-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD & Yields Mostly Under Pressure Ahead Of NFP

EXECUTIVE SUMMARY

- FED’S GOOLSBEE SAYS TREND OF ECONOMIC DATA JUSTIFIES MULTIPLE RATE CUTS, STARTING SOON - DJ

- US TO PRESENT GAZA PROPOSAL ‘IN COMING DAYS,’ BLINKEN SAYS - BBG

- JAPAN’S HOUSEHOLD SPENDING STAYS FLAT IN SIGNS OF TEPID GROWTH - BBG

- CHINA NEEDS TO FIGHT DEFLATION STRESS - YI GANG - MNI BRIEF

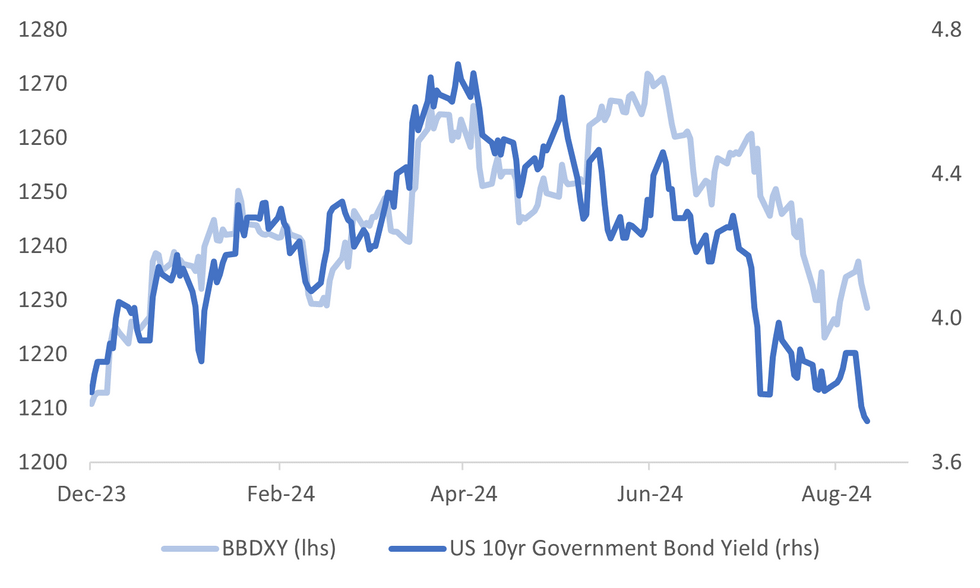

Fig. 1: USD BBDXY Index & 10yr Nominal Tsy Yield

Source: MNI - Market News/Bloomberg

EU

ECB (MNI): ECB Rate Shift Gives Added Focus To Deposit Facility Rate

FRANCE (BBG): “France’s new prime minister, Michel Barnier, made a plea for the country’s political factions to work together in order to move beyond the turbulence that’s caused so much chaos over the past two months.”

GERMANY (BBG): “Germany’s Christian Democratic opposition leader said he’s building momentum for a change of government in Berlin next year — portraying Chancellor Olaf Scholz’s ruling coalition as a weakened administration.”

CHINA/EU (MOFCOM): “China’s anti-dumping investigation into EU brandy will continue despite the recent decision not to impose provisional tariffs, said He Yongqian, spokesperson for the Ministry of Commerce.”

US

FED (DJ): “In exclusive interview, Goolsbee sees mounting warning signs about outlook of labor market. The longer-run trend of labor-market and inflation data justify the Federal Reserve easing interest-rate policy soon, and then steadily over the next year, Chicago Fed President Austan Goolsbee said Thursday, in an exclusive interview with MarketWatch.”

