-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Will Scholz Get The Green To Form Traffic Light Coalition?

EXECUTIVE SUMMARY

- SCHOLZ HAS EDGE AS GERMAN ELECTION LEAVES OUTCOME UNDECIDED (BBG)

- CHINESE CITIES SEIZE EVERGRANDE PRESALES TO BLOCK POTENTIAL MISUSE OF FUNDS (FT)

- EVERGRANDE FALLOUT SPREADS BEYOND MARKETS TO WEALTHY INVESTORS (BBG)

- EVERGRANDE'S EV UNIT TERMINATES PLANS TO ISSUE RMB SHARES (RTRS)

- CHINA REPEATS IT'S TARGETING TACKLING MONOPOLIES IN DATA SECTOR (BBG)

- HAULIERS AND POULTRY WORKERS TO GET TEMPORARY UK VISAS (BBC)

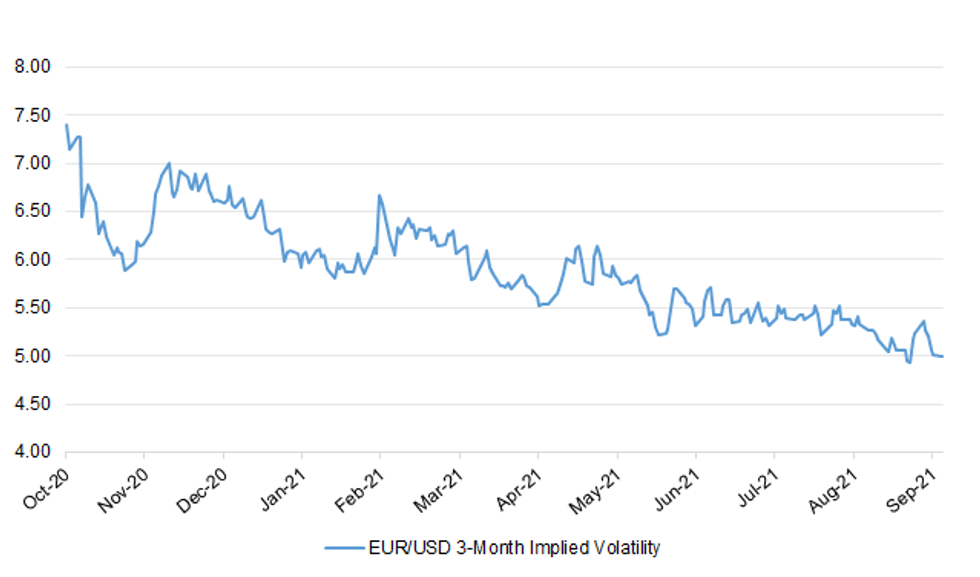

Fig. 1: EUR/USD 3-Month Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Up to 10,500 lorry drivers and poultry workers can receive temporary UK visas as the government seeks to limit disruption in the run-up to Christmas. The government confirmed that 5,000 fuel tanker and food lorry drivers will be eligible to work in the UK for three months, until Christmas Eve. The scheme is also being extended to 5,500 poultry workers. Transport Secretary Grant Shapps said it would "ensure preparations remain on track" for the festive season. But the British Chamber of Commerce said the measures were the equivalent of "throwing a thimble of water on a bonfire." And the Road Haulage Association said the announcement "barely scratches the surface... validity to Christmas Eve is not long enough from where we are." However, the news was welcomed by freight industry group Logistics UK, which called the policy "a huge step forward in solving the disruption to supply chains." (BBC)

ECONOMY: Soldiers are likely to be put on notice to drive petrol tankers to forecourts within days as motorists continue to panic buy, The Times has been told. The government is expected to tell the military to prepare hundreds of personnel to man tankers after about half of petrol stations said that they were out of fuel. The Petrol Retailers Association (PRA), which represents the majority of them in Britain, said that up to 90 per cent of its members reported having run dry. Kwasi Kwarteng, the business secretary, suspended competition laws last night to allow fuel suppliers to co-operate and ensure that petrol stations running empty were restocked. (The Times)

FISCAL: Council tax would have to rise by up to 9 per cent next year to plug gaps in the government's social care plan, local authorities have said. In the latest warning about the rising cost of living, the Local Government Association (LGA) said that to pay for social care voters faced a "double whammy" of both council tax increases and a rise in national insurance. Attacking ministers' "wholly unrealistic" plan to pay for elderly care, council chiefs said that next month's spending review must promise extra cash for the system next year. (The Times)

POLITICS/FISCAL: A Labour government would cut business rates in England and then phase them out completely, shadow chancellor Rachel Reeves will announce on Monday. The party wants to boost the High Street by axing what it views as an outdated tax that harms business. It plans a new property tax it says will shift the burden onto tech giants. Ms Reeves will tell Labour's conference in Brighton: "Labour will tax fairly, spend wisely, and get our economy firing on all cylinders." The conference has so far been dominated by a row over Sir Keir Starmer's plans to change the way leaders and MPs are selected. The Labour leader got a watered-down version of the plans passed by conference, despite fierce opposition from left-wingers. Labour's deputy leader Angela Rayner also grabbed headlines on Sunday, when she said she would not apologise for branding Boris Johnson "scum" until the prime minister retracted past comments she described as homophobic, racist and misogynistic. On Monday, Ms Reeves will attempt to shift the focus on to policy. (BBC)

