo Kyung-ho on Thursday reiterated his call for local truckers to return to work, stressing that their strike is causing severe damage to the country's economy, already hurt by uncertainties. (Korea Herald)

SOUTH KOREA: A strike by South Korean truckers is estimated to have cost 1.6 trillion won ($1.23 billion) in lost shipments, the industry ministry said on Thursday. (RTRS)

NORTH KOREA: North Korea will hold a plenary meeting of its ruling party's central committee in late December to set major policy directions, state media KCNA said on Thursday. (RTRS)

NORTH KOREA: The United States is working a new round of sanctions against North Korea, U.S. National Security Advisor Jake Sullivan said on Thursday, as Pyongyang forges ahead with banned missile development and signals a possible new nuclear test. (RTRS)

CANADA: U.S. Trade Representative Katherine Tai on Wednesday raised concerns about Canada's proposed digital service tax and pending legislation in the Canadian Parliament that could affect digital streaming services, Tai's office said. (RTRS)

MEXICO: Mexico’s central bank boosted its growth forecast for this year and next despite a possible recession in the US, the country’s biggest trading partner, as the services sector recovered in the third quarter. (BBG)

TURKEY: The US warned Turkey against a new military campaign into Kurdish-controlled parts of Syria, saying that some recent airstrikes had posed a threat to US personnel working with Syrian partners to defeat the Islamic State. (BBG)

RUSSIA: German Chancellor Olaf Scholz said on Wednesday that Russia could no longer win the war in Ukraine on the battlefield. Speaking at the Berlin Security Conference, Scholz also said that Germany took Russia's nuclear rhetoric seriously but would not be cowed by it. (RTRS)

RUSSIA: Russia's economy contracted by 4.4% in October on a year-on-year basis, the country's economy ministry said on Wednesday. (RTRS)

RUSSIA: European Union officials said the bloc can’t confiscate tens of billions of euros worth of frozen Russian central-bank funds to pay for Ukraine’s reconstruction, while its executive body sent proposals to member states on setting up an international court to prosecute Russian officials for this year’s invasion. (WSJ)

SOUTH AFRICA: An advisory panel established by South Africa’s parliament found there are grounds for lawmakers to investigate President Cyril Ramaphosa in connection with a scandal over a robbery at his game farm, a finding that could ultimately cost him his job. (BBG)

ENERGY: The European Union's energy chief on Wednesday defended the bloc's proposal to cap gas prices and said countries will negotiate possible changes to the proposal, after a backlash from EU member states. (RTRS)

OIL: European Union states are discussing capping the price of Russian crude oil at $60 a barrel to help secure an agreement among the bloc’s wider membership and the broader Group of Seven, according to people familiar with the matter. (BBG)

OIL: Russia oil output rose to an eight-month high in November, just days before the European Union imposes a ban on importing the country’s crude. (BBG)

OIL: Bulgaria is looking at ways to preserve partial exports from its Black Sea refinery, which faces drastic output cuts by the European Union’s ban on Russian oil due to start next week. (BBG)

OIL: OPEC oil output has fallen in November, led by top exporter Saudi Arabia and other Gulf members, after the wider OPEC+ alliance pledged steep output cuts to support the market amid a worsening economic outlook, a Reuters survey found on Wednesday. (RTRS)

OIL: The Biden administration is considering tapping additional reserves of heating and crude oil as winter nears and uncertainty over market prices worsens, according to four people familiar with the matter. (CNBC)

OIL: U.S. oil output climbed 2.4% to 12.27 million barrels per day (bpd) in September, government figures showed on Wednesday, the highest since the start of the COVID-19 pandemic. (RTRS)

OIL: Venezuelan President Nicolas Maduro on Wednesday said licenses and authorizations so far granted by the U.S. government to the OPEC member country are going in right direction, but they are not enough. (RTRS)

CHINA

CORONAVIRUS: The Chinese capital of Beijing reported 5,006 cases for Wednesday, a record, as it struggles to contain the worst ever outbreak to hit the country’s political and cultural center amid public anger at the punishing Covid Zero regime. (BBG)

