-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Makes Fresh Highs Before FinMin Threatens Bold Action

EXECUTIVE SUMMARY

- ECB TO CUT 50BP, THEN WAIT AND SEE - BINI SMAGHI - MNI INTERVIEW

- POLICY TO NORMALIZE STEADILY - BOJ’S TAMURA - MNI

- YEN DROPS TO WEAKEST LEVEL SINCE 1990, RAISING INTERVENTION RISK - BBG

- AUSSIE MONTHLY CPI FLAT AT 3.4% Y/Y - MNI BRIEF

- NEW ZEALAND TO PRESS AHEAD WITH TAX CUTS EVEN AS BUDGET WORSENS - BBG

- CHINA TO CONTINUE HOUSING RELAXATION AS DEVELOPERS SUFFER - MNI

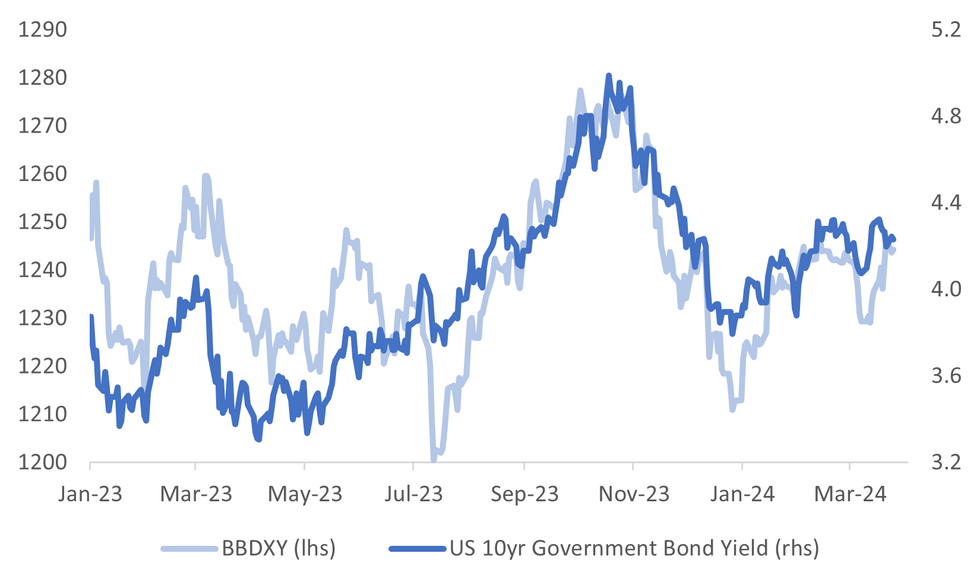

Fig. 1: BBDXY USD Index & US Tsy 10yr Nominal Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI INTERVIEW):The Bank of England could enhance its policy communication by publishing alternative scenarios for inflation, former Deputy Governor Charles Bean told MNI ahead of the April publication of a review into the BOE’s forecasting by former Federal Reserve chief Ben Bernanke.

INFLATION (MNI INTERVIEW): Services and core inflation are unreliable guides to underlying inflation pressure following large energy price shocks, former Bank of England Monetary Policy Committee member Gertjan Vlieghe told MNI, adding that his research implies that the economy will not have to cool much to dampen the recent bout of price rises.

EUROPE

ECB (MNI INTERVIEW): The European Central Bank should cut its deposit rate by 50 basis points in June or by 25bp in both June and July if it wants to buy itself time over the summer without prompting immediate speculation about the timing of subsequent easing, former Executive Board member Lorenzo Bini Smaghi told MNI.

HUNGARY (MNI NBH WATCH):As expected, the National Bank of Hungary cut interest rates by 75bp to take the base rate to 8.25% Tuesday, with recent forint weakening following a series of rows with the government in Budapest cited as the reason why it did not repeat last month’s 100bps pace despite falling inflation and muted demand pressures.

ITALY (BBG): Italy sold about 12.5% of Banca Monte dei Paschi di Siena SpA for about €650 million ($704 million) as part of Giorgia Meloni’s government plan to divest from the bailed-out lender.