BREXIT: Threats by the UK to trigger Article 16 of the Northern Ireland Protocol "are not helpful", Irish EU Commissioner Mairead McGuinness has said. The UK's Brexit Minister Lord Frost said it would be a "significant mistake" to think the UK would not trigger Article 16. Ms McGuinness said the agreement would "not be renegotiated". Article 16 is the part of the Northern Ireland Protocol which allows parts of the deal to be temporarily set aside. It can be done on the condition that they are causing "serious economic, societal or environmental difficulties that are liable to persist, or to diversion of trade". (BBC)

SCOTLAND: Downing Street has told ministers to stop talking about Scottish independence for fear it makes Westminster sound needy and plays into the hands of nationalists. In a private edict, government ministers have been told not to engage with the SNP or proactively make the case for the Union. They were advised to take a show-not-tell approach of prioritising policies that will benefit the UK and ensuring that civil servants and ministers think about the impact of decisions north of the border. (The Times)

EUROPE

GERMANY: Olaf Scholz of the Social Democrats inched ahead of Chancellor Angela Merkel's conservatives in an unprecedentedly tight German election which is still to decide who will lead Europe's biggest economy. Scholz's SPD, the front-runner over the final weeks of the campaign, took 25.7% of the vote on Sunday, while the Christian Democrats under Armin Laschet got 24.1%, according to provisional results of the official federal tally. Both men said they aim to head the country's next government. (BBG)

GERMANY: Voters in the German capital have backed a proposal for the Berlin regional government to take over nearly 250,000 apartments worth billions from corporate owners to curb rising rents. A nearly complete count of Sunday's referendum showed 56.4% of voters in favor of the measure, and 39% opposed. The non-binding referendum forces the Berlin government to consider consider expropriating big landlords in a radical move to cool one of Germany's hottest real estate markets, where rents have become unaffordable for many residents in recent years. (AP)

ITALY/BTPS: The Italian Treasury plans to launch three new conventional government bonds, or BTPs, in the fourth quarter of 2021, it said in its quarterly guidance on Friday. The new bonds will have maturity dates of December 2024, February 2029 and June 2032, respectively, the Treasury said. It targets minimum final final outstanding of 9 billion euros ($10.56 billion) for the 2024-dated BTP, and EUR10 billion for each of the 2029- and 2032-dated BTPs. The minimum final outstanding is the overall issuance volume a bond has to reach before it is replaced by a new benchmark. New bonds, in addition to the announced ones, could also be issued during the quarter, subject to market conditions, the Treasury said. (Dow Jones)

SPAIN: Catalan independence leader Carles Puigdemont said he will continue to travel across Europe even after he was arrested in Italy earlier this week. "I will continue traveling across Europe explaining" the case for independence for Catalonia, the region in north eastern Spain that includes Barcelona, Puigdemont said at a press conference Saturday in Sardinia. Because Europe has a "strong and independent" judiciary he continues to be free from the "persecution" of Spanish courts, he said. (BBG)

SWITZERLAND: Switzerland is set to allow same-sex couples to marry, 20 years after the Netherlands became the first country to do so, according to a trend projection for Sunday's ballot by the national broadcaster. About two-thirds of Swiss voters backed liberalization of the marriage law, SRF said. Polls had signaled that public support for the change was broad based. (BBG)

RATINGS: Rating reviews of note from Friday include:

- Fitch affirmed Belgium at AA-; Outlook changed to Stable from Negative

- Fitch affirmed Cyprus at BBB-; Outlook Stable

- Moody's upgraded Hungary to Baa2; Outlook Stable

- DBRS Morningstar confirmed the European Union at AAA, Stable Trend

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

U.S.

FED: Restaurant and hotel owners struggling to fill jobs. Supply-chain delays forcing up prices for small businesses. Unemployed Americans unable to find work even with job openings at a record high. Those and other disruptions to the U.S. economy — consequences of the viral pandemic that erupted 18 months ago — appear likely to endure, a group of business owners and nonprofit executives told Federal Reserve Chair Jerome Powell on Friday. The business challenges, described during a "Fed Listens" virtual roundtable, underscore the ways that the COVID-19 outbreak and its Delta variant are continuing to transform the U.S. economy. Some participants in the event said their business plans were still evolving. Others complained of sluggish sales and fluctuating fortunes after the pandemic eased this summer and then intensified in the past two months. "We are really living in unique times," Powell said at the end of the discussion. "I've never seen these kinds of supply-chain issues, never seen an economy that combines drastic labor shortages with lots of unemployed people. ... So, it's a very fast changing economy. It's going to be quite different from the one (before)." (Fortune)

