-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tokyo CPI Mixed Ahead Of BoJ Next Week

EXECUTIVE SUMMARY

- G20 CENBANKS CONCERNED ABOUT RATE NORMALIZATION - MNI POLICY

- CHANCELLOR REEVES SAYS SHE’LL FIX ‘MESS’ OF UK PUBLIC FINANCES - BBG

- JAPAN JULY TOKYO CORE CPI RISES 2.2% VS. JUNE’S 2.1% - MNI BRIEF

- NEW ZEALAND CONSUMER CONFIDENCE JUMPS AS RATE CUTS APPEAR ON HORIZON - DJ

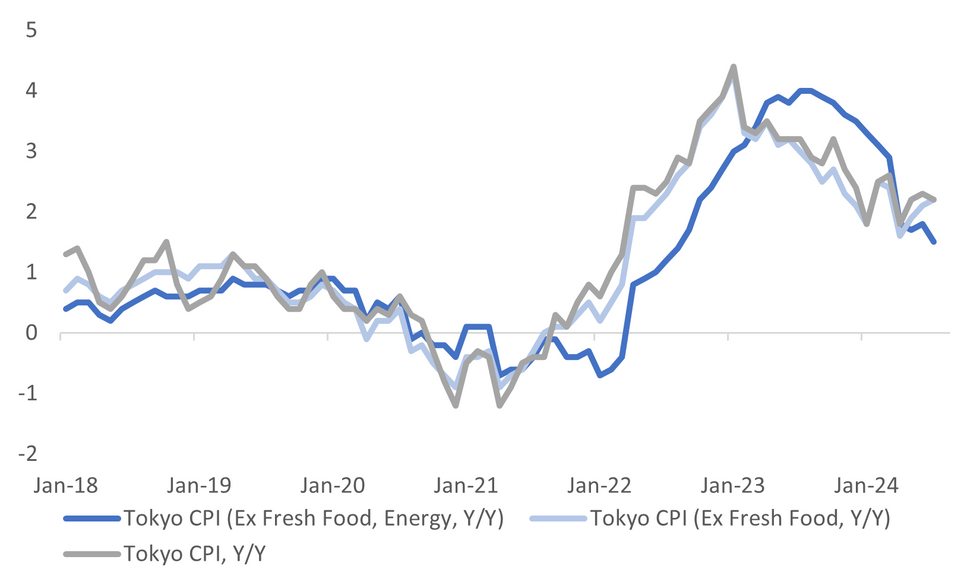

Fig. 1: Tokyo CPI - Mixed July Trends

Source: MNI - Market News/Bloomberg

UK

FISCAL (BBG): “ Chancellor of the Exchequer Rachel Reeves said she has inherited a “mess” in Britain’s public finances from the previous Conservative administration, her latest warning about the UK’s fiscal position that suggests a tax-raising Budget in the autumn.”

BOE (BBG): "Some of the UK price indicators the Bank of England is watching closely for signs of lingering inflation are flashing a green light for interest-rate reductions as soon as next week."

EUROPE

CORPORATE (BBG): “Meta Platforms Inc. is facing its first European Union fine over allegations it abused its dominance in the classified ad market by tying Facebook Marketplace to its social network.”

EU/CHINA (BBG): " China’s electric carmakers are expanding in Europe to blunt the impact of tariffs meant to weaken their price advantage over the region’s ailing legacy manufacturers."

US

FED (MNI INTERVIEW): Growing Spillover Risk Of Banks, NBFIs- Acharya

POLITICS (BBG): “Kamala Harris said she would debate Donald Trump and accused her Republican opponent of trying to back out of a previously scheduled face-off in September.”

OTHER

US/ISRAEL (RTRS): “ U.S. Vice President Kamala Harris pressured Israeli Prime Minister Benjamin Netanyahu on Thursday to help reach a Gaza ceasefire deal that would ease the suffering of Palestinian civilians, striking a tougher tone than President Joe Biden. "It is time for this war to end," Harris said in a televised statement after she held face-to-face talks with Netanyahu.”

GLOBAL (MNI POLICY): Central bankers gathered at the G20 meeting in Rio de Janeiro this week are concerned about potential disruptions from countries' efforts to normalize monetary policy after a prolonged period of elevated borrowing costs, MNI understands.

GLOBAL (MNI BRIEF): U.S. Treasury Secretary Janet Yellen said Thursday that tax policy is hard to coordinate globally, as Brazil tries to build a consensus about a 2% minimum tax on the wealth of the world's billionaires at G20 meetings the country is hosting.

JAPAN (MNI BRIEF): “Tokyo's core inflation rate accelerated to 2.2% y/y in July from June’s 2.1%, the third straight increase and above 2% for the second straight month, data from the Ministry of Internal Affairs and Communications showed on Friday.”

NEW ZEALAND (DJ): “New Zealand consumer confidence jumped in July amid rising expectations of aggressive interest-rate cuts over the next year.”

