-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Bank Deposit Rumours & ECB Speak Dominate

EXECUTIVE SUMMARY

- FEDERAL RESERVE FACES TOUGH DECISION ON RATE INCREASE (WSJ)

- US STUDIES WAYS TO GUARANTEE ALL BANK DEPOSITS IF CRISIS EXPANDS (BBG)

- FHLB ISSUES $304 BILLION IN ONE WEEK AS BANKS BOLSTER LIQUIDITY (BBG)

- JPMORGAN ADVISING FIRST REPUBLIC ON STRATEGIC ALTERNATIVES, INCLUDING A CAPITAL RAISE (CNBC SOURCES)

- LAGARDE SAYS EUROZONE BANKS’ EXPOSURE TO CREDIT SUISSE ‘LIMITED’ (BBG)

- ECB'S HOLZMANN WATERS DOWN CALL FOR THREE MORE RATE HIKES (RTRS)

- ECB ISN’T DONE RAISING INTEREST RATES, LATVIA’S KAZAKS SAYS (BBG)

- MACRON NARROWLY SURVIVES CRUCIAL NO-CONFIDENCE VOTES IN PARLIAMENT (POLITICO)

- RBA MINUTES POINT TO APRIL PAUSE (MNI)

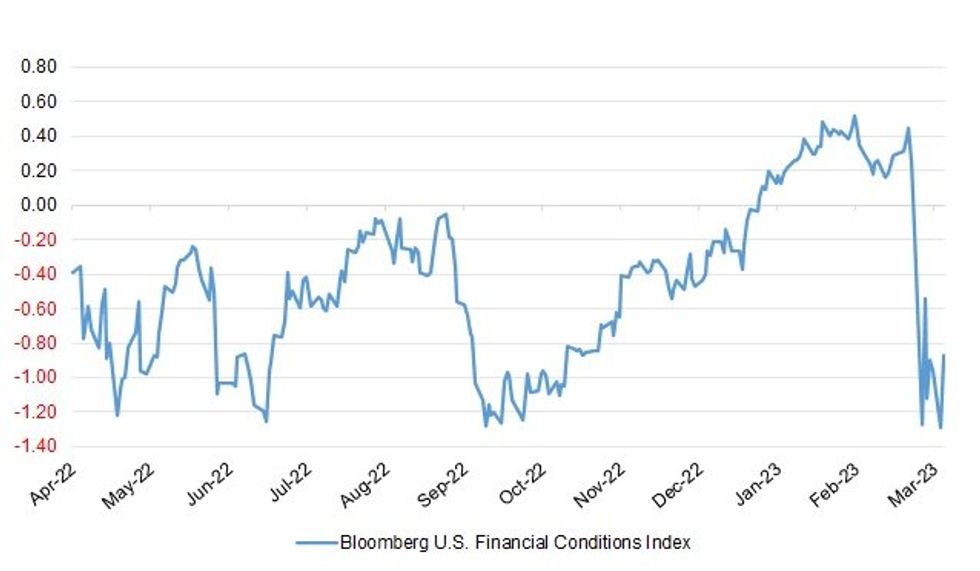

Fig. 1: Bloomberg U.S. Financial Conditions Index

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England should press ahead with another interest rate rise this week and avoid reacting too hastily to market fears over the health of the global banking system, according to the Times shadow monetary policy committee. A majority of members of the shadow MPC, which is made up of former rate setters, ex-Treasury officials and economists, said the Bank should carry out its 11th consecutive interest rate rise on Thursday. Two members said the Bank should stick with an outsized increase of 50 basis points, but a majority of five said a slower 25 basis-point change was more appropriate. One member, Sir John Gieve, said that the Bank should make no change to its base rate, which stands at 4 per cent. (The Times)

EUROPE

ECB: European Central Bank (ECB) policymaker Robert Holzmann on Monday watered down his recent call for three further interest-rate increases of 50 basis points in quick succession. (RTRS)

ECB: The European Central Bank isn’t done increasing interest rates, according to Governing Council member Martins Kazaks. (BBG)

ECB/BANKS: “It’s a very limited exposure to Credit Suisse, in particular to the AT1s — very limited,” ECB President Christine Lagarde told European Union lawmakers in Brussels on Monday. “We are not talking billions, we are talking millions here.” (BBG)

BANKS/BONDS: Lawyers from Switzerland, the United States and UK are talking to a number of Credit Suisse Additional Tier 1 (AT1) bond holders about possible legal action after the state-backed rescue of Credit Suisse by UBS wiped out AT1 bonds, law firm Quinn Emanuel Urquhart & Sullivan said on Monday. (RTRS)