FED: MNI INTERVIEW: Kashkari Says He's Rate-Hike Holdout in Dots

- Minneapolis Fed President Neel Kashkari told MNI Friday he's the lone FOMC official who prefers holding interest rates near zero into 2024 because in his view it will take longer to restore maximum employment, while backing Chair Jerome Powell's view on tapering bond purchases. "Yes, that is me," Kashkari said in a phone interview when asked if he's the single person to pencil unchanged rates for 2023 into the FOMC's dot plot published Wednesday. "I anticipate the first raise in 2024" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Kashkari Sees 'Neutral' Policy Being Restored

- Minneapolis Fed President Neel Kashkari told MNI Friday the Federal Reserve should be able to restore normal interest rates and balance sheet assets in this cycle, but shifts in the economy's foundations mean normalcy won't quite look the same as before the pandemic struck. While the Fed can unwind assets it bought under quantitative easing, Kashkari said the proper size of balance sheet will grow over time along with demand for U.S. dollars from the global economy and the banking system - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: House Speaker Nancy Pelosi pledged to pass a $550 billion infrastructure bill this week and signaled that the headline amount on a bigger package of spending and tax measures will be lowered from $3.5 trillion. In a nod to moderate Democrats eager to enact the roads-and-bridges bill, Pelosi said in a letter to caucus members that she'll open debate on the Senate-passed measure Monday and put it to a vote on Thursday. "Well, let me just say we're going to pass the bill this week," she said on ABC's "This Week" earlier Sunday. (BBG)

FISCAL: Two of the nine House centrists who demanded Speaker Nancy Pelosi (D-Calif.) bring the $1.2 trillion bipartisan infrastructure bill to the floor by Monday are now publicly promising to vote for the separate $3.5 trillion budget reconciliation package, Axios has learned. By explicitly announcing their support for a big package targeting climate change and expanding the social safety net, Reps. Vicente Gonzalez (D-Texas) and Filemon Vela (D-Texas) are trying to convince progressives to vote for the infrastructure bill this week. (Axios)

FISCAL: MNI BRIEF: US Treasury Has $70B in Extraordinary Measures Left

- The Treasury Department Friday released a report giving a detailed accounting of marketable debt, showing that most of the space from its "extraordinary measures" has already been used. The summary of debt balances shows the agency has used USD234 billion of the USD304 in authorized extraordinary measures as of September 22, with USD70 billion in headroom remaining. Once Treasury has utilized all of the emergency borrowing authority, only two sources will remain from which to continue funding government operations, including remaining cash on hand, which stands at USD174 billion as of September 23, and daily federal revenues received each day - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The number of people dying with Covid-19 in U.S. hospitals appears to have peaked, the latest sign of reprieve after the delta variant fueled record spikes in infections in some states. (BBG)

CORONAVIRUS: Parts of the U.S. health system "are in dire straits," as the spread of the Covid-19 delta variant forces some states to prepare for rationed medical care, said Rochelle Walensky, head of the U.S. Centers for Disease Control and Prevention. "That means that we are talking about who is going to get a ventilator, who is going to get an ICU bed," Walensky said on CBS's "Face the Nation" on Sunday. "Those are not easy discussions to have, and that is not a place we want our health care system to ever be." Idaho, among the U.S.'s least-vaccinated states, and Alaska have said that hospitals can begin to ration medical care if needed. A major hospital in Montana also implemented so-called "crisis of care standards" to prioritize who is treated. Health officials warned the measure could be widened across the state. (BBG)

CORONAVIRUS: A requirement for New York City school teachers and staff to get vaccinated for COVID-19 was temporarily blocked by a U.S. appeals court just days before it was to take effect, but the court on Saturday set a hearing on the matter for next week. (RTRS)

CORONAVIRUS: Pfizer Inc. will submit data to the U.S. Food and Drug Administration on vaccines for children ages 5 to 11 within "days, not weeks," Albert Bourla, the company's CEO, said on ABC's "This Week." "If they approve it, we will be ready with our manufacturing to provide this new formulation of the vaccine," he said. He said the dosage for young children is one-third that of the vaccine for adults. Last week Pfizer and BioNTech said that formulation produced strong antibody responses in children in a large-scale trial. The companies also plan to share the data with regulators in Europe. (BBG)

CORONAVIRUS: Dr. Rochelle Walensky, director of the Centers for Disease Control and Prevention, insisted Friday she didn't overrule a vaccine advisory committee by expanding the CDC's approval of Pfizer's Covid boosters to include a proposal rejected by the panel. In an unusual move, Walensky broke from the CDC's Advisory Committee on Immunization Practices, which voted 9-6 on Thursday against authorizing vaccines for those in high-risk transmission environments. (CNBC)

BONDS: The US Securities and Exchange Commission has given bond brokers a three-month reprieve to get in line with amendments to a 50-year-old rule that are set to come into effect next week, after banks, asset managers and trade lobbies fretted the changes could bring trading in large swaths of the market to a halt. Bond bankers and trading platforms had been left scrambling in recent weeks to get up to speed with SEC rule 15c2-11, which was first introduced in 1971. The rule was put in place to protect retail investors from predatory schemes in penny stocks by requiring dealers to check that an array of financial information was up to date on each company for which they quoted stock prices. The rule never explicitly exempted bond trading, but in practice had never been applied to the fixed-income market. Many traders — and even some SEC commissioners — had believed it solely pertained to the stock market. (FT)

