-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US Yields & Dollar Mostly Higher Post Powell Interview

EXECUTIVE SUMMARY

- POWELL SAYS FED NEEDS MORE DISINFLATION EVIDENCE TO CUT - MNI

- SENATORS REACH DEAL ON UKRAINE AID, US BORDER BUT HURDLES REMAIN - BBG

- ECB’S VUJCIC SAYS PATIENCE NEEDED BEFORE STARTING RATE CUTS - BBG

- BOJ TO PURSUE MKT FRIENDLY HIKES AFTER POLICY EXIT - MNI POLICY

- CHINA TO CONTROL IPO QUALITY, INCREASE DELISTING - MNI BRIEF

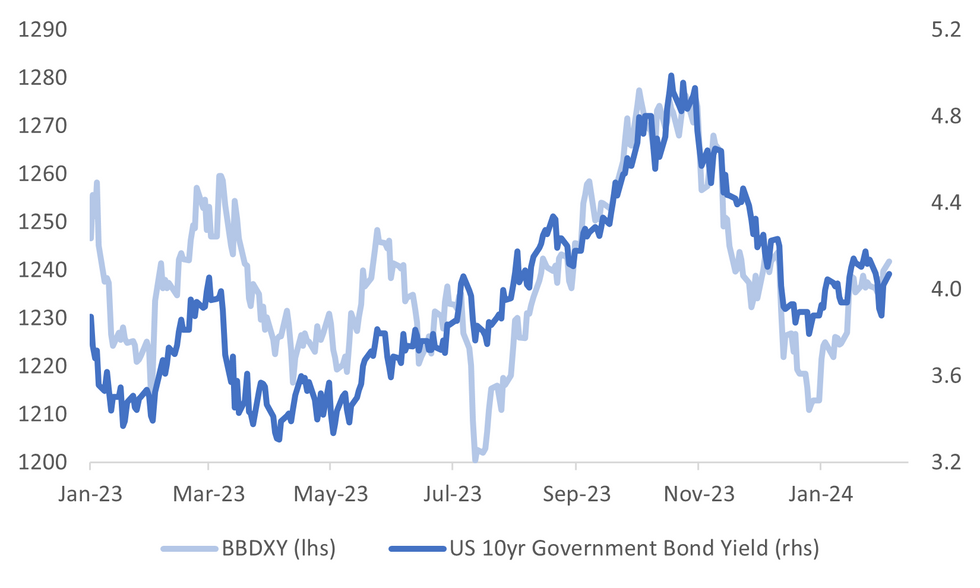

Fig. 1: USD BBDXY & 10yr Nominal Tsy Yield

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): UK Prime Minister Rishi Sunak will meet with political leaders in Northern Ireland on Monday to mark the restoration of the devolved government in Belfast after a two-year hiatus and answer questions about funding for public services.

PRICES (BBG): Four out of five UK businesses say that high energy bills will force them to raise prices in the next two years, signaling that the impact for households from Europe’s crisis has yet to subside.

EUROPE

ECB (BBG): European Central Bank officials need to ensure there aren’t any second-round effects on inflation from wages before cutting interest rates, according to Governing Council member Boris Vujcic. “We need to have patience at the moment before we get into the easing cycle, to make sure that wage costs aren’t translating into sustained wage pressure,” he said on Sunday.

ECB (BBG): The European Central Bank will have to react to slowing consumer-price growth, according to Governing Council member Mario Centeno. Speaking at the Warwick Economics Summit in the UK, the Portuguese official said that “if inflation is going down and it is coming down very fast — actually faster than it went up — monetary policy ought to respond to that.”

SHIPPING (FRANCE 24): French shipping company CMA CGM, the third largest container shipper globally, has decided to reroute its vessels away from the Bab al-Mandab Strait after one of its ships was targeted last week by Houthis.

GERMANY (BBG): Olaf Scholz is not known for expressions of self-doubt. So a nation took notice when the German chancellor voiced, for the first time, that things weren’t going to plan.

U.S.

FED (MNI): Federal Reserve officials are optimistic about a steady recent slowing in inflation but want to see it continue for a while longer before they take the “important step” of beginning interest rate cuts, Fed Chair Jerome Powell told 60 Minutes in an interview airing Sunday.

FED (MNI TRANSCRIPT): Attached is a transcript of Federal Reserve Chair Jerome Powell's interview with 60 Minutes' Scott Pelley. 60.Minutes.Chair.Powell.2.4.24.pdf

FISCAL (BBG): Senators released a bipartisan deal Sunday to impose new US immigration restrictions and unlock billions of dollars in Ukraine aid, a crucial step even as the measure faces long odds in the House.