POLAND (POLITICO): Polish law enforcement officers stormed the houses of former top government officials, including an ex-justice minister, on Tuesday in an investigation into alleged misuse of funds under the previous Law and Justice (PiS) party government.

HUNGARY (POLITICO): Péter Magyar, ex-husband of former Justice Minister Judit Varga, has released a recording alleging high-level corruption.

U.S.

SUPPLY (BBG):As much as 2.5 million tons of coal, hundreds of cars made by Ford Motor Co., and General Motors Co., and lumber and gypsum are threatened with disruption after the container ship Dali slammed into and brought down Baltimore’s Francis Scott Key Bridge in the early hours of Tuesday.

CHINA/US (BBG): President Xi Jinping met with a group of US business executives in Beijing as bilateral tensions continue to rise over trade restrictions and accusations of cyberattacks. The Chinese leader on Wednesday met with representatives from American business, strategic and academic communities, the official Xinhua news agency said. Xi took a group photo with the attendees before the meeting, according to state broadcaster CCTV.

OTHER

JAPAN (MNI):Bank of Japan board member Naoki Tamura said on Wednesday the BOJ must normalise policy slowly but steadily and end its unprecedented large-scale easy settings.

JAPAN (BBG):The yen slid to the weakest level in about 34 years against the dollar, fanning speculation that Japan will step up its effort to slow the decline. The currency declined 0.3% to 151.97 per dollar in Tokyo, passing the 151.95 level set in October 2022, as a hawkish Bank of Japan board member said financial conditions will remain accommodative. The yen subsequently pared losses after Finance Minister Shunichi Suzuki said Japan’s government will take bold action on the currency if necessary.

AUSTRALIA (MNI BRIEF):The Australian monthly CPI indicator rose 3.4% y/y over February, 10 basis points below expectations and flat against January, Australian Bureau of Statistics data showed Wednesday.

NEW ZEALAND (BBG):New Zealand Finance Minister Nicola Willis will press ahead with tax cuts this year even as the stagnant economy curbs government revenue. Tax relief will be announced in the May budget and delivered from July 1, Willis said Wednesday in Wellington when she released the Budget Policy Statement. She declined to offer any details other than to reiterate there will be an adjustment to the thresholds at which earners shift to a higher tax bracket.

COMMODITIES (BBG): A record delivery of lead into London Metal Exchange warehouses in Singapore has underscored the city state’s emergence as a dumping ground for surplus industrial metals as a global downturn in demand drags on.

INDONESIA (RTRS):Indonesia's losing candidate urges court to disqualify president-elect - RRTS Indonesia's losing presidential candidate Anies Baswedan laid out his challenge in court to last month's election on Wednesday, alleging interference by the state and urging a re-run and disqualification of winner Prabowo Subianto.

CHINA

PROPERTY (MNI): China will continue to ease homebuying restrictions and increase financing support for developers, but authorities must accelerate and intensify policies and implement unconventional measures to help the market bottom as quickly as possible to hasten the recovery, advisors told MNI.

PRIVATE SECTOR (ECONOMIC DAILY):Authorities should crack down on “false reports” and “inappropriate comments” that damage private enterprises and entrepreneurs, the Economic Daily said in an front-page editorial on Wednesday.

SMES (SHANGHAI SECURITIES):Many medium- and small-sized funds have sought buyers to acquire them in the past year and had difficulty finding buyers despite discounts, Shanghai Securities News reports Wednesday.

HOUSING (21st Century Business Herald):Home prices in first-tier cities including Beijing, Shanghai, Guangzhou and Shenzhen are likely to hit bottom and stabilise this year, said Li Daokui, director of the Academic Center for Chinese Economic Practice and Thinking at Tsinghua University. Li believes home prices must continue to adjust and let the market mechanism repair itself.

CHINA/AUSTRALIA (YICAI):Beijing hopes Canberra will respect the WTO ruling against Australia over measures related to railway wheels, stainless steel sinks and wind towers, according to a Ministry of Commerce spokesperson in a Yicai published article. China wants to work with Australia to jointly safeguard the multilateral trading system and promote the healthy development of China-Australia economic and trade relations.