OTHER

GLOBAL TRADE: The head of one of Asia's biggest ocean shipping companies has warned that governments may need to intervene to "restore order" to a global logistics market tormented by chronic delays, supply chain disruption and record container rates. In an interview with the Financial Times, Takeshi Hashimoto, president of Mitsui OSK Lines, which is part of Ocean Network Express, one of the world's biggest shipping alliances, said that the industry had miscalculated how long the disorder of the coronavirus pandemic would last. While some shipping companies had predicted normalisation early next year after the initial shock of the crisis, Mitsui has recently extended its forecast to the end of 2022. (FT)

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen, in a call on Friday with French Finance Minister Bruno Le Maire, stressed the importance of reaching a compromise on the withdrawal of digital services taxes, the Treasury Department said in a statement. Yellen also conveyed appreciation for Le Maire's dedication to the effort of reforming the global tax system, the statement said. (RTRS)

GEOPOLITICS: A diplomatic row between China and the West appears to be ending, after the release of two Canadians held in China and a Chinese tech executive in Canada. Huawei executive Meng Wanzhou, arrested on a US warrant in 2018, left Canada on Friday in a deal with US prosecutors. Hours later it was announced that Michael Spavor and Michael Kovrig, accused of espionage by China in the same year, were flying home to Canada. (BBC)

GEOPOLITICS: British navy frigate, HMS Richmond, sails through Taiwan Strait Monday en route to Vietnam, according to statement from the vessel via its Twitter account. Taiwan's defense minister says the military is monitoring and is on top of the situation of ships passing through the strait. (BBG)

CORONAVIRUS: The World Health Organization is reviving its investigation into the origins of the Covid-19 virus by building a new team of about 20 scientists, the Wall Street Journal reported Sunday. The previous team, which had been disbanded after a visit to Wuhan, had said data provided by Chinese scientists was insufficient to reach a conclusion. Members of the new team will be chosen by the end of this week, and the team's "priority needs to be data and access in the country where the first reports were identified," WHO officials told the Journal. The Chinese government declined to say if the new team will be allowed to enter the country. (BBG)

CORONAVIRUS: French President Emmanuel Macron said France will double the number of vaccine doses it donates to poorer countries to 120 million. "The injustice is that in other continents vaccination is far behind because of us, collectively," Macron said in a message broadcast during the Global Citizen fundraising concert in Paris. France will also commit to helping UNICEF and health systems with vaccine distribution, Macron said, noting that only 3% of Africa's population is vaccinated. (BBG)

JAPAN: Taro Kono is the favorite to become the next leader of Japan's ruling Liberal Democratic Party and effectively the next prime minister, a poll by Nikkei and TV Tokyo shows. The opinion poll, conducted Thursday to Saturday, shows 46% of respondents picked Kono, the vaccination minister, as the "most suitable person"; to succeed outgoing LDP President and Prime Minister Yoshihide Suga. Former LDP policy chief Fumio Kishida was second with 17% and former Internal Affairs Minister Sanae Takaichi was third with 14%. The LDP's executive acting Secretary-General Seiko Noda was fourth with 5%. The four candidates will face off in the LDP presidential race on Wednesday. The election will count votes from lawmakers in the Diet, as well as other ballots from party members and supporters nationwide. If no candidate receives a majority, the two front-runners will head into a runoff. (Nikkei)

JAPAN: None of the 4 candidates in the ruling Liberal Democratic Party leadership race is expected to win a majority in the first round, Japan's public broadcaster NHK reports, citing its analysis. Taro Kono, Fumio Kishida, Sanae Takaichi and Seiko Nodaare campaigning for a total of 764 votes, half coming from lawmakers and another half from rank-and-file party members Kishida seen winning ~30% of lawmaker votes, Kono ~25% and Takaichi ~20%; Noda is supported by ~20 lawmakers. (BBG)

JAPAN: The Japanese government is making final arrangements to lift all coronavirus states of emergency in the nation as scheduled at the end of this month, the Asahi newspaper reported Monday, citing several unidentified officials. Prime Minister Yoshihide Suga plans to hold a meeting with relevant ministers later today to set the administration's direction, the report said. The government will then consult an expert panel Tuesday to officially decide an end to the emergencies in all 19 prefectures, including Tokyo and Osaka, according to the Asahi. (BBG)

JAPAN: Tokyo is considering keeping some restrictions on bars and restaurants serving alcohol even if the state of emergency is lifted at end-Sept., broadcaster FNN reports, citing an unidentified person. May ask restaurants to stop serving alcohol by 7pm and close by 8pm; plans to decide the length of measures considering the virus situation. Tokyo is concerned that immediate lifting of all restrictions could lead to resurgence in cases. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison said state premiers must not keep borders closed once agreed Covid-19 vaccination targets are reached. "We can't stay in second gear," he said on a Sunday morning television program. "We've got to get to top gear in living with the virus." State governments where Covid-19 cases are low, such as Queensland and Western Australia, have been reluctant to open their borders. Morrison says that will need to change when fully-vaccinated rates reach 80%, which he expects to happen before the end of the year. "I can't see any reason why Australians should be kept from each other," the leader said. "And so that puts a heavy, heavy responsibility on those who would seek to prevent that from happening." (BBG)

