-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

MNI EUROPEAN OPEN: TSY Futures Test Lows On Fed Speak

EXECUTIVE SUMMARY

- FED'S WALLER ON RATE CUTS - 'WHAT'S THE RUSH?' - MNI

- FED's HARKER SAYS MAY RATE CUT POSSIBLE - MNI BRIEF

- US TO IMPOSE SANCTIONS ON OVER 500 TARGETS IN RUSSIA ACTION ON FRIDAY - RTRS

- CHINA HOME PRICES FALL AT SLOWER PACE AS SUPPORT MOUNTS - BBG

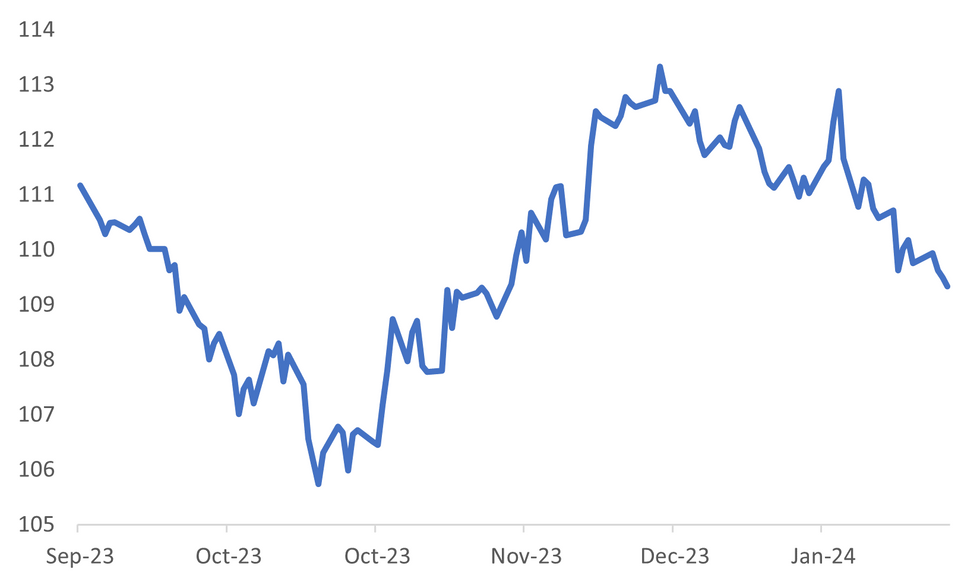

Fig. 1: US TSY 10yr Future Tracking Lower

Source: MNI - Market News/Bloomberg

U.K.

CONSUMER CONFIDENCE (BBG): UK consumer confidence slipped back in February, suggesting households are not ready to splash out despite growing signs that the economy has emerged from its shallow recession.

RUSSIA (RTRS): Britain announced a new package of sanctions against Russia on Thursday, saying it was seeking to diminish President Vladimir Putin's weapons arsenal and war chest two years after the invasion of Ukraine.

EUROPE

UKRAINE (BBG): French President Emmanuel Macron has invited European leaders to Paris next week to discuss proposals to help war-ravaged Ukraine, Polish President Andrzej Duda said on Thursday.

GAS (BBG): Four European Union member states warned that a German levy on gas makes the fuel more expensive at a time when the bloc is trying to cut its reliance on Russian supplies.

POLAND (BBG): The European Union is likely to announce the unblocking of post-pandemic funds to Poland, giving a boost to Prime Minister Donald Tusk whose coalition came to power on a promise to win access to almost €60 billion ($64.9 billion) in aid.

U.S.

FED (MNI): The Federal Reserve can take its time as it considers when to begin cutting interest rates because the economy and employment remain robust, Fed Governor Christopher Waller said Thursday.

FED (MNI BRIEF): Federal Reserve Bank of Philadelphia President Pat Harker said Thursday it is possible it could just take a couple more months of data before he supports easing interest rate, adding that a rate cut in May is possible but more likely to come later.

FED (MNI): Declining U.S. inflation will at some point allow the Federal Reserve to begin cutting interest rates, but officials need greater confidence that price pressures are headed sustainably back to the central bank’s 2% goal, Fed Governor Lisa Cook said Thursday.

RUSSIA (RTRS): The United States will impose sanctions on over 500 targets on Friday in action marking the second anniversary of Russia's invasion of Ukraine, Deputy U.S. Treasury Secretary Wally Adeyemo told Reuters in an interview on Thursday.

TSYS (BBG): A Fidelity International money manager has sold the vast majority of US Treasuries from funds he oversees on expectations the world’s biggest economy still has room to expand.

