-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN OPEN: U.S. Senate Passes Amended Fiscal Bill, Middle East Worry Boosts Oil

EXECUTIVE SUMMARY

- SENATE PASSES $1.9 TRILLION RELIEF BILL AFTER MARATHON VOTES (BBG)

- CONTINUED LACK OF FED PUSHBACK VS. HIGHER TSY YIELDS PRE-BLACKOUT

- KEY SAUDI ARABIAN OIL SITE ATTACKED, SENDING BRENT ABOVE $70 (BBG)

- CHINESE TRADE DATA MUCH STRONGER THAN EXP., ALBEIT WORKING OFF VERY LOW Y/Y BASE

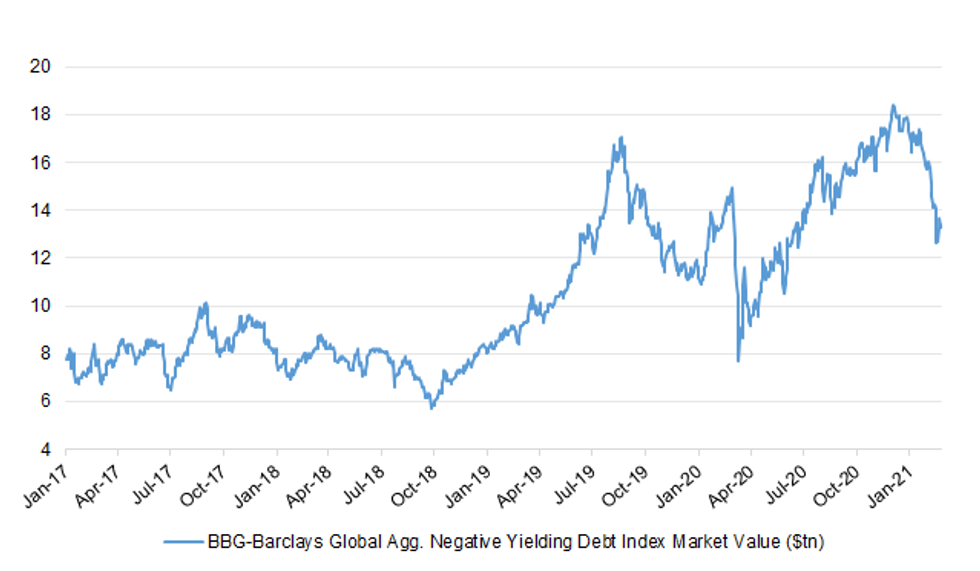

Fig. 1: Fig. 1: BBG-Barclays Global Agg. Negative Yielding Debt Index ($tn)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has said the country is starting to move towards a sense of "normality" as schools in England get ready to open to more pupils on Monday. The PM has urged the public to stick to the rules as the government follows a "cautious" approach to easing lockdown. Monday marks the first step of the "roadmap" out of national restrictions. But the UK's largest education union has accused the government of failing to put adequate safety measures in place ahead of schools reopening. (BBC)

CORONAVIRUS: Children may be wrongly kept off school because there is a risk that the "majority" of positive cases detected by the Government's lateral flow tests "could be false positives", experts have warned. (Telegraph)

CORONAVIRUS: New variants of Covid-19 are "very unlikely" to stop Britain getting back to normal in the summer, according to the scientist in charge of tracking strains of the said. Professor Sharon Peacock, head of the Covid-19 Genomics UK scientific body, told The Times that the country was now well equipped to "stay ahead" of the virus by adapting vaccines quickly. She was "very optimistic" that immunisation would allow Britain to ease restrictions as planned. Schools in England will reopen to all pupils on Monday in the first stage of the lockdown easing, with all restrictions due to end by June 21. The emergence of new variants that could be resistant to vaccines is seen as the most significant risk to the timetable. (The Times)

CORONAVIRUS: The U.K. is expanding its vaccination program in a signal the country is on track to meet its targets in fighting Covid-19. About 1.7 million people aged 56 to 59 are being invited to book an inoculation, the National Health Service said on Sunday. More than 80% of people between 65 and 69 took up the offer. Those aged 50 to 55 are set to be invited shortly. (BBG)

CORONAVIRUS: Passengers travelling overseas from England will be required to complete and carry a 'Declaration to Travel' form, starting from Monday. Airlines, ferry companies and train operators will be legally obliged to explain on their websites that the document must be filled out before travelling. They will then check that passengers have completed the form before they board – individuals who have not done so may not be allowed to join the service they have booked. Anyone identified by police as trying to travel overseas for reasons that are not currently permitted will be asked to return home and they risk receiving a fixed penalty notice for breaking non-essential travel rules. These fines start at £200 and double for each incident; they can go up to a maximum of £6,400. (Telegraph)

ECONOMY: Household and business confidence has rebounded to levels not seen since the start of the pandemic thanks to the rapid deployment of Covid-19 vaccines. The improving sentiment will raise hopes that the economy is poised for a robust recovery when restrictions are largely phased out in the summer. Consumer confidence hit 105.4 last month, according to an index compiled by the Centre for Economics and Business Research and YouGov. That compared with 103.4 the previous month and is the highest since February last year. (The times)

BREXIT: Brussels must stop sulking over the UK's decision to leave the European Union and work to make Brexit a success, Boris Johnson's Europe adviser has said. Lord Frost says the EU should "shake off any remaining ill will towards us for leaving, and instead build a friendly relationship, between sovereign equals". (Telegraph)

BREXIT: The Cabinet Office run by Michael Gove has been officially reprimanded by the UK Statistics Authority for using unpublished and unverifiable data in an attempt to deny that Brexit had caused a massive fall in volumes of trade through British ports. The criticism follows a story in the Observer on 7 February that cited a survey by the Road Haulage Association (RHA) of its international members showing export volumes had dropped by a staggering 68% in January through British ports and the Channel Tunnel. (Guardian)

POLITICS: A row over a 1% pay rise for National Health Service staff in England has overshadowed Boris Johnson's push to re-open schools on Monday, with the nurses fundraising for possible strike action against the government. The low-level pay rise sparked fury among health unions after a year in which NHS hospitals have been deluged with huge numbers of critically ill Covid-19 patients. (BBG)

