-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Yen Volatile On Suspected Further Intervention

EXECUTIVE SUMMARY

- POWELL LEANS INTO HIGHER FOR LONGER, NOT HIKES - MNI FED WATCH

- US SANCTIONS FIRMS IN CHINA, UAE FOR SUPPORT OF RUSSIA’S WAR

- ECB’S DEC COS IS INCREASINGLY SURE INFLATION WILL SLOW TO 2% SOON - BBG

- UPSIDE RISKS TO PRICES TOLERABLE - BOJ MINUTES - MNI

- YEN GIVES UP GROUND VS DOLLAR FOLLOWING SURGE ON SUSPECTED INTERVENTION - RTRS

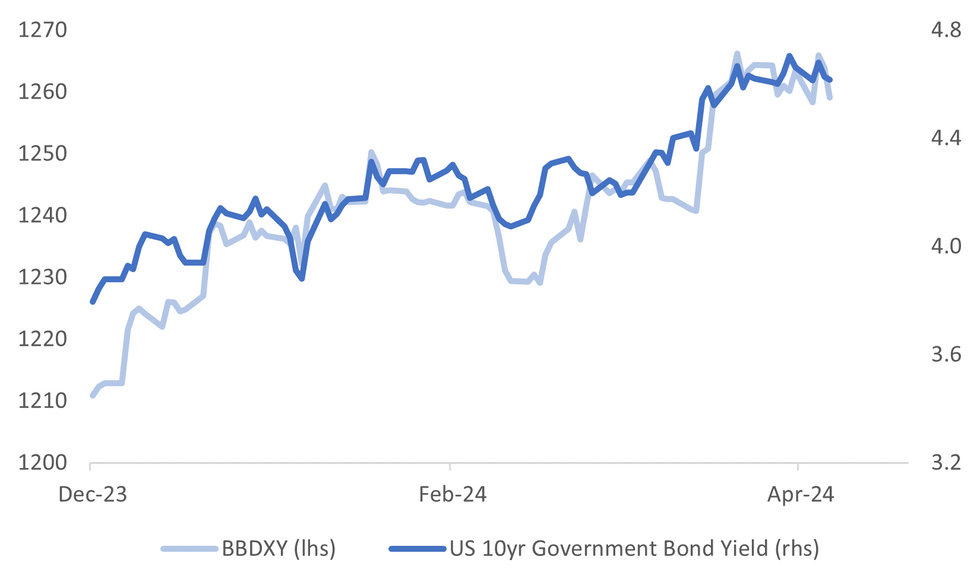

Fig. 1: USD BBDXY Index & Nominal 10yr Tsy Yield

Source: MNI - Market News/Bloomberg

U.K.

ELECTIONS (STRAITS TIMES): Britons head to the polls on May 2 in a set of local elections that could put Prime Minister Rishi Sunak in a perilous position if the governing Conservatives suffer significant losses. Thousands of politicians are vying for more than 2,500 council seats, 25 places in the London Assembly and 10 regional mayoralties.

EUROPE

CEE (MNI INTERVIEW): The economies of the Czech Republic, Hungary and Poland will continue to see a gradual recovery in the coming quarters, but they remain fragile due to a combination of sluggish German growth, fiscal challenges, rising geopolitical risk and inflation uncertainty, a leading regional economist told MNI.

ECB (BBG): European Central Bank Governing Council member Pablo Hernandez de Cos struck an optimistic tone on euro-area inflation slowing to target, the latest signal that officials will cut interest rates next month.

RUSSIA (KYIV INDEPENDENT): Russia's Defense Minister Sergei Shoigu has ordered for an increase in weapons production, with the goal of delivering weaponry to Ukraine's easter front quicker, Russia's Defense Ministry shared on May 1.

U.S.

FED (MNI FED WATCH): The Federal Reserve made clear Wednesday it is prepared to keep interest rates on hold for as long as needed as policymakers bemoaned a loss of momentum in the fight against inflation, although Fed Chair Jerome Powell deemed additional increases in borrowing costs unlikely.

FED (MNI BRIEF): The Federal Reserve's next policy move is unlikely to be an interest rate increase, although the central bank is prepared to keep interest rates at current 23-year highs for as long as it takes to gain greater confidence inflation is heading sustainably back to 2%, Fed Chair Jerome Powell told reporters Wednesday.

FED (MNI): Attached is a rough transcript of Federal Reserve Chair Jerome Powell's press conference on May 1.

ECONOMY (MNI INTERVIEW): U.S. manufacturing remains on pace for weak expansion this year even after the Institute for Supply Management's index fell back into contractionary territory in April, survey chair Timothy Fiore told MNI Wednesday.