MIDEAST (RTRS): The United States intends to launch further strikes at Iran-backed groups in the Middle East, the White House national security adviser said on Sunday, after hitting Tehran-aligned factions in Iraq, Syria and Yemen over the last two days.

FED (MNI): Federal Reserve Governor Miki Bowman on Friday said a number of important inflation risks remain and the Fed should not yet lower the fed funds rate target range to prevent from overshooting.

ECONOMY (MNI BRIEF): U.S. employers added 353,000 jobs in January and hiring for the last two months of 2023 were revised up another 126,000, nearly double what Wall Street analysts expected, while average hourly earnings also topped predictions, coming in at 0.553% in January compared to 0.38% in December, the Bureau of Labor Statistics said Friday. The unemployment rate stayed at 3.7%.

OTHER

JAPAN (MNI POLICY): The Bank of Japan will likely gradually raise its overnight rate to 1% after it moves away from negative levels, but will likely avoid signalling a clear hiking path amid uncertainty over the level of the neutral rate of interest and concern tighter policy might overly strengthen the yen, MNI understands.

TURKEY (BBG): Investors who bought into Turkey’s transformation story are unusually optimistic after the shock departure of central bank Governor Hafize Gaye Erkan, expecting her successor to intensify an orthodox push in the nearly $1 trillion emerging market.

CHINA

MARKETS (MNI BRIEF): China’s top securities regulator said it will strictly control the quality of initial public offerings and increase delisting efforts to improve the quality of listed companies and maintain capital-market stability, according to a statement by the China Securities Regulatory Commission on its website Sunday.

MARKETS (21st Century Business Herald): China should set up a stocks stabilization fund as soon as possible to boost market confidence, with an aim to get its size to 10 trillion yuan ($1.4 trillion) or more, according to an academic at a government think tank.

RATES (SECURITIES DAILY): The benchmark Loan Prime Rates are likely to be lowered in February following the cut to the reserve requirement ratio releasing CNY1 trillion in liquidity, along with lowered targeted relending rates for agriculture and small business and reduced deposit interest rates earlier, said Wen Bin, chief economist at Minsheng Bank. Uncertainty exists over whether the PBOC will cut the medium-term lending facility rate as early as February, said Wen.

HOUSING (21st CENTURY BUSINESS HERALD): Authorities have issued CNY864.6 billion in credit to support urban village transformation in 19 cities so far, according to a report by the 21st Century Business Herald. Cities received the funds via the PBOC’s pledged supplementary lending (PSL) facility issued through policy banks, the Herald understands.

ECONOMY (CAIXIN): The China New Economy Index (NEI) recorded 29.4 in January, declining by 0.5 percentage points from the previous month to near the historical midpoint, said the financial publisher Caixin. The index means new economic investment accounts for 29.4% of the total economic investment, with labor force, capital and technology weighing 40%, 35% and 25%. The fall in venture capital within the new economy drove the index lower.

SERVICES (RTRS): China's services activity expanded at a slightly slower pace in January as new orders fell, a private-sector survey showed on Monday, suggesting a soft start for the world's No.2 economy amid tepid demand and a property slump.

CHINA MARKETS

MNI: PBOC Drains Net CNY400 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY100 billion via 14-day reverse repo on Monday, with the rates unchanged at 1.95%. The reverse repo operation has led to a net drain of CNY400 billion reverse repos after offsetting CNY500 billion maturity today, according to Wind Information. The reserve requirement ratio cut announced on Jan 24 is effective today which releases an estimate of CNY1 trillion long-term funds to the market.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9310% at 10:58 am local time from the close of 1.9431% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Friday, compared with the close of 49 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The USD/CNY fix was set at 7.1070 on Monday, higher than Friday's 7.1006 outcome.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1070 on Monday, compared with 7.1006 set on Friday. The fixing was estimated at 7.2053 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JAN. JUDO BANK COMPOSITE PMI 49; DEC. 46.9

