-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Supported On Dips, Verbal FX Rhetoric Continues

EXECUTIVE SUMMARY

- FED’S DALY SAYS CONSUMER SPENDING IS SLOWING - MNI BRIEF

- US PROBING CHINA TELECOM, CHINA MOBILE OVER INTERNET, CLOUD RISKS - RTRS

- ECB’S SCHNABEL DOWNPLAYS PROSPECT OF POLICY DIVERGENCE FROM US - BBG

- JAPAN MAY SERVICES PPI RISES 2.5% VS. APRIL 2.7% - MNI BRIEF

- AUSTRALIAN HOUSEHOLDS REMAIN PESSIMISTIC ON RBA RATE-RISE FEARS - BBG

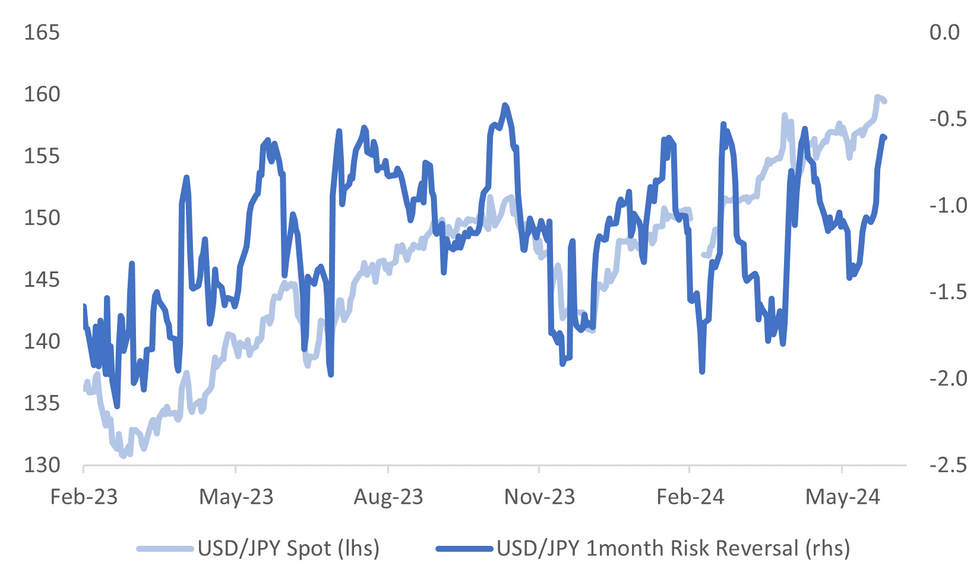

Fig. 1: USD/JPY Spot & 1 Month Risk Reversal

Source: MNI - Market News/Bloomberg

UK

ECONOMY (BBG): “Rishi Sunak and Labour leader Keir Starmer traded stark warnings about each other’s handling of the UK economy as the prime minister sought to turn around his Conservative Party’s fortunes ahead of next week’s general election.”

EUROPE

ECB (BBG):”European Central Bank Executive Board member Isabel Schnabel downplayed the likelihood that interest rates in the euro zone will take a significantly different path from those in the US.”

EU (MNI): Italian Prime Minister Giorgia Meloni has agreed to support Ursula von der Leyen’s bid for a second term as European Commission president in return for a high-ranking job for Italy in the new Commission, a source close to the Italian government told MNI.

SWEDEN (MNI RIKSBANK WATCH): Sweden’s Riksbank is likely to leave policy on hold this week, with an inflation uptick raising questions over whether its rate path will point to another cut in August or September.

FRANCE (BBG): “President Emmanuel Macron said the agendas of the far-right and far-left blocs in France’s upcoming legislative elections pit the country’s people against each other, going so far as to say that “extreme” parties could spark a “civil war.””

CORPORATE (BBG): "Airbus SE cut its earnings and aircraft-delivery goals for the year as persistent supply-chain issues continue to deprive the European planemaker of vital components, dealing a setback to the company at a time when demand for its jets is at a record."

US

FED (MNI BRIEF): U.S. consumer spending is slowing as Americans exhaust excess savings built up during the pandemic, San Francisco Fed President Mary Daly said Monday.

FED (MNI): The Federal Reserve faces a risk of rising unemployment, in addition to sticky inflation, and it would be appropriate to lower the policy rate if the labor market weakens more than expected, San Francisco Fed President Mary Daly said Monday.

