-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. CPI Fallout Dominates In Asia

EXECUTIVE SUMMARY

- FED'S WILLIAMS SEES RISK OF HIGHER FED FUNDS PATH (MNI)

- FED IS “LIKELY CLOSE” TO DONE ON TIGHTENING, HARKER SAYS (MNI)

- INFLATION REPORT KEEPS FED ON TRACK TO CONTINUE RATE INCREASES (WSJ)

- LAEL BRAINARD’S FED DEPARTURE COULD LEAVE IMMEDIATE IMPRINT ON INFLATION FIGHT (WSJ)

- JAPAN'S KISHIDA SAYS UEDA IS MOST FIT TO LEAD BOJ (RTRS)

- RBA’S LOWE SAYS BLAME FOR RAISING RATES ‘UNFAIR,’ WON’T RESIGN (BBG)

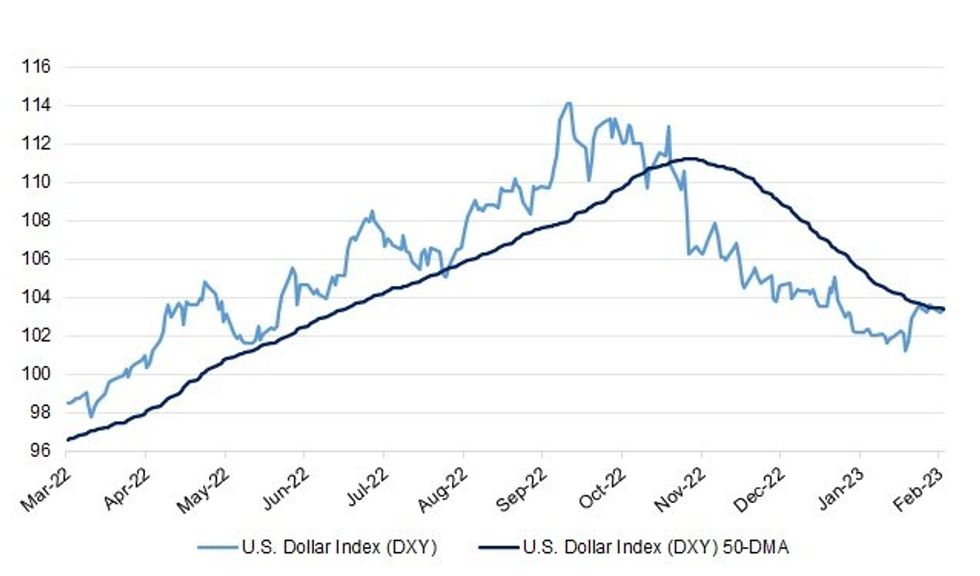

Fig. 1: U.S. Dollar Index (DXY) Vs. 50-DMA

Source: MNI - Market News/Bloomberg

UK

FISCAL/ECONOMY/POLITICS: Prime minister Rishi Sunak and chancellor Jeremy Hunt are exploring a pay offer to try to end the wave of public sector strikes that would backdate next year’s wage award for NHS staff and other key workers. (FT)

POLITICS: The UK’s opposition Labour Party leads Prime Minister Rishi Sunak’s Conservatives in a raft of seats historically dominated by the ruling party, a poll showed. (BBG)

BREXIT: Rishi Sunak is due to meet EU leaders in Bavaria this week in a final push for a Brexit deal on Northern Ireland, amid warnings of a revolt by Conservative MPs if they judge the UK prime minister is ceding too much ground to Brussels. (FT)

BREXIT: Negotiations over the Northern Ireland protocol are in the crucial final phase with a deal possible as early as next week, according to multiple sources. (Guardian)

BREXIT: Rishi Sunak has had the text of a Northern Ireland Brexit deal on his desk for over a week, with Brussels concerned about his delay in signing off on it. Downing Street continues to insist that no deal has been agreed with the EU to solve the problems of the Northern Ireland protocol, saying that both sides are still engaged in “intensive scoping”. (The Times)

EUROPE

ECB: The European Central Bank is likely to raise borrowing costs after the half-point increase it’s flagged for its meeting next month, according to Governing Council member Gabriel Makhlouf. (BBG)

FRANCE: French Finance Minister Bruno Le Maire says he will meet the country’s retailers to discuss ways they can reduce prices of essential goods in their stores amid rampant inflation that’s lowering household purchasing power. (BBG)

RATINGS: Fitch affirmed the European Union and Euratom at 'AAA'; Outlook Stable

U.S.