AUSTRALIA: The Australian government will assist in arranging flights home for its citizens stranded overseas once 80% of eligible residents are fully vaccinated, Prime Minister Scott Morrison said. "The caps at the airports for vaccinated Australians to return will be lifted," the prime minister said in Washington after talks with leaders from U.S., Japan and India. Morrison said he expects Australia's biggest airline, Qantas Airways Ltd., to ramp up its number of flights once restrictions are lifted. (BBG)

AUSTRALIA: New South Wales has unveiled how it will fully reopen its state after months of lockdowns to curb its Delta outbreak, with freedoms substantially staggered for unvaccinated residents to re-engage with society. Having already unveiled freedoms residents will be able to enjoy once the state achieves 70% double dose vaccination, the premier, Gladys Berejiklian, on Monday confirmed that this was likely to be achieved within a fortnight, meaning lockdowns will end for vaccinated people from 11 October. NSW's reopening will be split into three stages: 70% vaccination coverage, 80% vaccination coverage, and a third and final stage of reopening, set for 1 December. While only those who are vaccinated will be eligible for the first and second stages of reopening, unvaccinated residents will enjoy the same level of freedom as vaccinated people from 1 December. (Guardian)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern says a small pilot program will begin soon to trial self-isolation for returning international travelers. Says self-isolation is an alternative to managed isolation, allowing people to isolate at home for 14 days. Pilot to be capped at 150 people and focus on businesses and employees who are required to travel internationally for work. (BBG)

SOUTH KOREA: South Korea reported 2,383 new cases after hitting a record of 3,272 on Saturday. Health authorities expect infections to rise sharply from the middle of this week in the aftermath of the Chuseok holiday. The government is set to announce a plan Monday afternoon to vaccinate those aged 12 to 17 and to give booster shots for the elderly. (BBG)

SOUTH KOREA: South Korea plans to unveil additional measures next month to curb household debts, the head of the financial regulator said Monday. Financial Services Commission (FSC) Chairman Koh Seung-beom said such measures will focus on improving ways of calculating a household's ability to repay debts. Koh said the government will continue to take stricter measures to rein in household debts, calling such debts the "biggest potential risk" on the nation's economy. (Yonhap)

SOUTH KOREA: The Bank of Korea said the nation's jobless rate was probably higher than official estimates during the pandemic because the survey failed to capture people who were willing to work, but unable to hunt for employment. South Korea's central bank said the actual jobless rate from March 2020 to August this year could've been an average 0.29 percentage point higher than reported, once those who stayed out of the labor market due to quarantine, childcare requirements, delay in interviews and other Covid-related reasons are factored in. The BOK reckons last month's record-low 2.8% rate could in fact have been as high as 3.7%, when accounting for discouraged workers, according to the analysis released Monday. (BBG)

NORTH KOREA: North Korea remained unresponsive to South Korea's calls via liaison and military hotlines Monday despite cautious optimism created after the sister of North Korean leader Kim Jong-un said the two Koreas could discuss improvements in long-strained relations. "North Korea did not answer our opening call through the South-North joint liaison office at 9 a.m.," a unification ministry official said. A military official also said a call via the military hotline went unanswered. Kim Yo-jong, the powerful sister of the North Korean leader, issued two statements last week in which she said the two Koreas could discuss improvement in inter-Korean relations, reestablishment of the Kaesong liaison office and even a summit on conditions that Seoul drops its double-standard and hostile attitudes against it. (Yonhap)

TURKEY: Turkey's president has said he would consider buying a second Russian missile system in defiance of strong objections by the United States. In an interview with American broadcaster CBS News, President Recep Tayyip Erdogan said Turkey would have to decide its defense systems on its own. Speaking to correspondent Margaret Brennan in New York this past week, Erdogan explained that Turkey wasn't given the option to buy American-made Patriot missiles and the U.S. hadn't delivered F-35 stealth jets despite a payment of $1.4 billion. Erdogan's comments came in excerpts released in advance of the full interview being broadcast Sunday. (BBG)

BRAZIL: Brazilian Senator Angelo Coronel, the rapporteur of income tax reform bill, is considering a further tax hike in the so-called FinancialCompensation for the Exploitation of Mineral Resources, Folha de S.Paulo newspaper reports, citing an interview with the lawmaker. Proposal raises from 4% to 5.5% the tax rate on exploitation of products such as iron, copper, bauxite and gold. Coronel told Folha that mining companies pay less taxes in Brazil than in other countries. Rapporteur also studies changes in dividends and corporate income tax rates, according to the media outlet. (BBG)

SOUTH AFRICA: The more infectious nature of the delta mutation of the coronavirus has seen it almost completely displace the beta variant in South Africa, the discovery of which led to widespread travel bans. A study, released by two South African genomics institutes on Sept. 23, showed that the delta variant, first identified in India, drove a third wave of infections in the country. "The dominance of delta was consistently observed through increased genomic surveillance during the third wave, with the detection of beta drastically decreasing to almost none in the last weeks," the scientists said in the report. (BBG)