BANKS/BONDS: Bond giant PIMCO lost about $340 million on a category of Credit Suisse bonds that were wiped out by the takeover by UBS, with the American investment manager's overall exposure to the Swiss lender running into billions, a source familiar with the situation said. (RTRS)

BANKS/BONDS: For years, senior Credit Suisse employees were paid partly in a special bond that is now worth nothing, zeroed out as part of the bank’s fire sale to UBS, people familiar with the matter said. (Semafor)

BANKS/RATINGS: S&P affirmed UBS at A-; Outlook revised to Negative from Stable (MNI)

BANKS/RATINGS: Moody's affirmed UBS’s A3 senior unsecured debt and Baa3 (hyb) Additional Tier 1 ratings; Outlook revised to Negative from Stable

GERMANY: Germany’s finance ministry signaled to the country’s regional governments and municipalities that the days of generous emergency funding to offset the impact of the war in Ukraine and the energy crisis are over. (BBG)

GERMANY: Germany should refrain from expanding its finance ministry to cut back on non-essential spending, Finance Minister Christian Lindner told Bild newspaper. (BBG)

FRANCE: Emmanuel Macron’s government survived a no-confidence vote in the French parliament Monday, after it pushed through a deeply unpopular pensions overhaul without a vote last week, sparking outrage and spontaneous protests across the country. (Politico)

ITALY: Italian companies are looking at the health of the banks they rely on in the wake of the current financial turmoil and turning more conservative over how they invest their cash, the head of the country's Association of Corporate Treasurers (AITI) said. (RTRS)

U.S.

FED: Federal Reserve Chair Jerome Powell and his colleagues this week face one of their toughest calls in years: whether to raise interest rates again to fight stubbornly high inflation or take a timeout amid the most intense banking crisis since 2008. (WSJ)

FED: The Federal Reserve decides Wednesday whether to press ahead with a ninth straight interest-rate increase to fight inflation or keep rates steady amid an unfolding global financial crisis. (MNI)

FED: President Joe Biden maintains confidence in Federal Reserve Chair Jerome Powell, the White House said on Monday, amid criticism about the multiple rate increases the Fed has approved in recent months and its handling of the banking crisis. (RTRS)

BANKS: US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis. (BBG)

BANKS: JPMorgan Chase is advising embattled First Republic Bank on strategic alternatives, sources told CNBC’s David Faber. The alternatives may include a capital raise, the sources said, which could dilute current shareholders. A sale of the bank is also a possibility. (CNBC)

BANKS: First Citizens BancShares Inc., one of the biggest buyers of failed US lenders, is still hoping to strike a deal for all of Silicon Valley Bank, according to people familiar with the matter. (BBG)

BANKS: House conservatives said they would oppose any universal guarantee of bank deposits above the current $250,000 FDIC insurance cap, even as other lawmakers said they’re weighing a statutory increase in the limit following two recent bank collapses. (BBG)

BANKS: The Federal Home Loan Bank System issued $304 billion in debt last week, according to a person familiar with the matter, who asked not to be identified discussing non-public data. That’s almost double the $165 billion that liquidity-hungry lenders tapped from the Federal Reserve. (BBG)

BANKS: The top Republicans on committees that oversee the U.S. financial system sent letters Monday to Federal Reserve Chair Jay Powell and FDIC Chair Martin Gruenberg formally requesting documents and personnel records related to the oversight of two banks that failed over the last 11 days. (CNBC)

BANKS: California’s Department of Financial Protection and Innovation said it’s conducting a “comprehensive review” of the department’s oversight and regulation of Silicon Valley Bank. (BBG)

BANKS: Federal Deposit Insurance Corporation officials were told in mid-January that Signature Bank, a New York City-based lender with about $90bn in deposits, was in trouble. A letter from a short seller, who stood to make money if Signature’s share price fell, warned that the bank lacked basic controls. One example: Signature in April 2020 made a $370,000 pandemic assistance loan to Alameda Research, the hedge fund affiliate of the crypto exchange FTX that last year filed for bankruptcy protection and was alleged to be part of a fraud. (FT)

OTHER

GLOBAL TRADE: China is giving a handful of its most successful chip companies easier access to subsidies and more control over state-backed research, as tightening US controls on access to advanced technology force a major rethink in Beijing’s approach to supporting the sector. (FT)