EVs (CSJ): China will accelerate the release of a special assessment for the electric vehicle business of three central state-owned automakers, FAW Group, Dongfeng Motor, and Changan Automobile, to improve their competitiveness within the industry, China Securities Journal reported.

CHINA MARKETS

MNI: PBOC Injects Net CNY247 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY250 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY247 billion after offsetting CNY3 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0011% at 09:27 am local time from the close of 1.9766% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Tuesday, compared with the close of 48 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0946 on Wednesday, compared with 7.0943 set on Tuesday. The fixing was estimated at 7.2222 by Bloomberg survey today.

MARKET DATA

AUSTRALIA FEB. CONSUMER PRICES RISE 3.4% Y/Y; EST. +3.5%; PRIOR +3.4%

AUSTRALIA FEB. WESTPAC LEADING INDEX RISES 0.08% M/M; PRIOR -0.08%

CHINA JAN.-FEB. INDUSTRIAL COMPANIES' PROFIT RISES 10.2% Y/Y; PRIOR -2.3%

SOUTH KOREA APRIL MANUFACTURING CONFIDENCE FALLS TO 73; PRIOR 75

SOUTH KOREA APRIL NON-MANUFACTURING CONFIDENCE FALLS TO 69; PRIOR 70

MARKETS

US TSYS: Treasury Futures Little Changed, Bullish Bets Hit Lowest Since July

- Jun'24 10Y futures have traded sideways on Wednesday, while volumes remained on the low side, we hit lows of 110-19 and a high of 110-21+ and now trade - 00+ at 110-20. 5Y traded similar making lows of 106-30+ and a high of 107 heading into the European open we currently trade -00+ for the day at 106-31

- Looking at technical levels: Initial support lays at 110-08+ (Mar 21 low) while below here the 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low). While to the upside resistance holds at 110-30+ (Mar 21 & 22 high), above here 110-31+ (50-day EMA), while a break above here would open a retest of 111-24 (Mar 12 high).

- Cash Treasury curve has done very little today with the 2Y yield +0.4bp at 4.595%, 10Y +0.2bp to 4.234%, while the 2y10y unchanged at -36.354

- (Bloomberg) -- What Baltimore Bridge Collapse Means for Inflation (See link)

- (Bloomberg) -- Bond Managers Unwind Bullish Futures Bets to Lowest Since July (See link)

- Wednesday Data Calendar: Wholesale Sale/Inventories, Tsy $43B 7Y Note Auction while Fed Gov Waller will discuss economic outlook at Economic Club NY at 1800ET (text, Q&A).

JGBS: Stronger After 40Y Supply Absorbed Smoothly

In Tokyo afternoon trading, JGB futures are stronger, +13 compared to the settlement levels, after responding positively to the 40-year auction results. The issuance of 40-year bonds encountered a solid reception, with the actual high yield undershooting dealer expectations (1.925% versus the realised yield of 1.905%). Moreover, the cover ratio rose to 2.487x from 2.148x at the January auction.

- There weren’t any domestic data drivers to flag today.

- (Bloomberg) -- BoJ Board Member Naoki Tamura says the manner in which monetary policy is managed is going to be extremely important for a slow, steady normalization to put an end to extraordinarily large-scale easing. (See link ICYMI)

- (Bloomberg) -- The impact of cost-push inflation stemming from imports is expected to ease and people’s livelihood is likely to improve, BoJ Governor Ueda says. (See link ICYMI)

- The cash JGB curve has bull-flattened, with yields flat to 2bps lower. The benchmark 10-year yield is 0.5bp lower at 0.733% versus the YTD high of 0.801%.

- The 40-year yield is 2bps richer in post-auction dealings at 2.072%.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 3bps lower to 1bp higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Weekly International Investment Flow data, along with BoJ Rinban operations covering 3- to 25-year JGBs.

AUSSIE BONDS: Richer After CPI Monthly Data, Retail Sales Tomorrow

ACGBs (YM +2.0 & XM +2.0) sit slightly richer on the day but 4-5bps stronger than pre-CPI levels.

