-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US Yield Gains Weigh On Broader Risk Appetite

EXECUTIVE SUMMARY

- KASHKARI PENCILED IN ONE MORE RATE HIKE THIS YEAR - MNI BRIEF

- DIMON WARNS WORLD MAY NOT BE PREPARED FOR FED AT 7% - TOI

- SENATE NEARING BIPARTISAN MEASURE TO AVERT A GOVERNMENT SHUTDOWN - BBG

- EU TRADE CHIEF WARNS CHINA’S STANCE ON UKRAINE IS HURTING TRADE - BBG

- CHINA’S PROPERTY RECOVERY UP TO A YEAR AWAY, EX-PBOC ADVISER SAYS - BBG

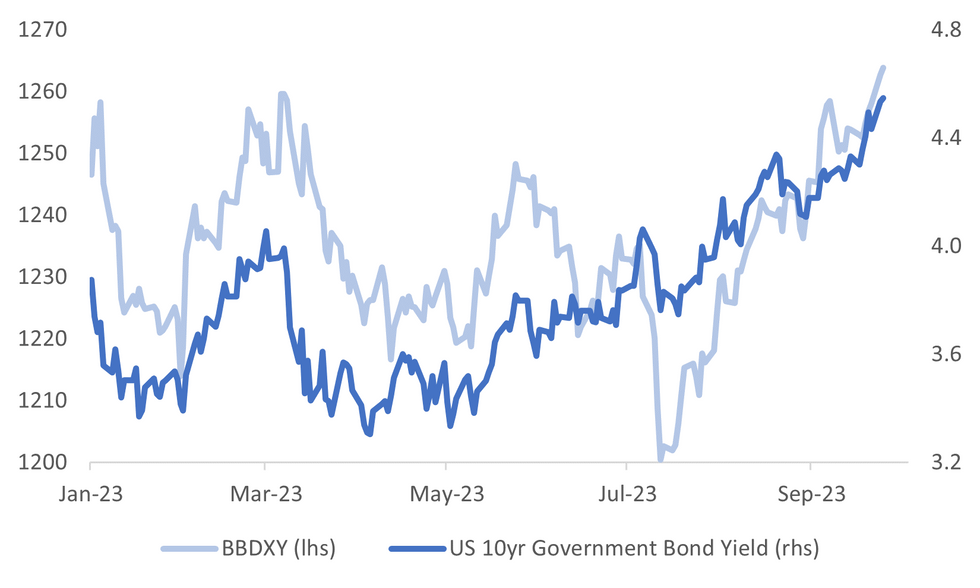

Fig. 1: US Treasury Nominal 10yr Yield & BBDXY

Source: MNI - Market News/Bloomberg

U.K

UK/EU: British and European Union officials will meet Wednesday to discuss post-Brexit plans to slap a tariff on electric vehicles from the UK, as a deadline on whether to delay the move nears. EV rules of origin, which have become a key area of contention in the UK’s ongoing relationship with the EU, are on the agenda for a half-day meeting of the UK-EU Trade Specialised Committee. (BBG)

EUROPE

EU/CHINA: The European Union’s probe into Beijing’s electric-vehicle subsidies is meant to protect its carmakers from a flood of cheap Chinese cars. But if it leads to tit-for-tat tariffs, Mercedes-Benz Group AG and BMW AG’s biggest moneymakers will be most exposed. (BBG)

EU/CHINA: The European Union’s chief trade negotiator warned that China’s position on the war in Ukraine is hurting its global image as an investment destination, as he completed a high-stakes trip to the Asian powerhouse. Valdis Dombrovskis, an executive vice president at the European Commission, issued some of the bloc’s strongest attacks yet on President Xi Jinping’s foreign policy at a press briefing in Beijing on Tuesday, wrapping up a four-day trip to the country. (BBG)

ITALY: Italy's government plans to raise its 2024 budget deficit target to between 4.1% and 4.3% of gross domestic product (GDP), up from the 3.7% goal set in April, sources familiar with the matter told Reuters on Monday. The headlines echoed reports from Friday that Italy may set a 2024 deficit target higher than 4% of GDP to preserve scope to enact promised tax cuts in the 2024 budget. (RTRS)

RUSSIA: Russia is still relying on European shipping to transport its oil even as the country’s supplies exceed Group-of-Seven price caps, according to a researcher. Roughly two-thirds of Russian crude and petroleum products is being transported by vessels insured or owned in nations implementing price caps imposed by the G-7 and its allies, the Helsinki-based Centre for Research on Energy and Clean Air said. That shows Moscow is still heavily using the European shipping industry, it said. (BBG)

U.S.