CORONAVIRUS: Beijing will allow some virus-infected people to isolate at home, starting with residents of the city’s most-populous district, a landmark shift that reflects the pressure officials are under from a outbreak and public opposition to Covid Zero. (BBG)

CORONAVIRUS: The International Monetary Fund sees scope for further gradual, safe recalibration of China's zero-COVID policy that could allow economic growth in the country to pick up in 2023, an IMF spokesperson said Wednesday. (RTRS)

PBOC: The People’s Bank of China will moderately increase open market operations to meet increased liquidity demand by the end of the year, thereby maintaining reasonable and ample liquidity, China Securities Journal reported citing analysts. (MNI)

ECONOMY/FISCAL: China's government needs to quickly implement policies to support growth following the fall in November’s PMI to 48 from 49.2 in October, according to 21st Century Business Herald. Experts told the newspaper that falling demand and weaker confidence was placing downward pressure on the economy. (MNI)

PROPERTY: China’s housing market could bottom out by the second quarter next year as potential homebuyers may enter the market as confidence is restored following recent support for the sector, Yicai.com reported citing a report by China Real Estate Information Corporation. (MNI)

CREDIT: The number of Chinese corporates with overdue trade acceptance bills (TAB) rose sharply in 10M22, largely led by distressed, privately owned property developers’ project companies, while some state-owned enterprises’ (SOE) TAB defaults suggest their liquidity is tight, says Fitch Ratings. (Fitch)

CHINA MARKETS

PBOC NET INJECTS CNY2 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY2 billion after offsetting the maturity of CNY8 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8161% at 9:36 am local time from the close of 2.0203% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Wednesday vs 49 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1225 THURS VS 7.1769 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1225 on Thursday, compared with 7.1769 set on Wednesday, marking the biggest daily rise since Nov 14..

OVERNIGHT DATA

CHINA NOV CAIXIN MANUFACTURING PMI 49.4; MEDIAN 48.9; OCT 49.2

Under pressures from shrinking demand, weakening expectations and a supply shock, the employment index has remained low for a long time. The downturn in employment coupled with the triple pressures have created a negative feedback loop. (Caixin)

JAPAN Q3 CAPITAL SPENDING +9.8% Y/Y; MEDIAN +6.4%; Q2 +4.6%

JAPAN Q3 CAPITAL SPENDING EX-SOFTWARE +8.0% Y/Y; MEDIAN +6.2%; Q2 +3.5%

JAPAN Q3 COMPANY PROFITS +18.3% Y/Y; MEDIAN +16.1%; Q2 +17.6%

JAPAN Q3 COMPANY SALES +8.3% Y/Y; MEDIAN +10.8%; Q2 +7.2%

JAPAN NOV, F JIBUN BANK MANUFACTURING PMI 49.0; PRELIM 49.4; OCT 50.7

“The economic landscape of Japan’s manufacturing sector worsened midway through the final quarter of 2022, according to latest S&P Global PMI data. (S&P Global)

JAPAN NOV CONSUMER CONFIDENCE INDEX 28.6; MEDIAN 30.0; OCT 29.9

AUSTRALIA NOV CORELOGIC HOUSE PRICE INDEX -1.1% M/M; OCT -1.1%

AUSTRALIA Q3 PRIVATE CAPITAL EXPENDITURE -0.6% Q/Q; MEDIAN +1.5%; Q2 0.0%

AUSTRALIA NOV, F S&P GLOBAL MANUFACTURING PMI 51.3; PRELIM 51.5; OCT 52.7

Against a backdrop of tightening monetary policy and a challenging global macroeconomic environment, the latest November Australia Manufacturing PMI revealed that the manufacturing sector further moderated its growth pace in November. (S&P Global)

