-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: Commodity-Tied FX Leads Overnight

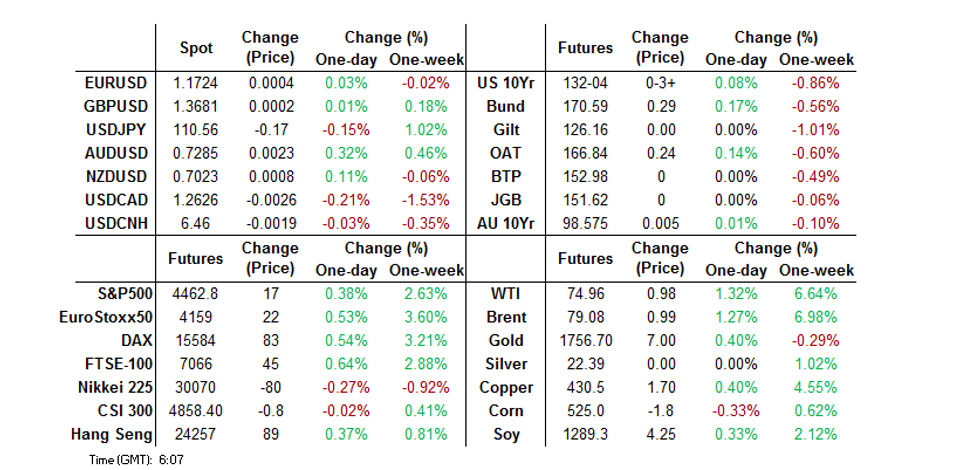

- The German Election saw the SPD win the greatest % of votes, with a 'traffic light' coalition seemingly the most likely outcome when it comes to government formation.

- General USD weakness was apparent in Asia-Pac hours, which allowed both oil & gold to push higher.

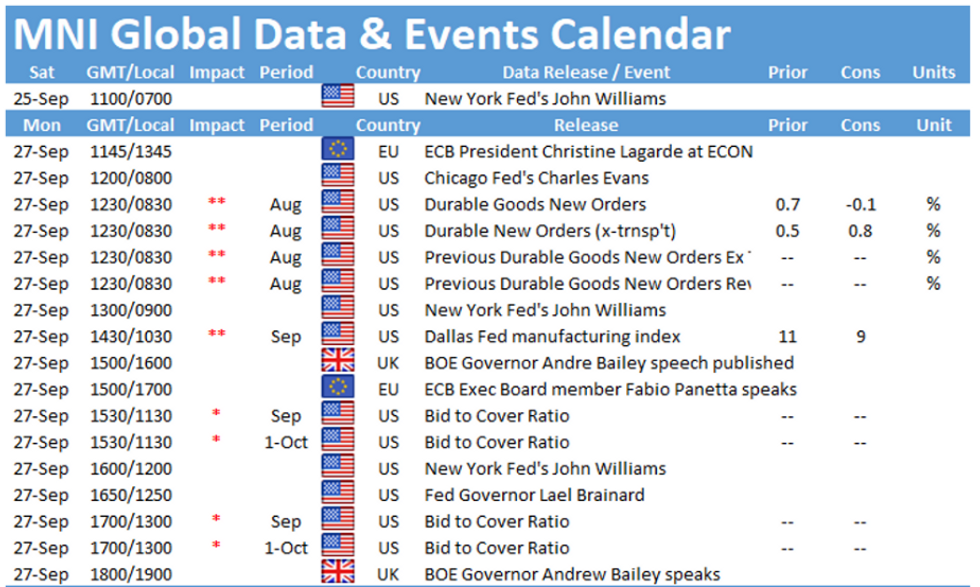

- Central bank speak from Fed's Williams, Brainard & Evans will cross on Monday, as will comments from ECB President Lagarde & BoE Governor Bailey.

BONDS: Off Lows

Core fixed income was fairly insulated from today's rally in crude (WTI & Brent trade over $1.00 above their respective settlement levels at typing), outside of the early and limited foray lower. As we mentioned earlier, the German federal election avoided the formation of coalition between the 3 left parties, which would have provided the biggest policy shock out of the potential outcomes, which is perhaps supporting the space. Perhaps some fiscal uncertainty in DC is also playing into the mix.