FED: Federal Reserve Bank of New York President John Williams Tuesday said raising the fed funds target range to somewhere between 5% and 5.5% remains reasonable, but there are risks it may need to go even higher due to labor market strength. (MNI)

FED: The Federal Reserve is not yet finished raising interest rates to combat high inflation but is edging closer to that point, with a pause expected “at some point this year,” Philadelphia Fed President Patrick Harker said Tuesday. (MNI)

FED: Federal Reserve officials pointed to Tuesday’s strong inflation report as the latest evidence for their view that the country could face a longer fight to subdue price pressures than many investors have anticipated until recently. Investors in interest-rate futures markets appeared to agree, after the Labor Department’s latest figures showed the recent trend of cooling inflation leveled off in January, as energy, food, shelter and other prices climbed. (WSJ)

FED: President Biden’s reshuffle of his economic team could have its most immediate economic impact on the Federal Reserve, with the departure of the central bank’s vice chair, Lael Brainard, for the White House. Ms. Brainard’s move to lead Mr. Biden’s National Economic Council means the Fed will lose an influential top official who has advocated for a marginally less aggressive approach to raising interest rates than Fed Chair Jerome Powell. (WSJ)

ECONOMY: Executives at some of Wall Street’s biggest banks said the US economy was holding up better than corporate leaders had anticipated and that the mood was more optimistic than it was a few months ago. (FT)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) on Tuesday declared Senate Republicans have “no agenda” to consider cuts or reforms to Medicare or Social Security, attempting to slam the door on efforts by Democrats to link the entire GOP to a plan by Sen. Rick Scott (R-Fla.) to sunset all federal legislation, including those popular entitlement programs, after five years. (The Hill)

POLITICS: Democratic U.S. voters express less support for President Joe Biden running for a second term 2024 than Republicans do for former President Donald Trump's latest White House bid, a Reuters/Ipsos poll shows, a potentially worrisome sign for Biden as he prepares to announce his re-election campaign. (RTRS)

EQUITIES/FISCAL: A group of Democratic senators including Banking Committee chair Sherrod Brown and Finance Committee chair Ron Wyden introduce a bill that would increase the tax on a publicly-traded company that buys its own stock to 4% from 1% currently. (BBG)

OTHER

U.S./CHINA: The Biden administration suspects that three unidentified objects downed since last Friday served commercial purposes and weren’t used for spying, a judgment that may help ease anxiety over a Chinese balloon that traversed the US before being shot down. (BBG)

U.S./CHINA: Sen. Jon Tester (D-Mont.) will lead a Senate investigation into why it took so long for the Defense Department to detect Chinese spy balloons that floated over the United States this month and in previous years, revealing an embarrassing gap in the nation’s air defenses. (The Hill)

GEOPOLITICS: The International Monetary Fund's strategy director on Tuesday said the goal of a new sovereign debt panel of creditors and borrowers due to meet on Friday is to try to reach understandings on common standards, principles and definitions for how to restructure distressed country debts. (RTRS)

BOJ: Japanese prime minister Fumio Kishida said on Wednesday Bank of Japan (BOJ) governor nominee Kazuo Ueda is the best fit to lead the central bank as he is a well known economist globally and has high expertise in financial field. (RTRS)

BOJ: Kazuo Ueda, nominated to lead a Bank of Japan that’s backing ESG efforts, has voiced skepticism in the past about monetary authorities getting involved in green policies. (BBG)

RBA: Australia’s central bank chief Philip Lowe acknowledged interest-rate rises are unpopular, while adding he finds it “unfair” that blame for them is directed solely at him, as he reiterated plans to serve out his term. (BBG)

RBA: Australia’s central bank is overly prescriptive in its interest rate communications and would benefit from being more circumspect, according to former Reserve Bank Governor Bernie Fraser. (BBG)

AUSTRALIA: Treasurer Jim Chalmers has asked the ACCC to "take a good look" at the issue, saying it should be the "silver lining" when rates do increase. The ACCC has been asked to report back to Mr Chalmers by December 1. (ABC)

