-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Slips, Equities Higher Ahead Of CPI Print

EXECUTIVE SUMMARY

- WILLIAMS-CUTS WHEN CONFIDENT PRICES SUSTAINED TOWARD 2% - MNI

- US SET TO PUSH ZELENSKIY AT DAVOS FOR CLEARER WAR PLAN - BBG

- BOJ MULLS FRAMEWORK POST LIKELY APRIL RATE LIFTOFF - MNI POLICY

- OECD URGES JAPAN'S CENTRAL BANK TO GRADUALLY RAISE INTEREST RATES - RTRS

- BANK OF KOREA KEEPS POLICY RATE AT 3.50%: PRESS - MNI BRIEF

- UPDATED RBA GOALS TO PUSH HAWKISH STANCE - EX OFFICIALS - MNI

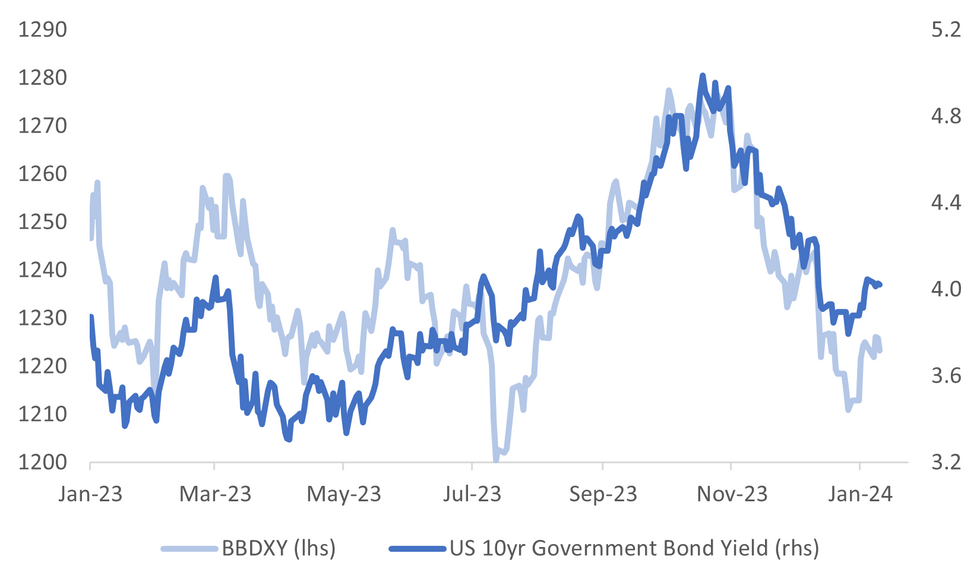

Fig. 1: BBDXY & US 10yr Government Bond Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BRIEF): The Bank of England is closely monitoring the rise in shipping costs due to disruptions stemming from the Middle East crisis, BOE Governor Andrew Bailey told the Treasury Select Committee, adding that increased geo-political tensions are a major concern this year.

EUROPE

ECB (BBG): Talk of lowering European Central Bank borrowing costs is premature at this stage, Executive Board member Isabel Schnabel said, prompting investors to bet on less monetary easing this year.

ECB (BBG): The euro area probably failed to grow in the final three months of 2023, according to European Central Bank Governing Council member Pablo Hernandez de Cos. “Economic activity has continued to show clear weakness and is only expected to increase its degree of dynamism gradually,” the Spanish official said Wednesday in Madrid. “In the third quarter, GDP decreased by 0.1% and available indicators suggest stagnation in the fourth.”

UKRAINE (BBG): The US wants Ukraine to sharpen its plan for fighting Russia’s invasion as the war heads into its third year and is expected to raise the issue with President Volodymyr Zelenskiy in Davos next week.

UKRAINE (BBG): Italian Prime Minister Giorgia Meloni is seeking to convince Hungarian Premier Viktor Orban to lift his opposition to the European Union’s support for Ukraine and to improve relations with President Volodymyr Zelenskiy.

RUSSIA (BBG): President Joe Biden’s administration is backing legislation that would let it seize some of $300 billion in frozen Russian assets to help pay for reconstruction of Ukraine, a shift as the White House seeks to rally support in Congress to further fund the war against Vladimir Putin’s forces.

BELGIUM (MNI BRIEF): Pierre Wunsch has been appointed to a second stint as the head of the National Bank of Belgium, it was reported Wednesday, after the government initially failed to meet the deadline to confirm a second five-year term.

