-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Weaker Hong Kong Tech Softens Risk-On Mood

EXECUTIVE SUMMARY

- MCCARTHY, SCHUMER EYE DEBT-LIMIT VOTES AHEAD OF JUNE 1 DEADLINE - BBG

- BIDEN SPOKE WITH DEBT-LIMIT NEGOTIATORS, STEADY PROGRESS MADE - BBG

- UKRAINE'S ZELENSKIY TO VISIT JAPAN FOR G-7, PEOPLE FAMILIAR SAY - BBG

- RAIMONDO TO MEET CHINESE COUNTERPART NEXT WEEK - POLITICO

- CHINA MULLS MOVING STAKES IN BAD BANKS TO SOVEREIGN WEALTH FUND - BBG

- BOJ STANDS READY IF US DEFAULTS - UEDA - MNI

- JAPAN APR CORE CPI RISES 3.4% Vs MAR 3.1% - MNI

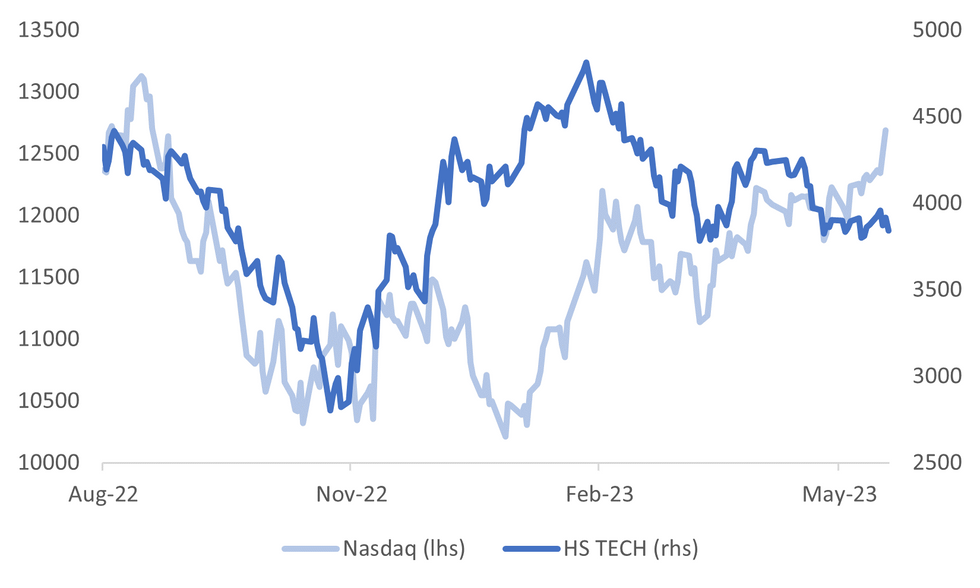

Fig. 1: Nasdaq Versus HSI TECH

Source: MNI - Market News/Bloomberg

U.K.

CHIPS: UK lays out $1.2bn plan to invest in domestic chip sector (BBG)

HOUSEHOLD CONFIDENCE: UK Household Confidence extends rebounds despite 10% inflation. (BBG)

EUROPE:

G7: President Volodymyr Zelensky of Ukraine was preparing to make the audacious trip halfway around the world as his country moves toward a counteroffensive against Russian forces. President Volodymyr Zelensky of Ukraine is expected to appear in person at the Group of 7 summit in Hiroshima, Japan, this weekend, several officials said, making an audacious trip halfway across the world as he tries to win commitments for continued arms and aid from the world’s wealthiest democracies. (NYT)

U.S.

