-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Close To Recent Highs Ahead Of Key Event Risks

EXECUTIVE SUMMARY

- US SECURITY COUNCIL BACKS ISRAEL-HAMAS CEASEFIRE PLAN - RTRS

- WHITE HOUSE PREPARES TO TAP DERIVATIVES REGULATOR TO OVERSEE FDIC - WSJ

- MEXICO’S SHEINBAUM TO PUSH FORWARD WITH JUDICIARY REFORM, PESO SLUMPS - RTRS

- AUSTRALIAN BUSINESS CONFIDENCE TURNS NEGATIVE, PRICES PICK UP - BBG

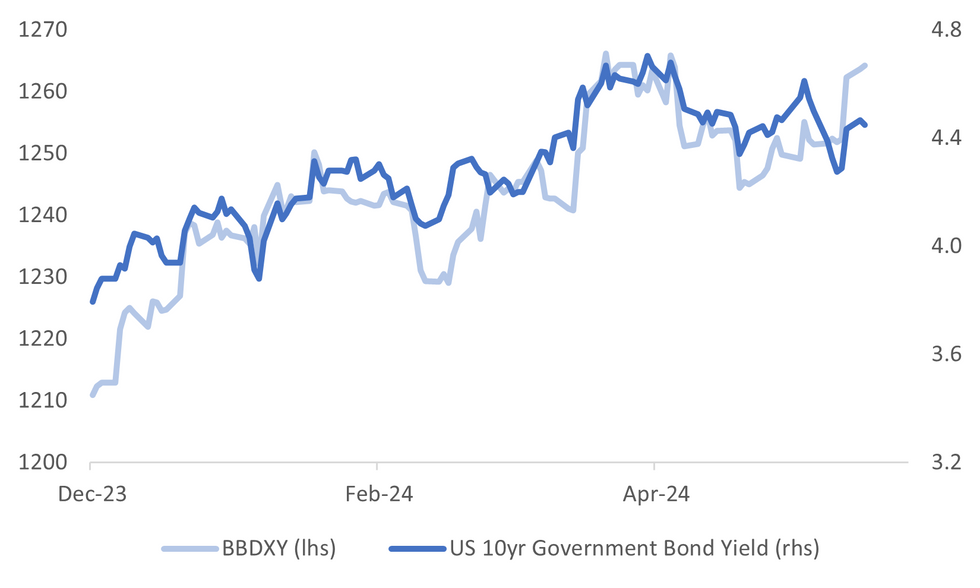

Fig. 1: US Nominal 10yr Tsy Yield & BBDXY USD Index

Source: MNI - Market News/Bloomberg

UK

ELECTION (BBC): The Conservative manifesto will include tax cuts, Rishi Sunak has said. The prime minister told the BBC's Nick Robinson: "We're going to keep cutting people's taxes. You'll see that in our manifesto tomorrow." Challenged over how he would fund his policies, Mr Sunak said they would all be "fully funded and costed".

ELECTION (BBC): The Conservatives are launching their election manifesto later, with a promise to cut a further 2p from National Insurance if re-elected. Prime Minister Rishi Sunak claimed the Tories were the party of "sound money", and that another Tory government would help working people "keep more of the money you earn".

ELECTION (BBC): Labour has dropped a plan to reintroduce a cap on how much people are allowed to save into their pensions before paying tax.

EUROPE

ECB (BBG): The European Central Bank must stay cautious, and last week’s cut in borrowing costs won’t necessarily be followed by further rapid moves, according to President Christine Lagarde.

FRANCE (RTRS): The far-right National Rally was forecast on Monday to win a snap election in France but fall short of an absolute majority in the first opinion poll published after President Emmanuel Macron's shock decision to dissolve parliament.

FRANCE (POLITICO): Only a day after French President Emmanuel Macron called a high-stakes snap election, the country’s two leading far-right forces explored the possibility of teaming up against him in a showdown that stands to prove crucial for the future of both France and the EU.