SANCTIONS (BBG): The US on Wednesday announced sanctions on nearly 300 companies and individuals, including in China and the United Arab Emirates, for alleged support of Russia’s invasion of Ukraine.

OTHER

JAPAN (MNI): Upside risk to prices is concerning despite its small risk, some Bank of Japan board members noted at the March 18-19 meeting which saw the end of the Bank's negative rate and yield curve control, the minutes showed Thursday.

JAPAN (RTRS): The yen gave up ground in early trade on Thursday, reversing direction after a sudden surge against the dollar overnight that traders and analysts were quick to attribute to intervention by Japanese authorities.

JAPAN (BBG): Japan is increasing pressure on companies with extensive cross-shareholdings. The government wants companies to be more transparent about why they hold stakes in other firms. The practice has long been criticized as contributing to poor corporate governance by protecting management.

CANADA (MNI): Bank of Canada Governor Tiff Macklem told lawmakers Wednesday conditions for lowering interest rates are emerging but he's still looking for solid evidence that trend inflation is settling back to his 2% target.

AUSTRALIA (BBG): The resilience of corporate Australia to rising interest rates has taken traders and economists by surprise in recent months. Now, the boss of the country’s biggest lender to businesses says he’s been caught out too.

NEW ZEALAND (BBG): New Zealand residential building consents fell to a six-year low in the first quarter, pointing to a continued slowdown in construction that may hamper the economy.

CHINA

US/CHINA (BBG): Regulators moved to bar a Huawei Technologies Co. lab from approving telecommunications gear for use in the US and proposed similar moves against other providers deemed a national security threat, including several Chinese companies.

HOUSING (BBG): China bans regions with home stockpiles sales of which would require more than 36 months from new land sales, according to a statement from the Ministry of Natural Resources Tuesday.

MARKET DATA

NEW ZEALAND MARCH HOME-BUILDING APPROVALS FALL 0.2% M/M; PRIOR +15.9%

AUSTRALIA MARCH BUILDING APPROVALS RISE 1.9% M/M; EST. +3.4%; PRIOR -0.9%

AUSTRALIA MARCH TRADE SURPLUS A$5.024B; EST. +A$7.300B; PRIOR +A$6.591B

AUSTRALIA MARCH EXPORTS RISE 0.1% M/M; PRIOR -3.2%

AUSTRALIA MARCH IMPORTS RISE 4.2% M/M; PRIOR +4.4%

AUSTRALIA MARCH TOTAL BUILDING APPROVALS +1.9% M/M; EST. +3.4%; PRIOR -0.9%

AUSTRALIA MARCH PRIVATE-SECTOR HOME APPROVALS RISE 3.8% M/M; PRIOR +12.4%

JAPAN END-APRIL MONETARY BASE OUTSTANDING 696.25T YEN; PRIOR 686.8T YEN

JAPAN APRIL MONETARY BASE RISES 2.1% Y/Y; PRIOR +1.6%

JAPAN APRIL CONSUMER CONFIDENCE 38.3; MEDIAN 39.8; PRIOR 39.5

SOUTH KOREA APRIL CONSUMER PRICES RISE 2.9% Y/Y; EST. +3.0%; PRIOR 3.1%

SOUTH KOREA APRIL CONSUMER PRICES UNCHANGED M/M; EST. +0.1%; PRIOR +0.1%

SOUTH KOREA APRIL CPI EX FOOD & ENERGY RISES 2.3% Y/Y; EST. 2.3%; PRIOR 2.4%

MARKETS

US TSYS: Cash Bonds Dealing Slightly Richer Ahead Of Q1 Productivity Data

TYM4 is trading at 107-30+, -0-05 from NY closing levels, but off Asia-Pac session lows.

- Cash bonds are dealing 1-2bps richer in the Asia-Pac session.

- Two block trades of note have crossed in today’s session: A block of 2,050 contracts in 30-year bond June futures traded at a price of 120-02 on CBOT; and A block of 9,500 contracts in five-year bond June futures traded at a price of 105-01 on CBOT.

- Later today the US calendar will see the preliminary release for Q1 productivity. This will provide broader macro considerations of Tuesday’s higher-than-expected ECI. Strong productivity gains have offset labour costs in recent quarters but consensus sees productivity growth tailing off to 0.7% annualized in Q1.

- Beyond that, the market’s focus is likely centred on Friday’s US Non-Farm Payrolls release.

JGBS: Futures Unchanged, Market Closed Tomorrow

JGB futures are just above session lows and unchanged compared to the settlement levels.

- The domestic calendar has been relatively light today, with the previously outlined BoJ Minutes for the March meeting as the light.

