-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

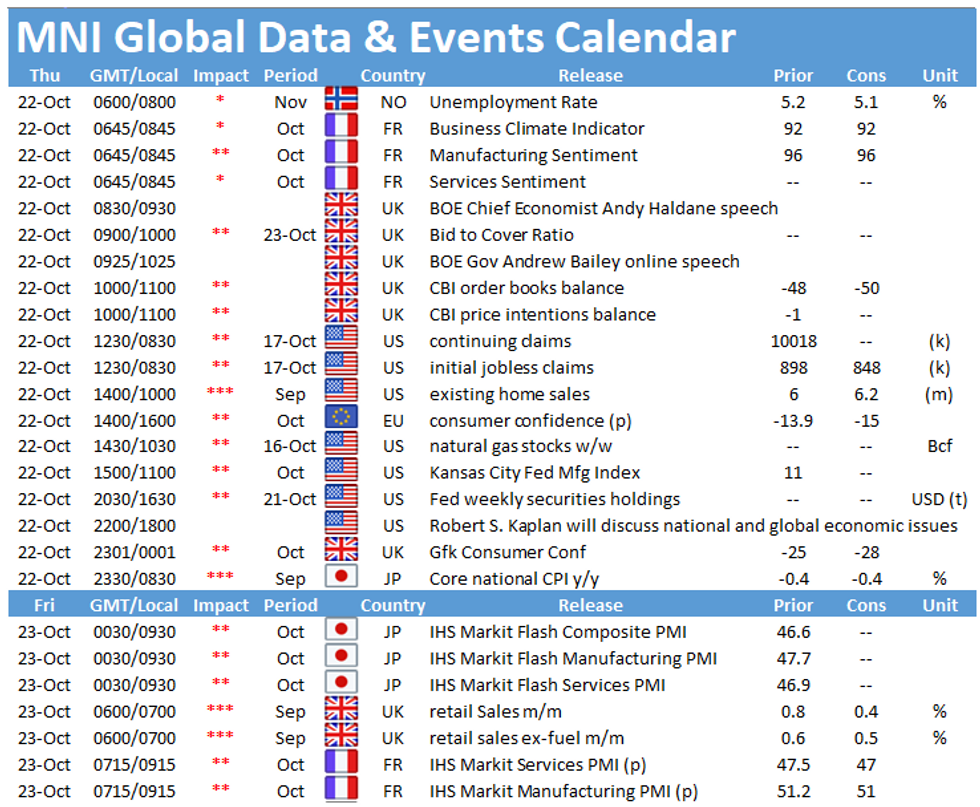

Thursday morning starts with the publication of the French business climate indicator at 0745BST, followed by the European Commission's flash consumer confidence index at 1500BST. In the US, the release of initial jobless claims at 1330BST will again be watched closely.

French business climate seen stable

The French business climate indicator as well as the manufacturing confidence index are seen unchanged in October. Business climate ticked up 2 points in September to 92 and markets expect the index to remain at this level. However, the indicator stayed below the long-term average (100) and February's pre-crisis level (105.1). Manufacturing sentiment rose as well in September by 4 points to 96, marking the highest level since March, and markets forecast an unchanged reading for October. The report noted that sentiment is still improving but at a slower pace. Nevertheless, rising Covid-19 cases and stricter social distancing rules pose a downside risk going forward. The October ZEW survey reported a decline of the expectations index in Europe due to increasing uncertainties regarding the pandemic and Brexit.

EZ consumer confidence expected to deteriorate

After edging higher in September to -13.9, which was the highest level since March, consumer confidence in the Eurozone is projected to fall to -15.0. September's uptick was driven by an increase in household's expectations regarding the general economic conditions. However, the deteriorating situation regarding the pandemic in Europe poses a downside risk on consumer's expectations about the general economic situation as well as their financial conditions.

US initial jobless claims forecast to slow slightly

Initial jobless claims filed through October 17 should reach 868,000 following an increase to 898,000 through October 10 which was the highest level in almost two months. Initial claims levels remain stubbornly high, but continuing claims figures continue to steadily decline, suggesting some underlying strength in rehiring activity. Markets look for another dip of continuing claims for the week ending October 10.

The highlights of the events calendar include speeches by ECB's Fabio Panetta, BOE's Andy Haldane and Andrew Bailey as well as San Francisco Fed's Mary Daly and Dallas Fed's Rob Kaplan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.