GLOBAL TRADE: India is considering imposing retaliatory tariffs on European Union exports in response to the bloc’s proposed carbon tax that could disrupt over $8 billion worth of Indian metal exports to the EU, two government officials aware of the development said. (Mint)

U.S./CHINA: National Security Council spokesman John Kirby on Monday revealed that a potential trip to China by Treasury Secretary Janet Yellen and Commerce Secretary Gina Raimondo was in the works. (Fox Business)

U.S./CHINA/TAIWAN: Expected U.S. stopovers in coming weeks by Taiwan President Tsai Ing-wen are standard practice and China should not use them as a pretext for aggressive action toward the democratically governed island, a senior U.S. administration official said. (RTRS)

EU/CHINA/TAIWAN: Germany is expanding scientific cooperation with Taiwan in areas including chips, a move that may help cement bilateral relations but also risks angering China. (BBG)

GEOPOLITICS: Chinese President Xi Jinping told his Russian counterpart Vladimir Putin Monday in Moscow that consolidating and developing bilateral relations is a strategic choice China has made on the basis of its own fundamental interests and the “prevailing trends of the world.” (BBG)

RBA: The Reserve Bank of Australia will consider a pause at its April meeting, according to minutes of its March meeting released on Tuesday. (MNI)

RBNZ: The Reserve Bank of New Zealand said on Tuesday it saw no immediate need to request the reinstatement of US dollar swap line that expired in 2021. (RTRS)

NEW ZEALAND/CHINA: New Zealand Prime Minister Chris Hipkins urged his nation’s exporters not to rely so heavily on China, saying it’s important for them to diversify in an uncertain world. (BBG)

SOUTH KOREA/JAPAN: South Korea’s finance ministry is considering resuming finance ministers’ meeting with Japan, as part of follow-up measures after last week’s summit between President Yoon Suk Yeol and Prime Minister Fumio Kishida, Yonhap News says, citing unidentified government sources. (BBG)

CANADA: Canada's Finance Minister Chrystia Freeland said Monday the nation's financial system is resilient to recent global turmoil and her budget due next week will deliver targeted spending aimed at helping poorer families keep up with inflation. (MNI)

TURKEY: Turkey’s governing party said former economy czar Mehmet Simsek wants to stay out of politics but may be able to contribute to government policies in the future. “After he left politics, he’s been busy with other things. He has responsibilities in civil society and in the business world. Therefore, he is not considering to be in active politics,” said Omer Celik, ruling AK Party’s spokesman. (BBG)

TURKEY: Turkey's central bank said on Monday it will require lenders to submit monthly forex position reports on corporates that have outstanding loans of 5 million lira ($263,002.86) or more. According to a letter sent to banks and seen by Reuters, lenders will be required to submit the reports for the preceding month in the first ten days of the current month. (RTRS)

BRAZIL: Brazil’s Lower House, Senate leaders received the new fiscal plan guidelines, Finance Minister Fernando Haddad said after meeting with Senate Head Rodrigo Pacheco and Speaker Arthur Lira. (BBG)

RUSSIA: The White House urged Chinese President Xi Jinping on Monday to urge Russian President Vladimir Putin to respect Ukraine's sovereignty and end Russia's war against Ukraine. John Kirby, the White House national security spokesperson, told reporters the United States is concerned that Xi, currently on a trip to Moscow, will reiterate calls for a ceasefire that leave Russian forces inside Ukrainian sovereign territory. (RTRS)

RUSSIA: Russia's defence ministry said a Russian SU-35 fighter jet was scrambled over the Baltic Sea on Monday after two U.S. strategic bombers flew in the direction of the Russian border but then left. (RTRS)

RUSSIA: Japanese Prime Minister Fumio Kishida will visit Ukraine on Tuesday for talks with President Volodymyr Zelenskiy, becoming the final leader from a Group of Seven nation to visit the country since Russia’s full-scale invasion about a year ago. (BBG)

MARKETS: Global banks postponed the sale of a loan equivalent to €820 million ($879 million) for Ineos Enterprises as demand dried up for all-but-the-safest debt securities. (BBG)

METALS: JPMorgan Chase owned bags of material kept in a Dutch warehouse that were supposed to contain nickel but turned out to be full of stones, people familiar with the matter said. (WSJ)

METALS: Copper prices are likely to hit a record in the next 12 months as available stocks shrink to near-zero levels, according to the world’s top trader of the industrial metal, Trafigura Group. (BBG)

