-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: A Spanner In The U.S. Fiscal Works

- Questions over the U.S. fiscal backdrop provide some light support for U.S. Tsys.

- The RBA leaves its monetary policy settings as they were, with the statement meeting broader expectations.

- Liquidity comes back to markets as the UK & Europe return from the Easter break.

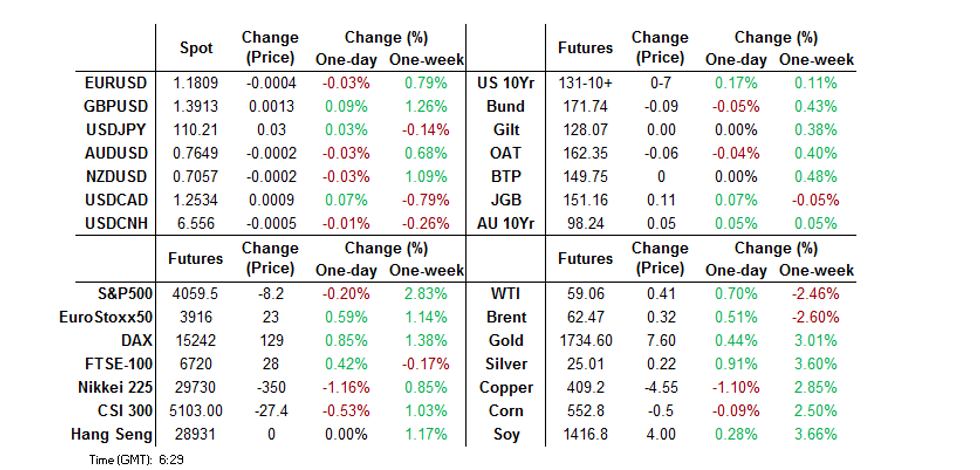

BOND SUMMARY: Core FI Firms On U.S. Fiscal Questions

The space has firmed in Asia-Pac hours, T-Notes last +0-08+ at 131-12, with the cash curve bull flattening as 30s richen by ~2.0bp. The space looked through headlines from Senate Democratic Leader Schumer's staff, which noted that the U.S. Senate parliamentarian has issued an opinion that a revised budget resolution may contain budget reconciliation instructions. Democratic Senator Manchin's previously flagged opposition to President Biden's corporate tax proposals negate the viability of the Democrats being able to force the infrastructure legislation through via a 50/50 vote split in the Senate (with Vice President Harris casting the deciding vote in any such instance), with Manchin seemingly pushing for a 25% corporate tax rate vs. Biden's 28% proposal. On the flow side Asia-Pac hours saw a 5.0K block seller of the 1x2 FVM1 123.75/124.00 call strip and FV/US futures steepener block flow (+9.0K vs. -2.5K). Eurodollar futures print unchanged to 2.5 ticks higher through the reds, with a 10K screen lift of EDM2 seen in early Asia dealing. JOLTS job openings, as well as Fedspeak from Richmond Fed President Barkin & Chicago Fed President Evans headline locally on Tuesday.

- JGBs saw a modest bid creep in during early Tokyo trade. Much of the move came before the latest bid in U.S. Tsys, with little local news apparent to drive the uptick, outside of a downtick in local equity indices. Local data was mixed, with household spending missing and labour cash earnings data beating. The latest round of 30-Year supply wasn't the firmest, with local participants likely eying the allure of offshore paper in the early part of the new Japanese FY, although the low price managed to top dealer expectations, while the tail narrowed and cover ratio firmed. Still, the latter continued to operate in the lower confines of the recently observed range, with the March auction providing a particularly low comparative bar. Still, the space has firmed into the close, with futures +13 on the day. The cash curve has bull flattened, with the super-long end looking through the sub-par auction results.

