-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Extends Losses In Asia

EXECUTIVE SUMMARY

- ECB’s VILLEROY DOWNPLAYS “LAST MILE” ON INFLATION - MNI

- EU IS SET TO PLACE FRANCE ON ITS FISCAL WATCH LIST - BBG

- RBA’s FRESH FORECASTS EMBED STRONG RATES PROFILE - MNI POLICY

- STAFF SEE 1-2 MORE HIKES IN FORECASTS - RBA MINUTES - MNI BRIEF

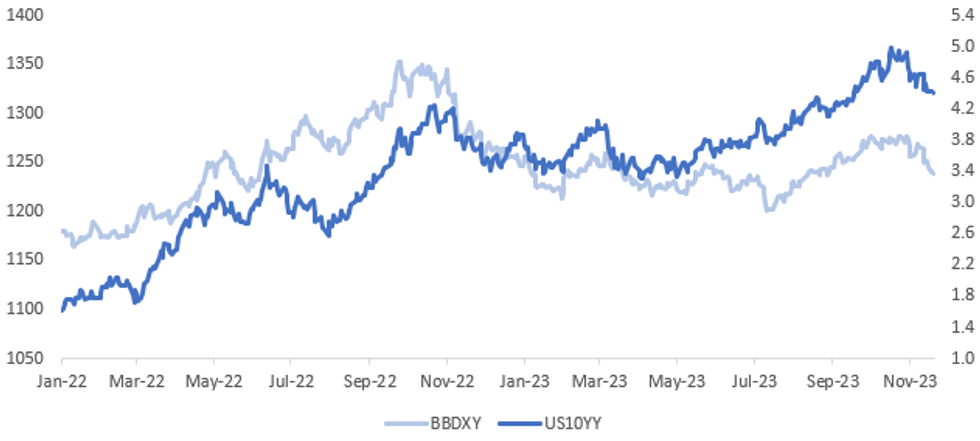

Fig. 1: BBDXY vs 10 Year Tsy Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): Bank of England Governor Andrew Bailey warned the central bank may have to raise interest rates again and that food and energy costs remain an upside risk to the inflation outlook.

TAX CUTS (BBG): Prime Minister Rishi Sunak said his UK government can begin to cut taxes after hitting a goal to halve inflation this year, suggesting economic plans to be unveiled this week by Chancellor of the Exchequer Jeremy Hunt will contain fiscal giveaways.

EUROPE

ECB (MNI): The European Central Bank has probably reached a plateau on rates where it can "experience the altitude and appreciate the view" as it weighs incoming data for several months before any change to rates, Bank of France Governor Francois Villeroy said in a speech on Monday, adding that he did not obsess about the "alleged challenge of the last mile" on inflation.

FISCAL (BBG): France is at risk of flouting the European Union’s fiscal guidance while Germany and Italy are deemed not fully compliant, according to people familiar with the matter. The watch list of countries — scheduled for release on Tuesday — forms part of the European Commission’s opinion on the national budgets for 2024.

DIGITAL EURO (MNI BRIEF): The Eurosystem expects that the Digital euro would be distributed by “payment services providers” as they are better positioned than central banks to deal with clients relations and the payment infrastructure, Bank of Spain Governor Pablo Hernandez de Cos said in a speech on Monday.

GERMANY (MNI INTERVIEW): German inflation is likely to pick up slightly in coming months, particularly in services, with tight labour markets putting upward pressure on pay, ZEW president Achim Wambach told MNI, adding that it was too early to say how close the European Central Bank is to achieving its inflation target.

ITALY (BBG): Italy sold about 25% of Banca Monte dei Paschi di Siena SpA for approximately €920 million ($1 billion) as part of its plan to divest from the bailed out lender.

FRANCE (BBG): France’s top diplomat will head to China this week to smooth relations after a European anti-subsidy probe championed by Paris into Chinese electric vehicles raised trade tensions with Asia’s biggest economy.

HOLLAND (BBG): Dutch far-right populist Geert Wilders jumped to third place in the latest survey ahead of elections on Wednesday, setting the stage for him to enter government.

U.S.

