-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Tests ¥145

EXECUTIVE SUMMARY

- BOE's OUTGOING TENREYRO SAYS RECENT SPIKE IN RATES ENOUGH TO TAME INFLATION- BBG

- FEDS BOSTIC RETITERATES VIEW THAT RATES SHOULD STAY ON HOLD - BBG

- TOKYO CPI SUPPORTS EXPECTATIONS BOJ WILL RAISE INFLATION EXPECTATIONS - BBG

- CHINAS PURCHASING MANAGERS INDEX CONTRACTS FOR THIRD STRAIGHT MONTH- MNI

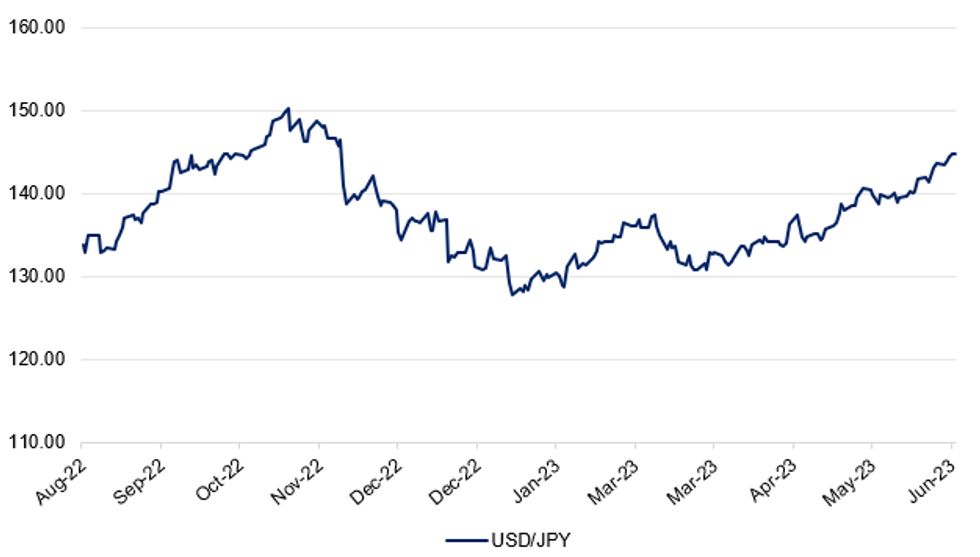

Fig. 1: USD/JPY Daily Spot

Source: MNI - Market News/Bloomberg

U.K.

BOE: Outgoing Bank of England rate-setter Silvana Tenreyro said the recent spike in market rates would be enough to bring UK inflation under control despite signs that price increases were becoming entrenched. (BBG)

NHS: Rishi Sunak unveiled his long-awaited plan to recruit record numbers of doctors and nurses, as he seeks to win back voters who blame his ruling UK Conservatives for the crisis facing the National Health Service. (BBG)

BUSINESS CONFIDENCE: UK business confidence rose to a 13-month high in June as firms shrugged off another Bank of England interest-rate increase, a survey by Lloyds Banking Group Plc found. (BBG)

EUROPE

ENERGY: The European Union will on Friday seek to resolve a deadlock between France and Germany over the role of nuclear energy in the bloc’s power market and pave the way for a deal on a key reform meant to help the shift to a low-carbon economy. (BBG)

UKRAINE: European Union leaders are trying to agree on steps to support Ukraine militarily over the longer term amid pressure to provide the government in Kyiv with additional security commitments and a clearer path on joining NATO. (BBG)

U.S.