FED: Minneapolis Federal Reserve President Neel Kashkari said Monday his "dot plot" is for one more interest-rate hike this year, and suggested 2024 could see either high-for-long rates or a cut. “We’re going to take our time, see what happens to inflation before determining how high we need to go,” Kashkari said during at talk hosted by the University of Pennsylvania’s Wharton School, and audio of the talk was delayed by technical problems. (MNI)

FED: The world may not be prepared for a worst-case scenario of Federal Reserve benchmark interest rates hitting 7% along with stagflation, JPMorgan Chase & Co. CEO Jamie Dimon said in an interview with the Times of India in Mumbai. “If they are going to have lower volumes and higher rates, there will be stress in the system,” he said. “Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out.” (TOI)

FISCAL: Senate Republican and Democrat negotiators are nearing a deal on a short term spending measure intended to keep the government open after Oct. 1, according to a person familiar with the talks. The legislation would extend funding for four to six weeks, the person said, asking not to be named discussing private negotiations. That’s a shorter time frame than the extension into December that Democrats originally wanted but could help get the bill through the House. (BBG)

US/CHINA: U.S. President Joe Biden's administration on Monday imposed new trade restrictions on 11 Chinese and five Russian companies, accusing some of supplying components to make drones for Russia's war effort in Ukraine. The Commerce Department, which oversees export policy, added a total of 28 firms, including some Finnish and German companies, to a trade blacklist, making it harder for U.S. suppliers to ship them technology. (RTRS)

OTHER

JAPAN: Japan’s world-beating stock rally should continue to fuel sales in both its primary and secondary equity markets through next year, according to BofA Securities Japan Co. Proceeds from initial public offerings and additional share sales in Japan have reached more than $20 billion so far in 2023, an increase of 3.5 times compared with the same period last year. That’s come as the benchmark Topix has surged about 11% in dollar terms, outpacing gains in a gauge of global peers. (BBG)

SOUTH KOREA: One of South Korea’s top financial regulators is optimistic of inclusion this month in FTSE Russell’s World Government Bond Index, a market gauge expected to bring billions of dollars in foreign capital inflows. Lee Bok-hyun, governor of the Financial Supervisory Service, said he believed Seoul has met most of the conditions required by the index compiler after the government eased certain rules. (FT)

AUSTRALIA: Australia is considering a “broader definition” of full employment and aims to plug labor market data gaps, a new policy paper showed, as the government prepares to tweak the central bank’s mandate. “We are improving our policy development process, and improving the data and analysis we have to measure progress and highlight shortfalls in pursuit of full employment,” the report released Monday showed. “Together, these are the foundational enablers of other priority actions.” (BBG)

CHINA

PROPERTY: China’s property market could take as long as a year to recover, according to a former central bank adviser, who’s urging Beijing to do more to encourage lending to developers to halt the spread of defaults. Sales in China’s largest cities could return to growth in the next four to six months, but in smaller cities “it will take anything to between six months to one year for a good recovery,” Li Daokui, a former member of the People’s Bank of China monetary policy committee, said in an interview. (BBG)

PROPERTY: The crisis at China Evergrande Group deepened Monday after the company’s mainland unit said it failed to repay an onshore bond, adding a new layer of uncertainty to the developer’s future as a restructuring plan with its offshore creditors teeters. (BBG)

EQUITIES: Some investors regard the outflow of overseas funds via China’s stock connect program as a bearish bellwether for the equity market, but the reality is they are a bit player as they account for only a small portion of the market in terms of turnover and stock holdings, Securities Times reports Tuesday, citing analysts. (SECURITIES TIMES)

GDP: China’s Q3 GDP growth is estimated to reach above 4.6%, slower than Q2’s 6.3%, as the higher comparison base for the same period last year kicks in, Securities Times reported citing the average forecast by eight economists. (MNI)

CHINA/EU: China and the EU agreed to strengthen macroeconomic policy coordination, work together to address global challenges such as climate change, food and energy security, and maintain the stability of global economic and financial markets, said the spokesman of the Ministry of Commerce following the 10th China-EU High-level Economic and Trade Dialogue held on Monday in Beijing. (MOFCOM Website)

CHINA/EU: China believes the EU’s recent decision to launch an investigation into China’s electric vehicle trade practices will bring instability to the global automotive industry and supply chain, according to Wang Wenbin, foreign ministry spokesman.. (Yicai)

CHINA MARKETS

PBOC Injects Net 170 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY378 billion via 14-day repo on Tuesday, with the rate unchanged at 1.95%. The operation has led to a net injection of CNY170 billion after offsetting the maturity of CNY208 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9155% at 09:55am local time from the close of 2.1469% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Monday, compared with the close of 43 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Flat At 7.1727 Tuesday Vs 7.1727 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate flat at 7.1727 on Tuesday. The fixing was estimated at 7.3133 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA SEPTEMBER CONSUMER CONFIDENCE 99.7; PRIOR 103.1

SOUTH KOREA AUGUST RETAIL SALES Y/Y 3.3%; PRIOR 5.9%

JAPAN AUGUST PPI SERVICES Y/Y 2.1%; MEDIAN 1.8%; PRIOR 1.7%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYZ3 deals at 108-03, -0-02+, a 0-06+ range has been observed on volume of ~97k.