SCOTLAND: A poll has suggested a majority of Scots would now vote in favour of remaining in the United Kingdom should a second independence referendum be held tomorrow. The survey is the first to take place after both Nicola Sturgeon and Alex Salmond gave their evidence to the Holyrood inquiry into the botched handling of harassment complaints against the former first minister. The polling conducted by Savanta ComRes for The Scotsman interviewed 1,015 Scots between March 4 and 5 – the two days immediately after the First Minister's appearance before the Salmond inquiry. The survey does show a general preference for a No vote in any second referendum, with a total of 46 per cent support for No, 43 per cent support for Yes and 10 per cent for don't know. With don't knows excluded, it suggests a 52 per cent lead for No, with 48 per cent for Yes. However, these figures are not weighted for voter turnout, with further polling expected this week to show a clearer impact of the inquiry on Scottish independence voting intention. (Scotsman)

EUROPE

ECB: Europe's top banking regulator has asked the continent's lenders for details of their exposure to stricken Greensill Capital and its key client GFG Alliance, as officials try to understand whether the crisis is contained, according to four people familiar with the matter. Greensill last week was pushed to the brink of insolvency after Credit Suisse abandoned €10bn of supply chain finance funds linked to the group and as Germany's banking watchdog BaFin froze its Bremen-based bank and filed a criminal complaint alleging balance sheet manipulation. Supervisors at the European Central Bank have asked banks to provide details of outstanding loans to Greensill and GFG, which operates steel mills around the world and relied heavily on Greensill for funding. (FT)

CORONAVIRUS: The EU will urge the US to permit the export of millions of doses of AstraZeneca's Covid-19 vaccine to Europe, as Brussels scrambles to bridge supply shortfalls that have hobbled its inoculation drive. The European Commission plans to raise the matter in forthcoming transatlantic discussions aimed at boosting collaboration on the fight against Covid-19, EU officials said. The EU also wants Washington to ensure the free flow of shipments of crucial vaccine ingredients needed in European production, including for groundbreaking mRNA technology vaccines. (FT)

CORONAVIRUS: Tens of millions of doses of Russia's Sputnik V vaccine could be produced a month in Europe, Kirill Dmitriev, chief executive officer of the state-run Russian Direct Investment Fund which backed its development, told Italian Rai3 television Sunday. "There are many Italian regions which are enthusiastic about having Sputnik, they would also want to produce it," said Dmitriev, who is in charge of Sputnik's international roll-out. "We have a partnership in Germany, we're talking to several French companies." Production in Italy could start in June, he added. (BBG)

GERMANY: German chancellor Angela Merkel's centre-right bloc has been rocked by scandal after two of its MPs announced they were resigning following disclosures that they had personally profited from government deals to procure coronavirus face masks. The announcements risk damaging the party ahead of two important regional elections next Sunday in the western states of Baden-Württemberg and Rhineland-Palatinate. The polls are seen as a critical test for Armin Laschet, the new leader of Merkel's party, the Christian Democratic Union, who was only elected in January and is still seeking to stamp his authority on the party. (FT)

ITALY: The government of Italian Prime Minister Mario Draghi is considering tighter curbs, including making the entire country a high-risk "red" zone at least during weekends, to counter a surge in the coronavirus pandemic. "The second wave never stopped, we're seeing a very strong pickup due to the variants, which is leading us to take measures that are ever-more restrictive," Health Minister Roberto Speranza told newspaper Corriere della Sera. (BBG)

ITALY: A decision by the government of Italian Prime Minister Mario Draghi to recruit consulting firm McKinsey & Co. for help with the European Union's recovery package has prompted disquiet within his coalition. The company will advise the finance ministry and help to accelerate the drafting of Italy's plan to spend its 209 billion-euro ($250 billion) share of the EU windfall, the ministry said in a statement on Saturday. Governance will remain the responsibility of the ministry and other authorities, the statement added. (BBG)

ITALY/BTPS: MNI INTERVIEW: Italy Eyes More Green, Dollar Issuance

- Italy will launch fresh new green bonds next year, and could tap this week's 2045 BTP Green again in 2021 as well as issue more than once in dollars, the Treasury's general director of Public Debt Davide Iacovoni told MNI. There will "definitely be new bonds next year," Iacovoni said in an interview, although he added "a new bond this year may be a bit challenging, because it would mean that we are not taking care of the liquidity of the existing one" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ITALY/BTPS: Italy plans to sell 6 billion euros of bills due Mar 14, 2022 in an auction on Mar 10. (BBG)

BELGIUM: Belgians can more than double the size of their outdoor social circles from Monday, meeting with a maximum of 10 people rather than the current limit of four, the government announced. But they will have to wait before the indoor bubble of one (or knufflecontact) can finally be burst. A week after dampening hopes that relaxations were on the way, Belgian Prime Minister Alexander De Croo announced the loosening of measures on Friday. (POLITICO)

AUSTRIA: Austria stopped shots from one batch of the AstraZeneca vaccine after two incidents involving women who received shots from that batch. One 49-year-old woman died from a severe coagulation dysfunction, and one 35 year-old woman developed a pulmonary embolism but is now recovering. The Austrian Federal Office for Safety in Health Care said on its website that "there is no evidence of a causal relationship" with the vaccination, and that "thrombotic events in particular are not among the known or typical side effects of the vaccine in question." The cases will be analyzed further to rule out any connection. Meanwhile there will be no further vaccinations with that batch, the office said. (BBG)

FINLAND: Finland is postponing its countrywide local elections by two months as the coronavirus pandemic takes a turn for the worse. Eight of nine parliamentary parties support moving the municipal vote to June 13 from April 18, Justice Minister Anna-Maja Henriksson said in a message posted on Twitter on Saturday. (BBG)

SWEDEN: Sweden's first major demonstration against coronavirus restrictions was broken up by Stockholm police on Saturday, the Associated Press reported. Swedish media showed a crowd, estimated at several hundred, gathering without masks near the capital's Old Town. Aftonbladet said the protest was organized by a group called Freedom Sweden. Sweden pulled back from its largely hands-off early approach to the pandemic after many more people died than in its more restrictive Nordic neighbors. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Moody's affirmed Estonia at A1, Outlook Stable

- S&P affirmed Cyprus at BBB-; Outlook Stable

- DBRS Morningstar confirmed Estonia at AA (low), Stable Trend

- DBRS Morningstar confirmed Spain at A, Stable Trend

U.S.