U.S.

FED (MNI): New York Fed President John Williams on Wednesday said he expects the central bank to keep a restrictive stance for some time and to begin rate cuts only when confident inflation is moving toward 2% on a sustained basis, also noting a slowing of QT does not seem to be close.

BITCOIN (BBG): US regulators for the first time approved exchange-traded funds that invest directly in Bitcoin, a move heralded as a landmark event for the roughly $1.7 trillion digital-asset sector that will broaden access to the largest cryptocurrency on Wall Street and beyond.

FISCAL (BBG): House Speaker Mike Johnson’s rush to avoid a government shutdown tumbled Wednesday into a familiar chaos, as rank-and-file Republicans questioned his resolve in talks with Democrats.

POLITICS (RTRS): Florida Governor Ron DeSantis and former U.N. Ambassador Nikki Haley repeatedly accused each other of lying in an acrimonious debate that mixed policy with insults as the two candidates battled to emerge as the top alternative to Donald Trump days before the campaign's first votes are cast.

POLITICS (BBG): Former New Jersey Governor Chris Christie said he is ending his long-shot 2024 campaign centered on denying onetime ally Donald Trump the Republican presidential nomination.

OTHER

JAPAN (MNI): The Bank of Japan is on course to raise its benchmark overnight rate from negative levels as soon as its April 25-26 meeting, but officials remain uncertain as to what will then become the main interest rate target, MNI understands.

JAPAN (RTRS): The Bank of Japan should gradually raise short-term interest rates and make its bond yield control policy more flexible, if inflation stays around its 2% target and is accompanied by sustained wage growth, the OECD said on Thursday.

SOUTH KOREA (MNI BRIEF): The Bank of Korea on Thursday decided to keep its policy interest rate unchanged at 3.50% amid persistent concerns over the weaker economy and despite elevated inflation rates, for the eighth consecutive meeting, Yonhap News Agency reported.

AUSTRALIA (MNI): The Reserve Bank of Australia’s updated agreement with the federal treasurer will put upward pressure on the cash rate over time, as the Bank’s inflation target shifts lower and it applies a more narrow definition of full employment, former officials told MNI.

BRAZIL (MNI BRIEF): Lingering concerns over above-target inflation expectations require restrictive monetary policy, Central Bank of Brazil deputy governor of economic policy Diogo Guillen said Wednesday.

ARGENTINA (RTRS): Argentina and the International Monetary Fund (IMF) finalized the details of an agreement over the country's embattled $44 billion loan program, unlocking a more-than-expected $4.7 billion, the fund said on Wednesday.

CHINA

YUAN (YICAI): The yuan will gradually strengthen to 7 against the U.S. dollar throughout 2024, but the currency could weaken to 7.3 should the dollar rally again in H1 of 2024 alongside weaker-than-expected performance of the Chinese economy, said Wang Tao, head of Asia Economic Research at UBS. USD may find it hard to weaken, at least in H1, likely supported by the greater-than-expected resilience of the U.S. economy which will give the Federal Reserve reason to hold interest rates.

ECONOMY (YICAI): China’s Chief Economist Index printed at 50.89 in January, unchanged from last month and above the expansionary mark of 50.0, Yicai news outlet said. Regarding data releases for December 2023, surveyed economists' average forecast for CPI was -0.34% and PPI -2.71%. Economists expect retail sales grew 8.05% y/y with fixed-asset investment up 3.08% y/y, offset by a fall in real-estate investment at -9.07% y/y.

FISCAL (21ST CENTURY BUSINESS): Local governments are planning to reserve ultra-long-term special treasury bond projects, mainly in the areas of food, energy and industrial chain security, urbanisation, and rural revitalisation, 21st Century Business Herald reported citing anonymous sources. In October last year, China issued an additional CNY1 trillion of China Government Bonds which were managed as special treasury bonds.

MARKETS (BBG): Citadel Securities LLC has made a non-binding offer for Credit Suisse’s securities venture in China, becoming the only global financial firm to submit a bid, people familiar with the matter said.

TOURISM (BBG): China will ease some visa requirements to make it easier for foreigners to travel for business, education and tourism, a move that comes as the government seeks to rejuvenate a slowing economy.