ENERGY: Iran counts on “huge volumes” of oil and gas swaps from Russia this year, Iranian Economy Minister Ehsan Khandouzi said in an interview with Russia’s RIA state news agency in remarks published on Tuesday. (RTRS)

OIL: Group of Seven Nations are not likely to revise a price cap on Russian oil this week, two European Union officials and one official from a coalition member told Reuters on Monday. (RTRS)

OIL: Crude oil exports and transit of Urals, KEBCO and Siberian Light oil grades from Russia's western ports are expected to rise 9% in March from February, data from trade sources and Reuters calculations showed. Russia's oil exports from its western ports, excluding Kazakhstan-sourced oil in transit, will increase by 4% on a daily basis, despite the announced plans to reduce oil production in March by 500,000 barrels per day. The initial plan assumed a 10% drop in oil shipments from Russian ports in March from February. The increase in Russian oil loadings from western ports is mostly due to delays in February loadings from Novorossiisk port amid storms, the sources said. The delays forced the port to postpone nearly 1 million tonnes of February oil for loading in March. Thus the expected volume of exports from Novorossiisk in March is 3.2 million tonnes. (RTRS)

OIL: U.S. crude exports to Europe have hit a record 2.1 million barrels per day on average so far this month, spurred by wide discounts to the global benchmark and weaker oil demand by U.S. refineries. (RTRS)

OIL: Libya’s oil minister said on Monday that approval of the No Oil Producing and Exporting Cartels Act, known as NOPEC, by the U.S. Congress will lead to instability in the international oil market. (RTRS)

CHINA

ECONOMY: The pace of US willingness to decouple from China may slow down in order to ease inflationary pressures exacerbated by the SVB collapse restricting the Fed’s ability to raise interest rates, according to Liu Yuhui, Professor at the Chinese Academy of Social Sciences and a member of the China Chief Economist Forum. Liu also said that China is facing the risk of deflation if domestic demand did not return sufficiently, and therefore macro policy needed to be bolder. In the past 3 years, China's residential, corporate, and local government balance sheets have declined, which will take time to recover, he said. (MNI)

ECONOMY: China’s trade environment is grim and complex but opportunities remain, while Beijing's competitive advantage remains unchanged, according to Yu Jianhua, Director of the General Administration of Customs. (MNI)

FISCAL: China’s local governments are accelerating bond sales this year to help stabilize the nation’s economic growth, the Securities Times reported, citing data from regional authorities. (BBG)

PBOC/POLICY: The Chinese central bank will work with police to tackle the disguised transfer of misappropriated assets overseas this year, the official Xinhua News Agency reported Monday, citing a meeting of the fugitive repatriation and asset recovery office under the Central Anti- Corruption Coordination Group. (BBG)

POLICY: Curbing systemic financial risk and enforcing discipline are priorities for 2023, according to a report released by the Ministry of Finance. Yicai news said recent fines imposed on Deloitte shows the ministry is serious about enforcing laws and regulations to prevent accounting irregularities. (MNI)

POLICY: China’s Ministry of Finance has started a campaign to scrutinize accounting standards to reduce risks and promote “high-quality” economic development, according to a statement from MOF. (BBG)

LIQUIDITY: Signs of a cash squeeze are appearing in China as the quarter-end approaches, underscoring how the nation’s economic rebound is driving demand for loans and leading to monetary easing by the central bank. (BBG)

MARKETS: Vanguard Group Inc., the US asset management giant, has decided to shutter its remaining business in China after a retreat two years ago, according to people familiar with the matter, abandoning a 27 trillion yuan ($3.9 trillion) fund market that global competitors are embracing. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY153 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY182 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY153 billion after offsetting the maturity of CNY29 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0718% at 09:24 am local time from the close of 2.1884% on Monday.

- The CFETS-NEX money-market sentiment index closed at 55 on Monday, compare with the close of 46 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8763 TUES VS 6.8694 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8763 on Tuesday, compared with 6.8694 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 76.5; PREV 77.0

Consumer confidence decreased for a fourth consecutive week and remains at very low levels. The index, in four of the past five weeks, was among the ten worst results since the COVID outbreak. Confidence among those paying off their mortgages fell 4.3pt and are at their lowest since the beginning of the monetary tightening cycle. Confidence among renters and outright homeowners rose a little. The proportion of people saying it is ‘a bad time to buy a major household item’ rose to 55%, its highest since early April 2020. Confidence about current finances increased 0.9pts but was still at its second lowest level since the initial COVID outbreak in Australia. (ANZ)