FED: The recent run-up in yields on longer-dated U.S. Treasury securities reflects improving expectations for the economy, St. Louis Federal Reserve President James Bullard said on Friday, adding that he is not eyeing a specific level of yields that might concern him. The 10-year U.S. Treasury note yield - which rose above 1.62% on Friday before falling back to about 1.55% - is just returning to the level consistent with the six months before the coronavirus pandemic, Bullard said in an interview on SiriusXM Radio, characterizing it as "still quite a low level of yields." Echoing Fed Chair Jerome Powell's comments from a day earlier, Bullard said he would be concerned by disorderly behavior in the Treasury market. "Something panicky would catch my attention, but we're not at that point. (RTRS)

FED: A sharp recent rise in bond yields mostly reflects expectations for stronger economic growth ahead, Cleveland Federal Reserve Bank President Loretta Mester said on Friday, but "we are still very far from our goals" of full employment and price stability. The U.S. recovery needs to become broader-based and sustainable, she told CNN International. "From my point of view on policy, I think that's going to take sustained accommodation from the Fed for some time," she said. (RTRS)

FED: MNI BRIEF: Rise in Real Yields Might Warrant Action: Kashkari

- Minneapolis Fed President Neel Kashkari said Friday he's not worried about the spike in Treasury yields so far but would be concerned if the level of inflation-adjusted rates were to spike considerably. "If we were seeing an real uptick in real yields, that would worry me," he said. "That might warrant a policy response" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Long Way From Full Employment: Fed's Kashkari

- The U.S. economy is still a long way from full employment, Minneapolis Fed President Neel Kashkari said Friday, and will thus require central bank support for the foreseeable future - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Favored Inflation Expectations Index Ticks Up

- One of the Fed's preferred gauges for inflation expectations has ticked up closer to 2%, a new release Friday showed, but remains below levels Fed officials have said is necessary to cause the central bank to adjust its monetary policy tools. The Index of Common Inflation Expectations was updated with data through December and shows that inflation expectations came in at 1.96%, after falling to 1.93% in March 2020 and drifting lower over previous years. The CIE index - a measure of 21 varying inflation expectation indicators - is expected to be updated quarterly with the Q1 release expected April 16 at noon ET - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: With Democrats on the verge of passing an almost $2 trillion stimulus bill and Covid-19 vaccinations moving ahead, the U.S. economic outlook is much sunnier than it looked in early January. The latest Bloomberg monthly survey of economists shows the annualized pace of growth in the first quarter will be 4.8%, twice as fast as respondents expected just two months ago. For the full year, gross domestic product is projected to rise 5.5%, which would be the fastest since 1984 and is up from January's estimate of 4.1%. (BBG)

ECONOMY: New York City movie theaters finally reopened this weekend but it apparently wasn't enough to give the U.S.'s box office a big boost. Walt Disney Co.'s "Raya and the Last Dragon" brought in lower-than-expected box office sales of $8.6 million in North America during its opening weekend, failing to draw audiences back to theaters in large numbers instead of streaming at home. In New York City, where movie theaters were allowed to reopen on Friday after a yearlong hiatus, 27 cinemas were open this weekend, representing 44% of the number of theaters in 2019, according to Comscore. About 45% of all North American theaters are now currently open, up from 42% last weekend. (BBG)

FISCAL: President Joe Biden's signature $1.9 trillion Covid-19 relief bill passed the Senate 50-49 on Saturday following a more than 25-hour marathon of amendment votes completed after Democrats settled an intra-party dispute over unemployment aid. The measure, the American Rescue Plan Act, now heads back to the House, where Majority Leader Steny Hoyer said a vote will be held Tuesday. Although some House progressives have complained about changes made by the Senate, none so far have threatened to withhold votes. Democrats aim to have it signed into law next week. (BBG)

FISCAL: President Joe Biden said Saturday that Americans will start getting their stimulus checks this month, as Democrats rush to send more aide out. (CNBC)

FISCAL: Senate Majority Leader Chuck Schumer indicated on Saturday that congressional Democrats might consider more stimulus depending on how the economy and pandemic progress in the coming months, after the Senate passed a $1.9 trillion Covid-19 relief package. "It's a very strong bill, part of it will depend on Covid," said Schumer, D-N.Y, when asked by a reporter whether this was the last Covid stimulus package Congress would pass. "How long will it last, will there be a new strain? Part of it will depend on — the economy has some underlying weaknesses that need bolstering. How deep and weak are those?" the Senate leader asked. (CNBC)

FISCAL: An effort by Sen. Bernie Sanders (I-Vt.) to include a $15 minimum wage in President Biden's $1.9 trillion stimulus plan despite opposition from lawmakers—including eight Democrats—and a key Senate rules and procedures advisor failed on Friday as the Senate embarked on a marathon voting session to advance the sweeping relief package. (Forbes)

FISCAL: Treasury Secretary Janet Yellen played down any concern that the recent surge in U.S. government-bond yields reflects expectations for an outsized breakout in inflation. "I don't see that the markets are expecting inflation to rise above" the Federal Reserve's 2% objective, Yellen said Friday in an interview with PBS NewsHour. "Long-term interest rates have gone up some -- but mainly, I think, because market participants are seeing a stronger recovery." (BBG)

FISCAL: U.S. Treasury Secretary Yellen tweeted the following on Saturday: "The Senate took a critical step today. With the economy down 9.5 million jobs since February 2020, it could be 2 years before the labor market simply reaches its pre-pandemic level. These high rates of job loss threaten the wellbeing of workers & their families. Such loss may create economic scars that last well beyond the end of the pandemic. This is why our country is in need of an ambitious relief bill to help Americans endure the final months of this crisis; to put food on the table, checks in the mail, & vaccine shots in the arm. With the Senate's vote on the America Rescue Plan, the bill is one step closer to passage. Once the plan is signed into law, I am confident that Americans will be met by a strong economy when we make it to the other side of the pandemic." (MNI)