US/CHINA (RTRS): “The Biden administration is investigating China Mobile, China Telecom and China Unicom over concerns the firms could exploit access to American data through their U.S. cloud and internet businesses by providing it to Beijing, three sources familiar with the matter said.”

CORPORATE (BBG): “Boeing Co. has offered to acquire Spirit AeroSystems Holdings Inc. in a deal funded mostly by stock that values the key supplier at about $35 per share, according to people familiar with the matter.”

OTHER

JAPAN (MNI BRIEF): Japan's services producer price index rose 2.5% y/y in May vs. April's 2.7%, according to preliminary data released by the Bank of Japan on Tuesday, which also showed firms transferring higher labour costs to services prices.

JAPAN (RTRS): Japanese Chief Cabinet Secretary Yoshimasa Hayashi said on Tuesday authorities would respond appropriately to excessive currency volatility, in a fresh warning as the yen weakens towards to the key 160 per dollar level.

AUSTRALIA (BBG): “Australia’s consumers remained downbeat in June, reflecting concern that persistent inflation could prompt the Reserve Bank to resume raising interest rates.”

NEW ZEALAND (BBG): “Employment confidence index fell 13 points to 91.4 in 2q, Westpac Banking Corp. and McDermott Miller Ltd. say in emailed statement. Weakest since 2020. Gauge below 100 indicating households now have a pessimistic view of the labor market.”

CANADA (MNI BRIEF): Bank of Canada Governor Tiff Macklem Monday affirmed his view that if inflation continues to make progress as officials expect, more interest-rate cuts are warranted after the first reduction in four years earlier this month.

CANADA/CHINA (MNI BRIEF): Canada is moving to impose tariffs on Chinese electric vehicles following a similar move from the United States, seeking to head off any perception it will become a back door to the North American trade zone before the USMCA is up for review in 2026.

MEXICO (MNI WATCH): The Central Bank of Mexico is expected to hold its overnight interbank interest rate at 11.00% Thursday for the second consecutive meeting, despite board members having indicated that a 25 basis point cut could come as inflation falls.

CHINA

RRR (YICAI): “China’s central bank will likely lower the reserve requirement ratio rather than interest rates this year, given strong U.S. dollar expectations and the need to support fiscal policy, according to Sheng Songcheng, senior advisor at the Lujiazui International Finance Research Institute.”

GEOPOLITICS (BBG): “Chinese Premier Li Qiang warned of negative consequences for the world if nations parted ways economically, while hitting back at criticism that his nation’s industrial policy has led to overcapacity.”

FISCAL (SECURITIES TIMES): “China’s general public budget revenue fell by 2.8% y/y to reach CNY9.7 trillion in the first five months, with tax revenue falling by 5.1% but non-tax revenue rising by 10.3%, Securities Times reported.”

FINANCIAL MARKETS (FINANCIAL NEWS): “ China will strive to improve the attractiveness of its financial market from an institutional perspective and promote the opening of its derivatives market, SAFE spokeswoman Wang Chunying said in an interview with state-backed Financial News. “

CHINA MARKETS

MNI: PBOC Net Injects CNY214 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY300 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY214 after offsetting the CNY86 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0028% at 09:35 am local time from the close of 2.0074% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Monday, compared with the close of 46 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1225 on Tuesday, compared with 7.1201 set on Monday. The fixing was estimated at 7.2590 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUNE WESTPAC CONSUMER CONFIDENCE 83.6; PRIOR 82.2

AUSTRALIA JUNE WESTPAC CONSUMER CONFIDENCE M/M 1.7; PRIOR -0.3%

JAPAN MAY PPI SERVICES Y/Y 2.5%; MEDIAN 3.0%; PRIOR 2.7%

SOUTH KOREA JUNE CONSUMER CONFIDENCE 100.9; PRIOR 98.4

SOUTH KOREA MAY RETAIL SALES Y/Y 8.8%; PRIOR 10.8%

MARKETS

US TSYS: Tsys Futures Little Changed, Ranges Tight, 2Y10Y Taps -50bps

- Treasury futures have traded in tight ranges today, the front-end has underperformed just a touch with TUU4 now +0-00+ at 102-06⅛, while TYU4 is currently +0-03 at 110-20.