DEBT: House Speaker Kevin McCarthy and Senate Majority Leader Chuck Schumer are making plans for votes in the coming days on a bipartisan deal to avert a catastrophic US debt default. McCarthy said that negotiators on the federal debt limit may reach an agreement in principle as soon as this weekend, lining up a vote in his chamber. (BBG)

DEBT: US President Joe Biden requested and received an update this morning from his debt-limit negotiating team, according to a statement from the White House. Biden’s team informed him that steady progress is being made. Biden directed his team to continue pressing forward for a bipartisan agreement. (BBG)

DEBT: Speaker Kevin McCarthy on Thursday sounded more optimistic than he has in months about finalizing a debt ceiling deal in time to ward off default. Ideally, White House and congressional negotiators can finalize an agreement in the coming days, with a vote on the House floor next week, McCarthy said. But that timeline is likely still very ambitious, since both sides remain divided on a number of issues, including work requirements for federal benefits and potential spending cuts demanded by House Republicans. (Politico)

US/Taiwan: The US and Taiwan agreed to boost trade ties, the first tangible results under an initiative announced last year that faces vehement opposition from Beijing and clouds the outlook for a visit to the US next week by a Chinese commerce official. (BBG)

OTHER

JAPAN: Bank of Japan Governor Kazuo Ueda told lawmakers Friday that the central bank will take policy action in a flexible manner to maintain the stability of financial markets amid a potential U.S. debt default. He reassured parliament a potential US Treasury default would not impact the BOJ's ability to provide liquidity to the country's financial institutions. However, Ueda warned any default would present problems, injecting confusion into financial markets and affecting various financial transactions thanks to the wide use of U.S. Treasuries as collateral for financial transactions. (MNI)

JAPAN: Japan's annual y/y core CPI rose 3.4% in April – accelerating from March's 3.1% – beating Bank of Japan expectations, Ministry of Internal Affairs and Communications data released Friday showed. Higher food prices, excluding fresh food, and lower energy price drove the latest print, which will increase pressure on the BOJ to revise up the median forecast for core CPI this fiscal year from 1.8% made in April. The strong price view may prompt the BOJ to change its forecast that the y/y rise in core CPI will fall below 2% toward the middle of fiscal 2023. (MNI)

JAPAN: Japan's core consumer inflation stayed well above the central bank's 2% target in April and a key index stripping away the effects of fuel hit a fresh four-decade high, keeping alive expectations of a tweak to its massive stimulus this year. (RTRS)

NZ: New Zealand Finance Minister Grant Robertson said the increase in government spending announced in yesterday’s budget isn’t a reason for the central bank to raise interest rates. (BBG)

NZ: ASB Bank now expects a 50 bps hike in the Official Cash Rate to 5.75% in next week’s RBNZ policy announcement, Chief Economist Nick Tuffley says in emailed note. (BBG)

G7/RUSSIA: G7 countries are preparing new sanctions against Russia, covering ships, aircraft, individuals and diamonds, officials say, as they seek to increase economic pressure on the Kremlin’s war machine. (FT)

CHINA

US/China: China’s Commerce Minister Wang Wentao will meet with Commerce Secretary Gina Raimondo in Washington next week, Politico reports, citing officials at the Chinese Embassy in the US. Wang will also meet with US Trade Representative Katherine Tai in Detroit next week as part of his trip to the US: Politico, citing Chinese officials (Politico)

GEOPOLITICS: President Xi Jinping said China is ready to help Central Asian nations bolster their security and defense capabilities as he wrapped a summit of the region’s leaders, underscoring Beijing’s efforts to deepen its influence there as an expansionist Russia raises fresh security issues. (BBG)

BANKING: China is considering transferring government ownership in the nation’s biggest bad-debt managers to a unit of its sovereign wealth fund as part of a financial regulatory regime overhaul, according to people familiar with the matter. (BBG)

YUAN: Recent depreciation of the yuan is within a “controllable range” and the currency is expected to keep basically stable at a “reasonable and equilibrium level” as the Chinese economy recovers, China Securities Journal reports Friday, citing analysts. (BBG)

ECONOMY: Government policy will prioritise enhancing confidence in the economic recovery, with more targeted measures to expand domestic demand, according to Li Qiang, China’s Premier. Speaking on a recent tour of Shandong province, Li said the government could boost domestic demand through high-quality supply and establishing more consumption hotspots. He emphasised rural areas needed policy support to increase use of electric vehicles, with more purchase subsidies and charging stations. China’s high quality growth was dependent on developing advanced manufacturing clusters and upgrading traditional industries, he said. (Source: Yicai) (MNI)