FISCAL: President Joe Biden's coming infrastructure plan should dramatically reduce tax breaks for the energy industry and focus them on green initiatives, the chairman of a powerful Senate committee told CNBC. Sen. Ron Wyden, who leads the Senate Finance Committee, said such an overhaul is at the top of his agenda. "I think this would trigger a real transformation for the economy," Wyden, D-Ore., said in an interview. (CNBC)

CORONAVIRUS: U.S. cases remain "very high" and a rush to lift virus-related restrictions risks triggering another surge, Anthony Fauci, President Joe Biden's chief medical adviser, said on CBS's "Face the Nation." "Plateauing at a level of 60,000-70,000 new cases per day is not an acceptable level," Fauci said. "That is really very high." Fauci's comments extend a series of warnings, including by Biden, that decisions by Texas and Mississippi to end mask mandates are premature, even as the pace of vaccination in the U.S. accelerates. (BBG)

CORONAVIRUS: President Joe Biden retains broad support for his coronavirus response, though the country appears to be wary of aggressively loosening restrictions aimed at curbing the spread of the virus, according to a new ABC News/Ipsos poll. (ABC)

CORONAVIRUS: U.S. government scientists are pushing back against calls for one-dose regimens for two Covid-19 vaccines designed to be administered with two shots, saying there isn't enough evidence that a single dose provides long-term protection. "It is essential that these vaccines be used as authorized by FDA in order to prevent Covid-19 and related hospitalizations and death," Peter Marks, director of the Food and Drug Administration's center that oversees vaccines, told The Wall Street Journal. (WSJ)

CORONAVIRUS: AstraZeneca Plc. has begun stockpiling its vaccine for use in the U.S., providing a potential supply boost that could speed up President Joe Biden's inoculation timetable, should the company win regulatory authorization. A company executive said this week it has begun production and expects to have 30 million doses ready for U.S. distribution, once it's approved by the U.S. Food and Drug Administration. AstraZeneca hasn't yet applied to the FDA and hasn't said when it will, but the U.K.-based company expects to produce 15 to 25 million doses per month for the U.S. after that. (BBG)

CORONAVIRUS: The U.S.'s first over-the-counter molecular Covid-19 test was given emergency-use authorization by the Food and Drug Administration on Friday for at-home use. (BBG)

CORONAVIRUS: Restaurants in New York state, outside New York City, can expand to 75 per cent capacity from 50 per cent from March 19, officials said on Sunday. Governor Andrew Cuomo said data has shown that restaurants can operate "safely and in accordance with strict health protocols" while three-quarters full. (FT)

CORONAVIRUS: New York City Mayor Bill de Blasio said he will have an announcement next week on high schools, the last tranche of the public education system whose students are still in remote learning a year after the pandemic shut down in-person learning. (BBG)

CORONAVIRUS: California officials said theme parks and stadiums can reopen as soon as April 1 provided they meet local requirements and take precautions against the coronavirus. (BBG)

CORONAVIRUS: Arizona Gov. Doug Ducey said Friday he will lift coronavirus restrictions on the state's businesses following weeks of declining cases, according to a statement from the governor's office. The new order, which will leave mask and social distancing rules in place, will eliminate capacity restrictions on "restaurants, gyms, theaters, water parks, bowling alleys and bars providing dine in services," the statement said. (CNBC)

CORONAVIRUS: South Carolina lifted its limited mask mandate, no longer requiring people in restaurants or in government buildings to wear them. Governor Henry McMaster signed an executive order on Friday that still encouraged people to wear masks when close to people not in the same household or where it is not possible to socially distance. In a Twitter post on Friday, the Republican governor held up South Carolina as a leader among states that rejected mask mandates. (BBG)

CORONAVIRUS: Nevada Gov. Steve Sisolak has signed an emergency order adjusting the minimum distance between performers and audience members that previously challenged the return of productions in Las Vegas. (BBG)

CORONAVIRUS: West Virginia Gov. Jim Justice announced that the state's restaurants and bars will be allowed to open at "100% of their seating capacity," though the governor will not lift the state's mask mandate. Other businesses with capacity limits, like gyms, fitness centers and museums, will also be allowed to reopen at full capacity, he said at a press briefing. Justice said residents can now gather in groups of 100 people, up from 75. (CNBC)

CORONAVIRUS: Governor Kate Brown issued an executive order for Oregon's primary school students to return to in-person classes by March 29 and grades 6-12 by April 19. "The time has come for our students to return to the learning environment we know serves them best: in-person instruction," she wrote in a letter to the state's top health and education officials Friday. (BBG)

CORONAVIRUS: Arkansas Gov. Asa Hutchinson (R), one of several governors from both parties to announce a reversal of coronavirus restrictions, defended his decision Sunday, saying he viewed the rollback in his state as an "off-ramp" that could be adjusted if infections spike. "Our businesses have taken the right measures… there's just a difference to how much the restrictions can be placed on business and for how long," Hutchinson said on "Fox News Sunday." "They've struggled, they've suffered and so we want to give more flexibility." (The Hill)

POLITICS: Sen. Joe Manchin, the moderate Democrat from West Virginia, said he would consider passing legislation through a party-line vote again but only in a situation where Democrats have tried to engage Republicans. Manchin's comments come as the Biden administration and Democratic lawmakers look toward other top priorities, including voting rights legislation, after they passed a $1.9 trillion Covid relief bill without any Republican support in the evenly divided Senate this weekend. (CNBC)

EQUITIES: The White House said on Friday a new White House economic adviser, big-tech critic Tim Wu, will help advance President Biden's agenda with regard to the technology sector, including addressing "monopoly and market power issues." The White House announced the addition of Wu to its National Economic Council earlier on Tuesday. "The president has been clear ... that he stands up to the abuse of power and that includes the abuse of power from big technology companies and their executives," White House spokeswoman Jen Psaki told reporters. "Tim will help advance the president's agenda, which includes addressing the economic and social challenges posed by the growing power of tech platforms, promoting competition and addressing monopoly and market power issues," she said. (RTRS)

OTHER

U.S./CHINA: Chinese Foreign Minister Wang Yi said Sunday that the U.S. needs to remove "unreasonable restrictions" for the two countries' relationship to move forward under President Joe Biden's administration. Wang's remarks come as tensions between the U.S. and China have escalated in the last few years under former President Donald Trump, whose term ended in January. So far, the Biden administration has maintained a tough position on China — calling the country a more assertive "competitor" — and raised concerns about Beijing's stance around Taiwan, Hong Kong, Xinjiang and Tibet. (CNBC)