MNI (INTERVIEW): US Service Growth To Keep Fed Cuts Gradual-ISM

ECONOMY (MNI BRIEF): Private U.S. employer hiring slowed for a fifth straight month to a slower-than-usual 99,000 in August, while wage growth has stabilized to a higher level compared to before the pandemic, signs of a normalizing job market, ADP chief economist Nela Richardson said Thursday

POLITICS (BBG): “ Donald Trump pledged to cut the corporate tax rate, slash regulations and audit the federal government, embracing an idea proposed by billionaire backer Elon Musk, as he pitched his agenda to Wall Street and corporate leaders in New York.”

US/CHINA (BBG): “ Apple Inc. has green-lit a version of Tencent Holdings Ltd.’s WeChat app for the upcoming iPhone 16, buying more time for ongoing negotiations about changes the US company has demanded to China’s most-used social media platform.”

US/CHINA (BBG): “The Biden administration plans to impose export controls on critical technologies including quantum computing and semiconductor goods, aligning the US with allies working to thwart advancements in China and other adversarial nations.”

OTHER

MIDDLE EAST (BBG): “The US, Qatar and Egypt will present a new cease-fire proposal to Israel and Hamas in the coming days, Secretary of State Antony Blinken said Thursday, as the Biden administration struggles to find a way to end the war in the Gaza Strip.”

JAPAN (BBG): “ Mitsubishi UFJ Financial Group Inc. will consider shifting more of its $488 billion securities portfolio into Japanese government bonds when yields reach 1.2%, as it expects the central bank to continue raising interest rates.”

JAPAN (BBG): “ The Bank of Japan may hike interest rates faster than many currently anticipate and it should strive to better telegraph those moves to ensure markets don’t panic, according to a former official.”

JAPAN (BBG): “Japan’s household spending was largely unchanged in July, adding to concerns that overall economic growth will stay tepid in the current quarter.”

CHINA

POLICY (MNI BRIEF): China should move immediately to fight deflationary pressure via an accommodative monetary policy and a proactive fiscal stance to address economic growth, said Yi Gang, former governor of the People’s Bank of China, on Friday at the 2024 Bund Summit.

MORTGAGES (CSJ): “ Industry insiders believe it is both possible and necessary to lower interest rates on outstanding mortgages for homeowners, as the differential between the rates on existing and new home loans has been widening, China Securities Journal reported on Friday.”

MARKETS (SHANGHAI SECURITIES NEWS): “ total of 10 domestic mutual fund houses have filed application to launch exchange-traded funds tracking a new broad stock index known as A500, giving investors a new vehicle to invest in the A-share market, Shanghai Securities News reported on Friday.”

CHINA MARKETS

MNI: PBOC Net Injects CNY111.4 Bln via OMO Friday

The People's Bank of China (PBOC) conducted CNY141.5 billion via 7-day reverse repos, with the rate unchanged at 1.70%. The operation led to a net injection of CNY111.4 billion after offsetting maturities of CNY30.1 billion, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6573% at 09:47 am local time from the close of 1.7108% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 56 on Thursday, compared with the close of 47 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0925 on Friday, compared with 7.0989 set on Thursday. The fixing was estimated at 7.0921 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q2 VOLUME BUILDINGS Q/Q -0.2%; MEDIAN -2.7%; PRIOR -3.2%

AUSTRALIA JULY HOME LOANS M/M 3.9%; MEDIAN 1.0%; PRIOR 1.0%

JAPAN JULY HOUSEHOLD SPENDING Y/Y 0.1%; MEDIAN 1.2%; PRIOR -1.4%

JAPAN JULY P LEADING INDEX 109.5; MEDIAN 109.4; PRIOR 109

JAPAN JULY P COINCIDENT INDEX 117.1; MEDIAN 116.2; PRIOR 113.2

SOUTH KOREA JULY CURRENT ACCOUNT BALANCE $9131.8Mln; PRIOR 12563.8Mln

MARKETS

US TSYS: Tsys Futures Steady Ahead Of NFP

- It has been a quiet session for US tsys today, futures have edged slightly over the last hour or so, however remain well within Thursday's ranges. The 2yr is 3.739 % (-1.1bps) while the 10yr is 3.727% (1.1bps)