- The 2Y10Y has hit -50.00 for the first time since December, with the dec lows at -56.116 (see chart 1 - source bbg)

- Volumes: TU 26k, FV 38k, TY 59k

- Tsys flows: Earlier there was a Block Fly (TU, TY, WN) Buyer belly, DV01 310k

- Cash treasury curve is little changed this morning, yields are flat to 0.5bp higher.

- APAC Markets: ACGB curve is slightly flatter, yields are 1-3bps lower, NZGB curve is 1.5-2.5bps lower, while JGBs are flat to 1.5bps higher, curve is slightly steeper.

- The Fed's Mary Daly warned that the US labor market is nearing an inflection point where further slowing could lead to higher unemployment and emphasized the need for restrained demand to return inflation to the 2% target. She stressed the importance of remaining vigilant and adaptable in monetary policy, given the uncertainty in inflation trends and labor market conditions.

- Projected rate cut pricing are steady to mildly higher vs. early Monday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.6bp (-18.4bp), Nov'24 cumulative -28.0bp (-27.1bp), Dec'24 -47.9bp (-46.8bp).

- Looking ahead, Fed Speak, Home Prices, Regional Fed Data and Fed Governors Michelle Bowman and Lisa Cook will speak

JGBS: Solid 20Y Auction Fails To Strengthen Market

JGB futures are weaker at 143.49, -9 compared to the settlement levels, after initially surging to a new session high of 143.58 following the results of today’s 20-year supply.

- 20-year supply went smoothly, with the low price beating dealer expectations and the auction tail ticking shorter. However, the cover ratio decreased versus last month’s auction. Today’s result is likely to be seen as consistent with the positive tone set at June’s 10- and 30-year JGB auctions.

- Outside of the previously outlined PPI Services, there hasn't been much in the way of domestic data drivers to flag. Leading & Coincident Indices and Machine Tool Orders data are due later today.

- (Bloomberg) Japanese bank shares including Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group climb on growing expectations the BoJ will raise interest rates as early as next month, and as investors rotated into lagging value stocks. (See link)

- The cash JGB curve has twist-steepened, pivoting at the 7s, with yields 1bp lower to 2bps higher. The benchmark 10-year yield is 0.6bp higher at 1.002% versus the cycle high of 1.101%.

- Swap rates are flat to slightly lower out to the 30-year and 4bps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar is empty, ahead of Retail Sales and weekly International Investment Flow data on Thursday. Thursday also sees 2-year supply.

AUSSIE BONDS: Richer Ahead Of May’s CPI Monthly Release Tomorrow

ACGBs (YM +2.0 & XM +2.0) are richer and at Sydney session highs ahead of tomorrow’s CPI Monthly release. Dealings were, however, relatively subdued with cash US tsys little changed in today’s Asia-Pac session.

- Outside of the previously outlined Westpac's consumer sentiment, there hasn't been much in the way of domestic drivers to flag.

- Cash ACGBs are 1-2bps richer, with the AU-US 10-year yield differential at -3bps.

- Swap rates are 1bp lower.

- The bills strip is slightly richer, with pricing flat to +2.

- RBA-dated OIS pricing is flat to 2bps softer across meetings. A cumulative 16bps of easing is priced by year-end from an expected terminal rate of 3.37%.

- Tomorrow, the local calendar will see May’s CPI Monthly, with consensus expecting 3.8% y/y up from 3.6% the previous month. Forecasts range from 3.5% to 4.0% with most around 3.7-3.8%. Housing costs, insurance, electricity prices and personal services are likely to rise.

- RBA Assistant Governor Kent will speak tomorrow at 0935 AEST and Deputy Governor Hauser on Thursday at 2000 AEST.

- Tomorrow, the AOFM plans to sell A$600mn of the 3.50% 21 December 2034 bond.

NZGBS: Modestly Richer, Subdued Dealings, Light Local Calendar Tomorrow

NZGBs closed on a strong note, with benchmark yields 2-3bps lower.

- Outside of the previously outlined Employment Confidence Index, there hasn't been much in the way of domestic data drivers to flag.

- “First-quarter GDP data indicates key sectors of the economy are deteriorating rather than improving and activity in sectors most affected by interest rates is weak, the NZ Treasury Dept. says in Fortnightly Economic Update.” (per BBG)

- Cash US tsys are little changed in today’s Asia-Pac session after yesterday’s small gains.