U.S./CHINA: A cyberattack on Microsoft Corp.'s MSFT 2.15% Outlook email software is believed to have infected tens of thousands of businesses, government offices and schools in the U.S., according to people briefed on the matter. Many of those victims of the attack, which Microsoft has said was carried out by a network of suspected Chinese hackers, appear to be small businesses and state and local governments. Estimates of total world-wide victims were approximate and ranged broadly as of Friday. Tens of thousands of customers appear to have been affected, but that number could be larger, the people said. It could be higher than 250,000, one person said. While many of those affected likely hold little intelligence value due to the targets of the attack, it is likely to have netted high-value espionage targets as well, one of the people said. (WSJ)

U.S./CHINA/HONG KONG: The United States on Friday called China's moves to change the Hong Kong electoral system a direct attack on its autonomy and democratic processes and said Washington was working at "galvanizing collective action" against Chinese rights abuses. Earlier on Friday, Beijing proposed legislation that would tighten its increasingly authoritarian grip on Hong Kong by making changes to the electoral committee that chooses the city's leader, giving it new power to nominate legislative candidates. (RTRS)

GEOPOLITICS: A sophisticated attack on Microsoft Corp.'s widely used business email software is morphing into a global cybersecurity crisis, as hackers race to infect as many victims as possible before companies can secure their computer systems.The attack, which Microsoft has said started with a Chinese government-backed hacking group, has so far claimed at least 60,000 known victims globally, according to a former senior U.S. official with knowledge of the investigation. Many of them appear to be small or medium-sized businesses caught in a wide net the attackers cast as Microsoft worked to shut down the hack. (BBG)

GEOPOLITICS: A sophisticated attack on Microsoft Corp.'s widely used business email software is morphing into a global cybersecurity crisis, as hackers race to infect as many victims as possible before companies can secure their computer systems.The attack, which Microsoft has said started with a Chinese government-backed hacking group, has so far claimed at least 60,000 known victims globally, according to a former senior U.S. official with knowledge of the investigation. Many of them appear to be small or medium-sized businesses caught in a wide net the attackers cast as Microsoft worked to shut down the hack. (BBG)

GLOBAL TRADE: China's manufacturing industry has made marked progress lately, but the general view that it is "big, but not strong" and "comprehensive, but not excellent" has not fundamentally changed, Miao Wei, deputy director of the Committee of Economy of the CPPCC National Committee and former head of the Ministry of Industry and Information Technology, said in a speech at the second plenary meeting of the fourth session of the 13th CPPCC National Committee on Sunday. (Global Times)

GLOBAL TRADE: China could establish a white list of core research teams with stable national sponsorship and promote the necessary replacement of imported technologies and products with domestic pharmaceutical products to tackle strangleholds in biotechnology, members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and National People's Congress (NPC) have proposed. Chen Wei, a vaccine scientist who developed the country's first single-dose coronavirus vaccine, suggested that China compile a white list, with stable and long-term national investment in key research teams, to integrate specific projects, technology bases and talent. (Global Times)

GLOBAL TRADE: The U.S. and the European Union will suspend tariffs for four months tied to a long-running dispute over illegal subsidies for Boeing and Airbus, the president of the European Commission said Friday. The agreement is step toward resolving the 17-year dispute that has led retaliatory tariffs on billions of dollars of goods affecting a range of exports from both sides of the Atlantic. It comes a day after the U.S. and U.K. also agreed to a four-month pause on tariffs tied to the dispute. (CNBC)

FISCAL: Democratic leaders struck an agreement with Sen. Joe Manchin (D-W.V.) on emergency unemployment insurance late Friday, clearing the way for Senate action on President Biden's $1.9 trillion stimulus package to resume after an hours-long delay. (Axios)

CORONAVIRUS: The World Health Organization will release their summary and full report into the origins of the virus at the same time around March 14-15, WHO official Peter Ben Embarek said in a briefing. He said it makes sense to issue them at the same time as they follow each other. Mike Ryan, head of the WHO health emergencies program, addressed a media report that an interim report had been scrapped. "There was never a plan to release an interim report," he said. (BBG)

CORONAVIRUS: Hong Kong's Department of Health reported two people had been admitted to intensive care units with "suspected serious adverse events following Covid-19 vaccination." The patients were aged 72 and 82 and both had histories of underlying medical conditions including diabetes. (BBG)

CORONAVIRUS: As an aggressive coronavirus strain from the Amazon ravages Brazil, a preliminary study has provided the first evidence that the country's principal vaccine, China's CoronaVac, might not be as effective against it. The small-scale study, which has yet to be peer-reviewed, comes as doctors warn of a humanitarian catastrophe in Brazil over coming weeks, with surging deaths as the disease overwhelms hospitals across the country. Researchers from Brazil, the U.K., and the U.S., found that plasma from eight people vaccinated five months ago with CoronaVac "failed to efficiently neutralize" the new Amazonian strain, called P.1. The study didn't show if CoronaVac can still stop people getting sick from the variant, one of the main goals of vaccination campaigns. (WSJ)

CORONAVIRUS: Ridgeback Biotherapeutics LP said it had been encouraged by preliminary data from a Phase 2a trial of its Covid-19 oral antiviral treatment molnupiravir, which it is developing in partnership with Merck & Co. The results were from Ridgeback's trial to evaluate the treatment's safety, tolerability, and efficacy to eliminate SARS-CoV-2, the companies said in a joint statement. "At a time where there is unmet need for antiviral treatments against SARS-CoV-2, we are encouraged by these preliminary data," Wendy Painter, chief medical officer of Ridgeback, said in the statement. (BBG)

HONG KONG: China's planned changes to the electoral system in Hong Kong will improve the global financial hub's ability to govern itself, the city's leader Carrie Lam said on Monday. China's parliament plans to dramatically reduce democratic representation in Hong Kong's legislature and the committee selecting the chief executive and vet any candidates in elections for their "patriotism." Lam was back in Hong Kong after attending the opening of China's annual parliament session last week. (RTRS)