FRANCE (FRANCE24): The leaders of France’s main leftwing parties, including firebrand three-time presidential candidate Jean-Luc Mélenchon, have called for unity in the run-up to snap legislative elections set for June 30 and July 7. However, discussions about an electoral coalition and a common platform may be difficult, especially with just three weeks of campaigning before the first round.

EU (RTRS): French President Emmanuel Macron is leaning towards endorsing Ursula von der Leyen for another term as president of the European Commission after her centre-right camp scored strongly in European Parliament elections, two sources told Reuters.

POLAND (BBG): Poland’s Finance Minister Andrzej Domanski expects the country will face the European Union’s procedure for its excessive deficit last year. Domanski told reporters on Monday he hopes the EU’s executive will be lenient in demanding budget cuts because the government needs to increase defense spending.

IRELAND (BBC): With fewer than 20 council seats left to declare in the Irish local elections, the two biggest government parties are far out in front of their rivals. Fianna Fáil have 242 seats, ahead of Fine Gael on 241. Independent candidates are faring well - they have secured 182 council seats.

RUSSIA (BBC): The Czech prime minister, Petr Fiala, has said a failed arson attack that took place in Prague last week was "very likely" organised and financed by Russia. Speaking after a meeting of the Czech National Security Council, Mr Fiala said the failed attack was evidently part of a "hybrid" campaign of sabotage being run by Moscow against European countries.

UKRAINE (POLITICO): Mustafa Nayyem, the head of Ukraine’s restoration and infrastructure development agency, abruptly resigned on Monday, claiming the Ukrainian government is undermining his agency’s work on fortifications and logistics infrastructure. His resignation came a day before the start of a two-day conference in Berlin dedicated to international support for Ukraine’s reconstruction after the war with Russia has ended.

US

INFLATION (MNI BRIEF): U.S. inflation expectations were mixed in May, according to the New York Fed's survey of Survey of Consumer Expectations, while the share of those expecting to be financially better off reached the highest level since mid-2021.

FDIC (WSJ): The White House is close to naming derivatives regulator Christy Goldsmith Romero to head the Federal Deposit Insurance Corp., replacing the beleaguered banking agency's longtime chairman Martin Gruenberg.

POLITICS (BBG): Donald Trump will meet with Senate Republicans on Thursday, the latest effort among Washington policymakers to plot out priorities if the former president wins a second term.

CORP (BBG): Apple Inc. took the wraps off long-awaited new artificial intelligence features, including a partnership with ChatGPT maker OpenAI, betting that a personalized and understated approach to the technology will win over customers.

OTHER

MIDEAST (RTRS): The United Nations Security Council on Monday backed a proposal outlined by President Joe Biden for a ceasefire between Israel and Hamas in the Gaza Strip and urged the Palestinian militants to accept the deal aimed at ending the eight-month-long war.

MEXICO (RTRS): Mexican President-elect Claudia Sheinbaum said on Monday that she would put up for discussion proposed constitutional reforms, including a judicial overhaul that has spooked markets, before the next congressional session kicks off.

BRAZIL (MNI BRIEF): Central Bank of Brazil Governor Roberto Campos Neto said Monday that he would advise the next BCB chief that to have a truly independent monetary authority he must be able to say no to the government sometimes.

AUSTRALIA (BBG): Australia’s business confidence turned negative and conditions slipped to below-average levels, suggesting high interest rates and darkening consumer outlook are dragging on the corporate sector.

NEW ZEALAND (BBG): Consumer spending is likely to be weak this year as households temper their spending to cover higher mortgage costs and purchase necessities, the Treasury Dept. says in a Fortnightly Economic Update.

CHINA

FISCAL (SHANGHAI SECURITIES NEWS): China is expected to ramp up fiscal spending in the second half of this year in order to achieve its economic and social development goals, Shanghai Securities News reported on Tuesday, citing analysts.