FED: Federal Reserve official Raphael Bostic reiterated that he favors keeping borrowing costs on hold but that Chair Jerome Powell and other colleagues don’t agree with him. “There is time for us to wait and let our policy work,” Bostic said Thursday in Dublin. “I don’t see as much urgency to move as others, including my chair.” (BBG)

OTHER

BOJ: Bank of Japan Deputy Governor Ryozo Himino said a virtuous wage-price cycle existed, but doubted its sustainability, Mainichi Shimbun reported Friday. (BBG)

JAPAN: The European Union is making final preparations to lift the last of its import restrictions on Japanese food products imposed in the wake of the Fukushima nuclear disaster, Nikkei reports, citing an unidentified EU official. (NIKKEI)

INFLATION: Inflation in Tokyo re-accelerated for the second time in three months in June, an outcome that supports expectations the central bank will raise its inflation forecast next month. Consumer prices excluding fresh food increased 3.2% in the capital from a year earlier, rising at a slightly faster pace than last month’s revised figures, according to the ministry of internal affairs Friday. (BBG)

JAPAN: Japan's industrial production fell 1.6% m/m in May for the first drop in four months, following 0.7% in April, due to weaker production for motor vehicles, electrical machinery and information, and communication electronics, the Ministry of Trade and Industry said Friday. The weak May data will not prompt the Bank of Japan to change its view that industrial production has been more or less flat, as it expects June production to rise. (MNI)

AUSTRALIA: The Australian government has fast-tracked funding for essential infrastructure damaged by natural disasters.Kristy McBain, the minister for regional development, on Friday announced that local government areas across the country will be able to access 1.8 billion Australian dollars (1.1 billion U.S. dollars) in funding to repair roads, bridges and other infrastructure assets damaged by floods and bushfires in recent years. (BBG)

AUSTRALIA/EU FTA: The European Union has failed to offer Australia satisfactory terms to seal a free-trade accord, Trade Minister Don Farrell said, as small but important sticking points threaten to derail plans to sign by the end of August. EU Trade Commissioner Valdis Dombrovskis said Wednesday evening in Brussels that it’s possible the agreement could be signed at a NATO summit in Lithuania in mid-July, the Australian Financial Review reported. The five-year negotiations between the bloc and Canberra are in their “end-game,” he told reporters, adding there is still “certain ground to be covered.” (BBG)

AOFM: The Australian Office of Financial Management plans to issue a new June 2054 Bond in the December quarter, according to an emailed statement. (BBG)

CHINA

PMI: China's Purchasing Managers' Index contracted for the third straight month, registering 49 in June, rebounding slightly from 48.8 in May though still below the breakeven 50 mark, data from the National Bureau of Statistics showed Friday. (MNI)

GOVT DEBT: China should establish a government debt repayment reserve fund to prevent default risks, according to a report published by the National People's Congress Financial and Economic Affairs Committee on Thursday. The balance of local government special bonds has exceeded CNY22 trillion after years of expansion in infrastructure projects, while the repayment risks increased with declining revenues from land sales in recent years. China should raise the warning line of the local government debt ratio to 150%, as the current ratio has exceeded 120% in many regions, said Zhao Quanhou, a researcher at the Chinese Academy of Fiscal Sciences. (MNI)

FREE TRADE ZONES: China will introduce new measures to promote the high quality opening up of free trade zones (FTZs), according to recent plans from the State Council. Officials said China will expand the scope of financial services that foreign firms can provide within FTZs, and widen tariff exemption rules for various products and services. Foreign firms will benefit from harmonized treatment for government procurement projects and a relaxation of business and spouse visas. The State Council said authorities would take targeted measures to boost residents' consumption, and coordinate cross government policy for renovating old age housing. (MNI)

BEIJING/HK: Officials from the Beijing and Hong Kong stock exchanges have signed an agreement to facilitate the listing of companies across platforms, according to a joint statement. Policymakers said Beijing listed firms will benefit from improved access to international capital markets and can further develop as a center for international science and technology innovation. Hong Kong will further enhance its status as an international financial hub and gateway to China’s capital market, officials said. (MNI)

REFORM: Flagging market-oriented reform to boost the confidence of entrepreneurs, rather than relying on policy stimulus, should be a top priority for Chinese policymakers, as economic pain stemming from Covid persists and relations with the U.S. remain troubled, a prominent liberal economist told MNI in an interview. (MNI)

PBOC: China took steps to slow a decline in the yuan for a fourth time this week, as its weakness intensified on souring sentiment toward the world’s second-largest economy. (BBG)

CHINA MARKETS

PBOC Injects Net CNY103 Bln Via OMOs Friday

The People's Bank of China (PBOC) conducted CNY103 billion via 7-day reverse repos on Friday, with the rates at 1.90%. The operation has led to a net injection of CNY103 billion as no reverse repo is maturing today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at half year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9321% at 09:33 am local time from the close of 1.9041% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 47 on Thursday, compared with the close of 46 on Wednesday.