AUSTRALIA JAN. JUDO BANK SERVICES PMI 49.1; DEC. 47.1

AUSTRALIA JAN. ANZ JOB ADVERTISEMENTS RISE 1.7% M/M; PRIOR 0.6%

AUSTRALIA DEC. TRADE SURPLUS A$10.959B; EST. +A$10.500B; PRIOR A$11.764B

AUSTRALIA DEC. EXPORTS RISE 1.8% M/M; PRIOR +1.7%

AUSTRALIA DEC. IMPORTS RISE 4.8% M/M; PRIOR -8.4%

AUSTRALIA JAN. MI INFLATION GAUGE RISES 0.3% M/M & 4.6% Y/Y; PRIOR 1.0% & 5.2%

NZ JAN. ANZ COMMODITY EXPORT PRICES RISE 2.2% M/M; PRIOR +2.4%

JAPAN JAN. JIBUN BANK COMPOSITE PMI 51.5; DEC. 50.0

JAPAN JAN. JIBUN BANK SERVICES PMI 53.1; DEC. 51.5

CHINA JAN. CAIXIN SERVICES PMI 52.7 VS 52.9 IN PREVIOUS MONTH

CHINA JAN. CAIXIN COMPOSITE PMI 52.5 VS 52.6 IN PREVIOUS MONTH

SOUTH KOREA JAN. FOREIGN EXCHANGE RESERVES $415.76B; PRIOR $420.15B

MARKETS

US TSYS: Yield Gains Extend, But Off Post Powell Highs

TYH4 is trading at 111-10+, - 10+ from NY closing levels.Futures have found some support going into Asia lunch, with Mar'24 10Y futures testing new lows of 111-08 post Powell's 60 minute interview. He mentioned that there needs to be more disinflation evidence to cut rates. The CBS reporter stated that Powell suggested a mid-year cut, but this wasn't in the transcript of the interview.

- Mar'24 10Y futures ended the week lower to close at 111-22, with a low of 111-16. Earlier we hit news lows of 111-08, before finding some support, we have been unable to break back above the lows from Friday with the next support level at 110-26 from Jan 19, a close below here would imply a bear trigger.

- Earlier we saw buying in Mar'24 5Y futures, at 107-20.25, in 4,700 size, month lows are 107-16.75.

- Cash yields curves have come off their highs of the day to trade 3.5-6.5bps higher, with a slight flattening of the curve. Currently, the 2Y yield is 5.4bps higher at 4.416%, while the 10y is 5.1bps higher at 4.071%. The 2y10y is -2.2 lower today at -34.2, but off Friday's lows of -40.198.

- Data Tonight: ISM Non-Manufacturing, PMI while Atlanta Fed's Raphael Bostic speaks.

JGBS: Cheaper, 10Y-20Y Underperforming, Labour & Real Cash Earnings Tomorrow

JGB futures are holding sharply weaker, -65 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Jibun Bank PMI Services & Composite. Labour and Real Cash Earnings, and Household Spending are due tomorrow.

- Cash US tsys are 2-6bps cheaper in today’s Asia-Pac session following Fed Chair Powell's appearance on 60 Minutes. This comes after Friday’s aggressive sell-off sparked by much stronger-than-expected Nonfarm Payrolls data.

- The cash JGBs are cheaper across the curve, with 10-20-year zone leading (5bps cheaper). The benchmark 10-year yield is 5.1bps higher at 0.723% versus the Nov-Dec rally low of 0.555%.

- The auction of 10-year inflation-indexed bonds drew a lower-than-expected cut-off price (104.50 vs 105.00 estimated by traders in the Bloomberg survey). However, the bid-to-cover ratio did increase to 3 from 2.73 at the previous sale on Nov. 7.

- (MNI) The BoJ on Monday offered to buy a total of JPY9 trillion of Japanese government bonds under repurchase agreements to cope with the rise of tomorrow's next repo rates caused by temporary strong fund demand. (See linkICYMI)

- The swaps curve has bull-steepened, with rates flat to 5bps higher. Swap spreads are tighter out to the 30-year.

AUSSIE BONDS: Holding Sharply Cheaper, RBA Policy Decision Tomorrow

ACGBs (YM -15.0 & XM -12.0) are holding sharply lower after dealing in relatively narrow ranges in today’s Sydney session. While the local market saw a raft of data releases (PMIs, Inflation Gauge, Trade Balance and Job Ads), US tsys were the key driver for ACGBs today.

- Cash US tsys are 2-6bps cheaper in today’s Asia-Pac session following Fed Chair Powell's appearance on 60 Minutes. This comes after Friday’s aggressive sell-off sparked by much stronger-than-expected Nonfarm Payrolls data.

- Cash ACGBs are 12-14bps cheaper, with the AU-US 10-year yield differential 6bps tighter at +4bps.

- Swap rates are 12-14bps higher.

- The bills strip has sharply bear-steepened, with pricing -4 to -16.