NEW ZEALAND CORELOGIC HOUSE PRICE INDEX -2.9% Y/Y; OCT -0.6%

SOUTH KOREA Q3 GDP, P +0.3% Q/Q; MEDIAN +0.3%; Q2 +0.7%

SOUTH KOREA Q3 GDP, P +3.1% Y/Y; MEDIAN +3.1%; Q2 +2.9%

SOUTH KOREA NOV TRADE BALANCE -US$7.010BN; MEDIAN -US$4.327BN; OCT -$6.698BN

SOUTH KOREA NOV EXPORTS -14.0% Y/Y; MEDIAN -11.2%; OCT -5.7%

SOUTH KOREA NOV IMPORTS +2.7% Y/Y; MEDIAN +0.5%; OCT +9.9%

SOUTH KOREA NOV MANUFACTURING PMI 49.0; OCT 48.2

Despite remaining in contraction territory, November PMI data pointed to a more positive economic landscape for South Korea's manufacturing sector. (S&P Global)

MARKETS

SNAPSHOT: The Powell Effect Ripples Through Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 302.15 points at 28267.44

- ASX 200 up 70.226 points at 7354.4

- Shanghai Comp. up 22.492 points at 3173.416

- JGB 10-Yr future up 28 ticks at 149.01, yield up 0.7bp at 0.26%

- Aussie 10-Yr future up 5.0 ticks at 96.520, yield down 4.8bp at 3.481%

- U.S. 10-Yr future up 0-17 ticks at 114-01, yield up 0.55bp at 3.6091%

- WTI crude down $0.16 at $80.40, Gold up $11.41 at $1779.64

- USD/JPY down 173 pips at Y136.38

- POWELL: PEAK US RATE 'SOMEWHAT HIGHER' THAN SEPT FORECAST (MNI)

- COOK SAYS PRUDENT FOR FED TO MOVE IN SMALLER STEPS (MNI)

- BEIJING SEES RECORD COVID CASES AS CHINA VOWS SMALL EASING STEPS (BBG)

- BEIJING EASES COVID CURBS, LETTING SOME PATIENTS ISOLATE AT HOME (BBG)

- KEY EU STATES MULL LOWER RUSSIA OIL PRICE CAP LEVEL OF $60 (BBG)

US TSYS: A Touch Cheaper As Asia Fades Modest Amount Of Month-End & Powell-Inspired Bid

The bulk of Wednesday’s rally held in Asia-Pac hours, although some of the month-end extension-related, and partially block-flow facilitated, rally that kicked in after the initial late NY bid surrounding Fed Chair Powell’s address faded overnight.

- That leaves cash Tsys 0.5-2.5bp cheaper into London hours, with the front end leading the modest cheapening. TYH3 deals just below the mid-point of its 0-08 range, last +0-16 at 114-00.

- There wasn’t much in the way of meaningful headlines to absorb overnight, with a slightly ‘less worse’ than expected Chinese Caixin manufacturing PMI print and headlines pointing to further COVID isolation tweaks in Beijing having little impact on the space.

- That left the fading of the month-end extension impulse and a couple of block sales in TY futures (2x 1,250 lots) at the fore.

- In terms of Fed pricing, FOMC dated OIS currently prices in 52bp of tightening for this month’s FOMC, with a terminal rate of just over 4.90% eyed. Both measures sit a little below pre-Powell levels.

- NY hours will be headlined by the PCE data suite, ISM manufacturing survey and Fedspeak from Bowman, Barr & Logan.

JGBS: Off Best Levels As BoJ's Noguchi Outlines Potential Triggers For Policy Tweaks

Cash JGBs have twist steepened, moving away from best levels in afternoon trade, as global core FI markets nudged away from best levels of the day.

- Cash JGBs run 2.5bp richer during to 1.5bp cheaper across the curve, after initially drawing support from Tokyo’s reaction to Fed Chair Powell’s latest address.

- 7s outperformed on the curve owing to the bid in futures, as local participants extended the overnight bid in that contract. Futures are +26 into the close, comfortably off of best levels.