GEOPOLITICS (RTRS): A spacecraft built and flown by Texas-based company Intuitive Machines landed near the south pole of the moon on Thursday, the first U.S. touchdown on the lunar surface in more than half a century and the first ever achieved by the private sector.

OTHER

GEOPOLITICS (BBG): Former Treasury Secretary Lawrence Summers said financial markets are underestimating risks of global political and social tumult resulting from populist policies and the potential erosion of rule of law.

ISRAEL (RTRS): Israel will take part in negotiations this weekend in Paris with the U.S., Qatar and Egypt on a potential deal for a ceasefire and release of hostages in Gaza, according to a source briefed on the matter and Israeli media.

MIDEAST (RTRS): Yemen's Iran-aligned Houthis claimed responsibility for an attack on a UK-owned cargo ship and a drone assault on an American destroyer on Thursday, and they targeted Israel's port and resort city of Eilat with ballistic missiles and drones.

BRAZIL (MNI): Upcoming government regulation to explicitly allow the Central Bank of Brazil to issue longer-term foreign currency swaps will formalize a capacity it already has in order to avoid potential legal problems, a source familiar with the matter told MNI

NEW ZEALAND (BBG): New Zealand Finance Minister Nicola Willis has cast doubt on her ability to return the budget to surplus by 2027, saying the weakening economy is likely to impact on tax revenue.

NEW ZEALND (BBG): TD Securities now forecasts the RBNZ will raise the Official Cash Rate by 25 bps to 5.75% next week, and will follow with another hike to 6% in May, according to an emailed note from senior Asia-Pacific rates specialist Prashant Newnaha.

NEW ZEALAND (BBG): New Zealand retail sales volumes contracted for the eighth straight quarter as high interest rates and the surging cost of living curb household spending.

CHINA

GDP (YICAI): Authorities will set a relatively high target of about 5% GDP growth for 2024 to improve confidence and avoid weakening expectations, according to Huang Wentao, chief economist at CITIC Securities. However, China will likely achieve 4.8% growth this year as the economy bottoms out, according to Mao Zhenhua, chief economist at China Chengxin International.

EQUITIES (YICAI): The Shanghai and Shenzhen stock exchanges recently took action to regulate abnormal trading behaviour but did not restrict normal sales, according to a spokesperson from the China Securities Regulatory Commission at a recent press conference.

CAR SALES (YICAI): Chinese car buyers are expected to maintain a wait-and-see approach amid a new round of price competition between sellers, which was not conducive to releasing demand, according to the China Passenger Car Association. Data showed car sales in February hit 1.15 million units, down 43.5% m/m, as the spring festival impacted buying.

HOUSE PRICES (BBG): China’s home prices declined at a slower pace for both new and existing-units in January, the first signs of improvement in 10 months.

LIQUIDITY (CSJ): China’s central bank will likely continue to maintain liquidity at a “reasonably sufficient” level through open market operations after the Spring Festival holiday, China Securities Journal reports Friday, citing analysts.

MARKETS (CSJ): Shares of most Chinese state-owned enterprises offer high dividends and stable profits, presenting decent investment opportunities, China Securities Journal reports Friday, citing analysts.

CHINA MARKETS

MNI: PBOC Injects Net CNY155 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY247 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY155 billion reverse repos after offsetting CNY92 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:44 am local time from the close of 1.8242% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Thursday, compared with the close of 45 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1064 on Friday, compared with 7.1018 set on Thursday. The fixing was estimated at 7.1940 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q4 RETAIL SALES EX INFLATION Q/Q -1.9%; MEDIAN -0.2%; PRIOR -0.8%

UK FEB GFK UK CONSUMER CONFIDENCE -21; MEDIAN -18; PRIOR -19

CHINA JAN NEW HOME PRICES M/M -0.37%; PRIOR -0.45%

CHINA JAN USED HOME PRICES M/M -0.68%; PRIOR -0.79%

MARKETS

US TSYS: Treasury Futures Test Lows, Goldman See Only Four Rate Cuts

TYH4 is currently trading at 109-11, down - 05 from New York closing levels

Treasury futures opened slightly higher Friday morning, however pushed lower post Fed Gov Waller speech on the economy, where he reiterated what earlier speakers said around there being no rush to cut rates.

- Mar'24 10Y futures are just off Thursday lows (109-10) trading at 109-11, futures have continued to edge lower Post Fed speeches, initial support holds at 109-10 (low Feb 22) a break here opens a move to 109-05+ (lows Nov 28). Mar'24 2Y futures broke the Thursday lows, and have continued to drift lower now at 101-25 ¼, initial support holds at 101-24+ lows from Nov 27.