- April’s Consumer Confidence Index has just been released showing a fall to 38.3; Est. 39.8.

- Today’s focus however has centred on the digestion of yesterday’s FOMC policy decision and suspected intervention by Japanese authorities to support the yen in NY trading. (See BBG link)

- The cash JGB curve has bear-steepened. The benchmark 10-year yield is 0.9bp higher at 0.900% versus the YTD high of 0.933%.

- A Liquidity Enhancement Auction for 1-5-year OTR JGBs is due later today.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates -1bps to +4bps. Swap spreads are tighter out the 10-year and wider beyond.

- The local market is closed tomorrow for the Constitution Memorial Day holiday.

- US Non-Farm Payrolls are due for release on Friday.

- Overnight, labour market data gave mixed signals. JOLTs data showed further signs of easing labour market pressures. The number of job openings dropped to a three-year low and the quits rate fell to the lowest since August 2020. However, US private payrolls increased more than expected in April while data for the prior month was revised higher.

AUSSIE BONDS: Richer At Sydney Session Highs, Weak Domestic Data & Stronger US Tsys

ACGBs (YM +5.0 & XM +6.0) are richer at Sydney session highs. This move has been supported by disappointing domestic data, specifically in Building Approvals and Trade Balance, as well as an uptick in US tsys during today's Asia-Pacific session.

- Cash ACGBs are 6bps richer, with the AU-US 10-year yield differential 2bps higher at -15bps.

- Swap rates are 6bps lower.

- The bills strip has extended its bull-flattening post-data, with pricing flat to +6.

- RBA-dated OIS pricing is 2-7bps softer for meetings beyond September. The expected terminal rate sits at 4.41%.

- (AFR) Markets have pushed back the timing for the Reserve Bank of Australia’s first cash rate cut until after the next federal election, complicating Labor’s bid for a second term amid red-hot voter concern over the cost of living. (See link)

- The local calendar will see Judo Bank Composite & Services PMI and Home Loans data tomorrow. The RBA Policy Meeting Decision is due next Tuesday.

- Later today the US calendar will see the preliminary release for Q1 productivity. This will provide broader macro considerations of Tuesday’s higher-than-expected ECI. Strong productivity gains have offset labour costs in recent quarters but consensus sees productivity growth tailing off to 0.7% annualized in Q1.

NZGBS: Closed On A Strong Note, US Q1 Productivity Later Today

NZGBs closed on a strong note, with yields 5-6bps lower. With the local calendar relatively light, today’s move can be linked to US tsys' reaction to a less hawkish-than-expected FOMC statement. While gains were pared into yesterday’s close, cash US tsys are 1-2bps richer in today’s Asia-Pac session.

- Today’s weekly supply showed solid demand metrics, with cover of 2.5-3.0x.

- The focus now turns to Friday’s US Non-Farm Payrolls release.

- Overnight, labour market data gave mixed signals. JOLTs data showed further signs of easing labour market pressures. The number of job openings dropped to a three-year low and the quits rate fell to the lowest since August 2020. However, US private payrolls increased more than expected in April while data for the prior month was revised higher.

- Swap rates closed 5-6bps lower.

- RBNZ dated OIS pricing closed 1-6bps softer across meetings. A cumulative 39bps of easing is priced by year-end.

- The local calendar is empty tomorrow.

- Later today the US calendar will see the preliminary release for Q1 productivity. This will provide broader macro considerations of Tuesday’s higher-than-expected ECI. Strong productivity gains have offset labour costs in recent quarters but consensus sees productivity growth tailing off to 0.7% annualized in Q1.

FOREX: Suspected Intervention Dominates Early Trade, But USD/JPY Up From Lows

Outside of yen weakness, G10 moves have been reasonably well contained in the first part of Thursday trade. The BBDXY USD index sits around 1259.40 in recent dealings, not too far from lows for the week. US yields are off a little over 1bps, as the market digests Powell's message from Wednesday (higher for longer, but next move unlikely to a hike). Equity sentiment is positive via higher US futures.

- A sharp yen rally was evident in NY/Asia Pac cross over, with USD/JPY falling from above 157.00 to 153.04. Since those lows we have generally tracked higher, albeit with a few further bouts of volatility.

- Session highs rest 156.28, and we were last near 155.85, down around 0.80% in yen terms. Currency Chief Kanda again stated no comment around whether the authorities had intervened. Given Japan markets are closed tomorrow and Monday it may take until next week to ascertain potential intervention efforts based off BoJ accounts data.

- The BoJ minutes from the March meeting came and went without impacting sentiment greatly. (see this link).

