-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

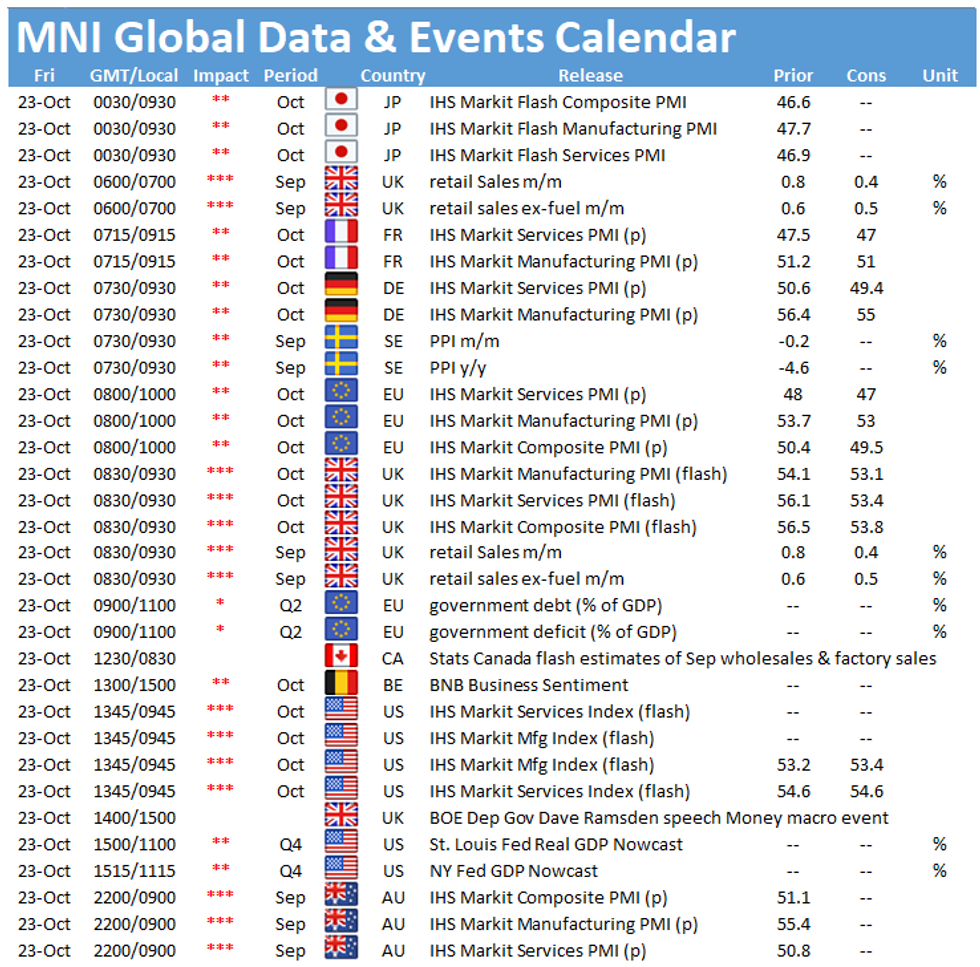

Friday kicks off with the release of UK retail sales at 0700BST, followed by the flash PMIs for France (0815BST), Germany (0830BST), the EZ (0900BST), the UK (0930BST) and the US (1445BST).

UK retail sales growth expected to slow

Monthly retail sales are expected to rise again in September, although at a slower pace of 0.2% after August's 0.8% gain. August's uptick marked the fourth successive increase and overall sales were 4.0% higher than in February. Nevertheless, sales growth has decelerated since July. Moreover, consumption patterns changed during the pandemic with non-store sales being almost 40% higher than in February, while clothing sales were still around 16% below their pre-crisis level. Despite a small drop in online sales, online retailing still remains elevated, as sales were 46.8% higher in August than in February. As Covid-19 cases are rising and strict social distancing measures have been reintroduced, the change in consumer behaviour seems likely to stay and high streets will continue to suffer. The BRC recently noted that footfall improved slightly, however the small upticks were mainly seen in retail parks and shopping centres, but high streets continued to remain empty.

Europe's flash PMIs forecast to ease

France's, Germany's and the EZ's flash PMIs are expected to ease slightly in October and the divergence between the manufacturing and the service sector is set to persist. All three services PMIs are seen below the 50-mark, while the manufacturing indices are forecast to signal expansion, although at a slower pace than in the previous month. September also saw a divergence on the country level with Germany outperforming its peers especially in the manufacturing sector. Italy was the only other country with a composite index above the 50-mark, while France slipped back to contraction and Spain's service sector suffers from the rise in Covid-19 cases.

While the French manufacturing PMI is projected to cool 0.2pt to 51.0, the services PMI is forecast to drop 0.5pt to 47 and hence remain in contraction territory. The German services PMI is expected to fall below the 50-mark to 49.4, down from 50.6, and markets look for the manufacturing PMI to tick down to 55.0. The overall EZ services PMI is anticipated to decline 1pt to 47.0 in October, while the manufacturing index is expected to register at 53.1.

UK flash PMI seen falling in October

The UK's manufacturing and services PMIs are both expected to ease in October. However, both are anticipated to remain in expansion territory, signalling growth in both sectors but at a slower pace. September's survey noted an uneven growth in the service sector with business-to-business services growing but sectors which are more exposed to social contacts such as hotels and restaurants reported another downturn. This divergence is likely to persist in October as Covid-19 cases are rising, restrictions got tightened and consumers are cautious regarding spending.

The manufacturing PMI is forecast to decline in October by 1pt to 53.1, while the services PMI is seen at 53.9, 2.2pt lower than in the previous month. September's survey noted that the outlook remains positive but there was an increased number of firms who worry about the development of the pandemic and Brexit.

US flash PMIs seen broadly unchanged

The US services PMI is forecast to remain at September's level so 54.6 in October, signalling solid growth of business activity in the sector. September's report noted a significant increase in new business and new sales, however business confidence dropped to a four-month low due to concerns regarding the pandemic. On the other hand, the manufacturing PMI is projected to tick up 0.3pt to 53.5 in October, after rising to the highest level since January 2019 in the previous month. While production, new orders and employment improved further in September, output expectations were muted, as the uncertainty regarding the development of the pandemic weighs on business confidence.

The events calendar remains quiet on Friday with the only highlights being speeches by New York Fed's Lorie Logan and BOE's Dave Ramsden.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.