NEW ZEALAND FEB TRADE BALANCE -NZ$714MN; JAN -NZ$2.113BN

NEW ZEALAND FEB EXPORTS NZ$5.23BN; JAN NZ$5.30BN

NEW ZEALAND FEB IMPORTS NZ$5.95BN; JAN NZ$7.42BN

NEW ZEALAND FEB 12-MONTH TRADE BALANCE -NZ$15.644BN; JAN -NZ$15.645BN

SOUTH KOREA FEB PPI +4.8% Y/Y; JAN +5.1%

SOUTH KOREA MAR 1-20 TRADE BALANCE -US$6.323BN

SOUTH KOREA MAR 1-20 EXPORTS -17.4% Y/Y

SOUTH KOREA MAR 1-20 IMPORTS -5.7% Y/Y

SOUTH KOREA MAR 1-20 DAILY AVERAGE EXPORTS -23.1% Y/Y

MARKETS

US TSYS: Futures Firmer, Cash Closed Until London

TYM3 deals at 115-13, +0-10, marginally off the top of the 0-19 range on volume of 70k.

- Cash tsys remain closed due to the observance of a national holiday in Japan and will re-open in the London session.

- TYM3 see-sawed in early dealing, there was no obvious headline driver, however there was some possible pre-Fed position squaring in early flows.

- Futures were briefly pressured as reports crossed of the US studying ways to guarantee all bank deposits, link here. The move in tsys was limited, with TYM3 not challenging daily lows, as the move to guarantee deposits is not seen as not yet necessary.

- A rally in ACGBs, post the minutes of the March RBA policy, provided support to the wider FI space.

- A fresh bid saw tsys marginally extend highs, again there was no obvious headline driver. Regional and US Equities paring gains may have added a level of support.

- In Europe today the German ZEW Survey is the highlight. Further out Canadian CPI, Philadelphia Fed Non-Manufacturing Index and Existing Home Sales headline the docket. We also have the latest 20-Year Supply.

AUSSIE BONDS: Stronger But Off Bests As Minutes Impetus Fades

ACGBs close richer (YM +2.0 & XM +5.0) in line with stronger U.S Tsy futures but off bests as the RBA Minutes failed to provide a fresh impetus for the market.

- The Minutes suggested the Board was considering the case for a pause while recognizing that further tightening of monetary policy would likely be required to reign in inflation. An emphasis was placed on the data releases ahead of the April meeting, but that pre-dated recent adverse credit developments.

- Cash ACGBs closed 2-5bp richer with the 3/10 curve 3bp flatter.

- Swaps were 1-5bp stronger with the curve 4bp flatter and EFPs +1bp.

- Bills strip twist flattened with pricing -3 to +4.

- RBA dated OIS pricing closed mixed with meetings out to July 3-4bp firmer and meetings beyond flat. April meeting closes at -2bp with 40bp of easing priced for year-end.

- The local calendar is light until next week’s releases of February Retail Sales (Tue) and Monthly CPI (Wed). Both releases were highlighted in today’s RBA Minutes as key to the April decision.

- Abroad, the calendar is also relatively light today, with Philly Fed and U.S. Existing Home Sales the highlights, ahead of the FOMC decision on Wednesday. BBG consensus expects a 25bp hike, although some analysts expect no move.

NZGBS: Closes At Bests With Stronger U.S. Tsys & ACGBs

NZGBs strengthen over the session to close at bests in sympathy with a richening in U.S. Tsy futures and ACGBs (post-RBA Minutes) in Asia-Pac trade. By the close, the 2- and 10-year benchmarks were respectively 9bp and 10bp richer with the strengthening garnering support from a narrowing in the trade deficit in February (-NZ$714mn versus a negatively revised -NZ2.113bn in January). The fact that the annual deficit remained close to record levels is however noteworthy given last week’s worse-than-expected current account deficit and S&P’s bond rating guidance.

- 2s10s swaps curve bull steepened 4bp with rates 2-6bp lower, implying wider swap spreads particularly at the long end.

- RBNZ dated OIS softened 2-8bp for meetings beyond April with terminal OCR pricing dropping to 5.17%. April meeting pricing closed with 21bp of tightening.

- The local calendar is light for the remainder of the week with RBNZ Chief Economist Conway’s speech, “The path back to low inflation in NZ”, at the KangaNews DCM forum on Thursday the highlight.

- Abroad, the calendar is also relatively light today, with Philly Fed and U.S. Existing Home Sales the highlights, ahead of the FOMC decision on Wednesday.