- It would seme that comments from BoJ’s Noguchi, who discussed potential parameters that could trigger BoJ policy tweaks, added an idiosyncratic input into the move away from best levels. There wasn’t much in the way of new information in the comments themselves, while Noguchi also played down the idea of a policy tweak in the near term (albeit while pointing to a data-dependent stance).

- There was no reaction to local data.

- We saw a very well received 10-Year JGB auction in which the tail vanished and low price marginally topped wider dealer expectations. Meanwhile, the cover ratio moved to the highest level observed at a 10-Year JGB auction since the early 2000s. It would seem that participants were willing to lean on the BoJ’s forward guidance and YCC settings here, with the auction clearing at the upper boundary (in yield terms) permitted under the BoJ’s YCC.

- Looking ahead, the latest round of BoJ Rinban operations headline the domestic docket on Friday.

JGBS AUCTION: 10-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2784tn 10-Year JGBs:

- Average Yield: 0.250% (prev. 0.248%)

- Average Price: 99.52 (prev. 99.53)

- High Yield: 0.250% (prev. 0.249%)

- Low Price: 99.52 (prev. 99.52)

- % Allotted At High Yield: 40.8288% (prev. 42.7523%)

- Bid/Cover: 6.028x (prev. 5.243x)

AUSSIE BONDS: Firmer, But Off Post-Powell Peaks

Aussie bonds firmed on Thursday, but backed away from best levels. This left YM +7.0 & XM +5.0 at the close, while cash ACGBs were 1-7bp richer as the curve bull steepened.

- Aussie 10s widened a little vs. their U.S. counterpart post-Powell (~7bp vs. yesterday’s local close), with the AU/U.S. 10-Year yield spread operating comfortably within the recently observed range.

- Local data didn’t have any meaningful impact on the space, with the late NY rally in U.S. Tsys (on the back of Fed Chair Powell’s address and month-end index extensions) initially allowing participants to extend the overnight uptick in Aussie Bond futures, before a pull back from best levels, alongside a similar move in the U.S. Tsy space.

- Bills finished 3-6bp richer through the reds, with some light bull flattening apparent.

- RBA dated OIS generally came in a touch post-Fed Chair Powell, with ~”19bp of tightening priced for next week’s decision and a terminal cash rate of ~3.70% observed on the strip.

- Housing finance data, A$600mn of ACGB Sep-26 supply and the release of the weekly AOFM issuance slate headline the domestic docket on Friday.

NZGBS: Off Best Levels, 10s Underperform On Uncovered Auction

NZGBs worked away from richest levels of the session, leaving the major benchmarks flat to 7bp firmer on the day come the bell.

- A very modest round of cheapening in U.S. Tsys (after a notable post-Powell rally extended on month-end extension-based demand into the NY close) initially helped the space away from best levels.

- There were also some idiosyncrasies at play, with an uncovered round of NZGB-33 supply resulting in underperformance for the 10-Year zone on the curve (as that benchmark finished virtually unchanged on the day), while NZGB-27 & May-51 supply passed smoothly, with the latter particularly well received.

- Swap rates pulled back from session lows but were still 2-5bp lower on the session, resulting in mixed swap spread performance.

- RBNZ dated OIS eased in lieu of Fed Chair Powell’s Wednesday address, with ~62bp of tightening priced in for the Bank’s Feb ’23 meeting, while terminal rate pricing eased to just over 5.35%, as both measures shed 5bp or so on the day.

- Looking ahead, quarterly terms of trade data headlines Friday’s domestic docket.

EQUITIES: Asian Markets Enjoy Post Powell Rally

MNI (Australia) - Most regional bourses are higher, tracking the strong positive lead from offshore markets overnight. Only Indonesian and Philippines markets are down within the Asia Pac region. US equity futures are modestly higher, +0.15/+0.20% at this stage. The risk on tone has been evident in other asset classes, with the USD softer and commodities mostly higher.