CHINA MARKETS

MNI: PBOC Injects Net CNY12 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY27 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY12 billion reverse repos after offsetting CNY15 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7856% at 10:00 am local time from the close of 1.8017% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Wednesday, the same as the close on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1087 Thursday vs 7.1055 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1087 on Thursday, compared with 7.1055 set on Wednesday. The fixing was estimated at 7.1696 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND NOV BUILDING PERMITS M/M -10.6%; PRIOR 8.5%

AUSTRALIA NOV TRADE BALANCE A$11.4BN; MEDIAN A$7.3BN; PRIOR A$7.66BN

AUSTRALIA NOV EXPORTS M/M 1.7%; PRIOR 0.8%

AUSTRALIA NOV IMPORTS M/M -7.9%; PRIOR -2.9%

JAPAN DEC TOKYO AVG OFFICE VACANCIES 6.03%; PRIOR 6.03%

JAPAN NOV P LEADING INDEX CI 107.7; MEDIAN 107.9; PRIOR 108.9

JAPAN NOV P COINCIDENT INDEX 114.5; MEDIAN 114.5; PRIOR 115.9

MARKETS

US TSYS: Cash Bonds Dealing Little Changed, Markets Await US CPI

TYH4 is trading at 111-28+, 0-00+ from NY closing levels.

- With little in the way of meaningful newsflow, cash US tsys are dealing little changed in today’s Asia-Pac session ahead of the US CPI data release later today.

- Consensus puts core CPI inflation at 0.3% m/m in December, with risk seen to the downside. If analysts are correct, supercore trend rates are likely to remain very strong at 4% annualised handles but treat with some caution as differences in methodology have seen core PCE at notably weaker rates in recent months. (see MNI’s US CPI Preview here)

JGBS: Futures At Session Highs Ahead OF US CPI Data, 30Y Supply Tomorrow

JGB futures are higher, +23 compared to the settlement levels, and at session highs.

- There hasn’t been much in the way of domestic drivers to flag given the relatively light local calendar. Leading & Coincident Indices are due later but are unlikely to be market movers.

- OECD urges Japan's central bank to gradually raise interest rates – Reuters.

- Asian participants have opted to remain on the sidelines concerning US tsys in anticipation of the pivotal US CPI data scheduled for later today. As a result, cash US tsys have experienced minimal changes during today's Asia-Pacific session. This cautious stance suggests a wait-and-see approach among Asian investors, highlighting the significance they place on the upcoming US CPI data and its potential impact on market dynamics.

- Cash JGBs are dealing mixed. The benchmark 10-year yield is 0.4bp lower at 0.582% versus a session high of 0.628%.

- The swap curve has slightly twist-steepened, with rates 0.1bp lower to 1bp higher. Swap spreads are wider.

- Tomorrow, the local calendar sees Weekly International Investment Flows, BoP Current Account Balance and Bank Lending data.

- The MoF will tomorrow sell Y900bn 30-year JGBs.

AUSSIE BONDS: Local Participants On The Sidelines Ahead Of US CPI Data

ACGBs (YM -2.0 & XM -2.0) show a slight weakening following a subdued trading session, ahead of crucial US CPI data later today. The domestic market lacked significant catalysts, with the previously highlighted trade balance data failing to have a substantial impact on market movements.

- Asian participants, too, have demonstrated a cautious approach to US tsys, opting to remain on the sidelines. This has resulted in minimal changes in cash US tsys during today's Asia-Pacific session.

- Cash ACGBs are 1-2bps cheaper, with the AU-US 10-year yield differential 1bp wider at +11bps.

- Swap rates are 2-3bps higher, with EFPs slightly wider.

- The bills strip has slightly bear-steepened, with pricing flat to -4.

- RBA-dated OIS pricing is flat to 3bps firmer across meetings, with December leading. A cumulative 51bps of easing is priced by year-end.

- Tomorrow, the local calendar is relatively light, with Home Loans data as the sole release.

NZGBS: Little Changed, Narrow Ranges, Awaiting US CPI

NZGBs closed flat to 1bp cheaper across benchmarks after dealing in relatively narrow ranges for today’s local session. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined homebuilding approvals for November.

- With US CPI due later today, local participants have been content to stay on the sidelines, especially with cash US tsys trading little changed in today’s Asia-Pac session.

- Consensus puts core CPI inflation at 0.3% m/m in December, with risk seen to the downside. If analysts are correct, supercore trend rates are likely to remain very strong at 4% annualised handles but treat with some caution as differences in methodology have seen core PCE at notably weaker rates in recent months. (see MNI’s US CPI Preview here)

- Swap rates closed 4-5bps higher, with implied swap spreads ~3bps wider.