- February CPI was steady at 3.4% y/y, slightly lower than Bloomberg consensus. Seasonally adjusted it rose 0.5% m/m, with the annual rate rising to 3.7% from 3.5%.

- Inflation continues to be contained by goods and tradeables prices. However, domestically driven inflation remains sticky as services in February rose to 4.2% y/y from 3.7% and non-tradeables to 4.8% from 4.7%. This area remains a particular focus for the RBA.

- The mixed messages from the February data confirm the importance of the quarterly CPI due on April 24.

- (AFR) Trimmed mean inflation, the RBA’s preferred measure for price changes, rose slightly from 3.8% to 3.9%. (See link)

- Cash ACGBs are 2bps richer, with the AU-US 10-year yield differential 4bps lower at -21bps.

- Swap rates are 1bp lower.

- The bills strip is slightly cheaper, with pricing -1 to -2.

- RBA-dated OIS pricing is little changed on the day across meetings. A cumulative 40bps of easing is still priced by year-end.

- Tomorrow, the local calendar sees Retail Sales, Consumer Inflation Expectations, Private Sector Credit and Job Vacancies data.

NZGBS: Closed Flat, Budget Policy Statement The Focus

NZGBs closed flat to 1bp cheaper but near the session’s best level. Today the focus was on the Budget Policy Statement.

- (Bloomberg) NZ Treasury has downgraded expectations for GDP growth in the Budget Policy Statement. It sees 0.1% annual average growth through June 2024 and 2.1% annual average growth through June 2025. As a result, tax revenue over five years to 2028 will be NZ$13.9b less than projected in HYEFU. (See link)

- (Bloomberg) NZ Finance Minister Nicola Willis will press ahead with tax cuts this year even as the stagnant economy curbs government revenue. Tax relief will be announced in the May budget and delivered from July 1, Willis said today in Wellington. (See link)

- Cash US tsys are dealing little changed in today's Asia-Pac session.

- Swap rates closed flat to 1bp lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is slightly softer across meetings. A cumulative 68bps of easing is priced by year-end.

- Tomorrow, the local calendar sees ANZ Consumer and Business Confidence.

- Tomorrow, the NZ Treasury plans to sell NZ$275mn of the 3% Apr-29 bond and NZ$225mn of the 4.25% May-34 bond.

- Later today will see US Wholesale Sale/Inventories and $43bn of 7Y US tsy supply. Also, Fed Gov Waller will discuss the economic outlook at Economic Club NY at 1800ET (text, Q&A).

FOREX: USD/JPY Prints Fresh Highs, Downside Limited Despite Further FX Rhetoric

The USD index sits higher, last around 1245. We aren't above 1247, which has marked recent highs, but broader USD trends remain positive. US yields are close to unchanged, while US equity futures are higher, although this hasn't lent support to higher beta FX in the G10 space.

- USD/JPY sits back under 151.70. We got to 151.97 earlier, fresh highs in the pair back to 1990. Earlier comments from BoJ Governor Ueda and board member Tamura didn't show any hawkish push back to the recent BoJ outcome. This weighed on yen at the margins. Comments from FinMin Suzuki in terms of fresh rhetoric around FX weakness, including stating that the authorities were prepared to take bold action, helped curb yen weakness.

- Still, the USD/JPY pull back has been shallow and 1 week risk reversals are not too far off recent highs, suggesting the market is not too concerned around a very sharp USD/JPY pull back.

- Elsewhere, AUD/USD was last near 0.6520/25, up slightly from session lows (0.6511). We weighed earlier by the Feb monthly CPI miss (3.4% y/y, versus 3.5% forecast), although the detail showed firmer services inflation. Another headwind has come from weaker HK/China stocks, due in part to earnings concerns. Iron ore prices are also lower, back sub $103/ton.

- Note as well USD/CNY spot has risen back close to highs from last Friday, near 7.2300. This is another constraint, particularly on the likes of AUD.

- NZD/USD is back to 0.5995, but like AUD is up from earlier lows (0.5988). Today focus has been on the NZ Budget Policy statement. The government plans to push ahead with tax cuts, even as the return to surplus gets pushed out. The NZ Treasury sees scope for RBNZ cuts in H2 this year.