AUSTRALIA (AFR): If the RBA was doing its job, it would immediately lift rates

CHINA

POLICY (MNI BRIEF): China will allocate CNY300 billion ultra-long special treasury bonds towards supporting large-scale equipment renewals and consumer good replacement projects, Zhao Chenxin, Deputy Director at the National Development and Reform Commission said on Thursday.

BOND YIELDS (SHANGHAI SECURITIES NEWS): “ There is still room for China’s government bond yields to move lower due to the country’s economic fundamentals, Shanghai Securities News reports on Friday, citing analysts.”

DEPOSIT RATES (SHANGHAI SECURITIES NEWS): “China’s small and medium-sized banks are likely to cut their deposit rates, following the footsteps of their bigger rivals, Shanghai Securities News reports on Friday.”

AUTOS (SECURITIES DAILY): “Major Chinese cities are considering to ease car purchase restrictions as part of government efforts to boost domestic consumption, according to a Securities Daily report, citing industry experts.”

CHINA MARKETS

MNI: PBOC Net Injects CNY299.05 Bln via OMO Fri

The People's Bank of China (PBOC) conducted CNY358.05 billion via 7-day reverse repo on Friday, with rate unchanged at 1.70%. The operation has led to a net injection of CNY299.05 billion after offsetting the CNY59 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8948% at 09:42 am local time from the close of 1.9168% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Thursday, compared with the close of 51 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1270 on Friday, compared with 7.1321 set on Thursday. The fixing was estimated at 7.2262 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JULY ANZ CONSUMER CONFIDENCE INDEX 87.9; PRIOR 83.2

NEW ZEALAND JULY ANZ CONSUMER CONFIDENCE M/M 5.6%; PRIOR -2.0%

JAPAN JULY TOKYO CPI Y/Y 2.2%; MEDIAN 2.3%; PRIOR 2.3%

JAPAN JULY TOKYO CPI EX-FRESH FOOD Y/Y 2.2%; MEDIAN 2.2%; PRIOR 2.1%

JAPAN JULY TOKYO CPI EX-FRESH FOOD, ENERGY Y/Y 1.5%; MEDIAN 1.6%; PRIOR 1.8%

MARKETS

US TSYS: Tsys Futures Steady Ahead Of PCE Later

- Treasury futures are little changed today, with investors awaiting today's data in particular core PCE, while personal income and spending, U. of Mich. Sentiment will also closely watched. TUU4 is unchanged at 102-16+, while TYU4 is + 01+ at 110-27.

- Volumes were on the low side today, there was a block buyer of 2,900 FV earlier.

- Cash treasury curve is little changed today, yields are about 0.5bps higher, with the 10Y at 4.243%

- The 2s10s reached it's least inverted level for the year overnight, although we now trade off those levels down 8bps at -19bps.

- (Bloomberg) PREVIEW: June PCE to Show Stretched Consumers, Soft Inflation - See link

- US futures are currently fully pricing in a cut in September, with cumulative 66bps of cuts in year-end.

JGBS: Futures Holding Higher, Solid 2yr Auction, BoJ Next Week

JGB futures are holding positive, but have been unable to breach the 143.00 handle. We were last 142.88 for JBU4, +.14 versus settlement levels.

- This leaves us towards the upper end of the trading range for the past few sessions.

- We had a solid 2yr auction result earlier. The bid to cover was 4.19, versus the prior 3.83, while the tail was 0.007 compared to 0.008 prior.

- Earlier the July Tokyo CPI update was mixed. Headline and the core ex fresh food trend remained above 2% y/y but core-core, which also excludes energy fell to 1.5%. Still, if history is a guide this core-core measure should follow the other headline metrics firmer in coming months.

- In the cash JGB space, we are mostly lower in yield terms, particularly towards the back end of the curve, off a little over 2bps for the 20-40yr tenors. The 10yr JGB yield remains under 1.06%. The 10yr swap rate is off 2bps to sub 0.98%.

- Looking ahead, next week's BoJ meeting outcome (on Wednesday) will be the key focus point. The broader consensus rests with no change at this stage, although reports this week (including from Reuters) have suggested the central bank is still considering a rate hike. The other focus point will be central bank's planned reduction in bond purchases.

AUSSIE BONDS: ACGB Curve Flattens, OIS Slightly Firmer Into Year-End

ACGBs (YM +1 & XM +1.5) are richer today with what was a subdued trading session with little int he way of domestic drivers or data, as a results moves were largely tied to US tsys.

- The ACGB curve has bull-flattened today, yields are 1-4bps lower, with the 10Y back below 4.30% for the first time this week.

- The AU-US 10-year yield differential little changed today at+5bps.

- The swap curve has bull-flattened with yields +/- 2bps

- The bills strip has flattened, trading flat to +2.

- RBA-dated OIS pricing is a pricing 1-2bps firmer heading into year-end, with the first full cut not priced in until July 2025

- Cross assets: Equities were higher today, led by financials & miners with commodity prices higher, the AUD was the top performing G10 currency after falling over 2% this week as the yen carry trade was unwound.