- Aussie bonds have firmed a little in the wake of the latest RBA monetary policy decision, which saw the Bank leave its monetary policy settings unchanged as expected. At first skim it was very matter of fact from the RBA, as it tipped its hat to the knowns going into the decision & pointed to a more upbeat central economic scenario, with no real surprises seen through the text. The Bank highlighted the recent positive developments in both the labour market and in terms of Q4 economic growth, although noted that a reduction in spare capacity that will result in the required level of wage growth to meet the Bank's inflation target will take some time. The Bank also noted that lending standards in the housing market will be "monitored carefully." The Bank's forward guidance was left as was. Early Sydney trade saw some chop with participants adjusting to the largely U.S.-centric news flow in play since the end of Sydney dealing last week, before the space ground higher alongside global core FI counterparts. The latest ANZ jobs ads reading was firm and was accompanied by upward revisions to the already firm prior reading. YM +1.5, XM +4.5 as we move into the latter rounds of Sydney trade, with the cash curve twist flattening. A$1.2bn of ACGB 1.00% 21 December 2030 supply headlines the local docket on Wednesday.

FOREX: Early Moves Reversed

After an initial decline the greenback picked up from lows, putting pressure on high beta currencies as risk assets lost favour.

- AUD and NZD are both lower, impacted by a stronger USD. Markets await the RBA rate announcement. There is seemingly little scope for anything in the way of notable developments at the upcoming RBA meeting, given the recent deluge of rhetoric from the RBA Governor.

- JPY has lost some ground, USD/JPY up 20 pips at 110.38. Data earlier in the session was broadly positive with labour cash earnings and real cash earnings both rising above estimates. Household spending fell more than expected though, despite encouraging retail sales data in the period.

- Offshore yuan has declined, USD/CNH up 53 pips at 6.5618, data earlier in the session showed Caixin Services PMI rose to 54.3 in March from 52.1 previously, this denotes the highest reading since December 2020 and the eleventh consecutive month of expansion. Service providers were very confident about the prospects for the economic recovery and getting the pandemic under control. The gauge for business expectations rose to the highest point since February 2011. Elsewhere reports the PBOC asked lenders to reign in loan growth over bubble risks have been rerun.

FOREX OPTIONS: Expiries for Apr06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E1.9bln, E1.5bln of EUR puts), $1.1825(E889mln-EUR puts), $1.1845-50(E400mln), $1.1870-80(E483mln-EUR puts), $1.1975-95(E1.4bln), $1.2000-05(E1.1bln)

- USD/JPY: Y107.65-80($1.8bln), Y108.00-05($761mln), Y108.70($810mln), Y110.00-10($638mln)

- GBP/USD: $1.3750(Gbp461mln)

- EUR/GBP: Gbp0.8700(E620mln)

- AUD/USD: $0.7640-50(A$975mln-AUD puts), $0.7725-35(A$812mln)

ASIA FX: EM Holds Its Own After Holiday

After an initial decline the greenback picked up from lows, putting pressure on high beta currencies as risk assets lost favour.

- CNH: Offshore yuan has declined, data earlier in the session showed Caixin Services PMI rose to 54.3 in March from 52.1 previously, this denotes the highest reading since December 2020 and the eleventh consecutive month of expansion. Elsewhere reports the PBOC asked lenders to reign in loan growth over bubble risks have been rerun.

- SGD: Singapore dollar is stronger, IHS Markit releases Singapore's March whole economy purchasing managers' index falls to 53.5 from 54.9 in Feb, fourth consecutive month of expansion.

- TWD: Taiwan dollar is stronger, playing catch up after a market closure. Stocks have risen as the global chip shortage wears on.

- KRW: The won is stronger, hitting the highest in two weeks. Coronavirus cases remain elevated but have dropped below 500, the prospect of further lockdown measures looms.

- IDR: Rupiah is broadly flat, markets await a speech from Fin Min Indrawati on "Economic Policy in Dealing with COVID-19 Pandemic and Proper Exit Policy"

- MYR: Ringgit is stronger supported by the rebound in crude oil. USD/MYR hits the lowest in two weeks.

- PHP: Peso is stronger, CPI rose less than expected in March, Y/Y printed 4.5% against estimates of 4.9%, the print denotes the first slowdown in prices in six months.

- THB: Market closed.

ASIA RATES: Bonds Supported After Break

Bonds mostly bid on the return after market holidays, mixed equity market performance and a pullback in US futures helped support the space.