- Later the Fed’s Waller and ECB’s Cipollone and Elderson speak. The March European Commission survey prints.

ASIA EQUITIES: China & HK Equities Mostly Lower, Mainland Prop The Exception

Hong Kong and China equities are mostly lower today, Mainland Property names the exception, while corporate earnings have started to be released. In the property space, Shimao Group has yet to move any closer to agreeing on restructuring terms with their creditors while Longfor looks to repay offshore loan. Elsewhere, Apple reports a drop in iPhone shipments in February, China EV maker BYD missed forecast profit, China will look to take the US to the WTO over EV subsidies, while earlier China Industrial Profit rose to 10.2% Feb from -2.3% in Jan

- Hong Kong equities are mostly lower today, with the HSTech Index as the worst performer down 1.70%. The Mainland Property Index is the top performer today, potentially moving higher on news Longfor will start repaying offshore debt with the index up 0.68%, while the HSI is down 0.75%. In China, small-cap names are faring the worst, with the CSI1000 down 1.75% and down about 5.5% for the past week. ChiNext is down 1.46%, while large-cap CSI300 is down just 0.49%.

- China Northbound flows were 4.7billion yuan on Friday, with the 5-day average at -1.34billion, while the 20-day average sits at 2.24 billion yuan.

- In the property space, a key creditor group of Chinese developer Shimao Group Holdings Ltd. has yet to support any of the four options proposed by the company for restructuring its offshore debt, extending negotiations that have lasted over a year and a half. Despite Shimao's offerings, which include debt-to-notes swaps and zero-coupon mandatory convertible bonds, the final debt restructuring plan remains under discussion, reflecting the ongoing challenges faced by Chinese developers amidst the country's property-sector debt crisis, while Longfor Group informed some investors during an investor call that it intends to initiate early repayment of an offshore syndicated loan due in January 2025, possibly commencing next month by remitting around 500 million to 1 billion yuan monthly

- In February, Apple's iPhone shipments in China dropped by 33% compared to the previous year, reflecting a continuing decline in demand exacerbated by the resurgence of Huawei as a competitor and a broader slowdown in the Chinese smartphone market, leading analysts to anticipate further deterioration in iPhone sales throughout the year.

- BYD Co., China's EV leader, reported annual profit slightly below analyst expectations at 30.04 billion yuan, missing the forecast of 30.94 billion yuan. Despite overtaking Tesla as the world's largest electric car seller in Q4 2023, BYD faces challenges in maintaining this title due to seasonal sales fluctuations around the Lunar New Year holiday. The company aims to boost EV adoption through aggressive price cuts and expansion into the luxury market, amidst a competitive landscape where industry growth is expected to slow down for the second consecutive year.

- China has taken its disagreement with the US regarding electric vehicle subsidies to the World Trade Organization, arguing that elements of President Joe Biden's climate law passed in 2022 are discriminatory and have distorted the global EV supply chain. The complaint follows US restrictions on electric car tax credits and reflects escalating tensions over trade and geopolitics in the EV sector. Despite China's legal challenge, experts suggest the case may face hurdles and is unlikely to compel the US to alter its policies. China's nurturing of its domestic EV industry through subsidies and support, including exclusivity for local battery manufacturers in the past, further underscores the complexities of the dispute.

ASIA PAC EQUITIES: Equities Mostly Higher, BoJ Speak, AU CPI Holds Steady

Regional Asian equities are mostly higher today. Japanese equities are getting a boost from the weaker yen. BoJ speak has been the main focus in the region, Ueda expressed confidence in achieving the price target due to the very low current short-term rate, Suzuki & Tamura mentioned they will do the utmost to ensure FX stability. South Korea had business manufacturing data earlier, while Australia had CPI data.