- Earlier there was a 4,690 Mar'24 5Y Block Sold at 106-08¼, DV01 $194k, which looked to aid the selling pressure, as it has now made fresh yearly lows and back to late November levels of 106-05+

- Elsewhere Goldman Sachs had dropped their forecast for a US rate cut in May, now expects only 4 cuts down from 5 prior.

AUSSIE BONDS: Front End Yields Continue To Climb, Jan CPI Out Next Wednesday

Aussie bond futures sit lower, YM off -.06, XM down -045. Cash government bond yields are around 2-5bps firmer across the curve, led by the front end.

- Spill over weakness has been evident from US TSYs. TYH4 is threatening a clean break sub Thursday lows. Fed speak has continued and generally pushed back against the idea of early rate cuts. Harker didn't rule out a cut in May but noted it wasn't the forecast and would rely on data surprising on the downside.

- Goldman Sachs also now has 4 cuts this year instead of 5 (with May no longer penciled in) in terms of its Fed outlook.

- For Aussie bond futures we remain with February ranges. YM lows came back on Feb 14 at 96.11 (last around 96.21).

- 2yr swap rates have firmed nearly 3bps but at 4.04% remain sub earlier Feb highs (in contrast to NZ). The 10yr swap rate is up 3bps to 4.25%.

- Looking ahead the data calendar holds Jan CPI next Wed (along with the RBNZ) as the next major domestic focus point.

NZGBS: Yields Firm On TSY Weakness, TD Now Expects RBNZ Hike Next Week

NZ government bond yields finished firmer, around +2-3bps across the benchmarks. There was slight outperformance at the front end, with the 2yr yield up nearly 3bsp to 4.945%.

- In the swap space, the 2yr is modestly higher, last at 5.1850% but this is through Mid Feb highs and back to highs last seen in Nov last year. The 10yr swap rate is 4.63%, nearly 2bps higher, but below earlier Feb highs.

- Markets largely shrugged off the much weaker than expected Q4 NZ CPI print, which fell nearly 2% and saw Q3 revised lower (-0.8% from initially reported as flat).

- A weaker US Tsys backdrop amid on-going Fed talk of push back to earlier rate cuts has likely aided the yield move. Also note Goldman Sachs now expects 4 cuts this year instead of 5 in the US (with the bank no longer expecting a cut in May).

- We also have the RBNZ next week, and headlines crossed from TD Securities with a view change. They now expect that the RBNZ would raise the OCR 25bps next week to 5.75%, and to 6% in May.

- Earlier NZ Finance Minister spoke in Sydney, where she spoke about the NZ Economy where she cast doubt on returning a budget surplus in 2027, and that Higher interest rates are starting to hit with unemployment rising.

FOREX: AUD & NZD Firm, USD Down Slightly Despite Softer US TSYs

The BBDXY sits slightly lower for the session, not deriving much benefit from a pull back in US TSY futures. The index last sat near 1241.70, only marginally below NY closing levels from Thursday.

- Japan markets have been out today due to a national holiday, hence no US cash Tsy trading. Still, a number of Fed speakers have pushed back against the idea of early rate cuts, while Goldman's now sees 4 cuts this year, down from 5. The bank no longer expects the easing cycle to start in May.

- USD/JPY has been quite steady, not drifting too far from the 150.50 level, which is where we started the session.

- The AUD has outperformed, up around 0.25%, last near 0.6575. Thursday highs at 0.6595 remain intact, but a weaker HK/China equity tone hasn't disrupted sentiment. Offshore dividend inflows have been cited by the sell-side this week as a potential AUD support point.

- For NZD/USD, we are back above 0.6200, but trailing AUD gains at the margin. The AUD/NZD cross has firmed back to 1.0600, but hasn't been able to hold gains above this level.

- At the start of the session Q4 retail sales volumes were much weaker than expected. However, there was no last negative impact on NZD. We also have the RBNZ next week, and headlines crossed from TD Securities with a view change. They now expect that the RBNZ would raise the OCR 25bps next week to 5.75%, and to 6% in May.

- Looking ahead to later today, we have ECB as the main focus point, headlined by Lagarde. In the US session, the calendar is light for data and there is no Fed speak.

CHINA/HONG KONG EQUITIES: China & HK Equities Mostly Lower, Home Prices Fall Less Than Dec

Hong Kong & China equity markets opened higher this morning, but as we head into the break, equities is largely lower with the property sector outperforming.