ECONOMY: Manufacturing in China needs more policy support to overcome challenges from slowing exports, low profits and investment, according to an editorial from Yicai. Authorities should prioritise the creation of manufacturing clusters and encourage private investors to invest more by combining investment with public funds. Newer industries such as electric vehicles and solar panels have performed well this year, but more focus is needed on upgrading traditional industries, the paper said. The sector has faced challenges from low-tech labour intensive firms, who have been unwilling to expand investment this year. (MNI)

REGULATION: China has officially opened its new financial super regulator the National Administration of Financial Regulation (NAFR), according to the Securities Daily. Analysts interviewed said authorities can use the NAFR to deepen financial reforms and coordinate macro-control, and supervision. Regulators are now better equipped to supervise fast evolving financial technology and the digital economy, as well as protect consumer rights, the news outlet said. The NAFR will overcome the previous issue of fragmented supervision that led to regulatory vacuums and serve the real economy by eliminating regulatory arbitrage. Vice Premier He Lifeng attended the opening ceremony. (MNI)

CHINA MARKETS

PBOC Injects CNY2 Billion Via OMOs Friday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to an unchanged liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9778% at 09:44 am local time from the close of 1.7730% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday, compared with the close of 46 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0356 FRI VS 6.9967 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0356 on Friday, compared with 6.9967 set on Thursday, first break 7 since Dec 5, 2022.

OVERNIGHT DATA

NZ APR TRADE BALANCE NZ$427mn; PRIOR -NZ$1586mn

NZ APR TRADE BALANCE 12MTH YTD -NZ$16804mn; PRIOR -NZ$16762mn

NZ APR EXPORTS NZ$6.80bn; PRIOR NZ$6.28bn

NZ APR IMPORTS NZ$6.38bn; PRIOR NZ$7.87bn

JAPAN APR CPI Y/Y 3.5%; MEDIAN 3.5%; PRIOR 3.2%

JAPAN APR CPI EX FRESH FOOD Y/Y 3.4%; MEDIAN 3.4%; PRIOR 3.1%

JAPAN APR CPI EX FRESH FOOD, ENERGY Y/Y 4.1%; MEDIAN 4.2%; PRIOR 3.8%

JAPAN MAR TERTIARY INDUSTRY INDEX M/M xx%; MEDIAN 0.3%; PRIOR 0.7%

MARKETS

US TSYS: Marginally Richer In Muted Asian Session

TYM3 deals at 114-00, +0-02+, with a 0-03+ range observed on volume of ~73k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys have observed narrow ranges with little follow through in a muted Asian session. Little meaningful macro news flow crossed.

- FOMC dated OIS price ~8bps of hikes in June with a terminal rate of 5.16%, there are ~50bps of cuts priced for 2023.

- In Europe today German PPI is the highlight of an otherwise thin docket. Fedpseak from Fed Chair Powell, NY Fed President Williams and Gov. Bowman will cross.

JGBS: Futures Holding Weaker, Narrow Range, Tokyo CPI The Data Highlight Next Week

JGB futures are sitting weaker, trading in a relatively narrow range in afternoon Tokyo trade, -20 versus settlement levels.

- Apart from the April CPI, which was in line with expectations and showed the highest annual core rate since the early 1980s, there have been few significant domestic factors worth noting. The presence of strong inflationary data may lead to speculation about potential upward revisions to the BOJ's price projections. This, in turn, could redirect attention to the possibility of a monetary policy adjustment that could have implications for the bond market.

- Cash JGBs are cheaper across the curve in afternoon trade, apart from the 2-year zone which is 0.3bp richer. Yields beyond the 2-year zone are flat to 2.0bp higher with the 7-year zone leading. The benchmark 10-year yield is 1.7bp higher at 0.399%, with the 40-year yield 1.7bp higher at 1.442% ahead of next week’s auction (May 25).