- Tsys futures are holding on to this week’s gains and a bullish theme remains intact. The bounce Tuesday, from below the 20-day EMA, highlights a reversal and signals the end of the recent corrective phase. TUZ4 is + 00⅝ at 104-04⅛, while TYZ4 is + 02+ at 114-26+

- Initial support rests at 113-30+ (20-day EMA), below here 113-12 (Sep 3 lows), while to the upside 114-29+ (Sep 5 highs) & 114-31+ (76.4% retracement of the Aug 5 - 8 pullback)

- The 2s10s curve continues to trade around flat, currently -1.913 after overnight hitting a high of 1.532 although was unable to close above flat.

- Fed funds was pricing has cooled slightly vs . Projected rate cut pricing through year end vs Wednesday close levels: Sep'24 cumulative -35.2bp (-36bp), Nov'24 cumulative -71.7bp (-3.2bp), Dec'24 -108.9bp (-111.2bp).

- Today we have calendar is dominated by payrolls and their implications for Fed policy, later in the session we will hear from the FOMC's Williams, Goolsbee and Waller who are anticipated to provide a final steer on the rate outlook going into the pre-September meeting blackout starting this weekend.

JGBS: Cash Curve Bull Flattener Ahead Of US Payrolls

JGB futures are at session highs, +12 compared to the settlement levels.

- Outside of the previously outlined household spending data, there hasn't been much by way of domestic drivers to flag.

- (Bloomberg) "The Bank of Japan may hike interest rates faster than many currently anticipate, and it should strive to better telegraph those moves to ensure markets don’t panic, according to a former official." (See link)

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session ahead of US Non-Farm Payrolls data later today (our preview ishere). We will also hear from the FOMC's Williams, Goolsbee and Waller ahead of the pre-September meeting blackout starting this weekend.

- The cash JGB curve has twist-flattened, pivoting at the 4-year, with yields 1bp higher to 3bps lower. The benchmark 10-year yield is 1.4bps lower at 0.866% versus the cycle high of 1.108%.

- The stronger performance of longer-dated JGBs is consistent with today's Rinban Operations results, which showed lower offer cover ratios.

- The swap rates are little changed.

- The local calendar will also see Coincident & Leading Indices later today.

- On Monday, the local calendar will see GDP (Final), Trade Balance and Bank Lending data.

AUSSIE BONDS: Slightly Richer But AU-US10Y Diff Near Top Of Range

ACGBs (YM +2.0 & XM +3.0) are slightly richer despite today’s home loans data printing stronger-than-expected.

- Outside of the previously outlined Home Loan data, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are ~1bp richer in today’s Asia-Pac session ahead of US Non-Farm Payrolls data later today.

- We will also hear from the FOMC's Williams, Goolsbee and Waller, who are anticipated to provide a final steer on the rate outlook going into the pre-September meeting blackout starting this weekend.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential at +18bps. At +18bps, the differential sits in the upper half of the +/-30bps range observed since November 2022.

- Swap rates are 2-3bps lower.

- Bills are flat to +3 across contracts, with the strip flatter.

- RBA-dated OIS pricing is 1-5bps softer across 2025 meetings after being 1-2bps firmer earlier. A cumulative 19bps of easing is priced by year-end.

- Next week, the local calendar is empty on Monday, ahead of Westpac Consumer and NAB Business Confidence on Tuesday.

- Next Wednesday, RBA Assistant Governor (Economic) Sarah Hunter will give a speech at the Barrenjoey Economic Forum alongside the AOFM's planned sale of A$1.0bn of 2.75% 21 November 2027 bond.

NZGBS: Little Changed & Narrow Ranges Ahead Of US Payrolls

NZGBs closed 1-2bps richer across benchmarks after dealing in narrow ranges ahead of US Non-Farm Payrolls data later today.

- Today’s US calendar will be dominated by payrolls (our preview is here). That said, we will also hear from the FOMC's Williams, Goolsbee and Waller, who are anticipated to provide a final steer on the rate outlook going into the pre-September meeting blackout starting this weekend.