- AUD/USD is up modestly, last near 0.6530, while NZD is down a touch, last around the 0.5925 region. The AUD/NZD cross has made fresh highs of 1.1028. We had NZ and Aust data earlier on building activity and trade, but sentiment wasn't shifted.

- Looking ahead we have Swiss CPI first up, followed by final PMI revisions for the EU. In the US, Challenger job cuts, Q1 productivity/ULC, March final durable orders and jobless claims print. The ECB's Lane also speaks.

ASIA PAC EQUITIES: Hong Kong Markets Rally On Return, US Futures Higher

Asia Pac equity markets have been mixed, with Hong Kong gains a standout. China markets remain closed until the start of next week. US equity futures are higher, close to best levels in recent dealings. Eminis up around 0.50%, Nasdaq futures slightly outperforming at +0.65%.

- A downtick in US yields is likely helping broader sentiment, although Tsy futures are off post FOMC highs. Powell was less hawkish than feared and noted the next policy move was unlikely to be a hike.

- Hong Kong markets have re-opened to positive momentum. We sit up 2.2% at the break for the HSI. Gains have been fairly broad based, with the tech sub index up 4%. Positive carry over from the end April Politburo meeting (which emphasized aiding demand) is likely helping today's moves.

- The US has sanctioned firms in China for support around Russia's war effort, while Huawei Lab has reportedly been barred by US regulators from approving tech use in US markets (per BBG). Still, these announcements haven't impacted broader sentiment.

- Elsewhere, Japan markets sit a touch higher. Focus remains on yen volatility, as the authorities look to have intervened at the start of the Asia Pac/late NY session.

- The Taiex and Kospi are both tracking lower. This follows a sharp fall in the SOX in US trade, amid disappointing earnings.

- The ASX 200 is tracking 0.40% higher in Aust.

- In SEA, trends are mixed. Indonesian markets are off 1.50%, while trends are more positive elsewhere.

OIL: Crude Regains Some Of Yesterday’s Losses

Oil prices are higher during today’s APAC trading after falling close to 3.5% yesterday. Brent is up 0.6% to $83.95/bbl, close to the intraday high, and WTI is also 0.6% higher at $79.49. This moderate recovery has been supported by a softer greenback (USD index -0.4%).

- A large US crude stock build of 7.27mn barrels spooked markets on Wednesday resulting in the sharp sell off. Prices fell through support levels signalling that they could decline more. Gasoline stocks rose 344k while distillate fell 732k as refinery utilisation fell 1pp to 87.5%.

- While Fed Chair Powell said that another hike is unlikely, the “higher for longer” stance has also worried markets as it could mean weaker oil demand with the US driving season approaching.

- On the supply side, April OPEC output was only 50kbd lower than March signalling that the group’s agreed cuts have still not been fully implemented, according to Bloomberg. Iraq and Libya increased production while Iran and Nigeria reduced it.

- Later US Challenger job cuts, Q1 productivity/ULC, March final durable orders and jobless claims print. The ECB’s Lane speaks and European April manufacturing PMIs are released.

GOLD: Steady After Yesterday’s Post-FOMC Rally

Gold is little changed in the Asia-Pac session, after closing 1.5% higher at $2319.56 on Wednesday.

- Wednesday’s move came after Fed Chair Powell and the FOMC delivered a less hawkish message than feared.

- The key addition to this statement compared to March’s was "So far this year, the data have not given us that greater confidence. In particular, and as I noted earlier, readings on inflation have come in above expectations. It is likely that gaining such greater confidence will take longer than previously expected."

- And the next sentence, "We are prepared to maintain the current target range for" used to conclude "longer, if appropriate" - now it ends "as long as appropriate".

- While a “Higher for Longer” message was conveyed, the market focused on Powell’s comment that "I think it's unlikely that the next policy rate move will be a hike".

- US treasury yields were down over double digits before profit-taking set in.

- The focus now turns to Friday’s US Non-Farm Payrolls release.

- Overnight, labour market data gave mixed signals. JOLTs data showed further signs of easing labour market pressures. The number of job openings dropped to a three-year low and the quits rate fell to the lowest since August 2020. However, US private payrolls increased more than expected in April while data for the prior month was revised higher.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2024 | 0630/0830 | *** |  | CH | CPI |

| 02/05/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 02/05/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 02/05/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/05/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 02/05/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 02/05/2024 | 0800/1000 | ** |  | IT | PPI |

| 02/05/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 02/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 02/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/05/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 02/05/2024 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/05/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 02/05/2024 | 1245/0845 |  | CA | BOC's Macklem appears at House finance committee. | |

| 02/05/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/05/2024 | 2015/2215 |  | EU | ECB's Lane lecture at University of Stanford |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.