HOUSING (MNI INTERVIEW): Strong demand for homes from millennial buyers in a market that's well short of new supply has kept housing buoyant despite sharply higher mortgage rates, Freddie Mac deputy chief economist Len Kiefer told MNI. "Mortgage borrowers have held up pretty well across various credit" categories and "home prices have actually been accelerating in the most recent data which is reflective of the very low levels of housing supply," Kiefer said in an interview.

CONSUMER (MNI INTERVIEW): Excess savings accumulated during the pandemic will help fuel American consumer spending into the first half of next year, longer than previously thought, with the implication that demand-driven inflation will remain elevated for longer, economists Luiz Oliveira and Hamza Abdelrahman of the Federal Reserve Bank of San Francisco told MNI.

US/CHINA (BBG): President Joe Biden has adopted a two-pronged approach to constrain China’s high-tech progress, curbing Beijing’s access to leading-edge chips while bolstering semiconductor production in the US.

OTHER

AUSTRALIA (MNI): The Reserve Bank of Australia’s November Statement on Monetary Policy is consistent with a more aggressive rates stance, MNI understands, despite speculation by some former staffers that pushing back the expected return to the 2-3% inflation target band by six months to December 2025 signals a dovish shift.

AUSTRALIA (MNI BRIEF): The increasingly fragmented geopolitical landscape could increase the frequency of supply shocks and raise the risk inflation expectations adjust higher, said Reserve Bank of Australia Governor Michele Bullock.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board noted the recently updated inflation forecasts found within the November Statement on Monetary Policy would have been higher if Reserve staff had not factored in one or two more rate rises, the recently published minutes from this month’s meeting showed.

CHINA

YUAN (SHANGHAI SECURITIES NEWS/BBG): The interest rate hiking cycle of overseas central banks has come to an end, thanks to a slowdown of the global economy and falling inflation, according to a front-page report by the Shanghai Securities News Tuesday, citing analysts.

FISCAL (ECONOMIC DAILY/BBG): Proceeds from the 1 trillion yuan ($137 billion) additional sovereign bonds, which China has announced to sell to support disaster relief and construction, should be allocated timely and used on projects precisely where the money should go, Economic Daily wrote in a front-page editorial on Tuesday.

CHINA MARKETS

MNI: PBOC Drains Net CNY105 Bln Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY319 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY105 billion after offsetting the maturity of CNY424 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:23 am local time from the close of 1.9805% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Monday, compared with the close of 49 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1406 Tuesday vs 7.1612 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1406 on Tuesday, compared with 7.1612 set on Monday. The fixing was estimated at 7.1682 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCT PPI Y/Y 0.8%; PRIOR 1.4%

SOUTH KOREA NOV EXPORTS 20 DAYS Y/Y 2.2%; PRIOR 4.6%

SOUTH KOREA NOV IMPORTS 20 DAYS Y/Y -6.2%; PRIOR 0.6%

SOUTH KOREA Q3 HOUSEHOLD CREDIT KR1875.6tn; PRIOR KR1862.8T

NEW ZEALAND OCT TRADE BALANCE NZD -1708M; PRIOR -2425M

NEW ZEALAND OCT TRADE BALANCE 12 mTH YTD NZD -14805M; PRIOR -15412M

NEW ZEALAND OCT EXPORTS NZD 5.40B; PRIOR 4.77B

NEW ZEALAND OCT IMPORTS NZD 7.11B; PRIOR 7.19B

MARKETS

US TSYS: TY Breaches Monday's High

TYZ3 deals at 108-31, +0-04, a 0-05 range has been observed on volume of ~70k.

- Cash tsys sit 1-3bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys have ticked higher through the Asian session as risk sentiment improves in Asia, the greenback is pressured and the Hang Seng is firmer.

- Gains have been marginally pared as news has crossed of an agreement between Hamas and Israel for the release of women and children hostages (RTRS), the story is developing and we are awaiting more details.

- TY sits above Monday's high, Technically the trend condition is bullish, resistance comes in at 109-08+ Nov 17 high then 109-20 Sep 20 high. Support is at the 50-Day EMA (108-03).

- The docket in Europe is thin today, further out FOMC minutes from the Nov 1 policy meeting cross, as does Existing Home Sales.

JGBs: Bull Flattening After Solid 20Y Auction

JGB futures are sharply higher and just off Tokyo session highs, +47 compared to settlement levels, after today’s 20-year supply saw solid demand metrics. The low-price beat dealer expectations and the cover ratio increased. The tail also declined materially.