- Cash tsys sit ~2bps cheaper across the major benchmarks.

- Tsys were pressured in early dealing as the move lower seen yesterday continued in early dealing. The USD ticked higher and US Equity Futures fell.

- Support was seen in TY ahead of the 108-00 level. Ranges were narrow for the remainder of the session with little follow through on moves.

- Federal Reserve Bank of Minneapolis President Kashkari said he expects the US central bank will need to raise interest rates one more time this year and keep policy tighter for longer if the economy is stronger than expected.

- There is a thin docket in Europe today, further out we have US new home sales and Conference Board consumer confidence, Fedspeak from Gov Bowmen is due. We also have the latest 2 Year Supply.

JGBS: Futures Weaker Despite Solid Absorption Of 40Y Supply

JGB futures remain in negative territory in the Tokyo afternoon session, -23 compared to settlement levels, despite solid absorption of today’s 40-year supply.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI Services.

- Cash JGBs are cheaper across the curve out to the 30-year, with yields 0.1bp (5-year) to 1.2bps (futures-linked 7-year) higher. The benchmark 10-year yield is 0.6bp higher at 0.742%, above BoJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.756%, set prior to the BOJ decision on Friday.

- The 40-year JGB yield is 0.4bp lower on the day at 1.846% and 1bp lower in post-auction trade. After a lacklustre 30-year auction earlier this month, today’s solid demand metrics suggest outright yields may be starting to provide adequate compensation for uncertainties and that the ongoing trend of local market participants shifting their portfolios from hedged offshore debt to holdings in yen-denominated bonds remains in play.

- The swaps curve has twist-flattened, pivoting at the 30s, with rates 0.1bp higher to 0.3bps lower. Swap spreads are mixed across maturities.

- Tomorrow the local calendar sees BOJ Minutes for the July Meeting, Leading and Coincident Indices, and Machine Orders.

- Tomorrow will also see BoJ Rinban operations covering 3- to 25-year+ JGBs.

AUSSIE BONDS: Cheaper But Off Worst Levels, CPI Monthly Data Tomorrow

ACGBs (YM -6.0 & XM -9.5) remain sharply cheaper but are above Sydney session lows. The local calendar has been light, ahead of the CPI Monthly release for August tomorrow. Accordingly, local participants have likely been on headlines and US tsys watch.

- US tsys have marginally extended yesterday's losses, with the 10-year yield printing a fresh cycle fresh in the Asia-Pac session. This leaves cash tsys ~2bps cheaper across the major benchmarks.

- Cash ACGBs are 5-9bps cheaper, with the AU-US 10-year yield differential unchanged at -15bps.

- Swap rates are 3-8bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -1 to -5.

- RBA-dated OIS pricing is flat to 2bps firmer across meetings, with terminal rate expectations at 4.32% (+25bps).

- (AFR) Some suggest the new RBA Governor Bullock, instead of raising interest rates, will soon be lowering them. Yet monetary policy in Australia is not as tight as in most economies. That does not seem justified by recent Australian data. (See link)

- Tomorrow the local calendar sees CPI Monthly release for August. Consensus expects 5.2% y/y after 4.9% in July.

- Tomorrow the AOFM plans to sell A$800mn of the 2.25% 21 May 2028 bond.

NZGBS: Closed Near Session Cheaps, Slightly Outperformed $-Bloc

NZGBs closed at or near local session cheaps, with benchmark yields 6-9bps higher. With the domestic calendar light until ANZ Business Confidence on Thursday, local participants have likely eyed US tsys in Asia-Pac dealings for guidance.

- US tsys have observed narrow ranges in recent dealing and are holding cheaper in Asia today. Little meaningful macro newsflow has crossed. TYZ3 sits a touch above support of 108-00, dealing at 108-03+, -0-02. Cash tsys sit ~2bps cheaper across the curve, with the 10-year yield having made a fresh cycle high of 4.5620%.

- The NZGB 10-year has slightly outperformed its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 1bp tighter at 67bps and 81bps respectively.

- Swap rates are 3-10bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations at 5.76%.