JAPAN: Japan may approve another Covid-19 vaccine in May or June after allowing the Pfizer Inc.-BioNTech SE vaccine in February, Japanese health minister Norihisa Tamura said on Fuji TV on Sunday. "AstraZeneca and Moderna's vaccines have filed for approval, and these may be approved as early as May, or June," he said. "Of course, it is under careful screening at the moment, and we must see their safety and effectiveness," the minister said. (BBG)

JAPAN: Japanese Internal Affairs Minister Ryota Takeda told reporters Monday that ministry dinners were highly likely to have breached the law. (BBG)

RBA: To understand if the official overnight interest rate will remain near zero until 2024 as the Reserve Bank of Australia suggests, RBA watchers need understand the bank's thinking on the economic concept known as NAIRU. (Australian Financial Review)

AUSTRALIA: The Australian government sent a letter to AstraZeneca on Friday saying it was surprised and disappointed by Italy's decision to block a vaccine shipment, according to Rome newspaper La Repubblica citing the text of the missive. The government reproached AstraZeneca in the letter for not having opposed the decision, and urged the company to immediately make a new export request to the EU, Repubblica said. (BBG)

NEW ZEALAND: New Zealand has purchased an additional 8.5 million doses of the Pfizer/BioNTech vaccine, meaning it will have enough to vaccinate the entire population, Prime Minister Jacinda Ardern said in an emailed statement. "This brings our total Pfizer order to 10 million doses, or enough for 5 million people to get the two shots needed to be fully vaccinated against Covid-19," Ardern said. (BBG)

SOUTH KOREA: The U.S. and South Korea have reached a tentative pact on defense cost-sharing that will see Seoul increase funding for U.S. forces stationed in the country, the State Department said. Negotiators reached an agreement in principle on the proposed text for the Special Measures Agreement, according to a series of Twitter posts from the U.S. agency's political-military affairs branch. (BBG)

CANADA: Canada's drug regulator approves the Johnson & Johnson COVID vaccine, the fourth to be given the green light in the country. Canada has pre-ordered 10 million doses of the J&J vaccine, with the option to buy 28 million more. "With millions of doses already secured, we're one step closer to defeating this virus," Prime Minister Justin Trudeau said on Twitter. (Nikkei)

TURKEY: U.S. President Joe Biden will call his Turkish counterpart Recep Tayyip Erdoğan "at some point" in the future, White House spokeswoman Jen Psaki said on Friday during a press conference. Erdoğan issued his congratulatory message for President-elect Biden's "success" in the elections on Nov. 10, four days delay after major U.S. news networks called the race for the Democratic Party. (Ahval)

TURKEY: American demands that Turkey scrap a Russian air-defense system could boomerang, Turkish President Recep Tayyip Erdogan's spokesman warned. "If another country comes to us with a maximalist position and demands, you know, 'It's either my way or the highway,' then that kind of attitude pushes you in other directions," Ibrahim Kalin said in an interview in Istanbul on Saturday. (BBG)

TURKEY: Turkey is sending its strongest signal yet that it's ready to mend ties with Arab countries that have been strained by Ankara's support for Islamist-rooted governments. "A new chapter can be opened, a new page can be turned in our relationship with Egypt as well as other other Gulf countries to help regional peace and stability," Ibrahim Kalin, the spokesman for Turkish President Recep Tayyip Erdogan, said in an interview in Istanbul on Saturday. (BBG)

BRAZIL: Brazil's daily COVID-19 death toll could reach 3,000 if serious action is not taken to halt the spread of the virus, according to a presentation made in a meeting of the government's crisis response team, two sources present told Reuters. The inter-ministerial task force, which includes the Health Ministry and the office of the president's chief of staff, met on Thursday to discuss the current situation of the pandemic in Brazil where a brutal second wave is killing people faster than at any previous point. (RTRS)

RUSSIA: The responses will start to define how President Biden fashions his new administration's response to escalating cyberconflict and whether he can find a way to impose a steeper penalty on rivals who regularly exploit vulnerabilities in government and corporate defenses to spy, steal information and potentially damage critical components of the nation's infrastructure. The first major move is expected over the next three weeks, officials said, with a series of clandestine actions across Russian networks that are intended to be evident to President Vladimir V. Putin and his intelligence services and military but not to the wider world. The officials said the actions would be combined with some kind of economic sanctions — though there are few truly effective sanctions left to impose — and an executive order from Mr. Biden to accelerate the hardening of federal government networks after the Russian hacking, which went undetected for months until it was discovered by a private cybersecurity firm. (New York Times)

IRAN: Britain called for the unconditional release of Nazanin Zaghari-Ratcliffe after her five-year sentence for spying ended yesterday, only for the Iranian judiciary to summon her over a second criminal case. Prison officers removed the ankle tag that Zaghari-Ratcliffe has been forced to wear for the past year since she was allowed to move from prison to house arrest at her parents' home in Tehran. But any prospect of her immediate return home to her husband and daughter in London was quashed when she was summoned to court next Sunday on a second set of charges of propaganda against the regime. (The Times)

MIDDLE EAST: Secretary of Defense Lloyd Austin warned those responsible for carrying out last week's rocket attack against an Iraqi base that hosts American troops will be held to account. "The message to those that would carry out such an attack is that expect us to do what is necessary to defend ourselves," Austin said in an interview with ABC that aired on Sunday. "We'll strike if that's what we think we need to do at a time and place of our own choosing. We demand the right to protect our troops," he said, adding that the U.S. is still assessing intelligence with its Iraqi partners. (CNBC)

COPPER: Rio Tinto is set to start face-to-face negotiations with the government of Mongolia as its seeks to complete the $6.75bn expansion of a huge copper project in the Gobi desert. The Anglo-Australian group is sending a team of senior executives to the capital Ulaanbaatar to try and hammer out a new financing agreement so that the development timeline can be maintained and underground caving operations can start later this year. The discussions will focus on a number of issues including tax, a new power agreement and benefit sharing, according to people with knowledge of the situation. (FT)

OIL: Saudi Arabia said one of the most protected oil facilities in the world came under attack on Sunday, but the missile and drone barrage didn't cause "loss of life or property." The Energy Ministry said a storage tank in the Ras Tanura export terminal in the country's Gulf coast was attacked by a drone from the sea. Shrapnel from a missile also landed near a residential compound for employees of national oil company Saudi Aramco. "Both attacks did not result in any injury or loss of life or property," said a spokesman for the Saudi Energy Ministry. (BBG)