- Swap rates closed flat to 1-2bps lower.

- RBNZ dated OIS pricing closed little changed. A cumulative 31bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty ahead of Consumer and Business Confidence on Thursday. Thursday will also see the NZ Treasury’s planned sale of NZ$250mn of the 4.5% May-30 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$50mn of the 2.75% Apr-37 bond.

- Tomorrow, the Australian calendar will see May’s CPI Monthly release. It is expected to post an increase of 3.8% y/y up from 3.6% the previous month.

FOREX: Early USD/JPY Dip Not Sustained, USD Indices Slightly Lower

USD FX indices sit a touch below their end Monday levels. The BBDXY was last near 1263.5, off close to 0.10% for the session so far.

- News flow and data outcomes have been light, which has kept most currencies in fairly tight ranges against the USD. US equity futures sit a touch higher (0.10-0.20%) following cash losses in Monday trade. US yields have been relatively steady, moves less than 0.5bps at this stage.

- USD/JPY did see a brief dip to 159.19 ahead of the Tokyo fix, but we recovered growth, and last track near 159.50, still down slightly for the session.

- Cabinet Secretary comments on FX were in line with recent rhetoric. The PPI services for May came out weaker than forecast at 2.5% y/y (projection was 3.0%) This didn't impact FX sentiment though.

- AUD/USD and NZD/USD are close to unchanged, albeit with NZD slightly off compared to the A$. AUD/USD last near 0.6660, NZD, close to 0.6120.

- Australian Westpac Consumer Sentiment rose for June but remains depressed by historical standards. Iron ore prices fell to multi-month lows before stabilizing.

- The USD/CNY fixing rose, which went against market expectations for a lower outcome, which provided some USD support, but follow through was limited.

- Looking ahead, Canada CPI is the data highlight Tuesday, before US consumer confidence and Richmond manufacturing also cross.

ASIA STOCKS: Hong Kong Equities End Three Day Slide, China Equities Mixed

Hong Kong & China equities have shown a mixed performance today, HK stocks are performing better than their mainland peers with the HSI up 0.5%, buoyed by gains in tech stocks such as Meituan, Tencent, and Alibaba, despite broader concerns. In contrast, mainland Chinese indices experienced modest losses, with the Shanghai Composite dipping 0.4%. Traders in Hong Kong attributed the volatility to improving fundamentals and a global rotation away from semiconductors into other sectors.

- Hong Kong equities are higher this morning with the HSI up 0.45% following a positive performance from US-listed Chinese shares, with the Nasdaq Golden Dragon China Index climbing 1.3%. Investors in Hong Kong are likely assessing the potential for a tech sector rally to run out of steam, as seen with Nvidia’s recent losses. Additionally, concerns about China’s economic outlook remain, particularly after data showed a significant decline in fiscal revenue, potentially prompting further government intervention to support the economy. The HSTech Index is 0.26% higher, while property Indices are higher with the Mainland Property Index up 0.90% and the HS Property Index up 0.66%

- In Mainland China, Investors are closely monitoring signs of pressure on the world’s second-largest economy. Data released on Monday showed China’s fiscal revenue shrank at the fastest pace in over a year, increasing expectations of a potential mid-year budget revision to support economic recovery. The CSI 300 is 0.40% lower today, the small-cap indices CSI 1000 is 0.10% higher, the CSI 2000 is 0.80% lower, the CSI 300 Real Estate Index is 1.20% higher, while the ChiNext is down 1.35%.

- Property space, The Shanghai luxury real estate market is thriving amid China's overall property downturn, driven by wealthy Chinese seeking secure investments in prime locations with recent policy relaxations favoring buyers, resulting in high demand and rapid sales for upscale properties exceeding $3.8 million.

- Canada, aligning with the Biden administration, plans to begin public consultations on imposing tariffs on Chinese-made electric vehicles due to concerns over unfair competition and potential impacts on domestic industries, while also considering adjustments to federal incentives and broader investment restrictions in the EV sector. While China has proposed easing tariffs on German luxury cars in exchange for the European Union dropping planned tariffs on Chinese electric vehicles (EVs), amidst escalating trade tensions. The EU, aiming to counteract alleged state subsidies benefiting Chinese EV manufacturers, faces pressure from Germany's auto industry to negotiate a resolution ahead of tariff implementation in July.