- Looking ahead to next week, focus will be on Retail Sales & CPI on Wednesday.

NZGBS: NZGB Curve Flattens Tracking US Tsys, NZ Consumer Confidence Jumps

The NZGB curve flattened today, with better buying through the 5-10yr part of the curve, the 10y yield dropped 5bps to 4.356%. There was little in the way of domestic drivers today, yields finished towards session's best, with equities finding some support.

- NZ consumer confidence increased in July, with the index rising to 87.9. This boost in confidence comes amid expectations of significant interest-rate cuts over the next year. Inflation expectations fell to 3.7%, the lowest since September 2020.

- The RBNZ is anticipated to start cutting rates soon due to falling inflation, rising unemployment, and a weak economy.

- RBNZ dated OIS pricing closed relatively stable out to year end today, but soften 2-7bps for 2025 meetings

- On a relative basis, the NZ-US and NZ-AU 10-year yield differentials continue to hover around their lowest levels since late 2022 at +11bps and +7bps respectively.

- The 2s10s swaps curve has bull-steepened, with rates 2 to 5bps lower.

- A 66% chance of a rate cut in August is currently priced in, with a cumulative 84.5% chance of a cut by October, before expectations jump sharply to three 25 bps cuts by year-end.

- Next week data is light on with just Building Permits & ANZ Business Confidence on Wednesday

FOREX: AUD & JPY Marginally Higher, Amid Tight Ranges, US PCE Coming Up

The BBDXY USD index is marginally down for the first part of Friday trade, last 1256.5. All of the majors are up against the dollar, with JPY and AUD outperforming at the margins.

- USD/JPY hasn't spent too much time out of the 153.50-154.00 range, with an option expiry at 154.00 strike (for NY cut later) potentially influence spot. Yen remains comfortably the best performer in the G10 space in the past week.

- Risk off in the equity space, slumping metal prices (which has contributed to AUD/JPY losses) along with Fed expectations have all aided the yen.

- Post Thursday's Q2 GDP beat we did see front end Tsy yields stabilize somewhat. This comes ahead of this evening's US PCE inflation print.

- This may be leaving market participants somewhat on the sidelines, particularly after the volatility this week.

- The Tokyo July CPI print was mixed, although is unlikely to shift BoJ thinking greatly.

- AUD/USD has firmed back to 0.6550, aided at the margin by a better tone to copper and iron ore prices, although we sit away from best levels. China equity sentiment has mostly seen upticks sold as well.

- NZD/USD has lagged the A$, the pair last near 0.5890. The ANZ consumer sentiment measure rebounded but this reflected easing rate expectations.

- US equity futures are tracking higher, lending some support to higher beta plays, although they aren't outperforming the JPY at this stage. US yields are close to flat.

- Outside of the US PCE print, the Friday calendar is light.

OIL: Brent Close To Flat For The Week, US GDP Beat Helps Rebound From Lows

Brent Crude prices continued to oscillate with the ongoing policy announcements from China.

- Recognizing that the announced stimulus measures reflect the ongoing challenges but are aimed at arresting them, saw Brent Crude pair back some of the intra week lows to finish flat on the week.

- Brent Crude was trading at $82.53 intraday in Asian time, trapped in a very tight trading range. This is unsurprising given the push pull in financial markets of China policy and the outlook from the FED.

- Brent Crude has held onto modest overall gains year to date though these are attributed more to OPEC output guidance, than the outlook for global growth. Last night’s surprise US GDP print likely contributed to the modest bounce back in price.

- During the week it was reported that projected overall oil-product consumption may fall in China in the second half of the year, reflective of the overall outlook

- for growth.

- WTI however had a somewhat softer week, falling to $78.43 during the morning

- following last week’s close of $80.13.

GOLD: Holding Lower For The Week, All Eyes On The Fed

Gold continued to trend lower this week, given the various stimulus measures announced out of China and last nights better than expected US GDP.

- Touching a low of $2,355.9 in Asian trading, prices appeared to stabilize at these levels as hopes of a near term rate cut from the FED appeared to dissipate. We were last near $2372.5.

- Despite the softer week, GOLD has enjoyed a strong year with prices up 13% year to date. The outlook for GOLD in the near term is hitched firmly to that of the FED.

- Market’s have priced in a September cut and earlier in the week a column from a Bloomberg columnist and former FED member Bill Dudley brought the FED’s

- upcoming meeting next week.

- The stronger than expected GDP has likely meant the next FED meeting may no longer be ‘live’, however tonight the Personal Consumption Expenditure’s index (a measure preferred by the FED as an underlying measure on inflation) now becomes a significant data release.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 26/07/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/07/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 26/07/2024 | - |  | EU | ECB's Cipollone at Rio de Janeiro G20 Fin min/central bank meeting | |

| 26/07/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/07/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 26/07/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.