- With the domestic data calendar empty today, today’s supply was the key domestic driver. That said, the local bid was also supported by an extension of yesterday’s rally in longer-dated US tsys in today’s Asia-Pac session. Cash US tsys are flat to 4bps richer, with the curve flatter.

- The cash JGB curve twist-flattens, with yields 0.5bp higher to 6.6bps lower. The benchmark 10-year yield is 5.1bps lower at 0.700% versus the cycle high of 0.97% set in late October.

- The 20-year yield is 6.0bps lower at 1.409%, outperforming on the curve in post-auction dealings. As highlighted in the auction preview, improved sentiment towards longer-dated bonds globally in November, especially following positive inflation data, had the potential to offset the fact that the outright yield on offer today was approximately 10bps lower than the level seen at October auction and around 30bps lower than the cycle high set late in October.

- The swaps curve has bull-flattened, with swap spreads mixed.

- Tomorrow, the local calendar is empty, apart from BOJ Rinban operations covering 1-10-year and 25-year+ JGBs.

ACGBs: Richer & At Best Levels, US Tsys & JGBs Provided Spillover Benefits

ACGBs (YM +3.0 & XM +6.5) are at Sydney session highs despite the November RBA Minutes seemingly leaving the door ajar for another rate hike. The Minutes stated that the forecasts for inflation assumed another 1-2 more rate rises and the risks around inflation not returning to target by 2025 had risen.

- Earlier at the ASIC Annual Forum, RBA Governor Bullock stated that the biggest challenge facing the economy is inflation. She also pointed out that the current inflation problem is not just due to the supply side but that there are also underlying demand pressures, which the central bank is trying to contain.

- Today’s ACGB rally has been aided by an extension of yesterday’s rally in longer-dated US tsys in today's Asia-Pac session.

- Richer longer-dated JGBs following a solid 20-year JGB auction also provided spillover benefits.

- Cash ACGBs are 4-7bps richer, with the AU-US 10-year yield differential at +5bps.

- Swap rates are 5-7bps lower, with the 3s10s curve flatter.

- The bills strip has twist-flattened, with pricing -1 to +4.

- RBA-dated OIS pricing is flat to 3bps softer across meetings.

- Tomorrow, the local calendar sees the Westpac Leading Index, along with a speech by Governor Bullock at the ABE dinner.

- Tomorrow, the AOFM plans to sell A$800mn of the Dec-34 bond.

NZGBS: Closed With A Twist Flattening In Line With $-Bloc Developments

NZGBs closed with a twist-flattening of the 2/10 curve, witnessed by yields 1bp higher to 1bp lower. The local market's movement today aligns with trends in the $-bloc, influenced by the more favourable-than-expected demand observed in yesterday's 20-year US tsy auction.

- The US tsy curve finished Monday’s NY session with a twist-flattening of the curve, pivoting at the 5s. US yields were 3bps higher to 2bps lower. Notably, the rally in longer-dated US tsys has persisted into today's Asia-Pac session, where cash US tsys are flat to 3bpps richer, contributing to a flatter curve.

- NZGBs have underperformed their $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 3bps wider on the day.

- The 2s10s swaps curve has also twist-flattened, with yields 2bps higher to 2bps lower.

- RBNZ dated OIS pricing closed with pricing flat out to the Apr’24 meeting and 1-3bps firmer beyond. Terminal OCR expectations remained at 5.54%.

- Tomorrow, the NZ Treasury plans to sell NZ$225mn of the 3.0% Apr-29 bond, NZ$225mn of the 3.5% Apr-33 bond and NZ$50mn of the 2.75% Apr-37 bond.

- The local calendar’s next release is Q3 Retail Sales Ex-Inflation on Friday.

GOLD: Buoyed By A Softer USD & Lower Longer-Dated US Tsy Yields

Gold is 0.8% higher in the Asia-Pac session, after closing 0.1% lower at $1978.07 on Monday.

- Bullion has been supported by a lower USD index and a US Treasury curve that finished Monday's NY session with a twist-flattening of the curve, pivoting at the 5s. US yields finished 3bps higher to 2bps lower. The 20-year finished 2.2bps richer after supply saw better than expected demand metrics.