- Hong Kong Equities were higher on the open, HSI trade up about 1%, before quickly reversing to now trade down 0.24%, tech names lead the decline today with the HSTech Index 1.00% lower, while property are outperforming after Jan House price data saw a slight improvement on the Dec outcomes, with the mainland property index up 0.90%

- China equities are mixed today, the CSI300 is down 0.13%, while the Shanghai Composite hit 3,000 for the first time, before heading lower to trade flat for the day.

- As has been reported earlier this week the CSRC has banned some institutional investors from selling stock on the open and close of market, however the CSRC on Thursday says although it has taken measures to regulate "abnormal trading" it has not restricted the selling of stock in the market.

- The number of foreclosed properties for sale in China rose 48% in January up from 37% a year earlier signaling the country's ongoing economic slowdown, while these foreclosed residential properties were sold at an average discount of 23% in January.

ASIA PAC EQUITIES: Asian Equities Ride The Tech Wave Higher

Regional Asian Equities are higher today, tech has been the main driver of the move, otherwise a quiet day for markets.

- Japan equities are closed today for Emperors Day.

- Taiwan Equities saw $413m of foreign equity inflows on Thursday, almost erasing all outflows from the day prior as investors took profit ahead of Nvidia earnings. TMSC again leads the market higher up 0.87%, as the Taiex makes new all time highs to trade up 0.48% today.

- South Korean equities are also higher today and set for a fifth week of gains, as optimism over the "Corporate Value-up Programme" has driven markets higher, while the recent surge in global tech prices linked to AI names has also give the market a boost. There is however some concern that investors will start to take profit, with momentum in equity flows slowing as the 5-day average now sits at $190m, well below the 20-day average of $296m. The Kospi trade up 0.25% today.

- Australian Equities are higher today, the tech sector is trading well although it contributes little to the overall market the largest gainer was Block Inc, up 16.50%. Financials are contributing the most to the market led by CBA, while the ASX200 is 0.39% higher.

- Elsewhere in SEA, New Zealand Equities closed up 0.25%, Indonesia saw net selling by foreigners on Thursday contributing to their equity trading lower today, down 0.88%, Philippines equities are up 1.10%

OIL: Off Thursday Highs, Tracking Down Slightly For Week

The first part of Friday trade has seen oil front month benchmarks soften. Brent was last near $83.25/bbl, down around 0.50% from end Thursday levels. If we hold at this level, we will finish the week marginally weaker. For WTI, we were last close to $78.20/bbl, off by a similar amount for the Friday session and also tracking lower for the week.

- At the margin a softer US Tsy futures backdrop has probably weighed on sentiment in the space so far today. US Fed officials, have for the most part pushed back against the idea of near term rate cuts.

- Fundamentally, Red Sea attacks look set to continue, with the Houthi leader saying the group is looking to 'Escalate' Red Sea operations. On Thursday we also had a lower-than-expected build in US crude stocks.

- Hence prices remain fairly close to recent highs on supply concerns. For Brent, late Jan highs at $84.80/bbl will be the upside focus.

GOLD: Bullion Steady Post Waller Speech, Trades Within Weekly Ranges

Gold continues to trade around $2025/oz, just above where it closed on Thursday and around the mid-point of its range this year, the USD is little changed after seeing some movement while Fed’s Gov Waller spoke earlier.

- Gold is currently headed for a modest weekly gain, off the weekly highs of 2035 after comments throughout the week and earlier today from Fed Gov Waller where they reiterated that there is no rush to cut rates, but that if data changes a May wouldn't be off the table.

- Gold is moving well below resistance at $2065.50, February 1 high, and it needs to clear this level in order for the bullish theme to be reinstated, while currently trading just below the 50-day SMA of $2032.55

- Looking at technicals, we trade slightly below initial resistance of $2034.9/2065.5 - High Feb 22 / Feb 1, while to the downside initial support is at $1984.3 - Low Feb 14

- Thursday marked the biggest one-day outflow since Oct'23 for SPDR Gold Shares ETF

- There is little in the way of data or fed speeches today.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2024 | 0700/0800 | *** |  | DE | GDP (f) |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde, de Guindos, and Cipollone in ECONFIN meeting | |

| 23/02/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 23/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 23/02/2024 | 0920/1020 |  | EU | ECB's Schnabel lecture on Inflation fight at Bocconi | |

| 23/02/2024 | 1300/1400 |  | EU | ECB's Schnabel speech at Forum Analysis | |

| 23/02/2024 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/02/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/02/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 23/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.