EQUITIES: Firmer, Aided By China/HK Gains

Regional equities are mostly tracking with a firmer bias, although gains are mostly under 1% at this stage. Markets have taken a positive cue from EU/US gains on Monday, particularly in the financials space. US futures are a touch firmer at this stage (around +0.10% for Eminis and Nasdaq futures), while EU futures are comfortably higher.

- US futures did firm on headlines that the US is studying guaranteeing all bank deposits, but we didn't see much follow through. Presumably because it is only under consideration at this stage rather than being enacted.

- China and Hong Kong stock indices have extended gains this afternoon. Both the CSI 300 and HSI are up 1%. Gaming/tech related stocks have risen, after China regulators approved 27 foreign games late yesterday.

- This is the first fresh round of approvals since late last year and is giving the market optimism that regulatory oversight of the sector won't be as strong as it was in 2022.

- Japan markets are closed today, while South Korea is +0.40% for the Kospi and +0.55% for the Taiex. In Singapore the STI is near +1%, with bank names enjoying a better session today. The ASX 200 has climbed 0.82%, with similar drivers in play.

GOLD: Bullion Stabilises Awaiting Wednesday’s FOMC Announcement

Gold has been trading in a $10 range today and is currently 0.3% higher after easing 0.5% on Monday, as fears of a banking crisis eased. It is around $1983.85/oz, close to the intraday high of $1985.22 following the $1975.49 low earlier. The USD index is up 0.1%.

- Bullion broke through the important $2000/oz level but couldn’t sustain it once Treasury yields rose again. This move strengthened the current uptrend though and opened $2034.

- Later ECB President Lagarde speaks and on the data front there are only Canadian CPI and US existing home sales for February. The focus of the week is Wednesday’s FOMC meeting. Currently a 25bp rate rise is expected by economists but there’s the possibility of a pause given recent banking troubles and this would be positive for gold prices.

OIL: Crude Awaiting Wednesday’s Fed Decision, Market Needs Banking Stabilisation

Oil prices have been unwinding Monday’s gains during APAC trading. Brent is down 1.0% after rising 1.2% yesterday to be around $73.02/bbl, close to the intraday low of $72.85 and off the high of $74.04 earlier. WTI is down 0.8% to below $67 at $66.83. The USD index is up 0.1%.

- While global central banks and regulators have put measures in place to ease banking concerns, oil markets are still nervous about the implications for demand. The risks to crude are to the upside once the banking sector stabilises, given the 15% correction in March.

- Later ECB President Lagarde speaks and on the data front there are only Canadian CPI and US existing home sales for February. The focus of the week is Wednesday’s FOMC meeting. Currently a 25bp rate rise is expected by economists but there’s the possibility of a pause given recent banking troubles and this would be positive for oil prices as a weaker USD makes it cheaper for non-US purchases.

FOREX: USD Firms In Asia, Antipodeans Pressured

The greenback is marginally firmer in Asia today, BBDXY is up ~0.1%. The USD firmed in the wake of reports crossed of the US studying ways to guarantee all bank deposits, link here.

- Kiwi is pressured and is the weakest performer in the G-10 space at the margins. The pair prints at $0.6210/15, down ~0.5%, and has broken through the 20-Day EMA. New Zealand trade deficit narrowed in February printing at -$700mn after a deficit of ~$1.9bn in January.

- AUD/USD is also pressured, the pair is dealing below $0.67 handle and is down ~0.4% today. Support in the pair comes in at $0.6590 the low from 15 March. The RBA minutes showed that the board is getting closer to pausing their tightening cycle, with upcoming retail sales and inflation data emerging as key inputs to the decision.

- Yen is little changed, USD/JPY has observed narrow ranges today with little follow through on moves.

- Elsewhere the broad based USD gains have EUR and GBP both down ~0.2%.

- E-minis have pared gains to sit unchanged on the day, the Hang Seng is ~0.3% having been up over 1% shortly after the open.

- In Europe today the German ZEW Survey is the highlight. Further out Canadian CPI, Philadelphia Fed Non-Manufacturing Index and Existing Home Sales headline the docket.

FX OPTIONS: Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E565mln), $1.0665-75(E797mln), $1.0690-10(E2.0bln)

- USD/JPY: Y133.25-50($805mln)

- GBP/USD: $1.2100(Gbp504mln), $1.2150-70(Gbp570mln)

- USD/CAD: C$1.3690-10($945mln)

- USD/CNY: Cny6.9225($918mln), Cny6.9300($501mln), Cny6.9500($574mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.