CREDIT (CSJ): China’s new credit in May could exceed 1.5 trillion yuan $207 billion), China Securities Journal reported, citing several analysts. The accelerated issuance of government bonds in May will support an incremental increase in the scale of social financing, said the story which cited analysts

DEPOSIT RATES (SECURITIES TIMES): Banks are expected to kick off a new round of deposit rate cuts due to continuous decline in their net interest margins, Securities Times reported on Tuesday, without citing a source.

ECONOMY (YICAI): A China private chief economist confidence index reached 50.23 in June, down from 50.52 in May, but above the 50 level, with participants noting a gradual improvement in conditions. Chief economists forecast May’s CPI at 0.38%, PPI at -1.56%, retail sales at 3.41% y/y, and industrial added value at 5.99%, according to the index published by First Financial Research Institute.

TOURISM (CCTV): China’s domestic tourism spending rose to 40.4b yuan in three-day Dragon Boat Festival holiday which ends Monday, China Central Television reports, citing the tourism ministry.

DEVELOPERS (BBG): The list of Chinese developers facing court-ordered liquidation in Hong Kong is getting longer, after a builder of homes in an affluent eastern coastal region was ordered to wind up.

CHINA MARKETS

MNI: PBOC net drains CNY2 bln via Omo Tues; rates unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY2 billion after offsetting the CNY4 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8045% at 09:40 am local time from the close of 1.7718% before Dragon Boat Festival holiday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Friday, compared with the close of 50 on the previous day. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1135 on Tuesday, compared with 7.1106 set before Dragon Boat Festival holiday. The fixing was estimated at 7.2621 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MAY NAB BUSINESS CONFIDENCE FALLS TO -3; PRIOR +2

AUSTRALIA MAY NAB BUSINESS CONDITIONS FALL TO 6; PRIOR +7

SOUTH KOREA APRIL CURRENT ACCOUNT MOVES TO DEFICIT $285.2M; PRIOR +$6931.4M

SOUTH KOREA APRIL GOODS TRADE SURPLUS NARROWS TO $5.111B; PRIOR $8.093B

SOUTH KOREA JUNE 1-10 TRADE DEFICIT $829M

SOUTH KOREA JUNE 1-10 EXPORTS FALL 4.7% Y/Y

SOUTH KOREA JUNE 1-10 IMPORTS DROP 7.4% Y/Y

JAPAN MAY M3 MONEY STOCK RISES 1.3% Y/Y; PRIOR +1.3%

JAPAN MAY M2 MONEY STOCK RISES 1.9% Y/Y; PRIOR +2.2%

MARKETS

US TSYS: Tsys Futures Edge Higher, Ranges Tight Ahead Of FOMC & CPI This Week

- Treasury futures have edged slightly higher today trading near session's best and overnight highs. TU is +00+ at 101-28⅞, while TY is + 04 at 109-06+.

- Volumes are on the low side with: TU 24k, FV 34k & TY 63k

- Tsys Flow: 1500 Block Likely Buyer of FVU4 at 106-01¼

- Looking at TYU4 technical levels, initial support is at 109-02 (Jun 10 lows), with the 108-27+(Jun 3 lows) the next target. While to the upside initial resistance is at 110-21 (June 7 highs), a break here would see a test of 110-27+ (1.00 proj of the Apr 25 - May 16 - 29 price swing)

- Cash treasuries yields opened the session 0.5bp higher, the 2y is -1.1bps at 4.87%, while the 10y is -1.8bps at 4.449%

- Looking ahead: NFIB Small Business Optimism, FOMC Begins Two-Day Meeting, 10y Bond Auction

JGBS: Richer Across Benchmarks, Ranges Narrow, PPI & BoJ Rinban Operations Tomorrow

JGB futures are holding in positive territory, +10 compared to settlement levels.