- Japan equities are higher today as the yen edged closer towards a 34 year low, while investors have also been seen adjusting positions heading into FY end later this week. Exports have been the largest gainers today with wholesale trading and transportation names the top gainers in the sector. BoJ's Tamura is currently speaking in Aomori where he emphasized that accommodative financial conditions will persist, indicating a commitment to maintaining supportive monetary policies. He stresses the importance of future monetary policy guidance in ensuring a gradual move towards policy normalization. Tamura expects a positive cycle of wages and prices to continue and highlights the goal of normalization as restoring the function of interest rates. He expresses optimism that a virtuous cycle in the economy is likely to persist. The Topix is up 0.95%, led higher by real estate names after data showed land prices had climbed, while hawkish comments from the BoJ helped add speculations borrowing costs will remain low, while the Nikkei 225 is up 1.24%.

- South Korean equities opened slightly higher but have erased those gains to now trade in the red. Earlier the BoK business manufacturing and non-manufacturing sentiment indicators printed for April. On the manufacturing side we slipped to 73 from 75. Non-manufacturing eased to 69 from 70. While foreign investors have pumped $3.4b into the markets over the past 5 days. The Kospi is now down 0.10%

- Taiwanese equities are higher today, with the Taiex now up 0.50%, after initially opening a touch lower. Semiconductor names have been the largest contributors to index moves today, while recently there has been a lot of talk from policy officials warning investors to stop flooding the market and pumping stock as they fear stock market bubbles while also looking at cracking down on internet influencers. Taiwan equity flows had largely been tracking SK's however have diverged over the past week with -$955m of net outflows occurring.

- Australian equities are higher today, earlier we had WBC Consumer confidence which fell from the month prior hitting -1.8% vs 6.2% in Feb, while the leading index rose to 0.8% from -0.8% in Jan and finally CPI data was in line with Jan coming in at 3.4% vs 3.5% expected. Most sectors ticked higher today, other than tech and Utilities. The ASX200 closed up 0.51%

- Elsewhere in SEA, New Zealand equities are lower today, down 0.18% earlier NZ released their Budget Policy Statement where they announced the treasury had downgraded expectations for GDP growth, Singapore Equities are 0.76% higher, Indian Equities up 0.70%, Philippines equities are down 0.12%, while Malaysian equities are down 0.32%

OIL: Crude Continues To Fall After Large US Stock Build Reported

After falling almost a percent on Tuesday, oil prices have continued shifting lower during APAC trading today after US data showed a large crude stock build. Weaker risk sentiment and a slightly stronger US dollar (US index +0.1%) are also weighing on oil and other commodities. WTI is down 0.8% to $80.97 off the intraday low of $80.81. Brent is 0.9% lower at $85.48/bbl after a low of $85.51.

- Bloomberg reported that there was a significant crude stock build of 9.34mn barrels last week, according to people familiar with the API data. However, gasoline inventories fell 4.44mn, while distillate rose 500k. The official EIA data is out later today, including refining rates.

- Fed easing, extended OPEC supply cuts, possible resumption of sanctions on Venezuela and geopolitical tensions are all positive for oil prices, but demand uncertainty in China, non-compliance with OPEC quotas and strong supply from the US remain negatives.

- Later the Fed’s Waller and ECB’s Cipollone and Elderson speak. The March European Commission survey prints.

GOLD: Holding Just Below All-Time Highs, Awaiting Friday US Inflation Data

Gold is slightly lower in the Asia-Pac session, after closing 0.3% higher at $2178.80 on Tuesday. An intraday high of $2200 was seen early, despite US Treasuries being little changed on the day.

- Bullion sits just below of its all-time high of $2200.89 ahead of Friday’s release of US PCE deflators, the Federal Reserve’s preferred inflation gauge. That said, the scope for any major surprises should be limited in Good Friday trading, with the CPI and PPI figures feeding into that release.

- According to MNI’s technicals team, the trend condition in gold remains bullish. Indeed, recent moves signal scope for a climb towards $2230.1, a Fibonacci projection. Key short-term trend support has been defined at $2146.2, the Mar 18 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 27/03/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/03/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 27/03/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 27/03/2024 | 0900/1000 |  | EU | ECB Cipollone At House of the Euro Event | |

| 27/03/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/03/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 27/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/03/2024 | 1230/1330 |  | EU | ECB Elderson At Climate-Related Financial Risks Panel | |

| 27/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/03/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/03/2024 | 2200/1800 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.