IRAN: Iran has failed to fully honour the terms of a deal struck with the U.N. nuclear watchdog two weeks ago allowing inspectors to service monitoring equipment in the country, the watchdog said on Sunday. Iran allowed International Atomic Energy Agency inspectors to replace memory cards in most of the equipment, as agreed on Sept. 12, the IAEA said. But it did not allowed that to happen at a workshop that makes centrifuge components at the TESA Karaj complex, the watchdog added. "The (IAEA) Director General (Rafael Grossi) stresses that Iran's decision not to allow Agency access to the TESA Karaj centrifuge component manufacturing workshop is contrary to the agreed terms of the Joint Statement issued on 12 September," the IAEA said. (RTRS)

IRAN: Russian Foreign Minister Sergei Lavrov called on the Biden administration to be "more active" in resolving disputes with Iran by removing sanctions that were "unlawfully" applied. The U.S. has criticized the new Iranian government for taking its time in returning to nuclear talks, but Lavrov said the U.S. -- which withdrew from the agreement under former U.S. President Donald Trump -- shouldn't be complaining about Iranian delays. (BBG)

IRAN: Iran's Islamic Revolutionary Guard Corps said it contained a fire at one of its research centers in western Tehran, according to a statement on the Guard's official website, Sepah News. Three people were injured and taken to the hospital after the fire erupted on Sunday evening, the statement added. There were no details about what caused the incident. The Guard described the facility as a "self-sufficiency research center" without explaining more about its purpose or location. (BBG)

CHINA

CREDIT: At least two local governments in China have taken control of sales revenue from Evergrande properties, even as Beijing remained silent about the unfolding liquidity crisis at the world's most indebted developer and investors braced for more missed bond payments In a circular issued on Wednesday and seen by the Financial Times, the Nansha District housing and urban-rural construction bureau in the southern city of Guangzhou asked an Evergrande subsidiary to put presale revenue from Sunshine Peninsula, a stalled residential development, into a state-controlled custodial account so that "homebuyers' interest can be protected and project construction continues". Another district housing bureau in Zhuhai, a southern city neighbouring Macau, asked an Evergrande residential project this month to transfer sale proceeds into a government account, according to people with knowledge of the matter. (FT)

CREDIT: Tens of thousands of Chinese households risk being sucked into the spectacular unraveling of China Evergrande Group after the embattled developer missed payments on investment funds sold through shadow banks, which have funneled billions into its construction projects. Some of these lenders, known as trusts, have already dipped into their own pockets to repay wealthy investors on Evergrande's behalf, according to people familiar with the matter. Others are negotiating payment extensions with Evergrande, said the people, asking not to be identified discussing private matters. It's not clear how much of the funds are in arrears and there's no evidence that trusts are passing payment delays on to customers who bought fixed-income products tied to Evergrande. (BBG)

CREDIT: The impact from a China Evergrande Group (CC) credit event on rated Chinese construction issuers will be manageable because they have limited exposure to Evergrande, Fitch Ratings says. The scale advantage of Fitch-rated engineering and construction (E&C) companies mitigates their risk of a single customer default or project failure incident. That said, E&C companies with material exposure to housing projects and property development business may be affected in the unlikely event that a default disrupts the broader property market. (Fitch)

EQUITIES: China Evergrande's electric car unit said on Sunday it will not proceed with plans to issue RMB shares on the Science and Technology Innovation Board of the Shanghai stock exchange. In a statement to the Hong Kong stock exchange, China Evergrande New Energy Vehicle Group said that after careful consideration the company and Haitong Securities had agreed to terminate the agreement to issue RMB shares. On Friday, China Evergrande New Energy Vehicle Group warned it faced an uncertain future unless it got a swift injection of cash, the clearest sign yet that the property developer's liquidity crisis is worsening in other parts of its business. (RTRS)

POLICY: Rule of law on the internet industry is necessary for China's digital economy, Sheng Ronghua, vice minister of Cyberspace Administration of China, says at the World Internet Conference in the eastern town of Wuzhen. China will further curb "disordered expansion" of capital in the digital economy, Sheng says, without elaboration. (BBG)

YUAN: The yuan's weakening in August didn't necessarily spell the end of the currency's current round of rally, Guan Tao, the chief global economist of BoC International and a former forex official, wrote in a column published by the 21st Century Business Herald. The yuan's movement may become more unpredictable as it gets more closely linked to asset prices, and the exchange rate will fluctuate more in excess, Guan wrote. The yuan has become more like a mature currency as the exchange gets more market-based, and its gains or losses are no longer simply tied to trade surpluses, wrote Guan. The yuan's recent round of appreciation was also not tied to the banks' exchange settlements, including those done on behalf of their clients, Guan wrote. (MNI)

ECONOMY: China's consumption will continue to recover steadily in October and the annual retail sales is expected to total CNY44 trillion, a gain of 12.5% y/y or about 8% over 2019 before the pandemic, the Securities Daily reported citing an official from the Ministry of Commerce. The ministry will promote consumption in the upcoming week-long holiday in October as well as the year-end sales season, the daily said citing Wang Bin, deputy director of the Department of Consumption Promotion. The ministry will stabilize the sales of big-ticket items including automobiles, home appliances and furniture as well as catering, which account for one-fourth of retail sales, mainly by encouraging the replacement of old products and expand the consumption of used cars, the daily cited Wang as saying. (MNI)