- RBA-dated OIS pricing is 6-15bps firmer for meetings beyond March ahead of tomorrow’s RBA Policy Decision. A cumulative 48bps of easing is priced by year-end.

- Tomorrow, the local calendar sees 4Q Retail Sales Ex Inflation, ahead of the RBA Policy Decision. Bloomberg consensus is unanimous in expecting a no-change decision.

- Bloomberg reported that Sally Auld, chief investment officer at JBWere, believes the RBA may seek to push back against market bets on any sort of rapid pivot toward interest-rate cuts at Tuesday’s policy meeting. (See link)

NZGBS: Closed On A Weak Note, Pressured By US Tsys

NZGBs closed on a weak note, with benchmark yields 11-12bps higher. With the domestic data calendar light (ANZ Commodity Prices as the sole release), the local participants have likely monitored today's extension of Friday’s post-payrolls sell-off in US tsys. Cash US tsys are trading 2-5bps cheaper in today’s Asia-Pac session, with a flattening bias, after an airing of a pre-recorded interview with Fed Chair Powell on 60 Minutes.

- The NZ-US 10-year yield differential ended the session 6bps narrower, settling at +56bps. This places it near the midpoint of the range observed over the last 12 months, which has fluctuated between +40 and +85bps.

- In contrast, the NZ-AU 10-year yield differential is currently positioned towards the upper end of its recent trading range, registering at +54bps. Over the past three months, this differential has hovered within a range of +30 to +60bps. However, it's worth noting that the 12-month high for this differential stands at approximately +100bps.

- Swap rates are 10-14bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is 1-10bps firmer across meetings. A cumulative 86bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty, ahead of 4Q Employment and Wages data on Wednesday.

FOREX: Dollar Up, But Away From Post Powell Highs

USD indices are holding higher, albeit way from best levels at this stage. The BBDXY was last near 1242 (+0.15%). Earlier highs in the index were at 1243.45 as headlines from Fed Chair Powell's interview on 60 Minutes crossed.

- The tone from interview appeared similar to last week's FOMC press conference, around a March rate cut as being unlikely and caution around easing policy too soon. Still the transcript points to plenty of discussion around easing. BBG headlines crossed that the CBS reporter stated that mid year was the most likely window for a cut, although this didn't appear in the transcript.

- US TSY futures broke lower on the headlines but have stabilized as the afternoon session progressed. US yields were last 2-5.5bps higher, led by the front end.

- USD/JPY got to 148.82 earlier, fresh highs for the year, but we now sit back at 148.35/10 little changed for the session.

- NZD/USD is marginally higher, off intraday and new yearly lows of 0.6050. The pair last at 0.6070. Data releases in NZ and Australia haven't impacted sentiment today.

- AUD/USD is marginally underperforming, last near 0.6505/10, with earlier lows at 0.6486.

- EUR/USD sits down slightly, last near 1.0780 (earlier lows were at 1.0767).

- Looking ahead, we have the US non-manufacturing ISM index along with speak from the Fed's Bostic. The BoE's Pill is also scheduled to speak.

CHINA EQUITIES: Equity Volatility Continues, Albeit Around A Weaker Trend, But Limited Spillover

Weakness/volatility in China equities remains the main focus point from a macro standpoint, although there isn't much in the way of spill over to other asset classes at this stage.

- Today's moves follows sharp volatility from Friday's session. The weekend also saw regulators vowing to stabilize sentiment, but it still seems we are searching for a circuit breaker at this stage.

- The CSI 300 was down by around 2% earlier, which put the index very close to intra-day lows from Friday. We have since rebounded back to around flat. A break sub 3000 would be fresh lows in the index back to 2019.

- Small cap indices were seeing the heaviest losses earlier. The CSI 1000 off over 8%, but we are now back to down around 6.3%.

- In HK, the HSI is only marginally lower at the time of writing, while the HS China Enterprise Index is also back to around flat.

- The spill over to USD/CNH is only very mild, with USD/CNH sitting slightly lower at this stage, last near 7.2130. It also hasn't impacted G10 FX in a major way. Other regional equity markets are mixed.

- Earlier we had the Caixin services PMI for Jan. It printed at 52.7, versus 53.0 forecast and 52.9 prior. The market didn't react though.