SOUTH KOREA: South Korean President Yoon Suk Yeol said will freeze public transport charges in 1H and control the speed of power and gas rates increases to assuage inflation fears and minimize the burden on the vulnerable population. (BBG)

SOUTH KOREA: South Korea said on Wednesday it would launch a task force this month to study ways to improve business practices among banks amid growing public discontent over their big profit and compensation payment to their employees. (RTRS)

SOUTH KOREA/CHINA: China plans to resume issuing short-term visas for travellers from South Korea on Saturday, the Chinese embassy in Seoul said on Wednesday, after South Korea lifted similar visa curbs last week citing an improved COVID situation in its neighbour. (RTRS)

TURKEY: Turkish President Tayyip Erdogan said on Tuesday that last week's powerful earthquakes were "as big as atomic bombs" and have killed 35,418 in the country's southern region. Erdogan also said that hundreds of thousands of buildings were uninhabitable across southern Turkey, adding "any country would face issues we did during such a disaster". (RTRS)

TURKEY: Turkish lenders will allocate 50b liras ($2.7b) from their 2022 income to help with relief efforts after last week’s twin earthquakes, Turkey’s President Recep Tayyip Erdogan says in a speech after cabinet meeting on Tuesday. (BBG)

TURKEY: Turkish stock exchange revokes volatility measures imposed on individual stocks, according to statement. (BBG)

CANADA/CHINA: Canadian authorities on Tuesday announced new restrictions on research grants designed to block funding to projects that include researchers who are affiliated with institutions with ties to foreign governments posing a risk to national security. (RTRS)

USMCA: US Agriculture Secretary Tom Vilsack rebuffed a concession by Mexico in a simmering trade dispute over a planned ban on genetically modified US corn. (BBG)

BRAZIL: Brazil's Finance Minister Fernando Haddad said on Tuesday that the National Monetary Council, the country's highest economic policy body, would not discuss changing inflation targets at its monthly meeting on Thursday. (RTRS)

BRAZIL: President Luiz Inacio Lula da Silva has yet to make up his mind on whether to increase Brazil’s inflation target this week, according to a high-ranking adviser to the leftist leader. (BBG)

BRAZIL: Former Brazilian President Jair Bolsonaro said he plans to return to Brazil in March to lead the political opposition to leftist President Luiz Inácio Lula da Silva and defend himself against accusations he incited attacks by protesters on government buildings last month. (WSJ)

RUSSIA: The U.S. military is considering sending Ukraine thousands of seized weapons and more than a million rounds of ammunition once bound for Iran-backed fighters in Yemen, an unprecedented step that would help Kyiv battle Russian forces, U.S. and European officials said. (WSJ)

RUSSIA: The Pentagon scrambled fighter jets to counter four Russian aircraft that approached but didn’t enter US or Canadian airspace, in what officials described as a routine encounter unrelated to the series of unidentified objects shot down in recent days. (BBG)

RUSSIA: The lower and upper chambers of Russia's parliament will hold an extraordinary meeting on Feb. 22, RIA Novosti news agency reported on Wednesday, citing a source. (RTRS)

RUSSIA: The European Union is poised to force banks to report information on Russian Central Bank assets as part of the bloc’s latest sanctions package targeting Moscow for its war in Ukraine, according to draft proposals seen by Bloomberg. (BBG)

IRAN: China’s president Xi Jinping has vowed to step up trade and investment co-operation with Iran and “constructively participate” in efforts to revive its nuclear deal with world powers, as he sought to reassure Tehran about the two nations’ bilateral relationship. (FT)

MIDDLE EAST: The US military said it shot down an Iranian-made drone in Syria on Tuesday. (RTRS)

METALS: A reduction in roadblocks in Peru has improved the flow of mining supplies, people and product, although some restrictions remain in the southern corridor, an industry association boss said. (BBG)

ENERGY: The European Commission will begin consulting with member states over whether to prolong emergency steps to reduce gas demand that were put in place at the height of the energy crisis last year. (BBG)

CHINA

ECONOMY: Recent high-frequency data shows China’s economic recovery is gaining strength, which lays a good foundation for the economy in 2023, according to Shanghai Securities News. (MNI)