OIL: Saudi Arabia's state oil producer Aramco set its April official selling price (OSP) for its Arab Light crude to Asia at plus $1.40 per barrel versus the Oman/Dubai average, up $0.40 from March, according to a statement issued on Sunday. It set its Arab Light OSP to Northwest Europe at minus $2.20 per barrel against ICE Brent compared with minus $0.50 in March. The OSP to the United States was set at plus $0.95 a barrel over Argus Sour Crude Index (ASCI) for April, $0.10 above March's premium. (RTRS)

OIL: Missile strikes in northern Syria near the Turkish border killed one person and injured at least eleven others on Friday, Turkish state media and a source from the Turkish-backed faction that controls the region said. Explosions rocked local oil refineries near the towns of al-Bab and Jarablus, sparking large fires, a witness and Turkey's state-owned Anadolu news agency said. (RTRS)

OIL: The U.S. Department of Energy sold crude oil from the Strategic Petroleum Reserve to a foreign government for the first time, according to the agency. The government of Australia and six companies were awarded supply in a DOE tender to sell 10.1 million barrels of SPR crude. The Pacific nation will be receiving 195,000 barrels of crude, the DOE said on its website. Last year, Australia was the first foreign country to lease storage space at caverns operated by the Department of Energy, which made it eligible to participate in the tender. (BBG)

CHINA

NPC: China's state planner on Monday outlined measures to promote high-quality development during the 14th Five-Year Plan period (2021-2015) and support economic recovery. China will continue to implement macroeconomic policies to promote the steady, healthy and sustainable development of the national economy, and make timely adjustments in accordance with changes, said Ning Jizhe, deputy head of the National Development and Reform Commission (NDRC) at a press conference. The country will continue to implement a proactive fiscal policy, Ning noted, adding that in 2021, the general public budget expenditure will exceed 25 trillion yuan ($3.85 trillion), up 1.8 percent from a year earlier. More structural tax cut policies will be in place to bolster small- and medium-sized enterprises (SMEs) and support the real economy, Ning said. The country will prolong the policies on inclusive loan repayment extension and the credit loan support program for smaller businesses. Inclusive loans for SMEs by major commercial banks will increase by over 30 percent, he said. (CGTN)

PBOC: Premier Li Keqiang failed to mention reducing money policy rates or deposit-reserve rates in his official speeches last week, a policy signal that such loosening measures will be unlikely this year, Yicai said citing market participants. The focus is more on preventing any asset bubble risk and keeping the macro-leverage ratio stable this year, Yicai said citing Zhou Maohua, an analyst with Everbright Securities. Policies will continue to tilt to supporting small firms, Zhou said. (MNI)

FISCAL: China's debt issuances this year will be similar to 2019 and the macro-leverage ratio will ease from 2020, said Wang Xin, PBOC's head of research, in a blog post by China Wealth Management 50. Economic growth must be maintained, however, or the debt ratio could rise much faster, Wang said. Debts held by government, corporates and residents should all be monitored, he said. (MNI)

CORONAVIRUS: China will help overseas Chinese receive vaccines made domestically or abroad, Foreign Minister Wang Yi said Sunday during a press conference for the annual National People's Congress. He added that his country will also introduce health certificates for international travelers, while pledging to protect personal privacy. (BBG)

CORONAVIRUS: China needs to vaccinate 70% to 80% of its population to reach herd immunity against Covid-19, and it can only accomplish that by mid-2022 at the earliest, said George Gao, head of the Chinese Center for Disease Control and Prevention, in an interview with Chinese News Service. (BBG)

OVERNIGHT DATA

CHINA FEB YTD US$ TRADE BALANCE +$103.25BN; MEDIAN +$59.00BN

CHINA FEB US$ EXPORTS +60.6% YTD Y/Y; MEDIAN +40.0%

CHINA FEB US$ IMPORTS +22.2% YTD Y/Y; MEDIAN +16.0%

CHINA FEB YTD CNY TRADE BALANCE +CNY675.86BN; MEDIAN +CNY347.95BN

CHINA FEB CNY EXPORTS +50.1% YTD Y/Y; MEDIAN +27.3%

CHINA FEB CNY IMPORTS +14.5% YTD Y/Y; MEDIAN +12.4%

MNI DATA IMPACT: China Feb Exports Up 155% On Strong Us Demand

- China's foreign trade surged in the first two months as exporters ramped up production to meet strong demand from the western economies, while a recovering domestic demand also boosted imports, though at a slower pace, the data from the General Administration of Customs showed on Sunday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA FEB FOREIGN RESERVES $3.20499TN; MEDIAN $3.20000TN; JAN $3.21067TN

JAPAN JAN BOP CURRENT ACCOUNT BALANCE +Y646.8BN; MEDIAN +Y1.2534TN; DEC +Y1.1656TN

JAPAN JAN BOP CURRENT ACCOUNT BALANCE ADJUSTED +Y1.4998TN; MEDIAN +Y2.2072TN; DEC +Y2.0768TN

JAPAN JAN TRADE BALANCE BOP BASIS -Y130.1BN; MEDIAN -Y39.3BN; DEC +Y965.1BN

JAPAN FEB BANK LENDING INCL TRUSTS +6.2% Y/Y; JAN +6.0%

JAPAN FEB BANK LENDING EX-TRUSTS +5.9% Y/Y; JAN 5.7%

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS; LIQUIDITY UNCHANGED MON

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Monday. The liquidity in the banking system is unchanged given the maturity of CNY10 billion of reverse repos today, according to Wind Information. The operation aims to maintain reasonable and ample liquidity, the PBOC said on its website.

CHINA SETS YUAN CENTRAL PARITY AT 6.4795 MON VS 6.4904 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4795 on Monday, comparing with the 6.4904 set on Friday.

CHINA CFETS YUAN INDEX UP 0.68% IN WEEK TO MAR 5

The CFETS Weekly RMB Index reached 97.06 last Friday, March 31, up from 96.40 in the week ended February 26. This followed a 0.09% increase over the previous week. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, is still up 5.90% from 91.65 on Dec. 27, 2019.