- RBNZ dated OIS pricing closed unchanged across meetings. A cumulative easing of 92bps is priced by year-end.

- Tomorrow, the local calendar is once again empty.

FOREX: USD Loses Ground Amidst Firmer Equity Backdrop

USD loses have extended as the Asia Pac session has progressed. The BBDXY sits 0.20% lower, last near 1223.50. A better risk on tone from equities, with Asia Pac markets higher and US futures ticking up, has weighed on USD sentiment. US yields are little changed as the CPI print comes into view.

- NZD and AUD have outperformed, consistent with the risk on theme, although JPY is not far behind.

- NZD/USD is up nearly 0.40% to 0.6250, but we remain comfortably within recent ranges. Earlier data showed Nov building permits down over 10%m/m, but this followed a strong Oct rise.

- AUD/USD is up +0.30%, last in the 0.6720/25 region. The Nov trade surplus surged thanks to a lower import bill as consumer imports slumped.

- USD/JPY sits in the 145.30/35 region, around 0.30% stronger in yen terms. Lows for the session rest at 145.29. The OECD sees scope for the BOJ to adjust away from ultra easing settings, with wages growth expected to keep inflation close to the BoJ target.

- All eyes in the US session will be on the CPI release.

EQUITIES: Major Indices Tracking Higher, Japan Benchmarks Still Outperforming

The major regional equity indices are all tracking higher, with some pockets of weakness in SEA. We had a positive lead from US cash trading on Wednesday, while US futures have also firmed in the first part of Thursday trade. Nasdaq futures are outperforming, up 0.35%, and the active contract is back above 17000. Eminis are up 0.19% at this stage, near 4829.

- Japan markets once again remain the standout. The Nikkei 225 is tracking nearly 2% firmer at this stage, after posting a similar gain yesterday. The Topix is trailing slightly at +1.7%.

- A modest yen recovery hasn't dampened sentiment, although the yen has only pared Wednesday losses modestly. The electric appliances sector has led the way again.

- Hong Kong markets are much stronger to the lunch time break, +1.51% for the HSI. The beaten up tech sub sector is up 1.83% to the break.

- China mainland indices are higher, but only modestly. At the break, the CSI 300 is up 0.29%.

- The Kospi and Taiex indices are modestly higher at this stage, but still underperforming Japan gains.

- In SEA, Malaysia and Thailand markets are weaker, while modest gains are evident elsewhere.

OIL: Benchmarks Recoup Some Of Wednesday's Fall, But Still Down For The Week

Oil benchmarks sit marginally above Wednesday session lows. Front month Brent was last near $77.10/bbl, while WTI was near $71.65/bbl. This is a gain of around 0.40%, but only partially offsets the more than 1% drop recorded for Wednesday's session. Moreover, we remain below end Friday levels from last week as well.

- Wednesday's move lower was driven by an unexpected build in US crude stocks. EIA Weekly US Petroleum Summary - w/w change week ending Jan 05: Crude stocks +1,338 vs Exp -199, Crude production 0, SPR stocks +606, Cushing stocks -506.

- Market expectations had been skewed the other way and the stock build helped offset renewed concerns around Red Sea tensions.

- Today's gain is in line with a slightly better risk appetite tone, with Asia Pac and US equity futures rising, while the USD has also been softer.

GOLD: Slightly Stronger Ahead Of US CPI Data

Gold is 0.3% higher in the Asia-Pac session ahead of US CPI data later today, after closing 0.3% lower at $2024.41 on Wednesday.

- Bullion was initially supported on Wednesday by geopolitical risks before fading into NY session close despite a softer USD index.

- Investors were possibly gearing up for turbulent trading following the release of US CPI data, which may firm views on when the Fed will start easing monetary policy.

- Cash US Treasuries are dealing little changed in today’s Asia-Pac session after cheapening slightly on Wednesday.

- Economists polled by Bloomberg expect core inflation to fall to 3.8% y/y in December from 4% prior.

- From a technical standpoint, the yellow metal approached support at the 50-day EMA of $2012.8 on Wednesday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 11/01/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 11/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 11/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/01/2024 | 1330/0830 | *** |  | US | CPI |

| 11/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 11/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/01/2024 | 1740/1240 |  | US | Richmond Fed's Tom Barkin | |

| 11/01/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/01/2024 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.