- The NZ economy has shown resilience to rising interest rates, past falls in house prices and intense cost-of-living pressures, the Treasury Dept. said in its Fortnightly Economic Update published Tuesday. “Nonetheless, growth has slowed and these headwinds, in addition to recent falls in commodity export prices, mean that growth will remain subdued for some time and provide room for inflation to continue to track down” (See link)

EQUITIES: Major Asia Pac Indices Tracking Lower, Eminis Just Above 200-Day EMA

Major regional Asia Pac equity indices are tracking lower, amid continued pressure from higher US yields, as the Fed's higher for longer theme continues to dominate broader sentiment. Only a handful of markets in South East Asia are tracking higher at this stage. US futures are lower. Eminis last near 4364, and not too far off the 200-day EMA (around 4355). The active contract is down 0.31%, while Nasdaq futures are -0.38% weaker this stage.

- US government yields are around 2bp firmer across the curve in Tuesday trade to date, building on solid gains from Monday's session. This is boosting the USD and weighing on broader risk appetite in the equity space.

- South Korea shares are the weakest performers, the Kospi off by around 1.25% at this stage. The headline index is now sub its simple 200-day MA. The Taiex is also weaker, down 0.80% at this stage. Japan's Topix is off ~0.55%, with Toyota losses weighing on aggregate trends.

- At the break, the HSI is down 0.84%. The index is back to late November 2022 levels. The CSI 300 is down 0.45%, with the index back sub 3700.

- In SEA, Thailand stocks are finding some support off the 1500 level (SET up 0.30%). Philippines PSEi is outperforming up +1.22%, with local banks surging on hawkish BSP rhetoric from yesterday.

FOREX: USD Marginally Firmer In Muted Asian Session

The USD is marginally firmer in Asia, albeit narrow ranges have been observed across G-10 FX. US Tsy Yields have nudged higher, the 10YY printed a fresh cycle high, and US Equity Futures are lower.

- AUD/USD is down ~0.1%, however a $0.6415/30 range has been observed. The trend condition remains bearish, support comes in at $0.6357, low from Sep 6 and bear trigger. Resistance is at $0.6502, 50-Day EMA.

- Kiwi is little changed from opening levels. NZ Tsy Noted that GDP growth will remain subdued for a long time, also saying that the path to lower inflation is unlikely to be smooth.

- Yen sits a touch below the ¥149 handle, there has been no follow through on moves today. The trend continues to be bullish, resistance comes in at ¥149.10, High from Oct 25 2022, and ¥147.71, high from Oct 24 2022. Support is at ¥147.12, the 20-Day EMA.

- Elsewhere in G-10 EUR and GBP are a touch pressured.

- There is a thin docket in Europe today, ECB speak from Lane is the highlight.

OIL: Broader Risk Off Outweighs Tight Supply Conditions

Oil is tracking lower in the first part of Tuesday trade. The Brent benchmark sits near $92.80/bbl. This is -0.45% down for the session so far, following Monday's flat outcome. WTI was last near $89.30//bbl, off a by a similar amount to Brent and follows a -0.40% fall in Monday trade.

- Broader risk appetite weakness, amid the further move higher in US yields (10yr last 4.55%, highs just above 4.56%) is weighing, with the USD firmer nearly across the board, and regional equity markets under pressure.

- These broader macro developments are outweighing further signs of tight supply. WTI prompt spreads have surged in recent dealings. Focus will be on the API report on stockpiles later today in the US, followed by the EIA report on Wednesday.

- For Brent, recent lows rest between the $92.00-$92.50/bbl region. The 20-day EMA rests back near ~$91.36/bbl. On the topside, recent rallies above $94/bbl have not been sustained.

GOLD: Pressured By A Resurgent USD As US Yields Hit Fresh Cycle Highs

Gold is slightly lower in the Asia-Pac session, after closing -0.5% at $1915.92 on Monday. Bullion came under strong pressure from a resurgent US dollar, fueled by a large bear steepening in US Treasuries and a surge in real yields.

- US Treasury yields climbed to new cycle highs across most maturities, with the 10-year printing a high at 4.5457% before marginally paring gains. The 30-year yield reached its highest since 2011 (4.6698%). The recent climb in oil prices combined with the Fed’s higher-for-longer message from last week and concerns over the US fiscal deficit weighed on US Treasuries.

- There was little reaction to the latest round of US data as the Chicago Fed Act. Index and Dallas Fed Mfg Activity Index were both weaker than forecast. Chicago Fed President Goolsbee said US rates were at their peak and the debate would soon shift to how long they'll hold there.

- A US government shutdown would have negative implications for its credit assessment as it would highlight the weakness of US institutional and governance strength compared to its peers, Moody’s said.

- Support at $1901.1 (Sep 14 low) could start to be eyed as the yellow metal remains far below last week’s pre-FOMC high of $1947.5, according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/09/2023 | 0700/0900 |  | EU | ECB's Lane speaks at CEPR conference | |

| 26/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/09/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/09/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/09/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/09/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2023 | 1730/1330 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.