- This allowed Tsys to move off of their early lows, with T-Notes +0-04 at 132-04+, while cash Tsys run little changed to 1.0bp richer across the curve. U.S. Tsy supply is front-loaded this week, with 2s and 5s set for auction on Monday, while 7s will be auctioned on Tuesday. Monday will also see Fedspeak from Brainard, Williams & Evans, in addition to prelim durable goods data for Aug.

- Morning trade saw JGB futures bounce ahead of the previously outlined technical support level (151.49) after a retest of the overnight low, with the contract last +1 vs. settlement, fully unwinding the overnight weakness. Cash JGBs are little changed to ~1.0bp richer out to 20s, while 30s and 40s are marginally cheaper on the day, perhaps facing some headwinds ahead of tomorrow's 40-Year JGB supply. Local news flow continues to fixate on the upcoming LDP Party leadership election (with reports suggesting that the first round may not result in a majority winner) and COVID (with reports pointing to all related state of emergencies being lifted come the end of this month).

- ACGBs mimicked the broader moves in global core FI markets. A piece from Westpac chief economist Bill Evans is being re-circulated early this week. The piece, which was initially published on Friday, suggested that the Australian government should realign the RBA's inflation target to 1-3% to be consistent with other central banks. YM last +0.5, XM +1.0.

FOREX: Commodity Related Currencies Bid

Risk tone was constructive in the Asia-Pac session as Evergrande worries take a back seat, this saw the greenback give back some of Friday's gains. AUD was top of the G10 pile after the NSW Premier said October 11 was the provisional date for a substantial loosening of restrictions while a rally across the commodity complex also helped support. The move helped support NZD which saw a more muted move higher, PM Ardern said New Zealand would start a small self-isolation pilot for business travellers soon.

- JPY strengthened as USD retreated; In Japan local news flow continues to fixate on the upcoming LDP Party election (with reports suggesting that the first round may not result in a majority winner) and COVID (with reports pointing to all related state of emergencies being lifted come the end of this month).

- USD/CAD is lower as CAD gets an extra boost from the gain in oil prices, both WTI and Brent up by almost 1.5% so far on Monday.

- EUR holding steady despite German political gridlock, GBP has recovered some early losses, there are some jitters surrounding the evolving fuel issues in the UK. The local press has suggested that UK PM Johnson will enlist the help of the military to deliver fuel in the coming days, after panic buying has resulted in fuel shortages

- Focus in the coming week turns to a speech from FOMC Chair Powell, the fallout from the German election uncertainty, MNI Chicago Business Barometer data as well as the ISM and University of Michigan releases.

FOREX OPTIONS: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-65(E1.3bln), $1.1800(E685mln)

- USD/JPY: Y109.85-00($1.1bln)

- GBP/USD: $1.3740-50(Gbp564mln)

- AUD/USD: $0.7330-40(A$630mln)

- USD/CAD: C$1.2875($750mln)

ASIA FX: Peso Underperforms, Hitting Worst Level For 16-Months

Risk tone was constructive in the Asia-Pac session as Evergrande worries take a back seat, this saw the greenback give back some of Friday's gains and most Asia EM currencies.

- CNH: Offshore yuan strengthened, USD/CNH fell but failed to break last week's low. News of prisoner swap with Canada also helped support risk sentiment.

- SGD: Singapore dollar is stronger, FinMin Wong said that growth of 6-7% was still achievable, but noted the biggest risk to the outlook was the resurgence in coronavirus cases.

- KRW: Won rose, shaking off opening weakness. There was chatter exporters selling USD near quarter-end, though elevated coronavirus case numbers helped moderate gains.

- TWD: Taiwan dollar rose, TWD is still benefitting from tailwinds after central bank raised its forecasts for economic growth and inflation last week at its on hold interest rate announcement. Markets look ahead to industrial production data.

- MYR: Ringgitt gained, the government said it will continue its vaccination programme until all those eligible are vaccinated by year end. The latest national development plan was released which said GDP growth in the next 5 years will be 4.5-5.5%.

- IDR: Rupiah was broadly flat, new coronavirus cases were the lowest in over a year yesterday, paving the way for potential further relaxation of rules.