ECONOMY: China may be diving head first into a power supply shock that could hit Asia's largest economy hard just as the Evergrande crisis sends shockwaves through its financial system. The crackdown on power consumption is being driven by rising demand for electricity and surging coal and gas prices as well as strict targets from Beijing to cut emissions. It's coming first to the country's mammoth manufacturing industries: from aluminum smelters to textiles producers and soybean processing plants, factories are being ordered to curb activity or -- in some instances -- shut altogether. Almost half of China's 23 provinces missed energy intensity targets set by Beijing and are now under pressure to curb power use. Among the worst hit are Jiangsu, Zhejiang and Guangdong -- a trio of industrial powerhouses that account for nearly a third of China's economy. (BBG)

OVERNIGHT DATA

JAPAN AUG PPI SERVICES +1.0% Y/Y; MEDIAN +1.2%; JUL +1.1%

CHINA MARKETS

PBOC INJECTS NET CNY100 BLN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY100 billion via 14-day reverse repos with the rate unchanged at 2.35% on Monday. The operations lead to a net injection of CNY100 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.0352% at 09:26 am local time from the close of 1.9622% on Sunday.

- The CFETS-NEX money-market sentiment index closed at 43 on Sunday vs 42 on Sep. 24.

PBOC SETS YUAN CENTRAL PARITY AT 6.4695 MON VS. 6.4599 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4695 on Monday, compared with the 6.4599 set on Friday.

CHINA CFETS YUAN INDEX UP 0.07% IN WEEK OF SEPTEMBER 24

The CFETS Weekly RMB Index was 99.09 last Friday, September 24, compared with 99.02 in the week as of September 17. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has risen 4.48% this year, when compares to 94.84 on Dec. 31, 2020.

MARKETS

SNAPSHOT: Will Scholz Get The Green To Form Traffic Light Coalition?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 32.94 points at 30216.72

- ASX 200 up 39.377 points at 7382

- Shanghai Comp. down 47.123 points at 3565.944

- JGB 10-Yr future up 2 ticks at 151.64, yield down 0.9bp at 0.051%

- Aussie 10-Yr future unch. at 98.570, yield down 0.5bp at 1.4%

- US 10-Yr future up 0-03+ ticks at 132-04, yield down 0.69bp at 1.444%

- WTI crude up $0.88 at $74.86, Gold up $8.23 at $1758.64

- USD/JPY down 16 pips at Y110.57

- SCHOLZ HAS EDGE AS GERMAN ELECTION LEAVES OUTCOME UNDECIDED (BBG)

- CHINESE CITIES SEIZE EVERGRANDE PRESALES TO BLOCK POTENTIAL MISUSE OF FUNDS (FT)

- EVERGRANDE FALLOUT SPREADS BEYOND MARKETS TO WEALTHY INVESTORS (BBG)

- EVERGRANDE'S EV UNIT TERMINATES PLANS TO ISSUE RMB SHARES (RTRS)

- CHINA REPEATS IT'S TARGETING TACKLING MONOPOLIES IN DATA SECTOR (BBG)

- HAULIERS AND POULTRY WORKERS TO GET TEMPORARY UK VISAS (BBC)

BONDS: Off Lows

Core fixed income was fairly insulated from today's rally in crude (WTI & Brent trade over $1.00 above their respective settlement levels at typing), outside of the early and limited foray lower. As we mentioned earlier, the German federal election avoided the formation of coalition between the 3 left parties, which would have provided the biggest policy shock out of the potential outcomes, which is perhaps supporting the space. Perhaps some fiscal uncertainty in DC is also playing into the mix.

- This allowed Tsys to move off of their early lows, with T-Notes +0-04 at 132-04+, while cash Tsys run little changed to 1.0bp richer across the curve. U.S. Tsy supply is front-loaded this week, with 2s and 5s set for auction on Monday, while 7s will be auctioned on Tuesday. Monday will also see Fedspeak from Brainard, Williams & Evans, in addition to prelim durable goods data for Aug.

- Morning trade saw JGB futures bounce ahead of the previously outlined technical support level (151.49) after a retest of the overnight low, with the contract last +1 vs. settlement, fully unwinding the overnight weakness. Cash JGBs are little changed to ~1.0bp richer out to 20s, while 30s and 40s are marginally cheaper on the day, perhaps facing some headwinds ahead of tomorrow's 40-Year JGB supply. Local news flow continues to fixate on the upcoming LDP Party leadership election (with reports suggesting that the first round may not result in a majority winner) and COVID (with reports pointing to all related state of emergencies being lifted come the end of this month).

- ACGBs mimicked the broader moves in global core FI markets. A piece from Westpac chief economist Bill Evans is being re-circulated early this week. The piece, which was initially published on Friday, suggested that the Australian government should realign the RBA's inflation target to 1-3% to be consistent with other central banks. YM last +0.5, XM +1.0.