- INDIA: Yields lower across the curve amid a second wave in coronavirus cases that have resulted in a lockdown in Mumbai the surrounding area. Markets await the RBI rate announcement tomorrow, the bank is expected to keep rates on hold but could address its plans to support the bond market amid worries over the markets ability to digest supply. Elsewhere the RBI has increased the additional subscription amount at Friday's auctions, a tool to help lower funding costs.

- CHINA: The PBOC matched maturities with injections again today, the twenty first straight session of matching maturities, while the bank hasn't injected funds since February 25. Repo rates are mixed, overnight repo rate up around 4.4bps at 1.7644% while the 7-day repo rate is down 8bps at 1.9191%. Bond futures are lower, despite poor performance for equity markets, declines from Friday seen accelerating. 10-year future hits the lowest since March 23. Data earlier in the session showed Caixin Services PMI rose to 54.3 in March from 52.1 previously, this denotes the highest reading since December 2020 and the eleventh consecutive month of expansion.

- SOUTH KOREA: Futures are higher in South Korea, bid as equity markets struggle to make it out of negative territory.10-year futures have been on a path higher after bottoming out around 125.50 mid-session yesterday. Yesterday's auction was well received but the amount sold was above the announcement which pressured bonds.

- INDONESIA: Yields lower, curve steepens. Markets look ahead to an IDR 10tn bond sale after a disappointing run of auctions, while a speech from Fin Min Indrawati on "Economic Policy in Dealing with COVID-19 Pandemic and Proper Exit Policy" is also in focus.

EQUITIES: Markets Mixed On Return

A few markets still remain closed for holidays, with mixed performance from those markets that are open despite a positive lead from the US. Chinese markets return after being closed yesterday, indices have struggled to make headway into positive territory and currently nurse some small losses. South Korea saw similar price action with markets in minor negative territory as the won strengthens. Markets in Japan are lower, weighed on by the energy sector. Markets in Australia were higher, boosted by the prospect of a travel corridor with New Zealand expected to announced today. US futures are in negative territory, receding after the S&P and Dow Jones hit record highs yesterday.

GOLD: Still Nowhere Near Key Resistance

The richening in the U.S. Tsy space and downtick in the USD has supported bullion in early trade this week, with spot last dealing $8/oz higher at $1,736/oz. Bulls need to a find a way to challenge and break key resistance in the form of the March 18 high ($1,755.5/oz) to alter the technical perspective.

OIL: Bounces

Crude futures are higher in Asia on Tuesday, bouncing after a sharp decline on Monday; WTI & Brent sit around $0.30 higher on the day into European hours.

- Markets look ahead to talks between the US and Iran regarding the status of the nuclear pact, which could potentially lay the ground for a resumption of oil exports from Iran. However, comments from both sides have not been encouraging and chances of a deal at the meeting are seen as slim.

- Headwinds could oil could manifest as demand concerns; India has reported over 100,000 cases a day and imposed lockdown measures on Mumbai and other areas, while Chile has also closed its borders amid ongoing lockdowns in several European countries.

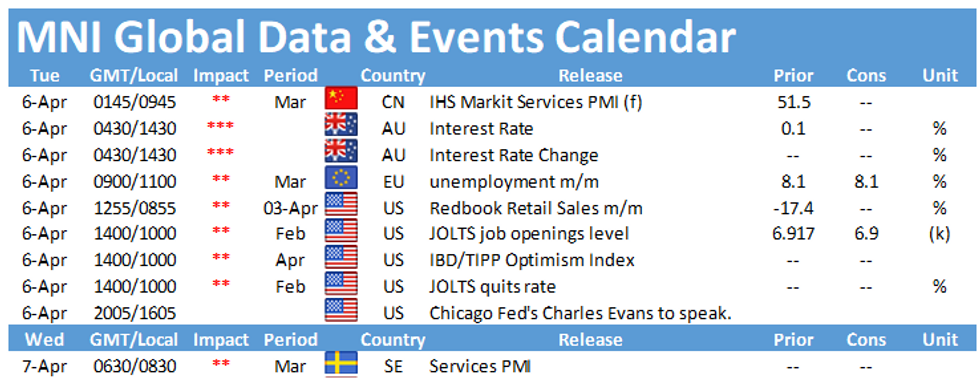

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.