- Outside of the previously outlined M2 & M3 Money Stock, there hasn't been much in the way of domestic drivers to flag. May Machine Tool Orders are due soon along with a Liquidity Enhancement Auction covering OTR 5-15.5-year JGBs.

- Reuters poll: 63% of economists predict the BoJ will decide to start reducing the size of bond buying at the June meeting (up from 41% in the May poll). Also, 92% of economists expect the BoJ to hike the interest rate to at least 0.20% by the end of 2024 (up from 88% in May).

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session.

- Investors now keenly await two key events on Wednesday: the latest US CPI data and the latest thoughts from Federal Reserve Chairman Jerome Powell following the FOMC Decision.

- Cash JGBs are richer across benchmarks, with yields flat to 2bps richer. The benchmark 10-year yield is 1.9bps lower at 1.025% versus the cycle high of 1.101%.

- The swaps curve has bull-flattened, with rates flat to 1.3bps lower. Swap spreads are mixed.

- Tomorrow, the local calendar will see PPI data alongside BoJ Rinban Operations covering 1-10-year and 25-year+ JGBs.

AUSSIE BONDS: Off Cheaps, Narrow Ranges, Focus On Wednesday’s US CPI & FOMC

In roll-impacted dealings, ACGBs (YM -0.4 & XM -1.3) are little changed and off early session cheaps after resuming trading following yesterday’s holiday.

- Outside of the previously outlined NAB business survey, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session as investors keenly await two key events on Wednesday: the latest US CPI data and the latest thoughts from Federal Reserve Chairman Jerome Powell following the FOMC Decision.

- A Bloomberg survey showed that 41% of economists expect the central bank to signal two cuts, while an equal percentage forecast either one cut or none at all.

- Cash ACGBs are 7-9bps higher than Friday’s close and well above session cheaps, with the AU-US 10-year yield differential at -14bps.

- Swap rates are 6-8bps higher, with EFPs tighter and the 3s10s curve steeper.

- The bills strip is little changed after giving up the early bear-steepening.

- RBA-dated OIS pricing is 4-7bps firmer for meetings beyond September, with early 2025 leading. 5bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty, ahead of the Employment Report and CBA Household Spending data on Thursday.

NZGBS: Closed On A Positive Note, US Tsys Richen In Today’s Asia-Pac Session

NZGBs closed near the session’s best levels, flat to 1bp richer across benchmarks. With the domestic calendar light, the move away from the morning’s cheaps was linked to a 1-2bps richening in US tsys across benchmarks in today’s Asia-Pac session.

- US investors now keenly await two key events on Wednesday: the latest US CPI data and the latest thoughts from Federal Reserve Chairman Jerome Powell following the FOMC Decision.

- The Federal Reserve is widely expected to keep borrowing costs steady for the seventh consecutive meeting.

- Consumer spending is likely to be weak this year as households temper their spending to cover higher mortgage costs and purchase necessities, the Treasury Dept. says in a Fortnightly Economic Update (per BBG).

- Swap rates closed 3-4bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 2-4bps softer for meetings beyond October. A cumulative 23bps of easing is priced by year-end.

- The local calendar will see Net Migration tomorrow, ahead of Card Spending data on Thursday.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 3% Apr-29 bond, NZ$200mn of the 2% May-32 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: Dollar Firmer, But Off Highs, A$ Weighed By Softer China Equities

The USD is off earlier highs, the BBDXY last just above 1264.3, only marginally above end NY levels from Monday.

- Regional equity sentiment is mostly negative with returning China and Hong Kong markets close to the weakest in the region. Tourism spending concerns and housing developments weighing.

- This hurt A$ sentiment. AUD/USD got to 0.6591, but now sits back around 0.6600. Recent lows under 0.6580 remain intact. Iron ore prices remain under pressure, the active SGX contract back to the $104/ton handle.

- On the data front, Australia's NAB business survey showed a further deterioration in conditions and confidence. However, it also showed price and cost measures picked up. NZD/USD is down slightly last near 0.6120.