EQUITIES: Positive Start

A mostly positive start to the week for equity markets in Asia, most major indices in the black alongside a rally in the commodity complex. The CSI 300 and the Hang Seng lead the way higher, though the Shanghai and Shenzen Comp's have struggled thanks to a drag from Evergrande. The firm remains silent on its $83m dollar bond interest payment that was due last Thursday, while another real estate firm Sunac has sought help from local authorities. In the US futures are higher, US House Speaker Pelosi pledged to pass a $550bn infrastructure bill this week. Focus in the coming week turns to a speech from FOMC Chair Powell, the fallout from the German election uncertainty, MNI Chicago Business Barometer data as well as the ISM and University of Michigan releases.

GOLD: Softer USD Lends Support

Gold trades higher early this week, with the softer DXY aiding the bid after Friday's pre-NY sell off halted just above Thursday's low, leaving the previously outlined technical picture intact. Spot last deals the best part of $10/oz firmer on the day, just shy of $1,760/oz. Last week's low ($1,738.0/oz) protects the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). While initial resistance is located at the Sep 22 high ($1,787.4/oz). A slew of Fedspeak, as well as the latest U.S. PCE and m'fing ISM surveys will garner most of the attention on the part of participants this week.

OIL: WTI Topples $75/bbl Handle

Oil continued to firm in Asia-Pac trade on Monday, adding to Friday's gains. WTI futures rose above $75/bbl for the first time since July, overcoming a key bull trigger at $74.23. Brent now within less than a dollar from $80/bbl, focus shifts to the OPEC+ gathering next week for their next move on output.

- Primary drivers remain the expected tightness of the energy market across Winter, with a number of sell-side firms flagging the risks to prices should a colder-than-expected season drive energy demand and thereby prices higher.

FOREX: Commodity Related Currencies Bid

Risk tone was constructive in the Asia-Pac session as Evergrande worries take a back seat, this saw the greenback give back some of Friday's gains. AUD was top of the G10 pile after the NSW Premier said October 11 was the provisional date for a substantial loosening of restrictions while a rally across the commodity complex also helped support. The move helped support NZD which saw a more muted move higher, PM Ardern said New Zealand would start a small self-isolation pilot for business travellers soon.

- JPY strengthened as USD retreated; In Japan local news flow continues to fixate on the upcoming LDP Party election (with reports suggesting that the first round may not result in a majority winner) and COVID (with reports pointing to all related state of emergencies being lifted come the end of this month).

- USD/CAD is lower as CAD gets an extra boost from the gain in oil prices, both WTI and Brent up by almost 1.5% so far on Monday.

- EUR holding steady despite German political gridlock, GBP has recovered some early losses, there are some jitters surrounding the evolving fuel issues in the UK. The local press has suggested that UK PM Johnson will enlist the help of the military to deliver fuel in the coming days, after panic buying has resulted in fuel shortages

- Focus in the coming week turns to a speech from FOMC Chair Powell, the fallout from the German election uncertainty, MNI Chicago Business Barometer data as well as the ISM and University of Michigan releases.

FOREX OPTIONS: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-65(E1.3bln), $1.1800(E685mln)

- USD/JPY: Y109.85-00($1.1bln)

- GBP/USD: $1.3740-50(Gbp564mln)

- AUD/USD: $0.7330-40(A$630mln)

- USD/CAD: C$1.2875($750mln)

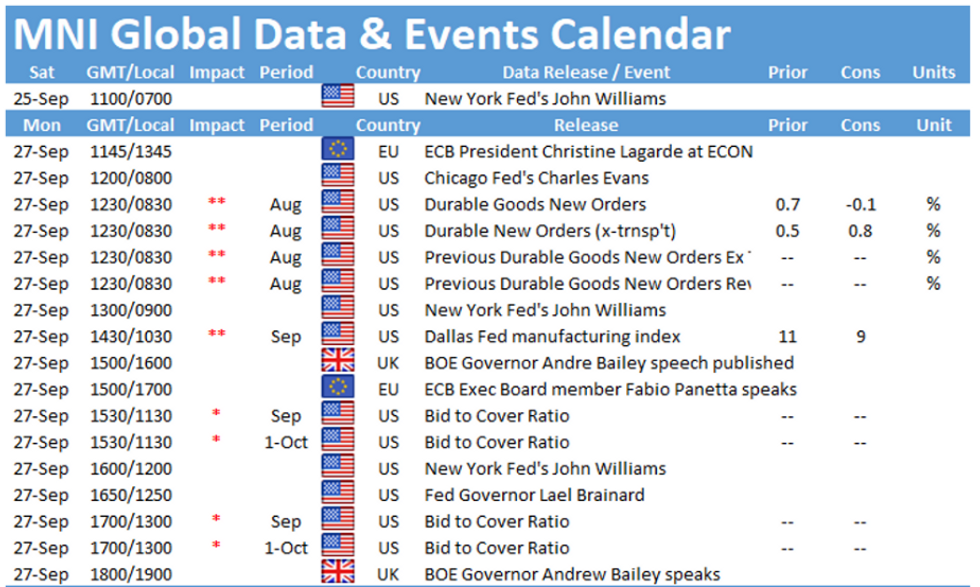

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.