ECONOMY: Governments at the provincial level in China intend to hire 16% more civil servants this year, bringing the total to 192,000 amid efforts to boost the economy, Caixin Global reports. (BBG)

POLICY: President Xi Jinping’s push for a consumer-led economic recovery has hit a new barrier: Chinese citizens misusing cheap consumer loans. (BBG)

POLICY: More policy stimulus is needed to convert excess savings into consumption, as January saw retail deposits increase, according to the Securities Times Network. (MNI)

FISCAL: A number of local government financing vehicles have increased coupon rates on puttable bonds recently, showing a trend reversal from a year ago, Shanghai Sec. News reports. (BBG)

PROPERTY: Migrant workers returning to their hometowns will aid the real estate market recovery in 2023 as local governments promote policies to stimulate demand, according to the 21st Century Business Herald. (MNI)

BANKS: China’s three policy banks are expected to recapitalise to meet demands for increased lending to bolster growth at a time when Beijing has taken a conservative approach to expanding the balance sheets of its central bank and fiscal authorities, policy advisers and economists said. (MNI)

CREDIT: An unprecedented rally in Chinese developers’ junk dollar bonds is losing steam, pushing the market toward a crossroads as investor views diverge and borrowers greet banks’ deal pitching frenzy with caution. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY239 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY203 billion via 7-day reverse repos and CNY499 billion via 1-year Medium-term Lending Facility on Wednesday, with the rates unchanged at 2.00% and 2.75% respectively. The operation has led to a net drain of CNY239 billion after offsetting the maturity of CNY641 billion reverse repos and CNY300 MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9642% at 9:30 am local time from the close of 1.9637% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, compared with the close of 45 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8183 WEDS VS 6.8136 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8183 on Wednesday, compared with 6.8136 set on Tuesday.

OVERNIGHT DATA

JAPAN DEC TERTIARY INDUSTRY INDEX -0.4% M/M; MEDIAN +0.1%; NOV +0.1%

SOUTH KOREA JAN UNEMPLOYMENT RATE 2.9%; MEDIAN 3.3%; DEC 3.1%

SOUTH KOREA JAN EXPORT PRICE INDEX -1.3% Y/Y; DEC +3.0%

SOUTH KOREA JAN EXPORT PRICE INDEX -3.0% M/M; DEC -6.1%

SOUTH KOREA JAN IMPORT PRICE INDEX +1.7% Y/Y; DEC +8.7%

SOUTH KOREA JAN IMPORT PRICE INDEX -2.3% M/M; DEC -6.5%

MARKETS

US TSYS: Marginally Richer In Asia

TYH3 deals at 112-14, +0-03+, a touch off the top of its 0-05 range on volume of ~70k.

- Cash Tsys sit flat to 1bp richer across the major benchmarks.

- Tsys opened Wednesday cheaper as Asia-Pac participants focused on yesterday's CPI numbers and hawkish Fedspeak from Dallas Fed President Logan in early regional trade.

- A recovery off session lows was facilitated by a move in ACGBs as Governor Lowe didn't deliver any fresh hawkish messaging at a Senate appearance.

- The modest richening move then held through the session, with a couple of block buys in TU futures helping underpin the move, alongside weakness in e-minis and the major regional equity indices.

- Little meaningful macro headline flow was observed.

- In Europe today we have CPI/RPI from the UK, further out there is Empire Manufacturing and Retail Sales. We also have the latest 20-Year Tsy Supply.

JGBS: Firmer & Flatter On Global Cues & Presence Of Rinban

JGB futures pared the modest losses seen in the overnight session and more to sit +7 on the day ahead of the bell, with an uptick in core global FI markets and the presence of the BoJ Rinban operations (covering 1- to 3- & 5- to 25+-Year JGBs) helping generate a light bid. The major cash JGB metrics sit flat to ~3.5bp richer, with a flattening bias apparent, while 10-Year yields operate around the upper boundary permitted under the BoJ’s current YCC settings. Swap rates are essentially flat across the curve, dealing either side of unchanged.

- There hasn’t been much in the way of meaningful domestic headline flow to digest, with PM Kishida outlining the positive characteristics he identified in his nominee for BoJ Governor, Ueda. He also underscored his desire for continued close work between the government and the Bank.

- The aforementioned BoJ Rinban operations continued the run of subdued offer/cover ratios (1.3-2.4x across the buckets covered by today’s purchases).