- USD/JPY got to highs of 157.33, but we now sit slightly lows, back near 157.25. We had money supply data, which didn't move sentiment. A Reuters survey ahead of this Friday's BOJ decision showed 61% of economists expect bond buying to be reduced at the meeting, up from the 41% polled previously.

- In the cross asset space, US yields sit lower, off around 1-2bps across the key benchmarks. Gold and oil sit off Monday highs.

- Later there are UK employment & wage data and US NFIB small business optimism for May. The ECB’s Lane, Buch and Elderson speak.

ASIA STOCKS: HK & China Equites Lower, State Council Looks To Stabilize Housing

Hong Kong and China stocks opened lower on Tuesday after the long weekend break, reflecting a broader sell-off across Asia. Chinese tourism-related stocks faced pressure as Citigroup reported weak travel demand during the recent three-day holiday. Despite some growth in domestic travel traffic and revenues, average spending per traveler remained subdued compared to pre-pandemic levels. Tech stocks are lower following Apples recent AI event.

- Hong Kong equities are lower today, HSTech Index is down 1.24%, while the Mainland Property Index is down 2% and the HS Property Index is down 2.60%, the HSI is down 1.70%

- China onshore equities are mixed today, the CSI300 Real Estate Index is down 0.20%, small-cap indices are lower with the CSI1000 is up 0.15% the CSI2000 is unchanged, while the CSI300 is down 1.20%.

- In the property space, Builder Dexin China is facing court-ordered liquidation in Hong Kong following a winding-up case, initiated by China Construction Bank due to the nonpayment of $350 million in senior notes. Despite receiving approval from scheme creditors in May 2023, Dexin failed to restructure in line with the plan, leading to the court's decision. The State council has urged officials to keep formulating new policies that will help absorb existing housing stocks and stabilize markets, per BBG.

- China plans to increase fiscal spending in the latter part of the year by issuing 920 billion yuan ($127 billion) in ultra-long special sovereign bonds between June and November, alongside the acceleration of local government special bond issuance, aiming to strengthen its economic recovery.

- Banks are likely to lower deposit rates due to shrinking net interest margins, prompting investors to shift focus to short-term government bonds amid expectations of further policy easing by the PBoC. This move aims to deter corporations from seeking higher returns by depositing low-cost credit into accounts with better interest rates, especially as substantial deposits have recently flowed into wealth management products for enhanced yields.

- (MNI) China Press Digest June 11: Housing, Economy, Tourism (See link)

- Looking ahead: China PPI & CPI are due out tomorrow

ASIA PAC STOCKS: Asian Equities Mixed, Market Cautious Ahead Of FOMC & BoJ This Week

Asian equities had a mixed performance today, Japanese & South Korean stocks are up, driven by higher tech shares following gains in the US, with the Philadelphia SE Semiconductor Index hitting records highs on Monday. Conversely, Australian stocks were down, impacted by falls in mining and real estate sectors after a public holiday. Overall, investors across the region are cautious ahead of the policy decisions by the Federal Reserve and Bank Of Japan later this week.

- Japanese stocks opened trading near session best and have since given up about half of those gains. The technology sector led the gains, inspired by the Philadelphia Stock Exchange Semiconductor Index reaching a record high. The Topix index increased up 0.14%, supported by resource shares benefiting from rising crude oil prices, with companies like ENEOS Holdings and Inpex among the gainers, while the Nikkei 225 is up 0.40%. Investors are cautiously optimistic, awaiting significant economic events later in the week, including the Federal Reserve meeting, the US consumer price index report, and the Bank of Japan policy decision.

- South Korean stocks are higher today. This uptick follows overnight gains on Wall Street, driven by investor caution ahead of the upcoming FOMC meeting and US inflation data. Large caps showed mixed performance, with Samsung Electronics and SK hynix experiencing slight declines, while Hyundai Motor and Kia Motors advanced. Despite the positive start, investors remain wary of potential volatility stemming from US macroeconomic developments and ongoing political uncertainty in Europe. The Kospi is up 0.25%.