PBOC Yuan Parity Higher At 7.2258 Friday VS 7.2208 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2258 on Friday, compared with 7.2208 set on Thursday.

OVERNIGHT DATA

South Korea May Industrial Production 3.2% M/M; Prior -1.2%

South Korea May Cyclical Leading Index Change 0.0; Prior -0.2

UK Jun Lloyds Business Barometer 37; Prior 28

Japan Jun Tokyo CPI 3.1% Y/Y; Prior 3.2%

Japan Jun Tokyo CPI Ex-Fresh Food 3.2% Y/Y; Prior 3.1%

Japan Jun Tokyo CPI Ex-Fresh Food, Energy 3.8% Y/Y; Prior 3.9%

Japan May Jobless Rate 2.6%; Prior 2.6%

Japan May, P Industrial Production -1.6% M/M; Prior 0.7%

Australia May Private Sector Credit 0.4% M/M; Prior 0.6%

China Jun Composite PMI 52.3; Prior 52.9

China Jun Mfg PMI 49.0; Prior 48.8

China Jun Non-Mfg PMI 53.2; ; Prior 54.5

MARKETS

US TSYS: Muted Asian Session On Friday

TYU3 deals at 112-06, +0-02, a narrow 0-04 range has been observed on volume of 54k.

- Cash tsys sit little changed from Thursday's closing levels across the major benchmarks.

- Tsys have respected narrow ranges with little follow through on moves in Asia.

- Little meaningful macro news flow crossed.

- The highlight flow was an FV block seller (1.25k lots).

- Coming up in Europe we have the final read of UK GDP and flash Eurozone CPI. Further out we have Personal Income and Consumer Sentiment.

JGBs: Futures Holding Weaker, Tokyo CPI Miss Fails To Support Market

JGB futures are dealing at overnight closing levels, -11 compared to settlement levels after the initial pop from the Tokyo CPI miss fails to hold in early Tokyo trade.

- The muted reaction may reflect the fact that inflation in Tokyo re-accelerated for the second time in three months in June, according to a Bloomberg article. Such an outcome supports expectations the BoJ will raise its inflation forecast next month amid lingering speculation of possible policy adjustments. (See link)

- Cash JGBs are trading -0.5bp to +0.5bp beyond the 1-year zone (+1.6bp). The benchmark 10-year yield is unchanged at 0.391%, below the BoJ's YCC limit of 0.50%. The 2-year yield is 0.5bp lower at -0.074% after yesterday's supply takedown saw solid demand with the cover ratio jumping to its highest level observed at a 2-year auction since September with a reduced tail. Bloomberg reports that MUFJ-MS Buys 24.7% of Japan 2-Year Bonds at sale yesterday. (See lin)

- Swap rates are flat to 0.3bp higher out to the 3-year and 0.1-0.5bp lower beyond, out to the 30-year. 40-year swap rate is 0.7bp higher.

AUSSIE BONDS: Cheaper Ahead Of RBA Decision On Tuesday, Awaiting US PCE Deflator

ACGBs are currently trading weaker (YM -10.0 & XM -10.5), nearing the session lows observed in Sydney. Market participants are eagerly awaiting the release of US PCE deflator data later today. The market consensus expects the headline deflator to show a monthly increase of +0.1%, indicating a slowdown in inflationary pressures. However, the Core PCE deflator, which is closely watched by the Fed, is anticipated to register a monthly increase of +0.3% following the +0.4% reading in April. The annual core PCE deflator is expected to remain unchanged at +4.7%.

- Cash ACGBs are 9-10bp cheaper with the AU-US 10-year yield differential unchanged at +16bp.

- Swap rates are 9bp higher with EFPs little changed.