- 5-Year JGB supply headlines the local docket on Thursday.

AUSSIE BONDS: Mid-Session Reversal Sees ACGBs Outperform U.S. Tsys

YM and XM reverse almost all of the early weakness to close -1.0 and flat, respectively, after RBA Governor Lowe's Senate Economics Committee Hearing failed to deliver a message that was meaningfully more hawkish than the one contained in last week’s RBA communique. YM and XM were down as much as -10.0 in early trade. Cash ACGBs saw yields pullback from the morning highs to be flat to up 1bp out to the 10-year zone and flat to -2bp for the 15-30yr benchmarks.

- Swaps rates closed flat to up 2bp after scaling back most of the morning’s weakness to leave the 3s10s curve 2bp flatter.

- The AU-US 10-year yield differential closed at ~+2bp off the morning wides of +6bp.

- Bills were 3-4bp up from session lows, closing +1 to -6 through the reds.

- While March meeting RBA-dated OIS pricing has shown little movement over recent days, attaching a 92% chance of a 25bp hike, terminal rate expectations have moved in a 4.10%-4.22% range with current pricing for Sep/Oct-23 at just over 4.15%.

- In the run-up to tomorrow’s all important January Australian labour market data, the market is likely to find its guidance from abroad with January prints for UK CPI and U.S. retail sales the most noteworthy global data releases.

AUSSIE BONDS: ACGB Apr-33 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 4.50% 21 April 2033 bond, issue #TB140:

- Average Yield: 3.8106% (prev. 3.6213%)

- High Yield: 3.8125% (prev. 3.6225%)

- Bid/Cover: 4.4786x (prev. 3.3571x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 42.9% (prev. 100.0%)

- Bidders 50 (prev. 35), successful 13 (prev. 10), allocated in full 5 (prev. 10)

NZGBS: Follow ACGBs In Mid-Session Reversal

NZGBs failed to hold the morning session’s U.S. Tsy induced selling pressure, delivering a 4bp reversal across the curve in line with their trans-Tasman counterparts. At the close, NZGB yields were 3.5bp higher for the 2-year benchmark and 1bp higher for the 10-year with a 2bp further inversion of the 2/10 bond curve.

- The swings in NZ swaps were even larger with the 2-year swap rate higher by as much as 10bp in morning trade before reversing to close up 5bp. 10-year swap rate rose 4.5bp in early trade but managed to close 3.5bp lower with the curve 8.5bp more inverted.

- RBNZ-dated OIS reversed early session upward pressure to close basically unchanged with the amount of tightening priced for this month’s meeting at 56bp and terminal OCR pricing sitting around 5.40%.

- There wasn't much in the way of domestic matters to shape price action.

- Looking ahead, the market is likely to find its guidance from abroad with January prints for UK CPI and U.S. retail sales the most noteworthy global data releases on Wednesday, while Australian labour market data may provide some trans-Tasman impetus on Thursday. The weekly NZDM supply will come in the form of NZGB-28, -33 & -37.

EQUITIES: Most Regional Markets Tracking Lower, China Equity Longs Viewed As Crowded

Regional equities are on the back foot. The risk off tone evident in the USD space has likely seen some negative spill over, with fears of a higher for longer Fed the main headwind for risk appetite. A number of specific news flow items have also likely dented sentiment in specific markets today. US futures are lower, with eminis down 0.40%, the Nasdaq off by 0.50%, at this stage.

- The HSI is down by -1.3% at this stage, while in China the CSI 300 is off by 0.43%. The Bank Of America Global Fund Manager survey highlighted that for Feb 23, long China equities is now viewed as the most crowded trade (replacing the long USD trade from Jan).

- Such positioning may be a factor limiting further gains. The HSI China Enterprise Index is now 10% off its Jan highs, so we may already be seeing some adjustment.

- Renowned investor Warren Buffet has also cut his stake in Taiwan semiconductor manufacturer TSMC in reported filings. The Taiex is down 1.45% so far today. The Kospi is down 1.40%. Higher core yields will also be weighing on the tech space all else equal.

- Losses elsewhere have been more modest, but only Thai and NZ shares have managed to post modest gains today. Indian markets are also attempting to push higher.