- Taiwan equities are slightly higher today, although shares of Taiwanese Apple suppliers dropped following disappointment over Apple's annual conference, which did not improve the outlook for iPhone shipments this year. Focus this week will turn to Taiwan rate decision on Thursday. The Taiex is currently trading up 0.10%.

- Australia equities are lower today, led by declines in mining and real estate stocks following Monday’s holiday closure. Investors are now awaiting this week’s Australian jobs report, along with the Federal Reserve decision and US inflation data later this week. The ASX200 is down 1.35%

- Elsewhere in SEA, New Zealand Equities are 0.15% higher, Indonesian equities are 0.14% lower, Singapore & Malaysian equities are 0.25% lower, Philippines equities are unchanged, while Indian equities continue their moves higher and now trade back of pre-election highs.

OIL: Crude Holds Onto Gains Ahead Of OPEC & EIA Monthly Reports Later Today

After Monday’s strong surge, oil prices are holding onto most of those gains and are only slightly lower during APAC trading today. WTI is down 0.1% to $77.65/bbl, off the intraday low of $77.55. Brent is 0.2% lower at $81.47/bbl after a low of $81.37. The benchmark has traded briefly above $82 yesterday. Crude is range trading ahead of key events this week. The USD index is up around 0.1%.

- There are a number of events for oil markets this week. Later today OPEC and the US EIA publish their monthly reports including the outlook with the IEA scheduled for Wednesday. Today also sees US API inventory data. Wednesday’s Fed decision will also be important as it will shape the US demand outlook for energy products.

- Crude rallied on Monday as traders bought the lows after the market flashed oversold following OPEC’s decision at the start of the month to reduce output cuts from October. Subsequent Saudi statements that the plan can be changed if needed have also supported the market. But the demand outlook remains uncertain with Saudi exports to China to be down for a third consecutive month in July and the outlook for the US driving season uncertain.

- Russia reduced its output in May but it still remains above what it has promised OPEC+, according to Bloomberg. It said at the June OPEC+ meeting it would make further efforts to achieve target.

- Later there are UK employment & wage data and US NFIB small business optimism for May. The ECB’s Lane, Buch and Elderson speak.

GOLD: Rebounds On Monday After Friday’s Collapse

Gold is trading 0.3% lower in the Asia-Pacific session, following a 0.7% rise to $2310.88 on Monday. Monday's increase came after a 3% decline on Friday, driven by stronger-than-expected US employment data.

- Investors now keenly await two key events on Wednesday: the latest US CPI data and the latest thoughts from Federal Reserve Chairman Jerome Powell following the FOMC Decision.

- The Federal Reserve is widely expected to keep borrowing costs steady for the seventh consecutive meeting.

- A Bloomberg survey showed 41% of economists expect the central bank to signal two cuts, while an equal percentage forecast either one cut or none at all.

- According to MNI’s technicals team, last week’s sharp sell-off in gold reinforced a short-term bearish theme. The yellow metal has cleared support around the 50-day EMA, at $2,313.5, opening $2,277.4, the May 3 low. Initial resistance to watch is $2,387.8, Friday’s high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/06/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/06/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/06/2024 | 1100/1300 |  | EU | ECB's Lane chat at Banking and Payments Federation Conference | |

| 11/06/2024 | - | *** |  | CN | Money Supply |

| 11/06/2024 | - | *** |  | CN | New Loans |

| 11/06/2024 | - | *** |  | CN | Social Financing |

| 11/06/2024 | 1230/0830 | * |  | CA | Building Permits |

| 11/06/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/06/2024 | 1400/1000 | * |  | US | Services Revenues |

| 11/06/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 11/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/06/2024 | 1645/1845 |  | EU | ECB's Elderson at Annual Banking Supervision Conference | |

| 11/06/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.