- The bills strip bear steepens with pricing -4 to -13.

- The local calendar sees Judo Bank PMI data (Jun F), MI Inflation Gauge (Jun), Home Loans (May), ANZ-Indeed Job Ads (Jun) and Building Approvals (May) on Monday ahead of the RBA policy decision on Tuesday. BBG consensus is currently expecting a no-change outcome although it is far from unanimous.

- RBA-dated OIS pricing is 3-8bp firmer across meetings today. The market attaches a 53% chance of a 25bp hike next week versus 31% pre-retail sales data.

NZGBS: Closed At Or Near Cheaps, Awaits US PCE Deflator

NZGBs closed with benchmark yields 5-8bp higher as the local market digested the surge in US tsy yields overnight, ahead of the all-important US PCE deflator data for May later today. Domestic drivers were scarce other than the previously mentioned consumer confidence data.

- Swap rates are 8bp higher with the 2s10s curve unchanged and implied long-end swap spreads wider.

- RBNZ dated OIS pricing closed flat to 11bp firmer across meetings with May’24 leading. Terminal OCR expectations closed at 5.65%.

- Central banks globally need to review their performance during the Covid-19 pandemic and acknowledge any policy errors, according to Bob Buckle, Emeritus Professor, Victoria University of Wellington and an external member of the RBNZ MPC in his address at the NZAE conference. (See link)

- The local calendar next week sees Building Permits (May) on Monday, NZIER Business Opinion Survey on Tuesday, and CoreLogic House Prices and the NZ Government’s 11-mth Financial Statement on Wednesday.

- In Australia, the focal point will be the RBA policy decision on Tuesday.

- The NZ Treasury also plans to sell NZ$250mn of the 0.5% 15 May 2026 bond, NZ$2000mn of the 2.0% 15 May 2032 bond and NZ$50mn of the 1.75% 15 May 2041 bond on Thursday.

GOLD: Dips Below $1900

Gold is little changed in the Asia-Pac session, after briefly dipping below $1,900 on Thursday as US tsy yields surged following the unexpectedly strong GDP revision and a decrease in jobless claims, which further raised the probability of the FOMC implementing further rate hikes.

- Rates moved to their highest levels since March, reminiscent of the previous market unease regarding aggressive actions by the Federal Reserve.

- But gold managed to quickly rebound after sliding below the $1,900 marker, a sign of enduring bids for the metal even as US bond yields and the dollar move against it.

- There has been a noticeable outflow of investments from bullion-backed exchange-traded funds (ETFs), contributing to the downward trajectory of gold prices. Data compiled by Bloomberg indicates that total holdings in gold-backed ETFs have declined for four consecutive weeks, and trading volumes are approximately 10% lower compared to the previous year. It is worth noting that sustained ETF buying played a significant role in driving the price of gold higher in 2020.

FOREX: USD/JPY Retreats After Testing ¥145

USD/JPY briefly dealt about ¥145 before paring gains after printing its highest level since November. The pair now deals little changed from Thursday's closing levels last printing at ¥144.70/80.

- USD/JPY printed a high at ¥145.07, if the pair can sustain a move through ¥145 ¥145.48, 2.0% 10-DMA envelope, provides the next resistance level. Tokyo CPI was softer than expected printing at 3.1% vs 3.4% exp. Japans Jobless Rate held steady at 2.6%.

- Kiwi is ~0.3% firmer, NZD/USD firmed as USD/JPY retreating from above ¥145 spilt over into wider greenback weakness. The pair last prints at $0.6085/90. In June Consumer Confidence rose 8.0% to 85.5 as the RBNZ's decision to pause rate hikes boosts sentiment.

- AUD/USD is up ~0.2%, the pair remains well within recent ranges and last prints at $0.6625/30.

- Elsewhere in G-10 NOK and SEK are ~0.2% firmer, however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.1% and e-minis are a touch higher. US Tsy Yields are marginally firmer across the curve.

- Coming up in Europe we have the final read of UK GDP and flash Eurozone CPI.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/06/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 30/06/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2023 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 30/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 30/06/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 30/06/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/06/2023 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.