MARKETS

SNAPSHOT: U.S. Senate Passes Amended Fiscal Bill, Middle East Worry Boosts Oil

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 144.87 points at 28719.45

- ASX 200 up 35.756 points at 6746.6

- Shanghai Comp. down 35.477 points at 3466.51

- JGB 10-Yr future down 34 ticks at 151.16, yield up 1.4bp at 0.11%

- Aussie 10-Yr future up 6.0 ticks at 98.230, yield down 6.1bp at 1.773%

- US 10-Yr future down -0-08+ ticks at 132-02+, yield up 1.4bp at 1.5801%

- WTI crude up $1.37 at $67.45, Gold up $7.21 at $1707.84

- USD/JPY up 5 pips at Y108.36

- SENATE PASSES $1.9 TRILLION RELIEF BILL AFTER MARATHON VOTES (BBG)

- CONTINUED LACK OF FED PUSHBACK VS. HIGHER TSY YIELDS PRE-BLACKOUT

- KEY SAUDI ARABIAN OIL SITE ATTACKED, SENDING BRENT ABOVE $70 (BBG)

- CHINESE TRADE DATA MUCH STRONGER THAN EXP., ALBEIT WORKING OFF VERY LOW Y/Y BASE

BOND SUMMARY: U.S. Fiscal & Saudi Oil Matters Pressure Tsys, JGBs Soften

Core FI markets were seemingly happy to operate against the tone set during the first half of Asia-Pac trade, with little in the way of tier 1 headline flow evident since the re-open, leaving the U.S. Senate's passage of an amended COVID relief Bill and oil market developments that became apparent over the weekend (a Yemeni Houthi missile attack on Saudi Aramco facilities, which didn't seem to harm output) in the driving seat.

- T-Notes -0-09 at 132-02 at typing, while the belly underperforms in cash trade, with 7s sitting ~2.0bp cheaper on the day, although the space is off intraday cheaps with e-minis now in negative territory, more than reversing their early gains.

- JGB futures run 35 ticks softer vs. settlement, with a large chunk of Friday's post-Kuroda rally now unwound. The belly once again proves to be the laggard here, suggesting the move may be futures driven, with 7s running ~2.5bp cheaper on the day, while super-long swap spreads have widened by ~2bp. Focus remains on the previously flagged address from BoJ Deputy Governor Amamiya, although scope for any notable deviation vs. the thoughts outlined by BoJ Governor Kuroda re: the permitted 10-Year JGB yield band back on Friday seem limited.

- Aussie bonds are the outperformers, even with the RBA refraining from conducting 3-Year yield target enforcing operations (see earlier bullets for details), with some pointing to an article from the AFR's RBA watcher Kehoe (which focused on the Bank's view on NAIRU and need to see actual not expected developments in the labour market and inflation) as a driving factor there. YM +3.0, XM +6.0, with the Aussie/U.S. 10-Year yield spread tightening back below 20bp early this week.

EQUITIES: Early Gains Wiped Out

A mixed day for equity market in Asia, major equity bourses opened in the green and had made strides into positive territory before a swift sell off in China dented sentiment in the region and dragged many indices into negative territory. At the time of writing markets in Japan, mainland China and South Korea are negative with tech stocks bearing the brunt of the losses, while Taiwan, Australia and India are still clinging on to some gains. Higher oil prices is helping support some of these markets, crude surged after Saudi Arabia said the world's largest crude terminal of Ras Tanura was attacked, though output is said to be unaffected.

- Futures in Europe and the US were initially higher before reversing direction and giving back gains, the move lower is again led by the Nasdaq which suffered heavy losses last week. There is chatter that the move lower in equity markets was catalysed as US yields continue to move higher.

GOLD: Back Atop $1,700/oz

U.S. real yields are flat to a touch lower vs. a similar time during Friday's Asia-Pac session, which has seemingly outweighed the impetus of an uptick in the DXY over that horizon, allowing spot to reclaim the $1,700/oz mark. U.S. real yields and USD dynamics will continue to dominate ahead of next week's FOMC decision, with this week's U.S. Tsy supply and continued market questioning re: Fed policy & reflation dynamics at the fore during the Fed's pre-meeting blackout period.

OIL: Attack On Oil Facility Extends Recent Rally

Crude futures are higher in Asia on Monday, WTI is up $1.41 at $67.50/bbl while brent is up $1.48 at $70.85/bbl.

- Oil jumped higher at the reopen after Saudi Arabia reported a drone attack on a petroleum storage tank at the Ras Tanura port. The attack, launched by Iranian-backed Houthi rebels from Yemen galvanized fears over the security of the global oil supplies Ras Tanura has storage capacity of 33m bbls exports all of Saudi Arabia's crude oil grades, in addition to exporting condensates and refined products. The attack follows a missile launch on March 4 by the Houthis rebels on Saudi Aramco facilities at the port city of Jeddah.

- Oil prices also received support from news that a $1.9tn stimulus package had cleared the US Senate, and was now awaiting final approval from the House of Representatives with a vote expected on March 10.

FOREX: Greenback Swings To Gains

The greenback initially started on the back foot after strong gains last week while safe havens were favoured after the attack on an oil facility in Saudi Arabia, but USD moved into positive territory as the session wore on, while safe havens dropped and equity markets fell into the red.

- AUD was higher from the open, buoyed by robust trade data from China. AUD/USD touched 0.7722 before pulling back on USD strength, the rate last changes hands at 0.7694, a quiet session with several states away for Labour Day.

- JPY has lost a handful of pips, USD/JY last up 7 pips at 108.37. Data earlier in the session showed the current account surplus narrowed to JPY 646.8bn in December against expectations of a JPY 1.25tn surplus, while the trade deficit widened to JPY 130.1bn. Bank lending including trusts rose 6.2%, after a 6.0% rise in January.

- The PBOC fixed USD/CNY at 6.4795, some 34 pips above sell side estimates, the PBOC once again resisting strength in the yuan. Trade data from China was strong which saw yuan gain in early trade, but as USD went bid the move reversed, USD/CNH last up 109 pips at 6.5269.

- Elsewhere, oil is higher after Saudi Arabia said one of the most protected oil facilities in the world came under attack on Sunday. This has seen CAD firm, USD/CAD last down 5 pips at 1.2653, resisting USD strength.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.