- Outside of the previously outlined Construction Work Done data, there hasn't been much by way of domestic drivers to flag.

- The RBNZ said total reserve assets stood at NZ$32.57bn in August, compared with NZ$35.65bn in July.

- Swap rates closed 2-3bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 1bp softer for 2025 meetings. A cumulative 77bps of easing is priced by year-end.

- Next week, the local calendar is empty on Monday, ahead of Q2 Mfg Activity data on Tuesday and Net Migration on Wednesday. Assistant RBNZ Governor Karen Silk will speak at a conference hosted by KangaNews on Wednesday.

FOREX: Yen Outperforms Amid Lower US Yields/Equity Futures, NFP Up Later

The USD BBDXY index sits sub 1229 in latest dealings, off a little over 0.15%. This largely reflects yen and to a lessor extent CHF gains in the first part of Friday trade. The USD index is above late August lows near 1222, but the trend remains poor ahead of the US NFP print.

- Cross asset signals have been negative from a US yield standpoint, with the 10yr yield breaking down through Thursday lows, last near 3.71%. The 2yr yield is also lower, but Thursday levels are holding for now. The Fed's Goolsbee stated that recent economic data trends justify multiple rate cuts, starting soon, per DJ/Market Watch. US equity futures sit lower, led by the Nasdaq off 0.40%.

- USD/JPY sits close to session lows, last near 142.95, around 0.35% stronger in yen terms. Thursday intra-session lows haven't been tested yet (142.85). Earlier data showed household spending much less than forecast in July, but this hasn't impacted sentiment. CHF is up around 0.15%, last close to 0.8430.

- AUD and NZD have both ticked down against the USD. AUD/USD last near 0.6730, NZD/USD close to 0.6215. The weaker equity backdrop weighing on both pairs, particularly against the yen so far today. Both currencies sit above recent lows against the yen though.

- Oil prices sit close to recent lows, while metal prices, including iron ore have struggled for upside, so a likely headwind, particularly for AUD.

- Looking ahead it is all about the US NFP print.

ASIA STOCKS: HK Shut For Typhoon, Chinese Equities Slightly Lower

Chinese stocks opened higher this morning as the PBoC hinted at easing monetary policy to support growth, with major benchmarks gains about 0.4%, equities have since turned red as tech and healthcare stocks weigh on the market. Hong Kong markets are close for the morning due to Typhoon and could open if conditions improve. The HSI has fallen 3% this week, weighed down by concerns over weak Chinese economic data and disappointing earnings.

- CSI 300 (-0.27%), with the Tech Index (-1.13%), Healthcare Index (-1.18%) while Financials Index is (+0.86%) after talks of a merger Between Haitong & Guotai Junan.

- Industry insiders in China are calling for a reduction in interest rates on outstanding mortgages, as the gap between rates on existing and new home loans has widened, according to a report by the China Securities Journal.

- Sun Hung Kai Properties reported a 9% drop in profit for the year ended June 30, marking its third consecutive annual decline as Hong Kong's real estate market struggles. Underlying earnings fell to HK$21.7b ($2.8b), just missing analysts estimates of HK$22.8b. High borrowing costs and an oversupply of apartments have hurt sales, forcing developers to offer discounts, while home prices hit an eight-year low in July. Sun Hung Kai cut its annual dividend by 24% to HK$2.8p/s. Despite the downturn, rental income from investment properties rose 3%, with retail and serviced apartments offsetting losses in the office sector.