- Swap rates are higher with the curve steeper and swap spreads narrower except for the 3-5-year zone.

- The economic data calendar highlight will be the release of Tokyo CPI on Friday. Ahead of that will be the release of Machine Orders (mar), Jibun Bank PMIs (May P) and weekly Investment Security flow data (May 19).

- The MoF plans to sell 10-year index-linked JGBs on Tuesday and 40-year JGBs on Thursday.

- BoJ Rinban operations covering 1-25-year JGBs is slated for Wednesday.

AUSSIE BONDS: Cheaper, Post-Jobs Data Reversal Continues

ACGBs sit near session lows (YM -10.0 & XM -10.0) as the post-employment data sell-off continues unabated. At the time of writing, futures are around 18bp lower than the post-data high, sitting at their lowest levels since March 13. Without economic data today, local participants have likely been on US tsy watch. US tsys have seen higher yield for five consecutive days.

- Cash ACGBs are 10bp higher with the 10-year yield differential +4bp at -5bp.

- Swap rates are 9-10bp higher with the 3s10s curve flatter.

- The bills strip is steeper with pricing -4 to -13.

- RBA dated OIS is 3-10bp firmer for meetings beyond June with early '24 leading. There is an 20% chance of a 25bp hike at the June meeting priced. The expected terminal rate is at 4.01%, the highest level since March 9.

- The AOFM plans to sell A$150mn of the 1.25% 21 August 2040 Indexed bond on Tuesday May 23 and A$800mn of the 3.50% 21 December 2034 bond on Wednesday May 24.

NZGBS: Post-Budget Sell-Off Continues

NZGBs closed weaker, but above the session’s worst levels, with 2- and 10-year benchmark yields 15bp and 10bp higher respectively.

- Strong demand for the May-32 bond (cover at 5.13x) at the weekly round of NZ$400mn supply likely assisted the move away from session cheaps. The cover ratio for the May-26 bond was lower at 2.43x versus 3.46x at the last auction. The May-41 bond saw a similar cover at 2.66x.

- Nonetheless, the NZGB 2-year benchmark yield sits 28bp higher in post-Budget trading with the 10-year yield 16bp higher.

- The NZ/US 10-year yield differential is 3bp wider at +77bp, compared to around 60bp at the start of the week.

- Swap rates are 10-19bp higher with the 2s10s curve 9bp flatter.

- RBNZ dated OIS has firmed 9-29bp post-Budget across meetings with early ’24 leading. 37bp of tightening is priced for next week’s RBNZ meeting. Terminal Rate expectations lift to a new cycle high of 5.92%.

- ASB now expects a 50bp hike at next week's RBNZ policy meeting.

- The local calendar is light ahead of Wednesday’s release of Retail Sales Ex-Inflation ahead of the RBNZ policy decision on the same day.

- With the global calendar light today, the markets will be on headlines watch, particularly regarding debt ceiling negotiations.

FOREX: Antipodeans, Yen Moderately Firmer In Asia

The Yen and the antipodeans are firmer in Asia on Friday, gains in AUD and NZD marginally extended as USD/CNH came off session highs. Elsewhere in G-10 ranges are narrow with little follow through on moves.

- USD/JPY is ~0.2% lower, last printing at ¥138.30/40. The pair is paring some of yesterday's gains after printing a YTD high yesterday. Early in the session Japan's April Core-Core CPI rose at its fastest annual pace since Sept 1981, core CPI and headline CPI printing in line with estimates.

- Kiwi is firmer this morning, widening rate differentials and a trade surplus in April have seen NZD/USD rise ~0.2%. The 200-Day EMA ($0.6258) presents as the first target for bulls, a break through here opens high from May 11 ($0.6385).

- AUD/USD is ~0.2% higher and we sit a touch beneath session highs. Bulls look to break the 50-Day EMA ($0.6708).

