-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Global Morning Briefing

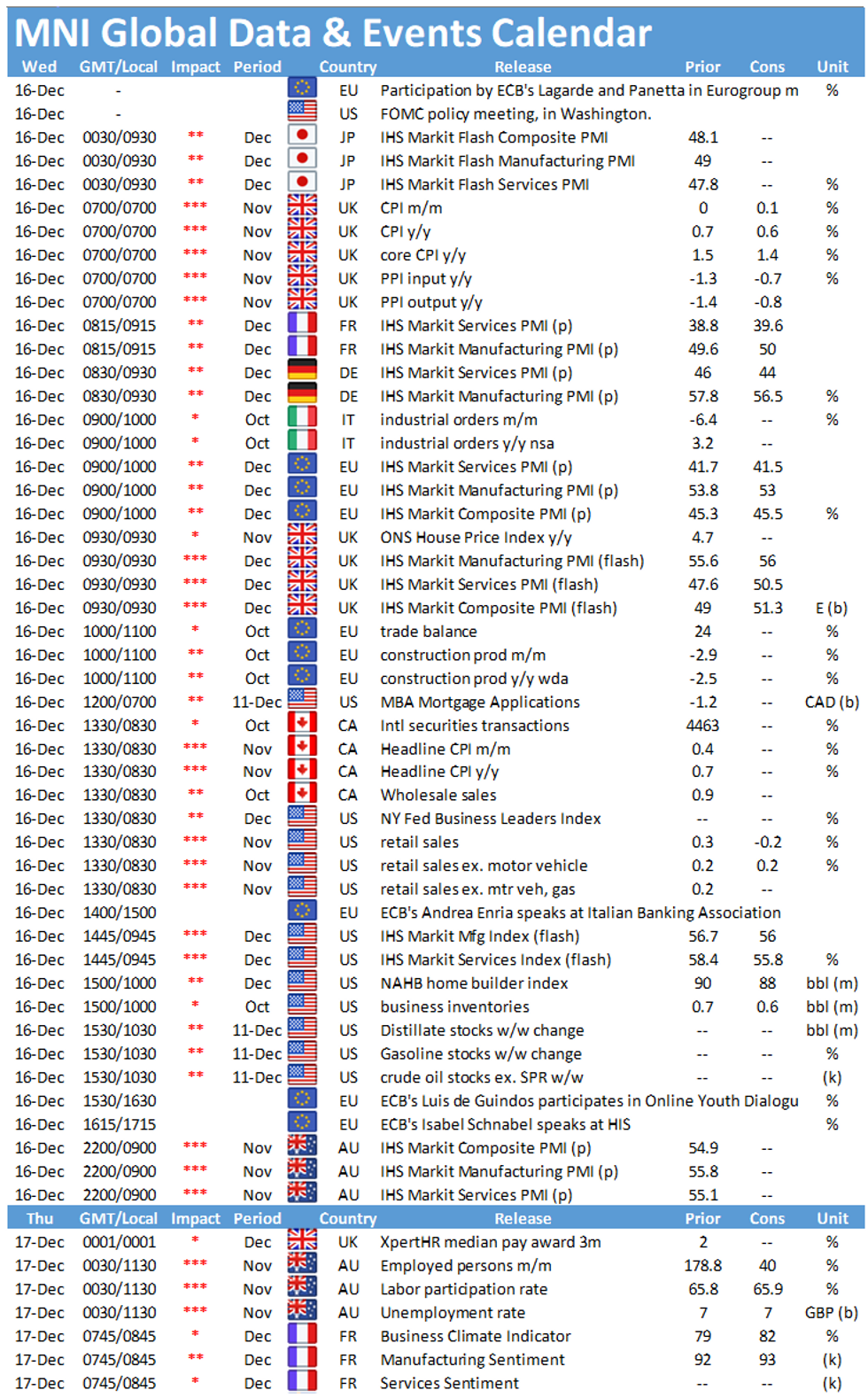

Wednesday sees a busy day forf data releases. At 0700GMT the release of UK inflation figures will be closely watched before the attention turns to the publication of the flash PMIs, starting with the French indices at 0815GMT, followed by the German PMIs at 0830GMT, the EZ figures at 0900GMT and the UK's flash PMIs at 0930GMT. In the US, the highlight of the day is the Fed's interest rate announcement at 1900GMT.

UK inflation set to remain subdued

Inflation is forecast to ease marginally to 0.6% in November, down from the 0.7% seen in October. The annual CPI decelerated significantly during the crisis, hitting a five year low in August. Inflation remains below target since August 2018 and the BOE sees CPI at around 0.5% during most of the winter before it is expected to rise towards target when the effects of low energy prices and the VAT reduction eases. Similarly, core inflation is projected to decline by 0.1pp to 1.4% in October.

Survey evidence is in line with market forecasts. The BRC shop price index showed another negative reading in November, while the services PMI reported another round of discounting in November to attract customers.

Europe's flash PMIs seen broadly unchanged

France's, Germany's and the EZ's flash PMIs are expected to change marginally in December as the situation regarding the pandemic has not changed significantly. Germany announced tighter rules starting mid-December, while France is set to ease the lockdown restrictions on December 15 but plans extra restrictions over Christmas. Many European countries are still struggling with the intense second wave and are likely to keep tight measures over the coming weeks.

The manufacturing sector continues to fair better than the service sector as the restrictions weigh more on businesses with close consumer interaction. While the French manufacturing PMI is projected to edge higher to 50.0, the German index is forecast to ease by 1.3pt to 56.5. The overall EZ manufacturing PMI is seen lower at 53.0, down 0.8pt. Markets look for a small uptick of the French services PMI to 39.6, while the German index is seen at 44.0, 2pt lower than in November. The EZ services PMI is forecast to drop to 41.5 in December.

The UK's flash PMIs are expected to tick up in December register above the 50-mark. The manufacturing PMI continues to signal solid expansion with markets looking for a small rise to 56.0. Similarly, the services PMI is expected to shift back above the 50-threshold to 50.5, signalling stagnation. The lockdown has been lifted at the beginning of December which is likely to provide a boost to service sector firms. Manufacturers have been less affected by the second wave as factories remained open and supply chains were less affected than at the beginning of the crisis.

Focus likely to be on Fed's QE forward guidance

The Fed is expected to hold its benchmark interest rate near zero and deliver forward guidance around QE, pledging to keep QE operating until certain economic outcomes are achieved. Officials have hinted that shifting asset purchases toward the longer end of the yield curve is unlikely at this meeting, but additional easing will be debated as the labour market recovery falters amid record-setting coronavirus caseloads and deaths. QE guidance will imply that asset purchases would taper and cease sometime before rates lift off zero, but the dot plot is expected to show no rate hikes through 2023 even as the medium-term outlook improves with the distribution of vaccines next year.

Besides the FOMC meeting, the highlights of the events calendar are speeches by ECB's Andrea Enria, Luis de Guindos and Isabel Schnabel.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.