ASIA PAC STOCKS: Asian Equities Mixed, Ranges Tight, Ahead of US NFP

Asian equity markets are seeing mixed trading today ahead of key US jobs data that could influence the size of a potential Fed rate cut. In Japan, the Topix is 0.4% lower as exporters like Toyota faced pressure from a stronger yen, while domestic retailers performed better, while the Nikkei remained virtually unchanged. In South Korea, the Kospi dropped as much as 1.5%, marking its fourth straight session of declines, with tech giants like Samsung and SK Hynix leading the losses. Meanwhile, Australia's ASX 200 is 0.4% higher, buoyed by financial stocks, though it's set for a weekly decline of about 1% amid a tech-driven global selloff. New Zealand's NZX 50 slipped 0.6%, but it's on track for a 1.6% weekly gain, outperforming the wider region.

- Nasdaq futures briefly dipped below recent lows earlier, as the JPY strengthened a touch while Asia tech stock dropped.

- Foreign investors have been selling Korean tech stocks, although only about $70m worth so far, they have been slightly better buyers of healthcare stocks

- Hong Kong markets are closed for the morning session due to a Typhoon.

- Overall trading has been subdued as the market awaits NFPs in the US later tonight, with BBG consensus at 165k , up from 114k in July.

- Nasdaq futures briefly dipped below recent lows earlier, as the JPY strengthened a touch while Asia tech stock dropped.

- Foreign investors have been selling Korean tech stocks, although only about $70m worth so far, they have been slightly better buyers of healthcare stocks

- Hong Kong markets are closed for the morning session due to a Typhoon.

- Overall trading has been subdued as the market awaits NFPs in the US later tonight, with BBG consensus at 165k , up from 114k in July.

OIL: OPEC+ Supply Hike Delayed in Face of Risk Off Environment

- OPEC+ coalition members issued a statement on OPEC’s website advising that the expected increase in production is now on hold.

- Production was expected to be ramped up by up to 180,000 barrels per day from next month.

- There is a longer term plan to ramp up production over the course of 2025 and for now that plan appears to remain, though the implementation period appears extended.

- The risk off sentiment in global markets was the overriding driver of Oil overnight as it steadied throughout the Asia trading day at $69.18, having peaked at $70.75 earlier, and much lower for the week having closed last Friday at $73.55.

- Brent too is off its highs having traded through $74 earlier, before hitting a one year low $72.69 and now settling at $72.74, and much lower for the week having closed last Friday at $78.80.

- Volumes have been light throughout the day.

- Ahead of tonight’s major data releases in the US it could be expected that the volatility should subside throughout the day as the market digests the push pull between supply news and expectations for US interest rates.

GOLD: Hovering Near All-Time Highs Ahead Of US Payrolls Data

Gold is slightly higher in today’s Asia-Pac session, after spot gold rose by 0.8% to $2,516.76/oz yesterday, keeping the yellow metal close to last month’s record high of $2,531.75.

- September Fed rate cut pricing again neared 50/50 for 50bp in Fed Funds futures yesterday following weak labour market data, before fading to 40/60.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- ADP reported private US employers added 99k jobs in August. This is the lowest number in more than three years and further signified a cooling labour market.

- Today’s US calendar will be dominated by payrolls (our preview is here). Later in Friday's session, we will hear from the FOMC's Williams, Goolsbee and Waller who are anticipated to provide a final steer on the rate outlook going into the pre-September meeting blackout starting this weekend.

- According to MNI’s technicals team, the focus remains on $2,536.4 next, a Fibonacci projection, while initial support is at $2,472.0, the Sep 4 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/09/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 06/09/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/09/2024 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/09/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 06/09/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 06/09/2024 | 0700/0900 |  | EU | ECB's Elderson speech at ESCB Conference | |

| 06/09/2024 | 0900/1100 | *** |  | EU | GDP (final) |

| 06/09/2024 | 0900/1100 | * |  | EU | Employment |

| 06/09/2024 | 0900/1100 | * |  | IT | Retail Sales |

| 06/09/2024 | 1230/0830 | *** |  | US | Employment Report |

| 06/09/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/09/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/09/2024 | 1245/0845 |  | US | New York Fed's John Williams | |

| 06/09/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/09/2024 | 1500/1100 |  | US | Fed Governor Christopher Waller | |

| 06/09/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.