- China's CSI 300 is firmer by 1.30% so far today, while the Shanghai Composite is +0.65% higher. A slight down tick in aggregate Covid cases, coupled with a Caixin PMI beat has helped.

- Further re-opening signs is the other focus point for markets, with a number of regions moving away from lock down conditions.

- The HSI is up by 1.60%, with the tech index up nearly 2.40%. Overnight the China Dragon Index rose a further 9.60%, capping off a +42% gain for the index in November.

- Japan's Nikkei 225 is up +1%, Q3 data showed better than expected company profits and Capex.

- The Kospi is showing a modest +0.15% gain, but offshore investors continue to return to the market, with a further $150mn in net inflows.

GOLD: Gold Approaching Bull Trigger On Less Hawkish Fed

Gold prices are up again so far today rising 0.4% to around $1776.20/oz after Fed Chairman Powell signalled a stepdown in tightening in December. It is off of its intraday high of $1779.99. The further downward move in the USD today (DXY -0.3%) is helping bullion to rally.

- Gold has been approaching the bull trigger of $1786.50, the November 15 high, this rally but hasn’t reached it yet. Further USD and Treasury yield weakness would be needed to take it through that level.

- There are European and US November manufacturing PMI/ISM data later. There is also some Fed speak and US consumption and jobless claims data. Weakness here could push gold prices higher.

OIL: Oil Prices Hold Onto Gains On Demand Hopes And Tight Supply

Oil prices are down slightly today after rising 3% overnight and are trading in a very tight range of less than one dollar. Supply and demand news has resulted in oil holding onto its recent gains.

- WTI is trading at $80.40/bbl after a high of around $81/bb and Brent is about $86.70 after reaching $87.25.

- Brent has struggled to hold a break through resistance of $86.67, the November 25 high. Whereas WTI has cleared its November 25 high of $79.90 and $82.43 has opened up, the November 18 high.

- EIA data showed a large drawdown in US crude inventories of 12.58mn barrels after 3.691mn last week, the largest decline since June 2019, and consistent with the API data. US exports of crude and products also rose to a new record. There were reports from CNBC that US President Biden is looking to use additional reserves of both crude and heating oil for the winter.

- On the output side, there is still uncertainty surrounding the outcome of the weekend’s OPEC+ meeting.

- There are European and US November manufacturing PMI/ISM data later. There is also some Fed speak and US consumption and jobless claims data.

FOREX: USD Index Holds Beneath 200-Day MA, USD/JPY Back To Late August Lows

The USD has remained on the back foot for much of the session. The BBDXY index, currently sub 1264.00, remains below its 200-day MA (1266.36).

- Risk-on signals have been evident in the equity and commodity space, although JPY is the standout performer within G10.

- USD/JPY is down over 1.3%, last near 136.30, fresh lows for the session and levels last seen in late August. Domestic data has been mixed, while the BoJ's Noguchi hasn't broken new ground relative to other recent BoJ commentary.

- AUD/USD is firmer, up to 0.6815, +0.40% for the session. The pair shrugged off a weak Q3 CAPEX result.

- NZD has outperformed, up 0.60% to 0.6335. The AUD/NZD cross has remained heavy but found support around the 1.0750 level.

- EUR (1.0445) and GBP (1.2100) are both up around 0.35% for the session so far.

- There are European and US November manufacturing PMI/ISM data later. There is also some Fed speak and US consumption and jobless claims data.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/12/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 01/12/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/12/2022 | 0730/0830 | *** |  | CH | CPI |

| 01/12/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/12/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/12/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/12/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 01/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 01/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/12/2022 | 1425/0925 |  | US | Dallas Fed's Lorie Logan | |

| 01/12/2022 | 1430/0930 |  | US | Fed Governor Michelle Bowman | |

| 01/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/12/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 01/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2022 | 1645/1745 |  | EU | ECB Lane at Banque de France / EUI conference | |

| 01/12/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Lustrum Symposium | |

| 01/12/2022 | 2000/1500 |  | US | Fed Vice Chair for Supervision Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.