GOLD: Bullion Retreats As USD Advances

Gold prices are down 0.4% during APAC trading to $1846.90/oz as the USD has rallied 0.25%. They fell following the US CPI which saw the monthly increase in headline rise and the annual inflation rates higher than expected. But gold bounced back and range traded late in the NY session.

- Bullion remains above its Tuesday low of $1843.36 today but is now below its 50-day simple MA and the Feb 14 low of $1850.50. Near-term support is $1825.50, the January 5 low.

- Fed speakers on Tuesday talked of the need for further rate hikes to rein in inflation but were not of the same view regarding where the terminal rate would be. A hawkish tone to the Fed has been weighing on bullion this month.

- Later today January US retail sales print and a strong outcome of 1.8% m/m is expected but the control group is forecast to rise only 0.3%. There are also US business inventories and IP and UK inflation data. No Fed officials are scheduled to speak.

OIL: Crude Continues Falling As Fed And Rising US Stocks Weigh On Market

Oil prices continued their downward move during APAC trading. WTI is down a further 0.8% to $78.40/bbl after falling 1.6% on Tuesday and Brent is down 0.8% to $84.90 after -1.6%. Both are close to their intraday lows. The USD DXY is up 0.2%.

- Brent has moved just below its 100-day simple MA and WTI is approaching its 50-day MA. Brent remains well above support of $83.05, the February 9 low, and WTI above $76.52, the February 9 low.

- The down move in crude has been driven by the large 10.51mn barrels build in US stocks reported by the API. Gasoline inventories rose 846k and distillate 1.73mn. The official EIA data is published later today. Inflation worries and their implications for US rates are also weighing on oil.

- OPEC revised up its 2023 oil demand forecasts in its monthly report due to higher demand from China. It also now expects a slightly tighter market this year. The IEA publishes its monthly outlook today.

- Later today January US retail sales print and a strong outcome of 1.8% m/m is expected but the control group is forecast to rise only 0.3%. There are also US business inventories and IP and UK inflation data. No Fed officials are scheduled to speak.

FOREX: Greenback Firms, Weaker Equities Weigh On Risk Sentiment

The greenback is firmer in the Asian session today, regional equities and US equity futures are softer weighing on risk sentiment.

- Yen is little changed and is outperforming as risk off flows support the JPY. USD/JPY is ~0.1% softer however the pair did print a session low of ¥132.55 below parting losses to deal at current levels.

- AUD is pressured, amid the equity pullback, and is the weakest performer in G-10 space at the margins. There were no new hawkish surprises in Gov Lowe’s appearance at a Senate committee. The pair deals at session lows $0.6930/40, downside support comes in at $0.6856 the low from 6 Feb.

- NZD/USD is also softer as weaker risk sentiment weighs. The pair is dealing at session lows, downside breaks of $0.63 have been supported in recent trade. AUD/NZD is ~0.2% softer, dealing a touch above the $1.10 handle.

- EUR and GBP are both ~0.2% softer, as the broad based USD bid weighs.

- Cross asset wise; Hang Seng is down ~1.3% and e-minis are down ~0.4%. BBDXY is up ~0.2%, since breaking above its 20-day EMA in early Feb the index has found support on the EMA and it is now emerging as a level to watch. The index dropped below the 20-day EMA post yesterday US CPI but recovered as rising US yields boosted the greenback.

- In Europe today we have CPI/RPI from the UK, further out there is Empire Manufacturing and US Retail Sales.

FX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0490-00(E554mln), $1.0650-70(E1.3bln), $1.0700(E1.2bln), $1.0715-20(E694mln), $1.0800-05(E1.1bln), $1.0830-50(E1.3bln)

- USD/JPY: Y130.00($1.1bln), Y130.15-21($1.1bln), Y134.00($1.2bln)

- AUD/USD: $0.7000(A$1.2bln)

- USD/CAD: C$1.3300(E700mln), C$1.3400(E690mln)

- USD/CNY: Cny6.8500($2.2bln), Cny6.9500($1.3bln), Cny7.0000($1.3bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 15/02/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 15/02/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 15/02/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/02/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/02/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/02/2023 | 1400/1500 |  | EU | ECB Lagarde at Plenary Debate on ECB Annual Report | |

| 15/02/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 15/02/2023 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.