- Looking ahead, it is a quiet week for China, while Hong Kong has trade balance data later today

ASIA PAC STOCKS: Regional Asian Equities Erased Earlier Losses

Asian equities edged higher on Tuesday, rebounding from recent losses despite another challenging day for tech stocks on Wall Street. Japan's Nikkei 225 rose 0.5%, buoyed by interventions to support the yen, which remains at a three-decade low against the dollar. Investors remain focused on the Federal Reserve's plans for interest rates and the upcoming release of the PCE index, while in the currency market, the yen strengthened slightly against the dollar. Taiwan equities are the worst performing largely being dragged down by TSMC.

- Japanese stocks rose as investors rotated into value stocks that have underperformed in recent weeks, including banks and automakers. The Topix Index increased by 1.31%, with banks and automakers as the biggest contributors. Toyota Motor Corp. led the gains, rising 2.3%. The Nikkei 225 advanced by 0.60%, although chip-related shares like Disco and Renesas were among the worst performers, following a decline in US peers.

- Korean shares opened higher on Tuesday as investors scooped up auto and chemical shares, despite a slump in technology shares on Wall Street. The Kospi is 0.37% higher . Car manufacturers like Hyundai Motors and Kia saw gains of 2.49% and 1.25%, respectively. Chemical shares also performed well, with LG Chem and SK Innovation rising. However, tech shares were bearish, with Samsung Electronics and SK hynix both falling.

- The Taiwan equities have opened lower, but well off earlier lows with the Taiex down 0.44% after earlier being down about 1.50%. The Philadelphia SE Semiconductor Index fell over 3% overnight which is weighing on local stocks.

- Australian shares are higher this morning with ASX 200 up 1.10%. This comes despite a mixed performance on Wall Street, where Nvidia and other semiconductor stocks extended their sell-off. Gains in the financial, real estate, and utilities sectors in the US helped offset losses in tech. Earlier, the Westpac Consumer Confidence rose 1.7% m/m from -0.3% rising to 83.6 vs 82.2.

- Elsewhere, New Zealand equities are 0.42% higher, Singapore equities are 0.22% higher, Thailand equities are 0.50% higher, Philippines are 0.40% higher, Indian equities are 0.20% higher, Indonesian equities are 0.30% lower, Malaysia are 0.05% lower

OIL: Holding Close To June Highs

Front month oil prices sit just off recent highs in the first part of Tuesday dealing. News flow in the space has been very light so far today, and we sit just off late Monday highs from US trade for both Brent and WTI.

- Brent front month was last near $86/bbl, little changed for the session. Recent highs rest just above this figure level. A clean break higher could see late April levels near $87.50/bbl targeted. The key EMAs are clustered on the downside between $83.60 to $83.80/bbl.

- For WTI, front month was last near $81.65/bbl. Both benchmarks are comfortably higher for June to date.

- Talk of stronger demand as the US driving seasons kicks into a gear is a factor, while some risk premium has been built into prices given on-going attacks from the Houthi's in Yemen.

- Also note the EU imposed sanctions on 27 ships, including 17 that have been transporting oil on behalf of Moscow, Bloomberg reported.

GOLD: Still In Consolidation Mode

Gold is 0.4% lower in the Asia-Pac session, after closing 0.5% higher at $2334.65 on Monday

- According to MNI’s technicals team, gold continues to trade below resistance - for now. The yellow metal recently pierced the 50-day EMA, at $2,318.3, a clear break of which would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

- Meanwhile, gold may rise to $3,000/oz over the next 12-18 months, according to separate reports from BofA and Citi. Citi notes that expected Fed rate cuts should be particularly bullish for precious metals.

- Lower rates are typically positive for gold, which doesn’t pay interest.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/06/2024 | 0700/0900 | *** |  | ES | GDP (f) |

| 25/06/2024 | 0700/0900 | ** |  | ES | PPI |

| 25/06/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/06/2024 | 1100/0700 |  | US | Fed Governor Michelle Bowman | |

| 25/06/2024 | 1230/0830 | *** |  | CA | CPI |

| 25/06/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/06/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/06/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/06/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/06/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/06/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/06/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/06/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/06/2024 | 1600/1200 |  | US | Fed Governor Lisa Cook | |

| 25/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/06/2024 | 1810/1410 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.