- PHP: Peso falls to its lowest level since May 2020, last week BSP assistant gov said BSP thinks the peso will depreciate against the dollar in the coming months.

- THB: Baht is lower, giving back early gains, the virus task force is due to meet later and could consider a delay in reopening of Bangkok and four other provinces as the regions haven't reached the 70% vaccination rate goal.

ASIA RATES: Indian Issuance Plan Looms

- INDIA: Bonds lower as oil prices continue to rally, while market participants await an announcement from the government on borrowing plans for second half of the fiscal year which begins on October 1. India originally planned to sell INR 12.1t this year, but later added INR 1.58t to the bill to compensate states for a shortfall in consumption tax collection, though the additional borrowing is yet to transpire. The 1H total currently stands at INR 7.05t, lower than the INR 7.24t planned. Later in the week participants will look forward to an INR 150bn bond purchase under the GSAP operations scheduled to take place on September 30, the RBI announced last week that this will be a twist operation (issuing shorter dated paper simultaneously) to address liquidity issues.

- SOUTH KOREA: Futures are higher, 10-Yr just below Friday's high, 3-Yr seeing a smaller move higher. In the cash space yields are lower across the curve, with some bull steepening seen. South Korean FSC chairman Koh spoke earlier, he said that strong preemptive measures would be taken against household debt and that a prolonged low rate could not last. This follows a signal that more BoK rate hikes are on the cards, the Bank said on Friday in its quarterly financial stability report that South Korean companies and households should be able to handle the impact of another interest-rate hike to 1%. Markets look ahead to the 5-Year auction later in the session.

- CHINA: The PBOC injected CNY 100bn of 14-day reverse repos at 2.35%, the injection helped subdue repo rates; the overnight repo rate is in line with recent levels at 1.7018%, while the 7-day repo rate is at 1.7452% after hitting highs above 2.60% yesterday. Futures are higher, 10-Year up 7 ticks at 100.00, approaching Friday's high of 100.055. Elsewhere focus remains on Evergrande, the firm remains silent on its $83m dollar bond interest payment that was due last Thursday, while there are reports that another real estate firm Sunac has sought help from local authorities.

- INDONESIA: Yields higher across the curve, some flattening seen. Indonesia reported the lowest number of Covid-19 infections in over a year on Sunday while the death count continues to fall, paving the way for potential further relaxation of rules, however a shortage of healthcare workers and logistical flaws are impeding inoculation efforts.

EQUITIES: Positive Start

A mostly positive start to the week for equity markets in Asia, most major indices in the black alongside a rally in the commodity complex. The CSI 300 and the Hang Seng lead the way higher, though the Shanghai and Shenzen Comp's have struggled thanks to a drag from Evergrande. The firm remains silent on its $83m dollar bond interest payment that was due last Thursday, while another real estate firm Sunac has sought help from local authorities. In the US futures are higher, US House Speaker Pelosi pledged to pass a $550bn infrastructure bill this week. Focus in the coming week turns to a speech from FOMC Chair Powell, the fallout from the German election uncertainty, MNI Chicago Business Barometer data as well as the ISM and University of Michigan releases.

GOLD: Softer USD Lends Support

Gold trades higher early this week, with the softer DXY aiding the bid after Friday's pre-NY sell off halted just above Thursday's low, leaving the previously outlined technical picture intact. Spot last deals the best part of $10/oz firmer on the day, just shy of $1,760/oz. Last week's low ($1,738.0/oz) protects the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). While initial resistance is located at the Sep 22 high ($1,787.4/oz). A slew of Fedspeak, as well as the latest U.S. PCE and m'fing ISM surveys will garner most of the attention on the part of participants this week.

OIL: WTI Topples $75/bbl Handle

Oil continued to firm in Asia-Pac trade on Monday, adding to Friday's gains. WTI futures rose above $75/bbl for the first time since July, overcoming a key bull trigger at $74.23. Brent now within less than a dollar from $80/bbl, focus shifts to the OPEC+ gathering next week for their next move on output.

- Primary drivers remain the expected tightness of the energy market across Winter, with a number of sell-side firms flagging the risks to prices should a colder-than-expected season drive energy demand and thereby prices higher.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.