- EUR and GBP are little changed from opening levels and narrow ranges have been observed.

- Cross asset wise; e-minis are ~0.2% higher and BBDXY is a touch softer. US Treasury Yields are ~1bp across the curve.

- German PPI is the highlight of an otherwise thin calendar today.

EQUITIES: Weaker Hong Kong Tech Weighs On Risk-On Mood

Regional Asia Pac markets are mostly higher, albeit not to the same degree as implied by gains in US/EU bourses from Thursday's session. Hong Kong equities are down as well, which has likely weighed on sentiment to some degree in the region today. US equity futures have tracked mostly higher, with the tech space leading the way. Nasdaq futures last +0.22% to 13924. Eminis are ~0.14% higher, last around 4218.

- The HSI is down around 1% at this stage, although we are above earlier session lows. Carry over from weaker Alibaba sentiment in US trade on Thursday has weighed (revenue growth from the company left investors disappointed). The HS TECH index is off 1.80% at this stage.

- China shares were weaker at the open but have clawed back into positive territory, the CSI 300 last around +0.20%.

- Japan shares remain on the front foot, albeit with gains slowing somewhat. The Topix +0.10% at this stage. The Nikkei 225 is faring better, last around 0.80% higher, back to early 1990s highs.

- The Taiex (+0.40%) and Kospi (+0.80%) have both risen, on the back of better tech sentiment from Thursday's session in the US. Offshore investors have added a further $269mn to local Korean shares today.

- In SEA, Thai shares remain under pressure, down a further 0.30%, but they may find some support ahead of the 1500 level.

OIL: Brent Tracking +3% Higher For The Week On Broader Risk Appetite Boost

Brent crude is higher, back in the $76.40-50/bbl region currently. This is +0.78% above NY closing levels from Thursday, although Brent remains within ranges for the past week or so. We are tracking around 3% higher at this stage versus end levels from last week. This would be the first gain since mid April for Brent. WTI was last near $72.40/bbl, and following a similar trajectory.

- From a levels standpoint, Brent is wedged between support at $73.49 (May 15 low) and recent highs at $77.60 (May 10 high).

- Broader risk appetite has improved in the equity space through the latter part of this week, as hopes of a debt deal rise. This has aided oil sentiment, helping to offset higher US real yields and weaker sentiment emanating out of China.

- Bloomberg notes oil demand out of South Korea and Taiwan has picked up (link), which has also likely helped at the margins.

- Elsewhere reports suggest wildfires in Alberta, Canada, is taking 240k barrels per day from supply.

GOLD: At Six Week Lows, USD & US Tsys Weigh

Gold is 0.3% higher at 1963.10 in Asia-Pac trade after the metal extended its decline into a third day to the lowest level in more than six weeks on Thursday as optimism for a US debt-ceiling deal and stronger-than-expected labour market data undercut the haven.

- President Joe Biden expressed confidence that negotiators would reach an agreement to avoid a default, while House Speaker Kevin McCarthy said he remained hopeful of an accord.

- US initial jobless claims fell more than forecast last week, underlining the robustness of the labour market despite higher interest rates.

- Hawkish remarks from the Dallas Fed's Logan, who indicated support for another interest rate hike in June due to sustained high core inflation and wages, pressured US tsy yields.

- The dollar and US tsy yields extended gains, weighing further on bullion, which dropped as much as 1.3% on Thursday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2023 | 0600/0800 | ** |  | DE | PPI |

| 19/05/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/05/2023 | 1245/0845 |  | US | New York Fed's John Williams | |

| 19/05/2023 | 1300/0900 |  | US | Fed Governor Michelle Bowman | |

| 19/05/2023 | 1400/1000 | * |  | US | Services Revenues |

| 19/05/2023 | 1455/1655 |  | EU | ECB Schnabel Speech at Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 19/05/2023 | 1600/1800 |  | EU | ECB Schnabel Panels Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1900/2100 |  | EU | ECB Lagarde Video Presentation at Banco Central Brasil |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.