ASIA EQUITIES: Regional Equities Mixed After US Jobs & Powell Interview

Regional Asia equities are mixed today, with Japan the outperformer. Higher than expected US Jobs data on Friday has been weighing on markets, while Fed President Powell's comments on 60 minutes this morning implied a rate cut won’t be coming until later in the year.- Japan equities are higher this morning outside of any real catalyst, the USDJPY is making new yearly highs, which could be helping exporters. BoJ has also offered to buy bonds in two fund-supplying operations to contain an increase in a key short-term interest rate (BBG). After Falling 35% in two days, on the back of losses sustained in their US commercial real estate portfolio, Aozoro Bank has found support, trading higher by 5.30% Currently the Nikkei is higher by 0.50% while the Topix is 0.55%

- Australia equities are lower this morning after the strong US Jobs data Friday and Powell's interview on 60 minutes earlier this morning implying a rate cut won’t be coming until later in the year, while Australia also saw raft of data releases (PMIs, Inflation Gauge, Trade Balance, and Job Ads). The RBA is out tomorrow with their interest rate announcement, expected to be left unchanged at 4.35%. Currently the ASX200 is lower by 1%.

- South Korea equities are lower to start the week, after a great start to the month last week. Government initiatives to close the "Korea Discount" were announced, with the KOSPI seeing $2.2b of inflows this month, we are giving some of those gains this morning with the KOSPI lower by 0.80% largely on the back of real money accounts taking profits.

- Taiwan, has so far escaped the sell off in Asia and is trading higher by 0.21%. CPI out tomorrow estimated to come in at 2.10%

- Elsewhere in SEA, Higher US yields are weighing on performance with markets largely down.

OIL: Crude Off Lows As US Downs Houthi Missiles

Oil prices trended lower through most of today’s APAC session, but have begun to recover following news that the US hit Houthi missiles on Sunday after strikes on Houthi positions in Yemen the day before. WTI is up 0.2% to $72.40/bbl after a low of $72.16 and Brent is 0.3% higher at $77.58/bbl after falling to $77.31. The stronger USD and signs of robust supply have put a lid on crude with the USD index up 0.2% today to be up 0.8% since Thursday.

- The US hit targets in Iraq and Syria on Friday used by Iran’s Islamic Revolutionary Guard Corps and the associated militants. US President Biden said that this may not be the end of the response to the attack on a US base and that the US could strike targets in Iran if needed, but the US won’t be dragged into a long engagement in the region.

- Attacks by the Iran-backed Houthis on Red Sea shipping have resulted in French shipping giant CMA CGM deciding to reroute its vessels away from the Bab al-Mandab Strait after one of its ships was targeted last week by Houthis. Also, the Chairman of the Suez Canal Authority said that revenue had almost halved in January and flows have fallen 36%.

- News talks were taking place to achieve a ceasefire deal between Israel and Hamas resulted in crude falling sharply last week, but on Sunday US National Security Advisor Sullivan said that an agreement wasn’t to be expected soon.

- The Lukoil refining facility in Volgograd has closed after a fire, which the Russians blame on a Ukrainian drone, pushing diesel prices higher.

- Later the Fed’s Goolsbee and Bostic speak. On the data front there are US/European January services ISM/PMIs.

GOLD: Stronger Than Expected US Payrolls Pressure On Friday

Gold is 0.4% lower in the Asia-Pac session, after closing 0.7% lower at $2039.76 on Friday.

- Bullion came under firm pressure as the USD soared after a strong US Payrolls Report. The employment report showed a broadly higher-than-expected Change in Nonfarm Payrolls: Total +353k vs +185k est. (prior up-revised to +333k from 216k) and Private +317k vs +170k est. The Unemployment Rate was 3.7% vs 3.8% est., while the Labour Force Participation Rate was near steady at 62.5% vs 62.6% est.

- The 2-year US Treasury yield shunted 16bps higher to 4.36%, the largest daily move since March 2023. 10-year yield increased 14bps to 4.02%, marking a sharp reversal from the 2024 low of 3.81%, seen in the lead-up to the FOMC. The sell-off has continued in today's Asia-Pac session.

- The large upside surprise to US payrolls pushed back the prospect of rate cuts by the Federal Reserve until later in the year—March's chance of a 25bp cut declined to 20% from 38% pre-data. May has a cumulative 23bps of easing, while June has a cumulative 45bps.

- Nevertheless, the precious metal held onto gains for the week, with a high of $2065.48, buoyed by US retaliatory Middle East strikes. Support is seen at $2033.0 (20-day EMA), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/02/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/02/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 05/02/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/02/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/02/2024 | 1530/1030 |  | CA | BOC quarterly Market Participants Survey | |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/02/2024 | 1730/1730 |  | UK | BOE's Pill MPR Virtual Q&A | |

| 05/02/2024 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.