- Today’s strength in the yellow metal has also been boosted an extension of yesterday’s rally in longer-dated US Treasuries during today’s Asia-Pac session. Cash US tsys are flat to 3bps richer, with the curve flatter.

- After last week’s strong gains, there is some way until support at $1943.1 (50-day EMA) whilst resistance is seen at $2009.4. (Nov 7 high), according to MNI’s technicals team.

OIL: Crude Down Marginally, Key Inventory Data Later

Oil prices have held onto most of their recent gains but are down moderately during APAC trading after two days of strong rises. Brent is down 0.4% to $81.96/bbl, close to the intraday low, and WTI is also 0.4% lower at $77.51/bbl. The USD index is down a further 0.3% but is failing to provide support to crude.

- Prices have been supported in recent sessions on expectations that Saudi Arabia and Russia will extend their voluntary cuts into 2024 and speculation that the rest of OPEC may reduce output further when the group meets this weekend given the latest price weakness. RBC said today that it sees “some scope for more OPEC cuts, according to Bloomberg.

- The return to fundamentals has made US inventory data important again and today US API data are released.

- Later the FOMC November meeting minutes are published. There are also Chicago and Philly Fed indices, October US existing home sales and Canadian CPIs. The ECB President Lagarde and Board member Schnabel speak.

EQUITIES: Markets Rally On US And China Optimism

Equity markets were generally stronger in Asia today, with the MSCI APEX 50 +1.3%, supported by China’s state-owned media calling for funding for the property sector and following Monday’s rise on Wall Street. There is optimism that the Fed won’t need to tighten further and that the US economy will manage a soft landing. In response US yields are lower and the USD has softened (USD index -0.3%). S&P futures are flat while the NASDAQ is 0.1% higher during APAC trading.

- China’s CSI 300 is up 0.7% at the time of writing, while its property index is 3.6% higher as speculation of stimulus grows. The Hang Seng is a percent higher.

- Japan’s Nikkei has overturned earlier losses to be flat on the day. The Topix is down 0.2%. Korea’s KOSPI is 0.9% higher. Taiwan’s TAIEX is +1.1%.

- Australia’s ASX is up 0.3% driven by the mining sector as iron ore prices continued to move higher, buoyed by the China reports, but the NZ’s NZX 50 is down 0.4%.

- ASEAN is mixed with Indonesia’s Jakarta Comp falling 0.6% but the SE Thai up 0.5%. The Malay KLCI is up 0.2% but Singapore’s Straits Times is down 0.3%.

- India’s Nifty 50 has rallied 0.4%.

FOREX: Greenback Extends Losses

The greenback has extended losses in Asia, another stronger than forecast Yuan fixing and firmer regional equities weighed today. BBDXY has printed a fresh 3 month low, the index is down ~0.3% today. US Tsy Yields have also ticked lower.

- Yen is the strongest performer in the G-10 space as risk-on flows provide a level of support. The low from Oct 3 and key support at ¥147.43 has been breached. Bears now target ¥145.91, trendline support drawn from Mar 24 low.

- The Kiwi is up ~0.5%, NZD/USD is testing the 200-Day EMA ($0.6063) and the pair sits at its highest level since early August.

- AUD/USD is ~0.4% higher, the pair last prints at $0.6580/85. Technically resistance comes in at $0.6382, 50.0% retracement of Jul-Oct bear leg. Support is at $0.6453, Nov 17 low.

- Elsewhere in G-10 EUR and GBP are both up ~0.2% reflecting the broader USD move.

- The docket is thin in Europe, further out we have Canadian CPI and the FOMC minutes of the November meeting.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/11/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/11/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 21/11/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 21/11/2023 | 1015/1015 |  | UK | Treasury Select Hearing on MPR | |

| 21/11/2023 | 1330/0830 | *** |  | CA | CPI |

| 21/11/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/11/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/11/2023 | 1600/1700 |  | EU | ECB's Lagarde discusses Inflation and democracy | |

| 21/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 21/11/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 21/11/2023 | 1715/1815 |  | EU | ECB's Schnabel at Wurzburg Policy Lecture | |

| 21/11/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/11/2023 | 2100/1600 |  | CA | Canada fall economic/fiscal statement (release time is approximate) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.