-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI Global Morning Briefing

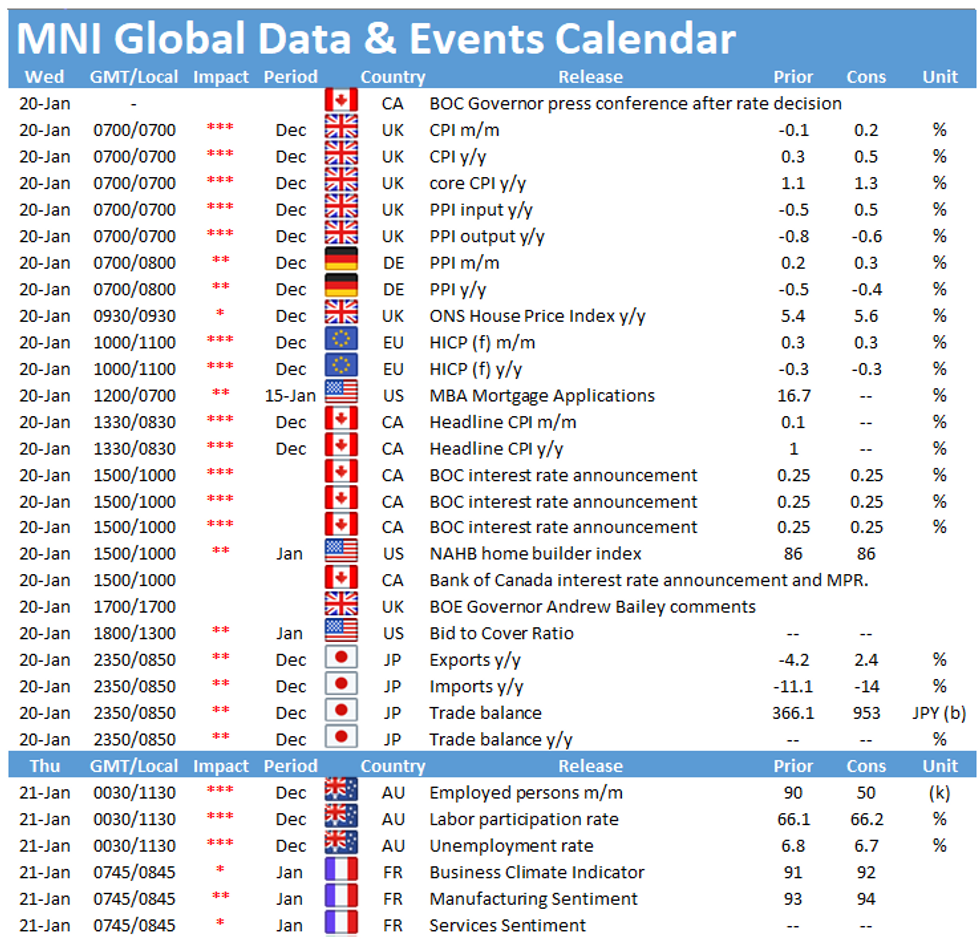

Wednesday kicks off with the release of UK inflation data at 0700GMT followed by EZ inflation at 1000GMT. In the North Americas, the interest rate announcement of the Bank of Canada at 1500GMT is the highlight of the day.

UK inflation expected to edge higher

Inflation is expected to edge slightly higher in December to 0.5%, up from 0.3% seen in the previous month. Falling prices for clothing, and food and non-alcoholic beverages resulted in the largest downward contributions in November as the country entered a second lockdown and firms continued discounting. Core inflation is forecast to tick up as well in December by 0.2ppt to 1.3%, while the monthly CPI is projected to rise by 0.2% after falling by 0.1% in November.

The BRC shop price index suggests that firms, especially in the clothing industry continued to discount to attract customers. Moreover, the survey noted lower prices for food in December as grocers saw fierce competition ahead of Christmas.

Final EZ inflation seen at flash estimate

Final inflation in the Eurozone is expected to register in line with the flash results showing an unchanged reading of -0.3% in December. This would mark the fourth consecutive reading at -0.3%. Energy prices continues to drag down inflation, although prices fell at a slower pace in December than in the previous month. The ECB expects headline inflation to remain negative in early 2021 and rise thereafter due to the end of the German VAT cut and upward base effects in energy price inflation. However, underlying price pressures are expected to remain subdued due to weak demand. Once the effects of the pandemic fade, a recovery of demand should provide upward pressure on inflation in the medium term, according to the ECB.

BOC to leave key rate unchanged

The Bank of Canada is expected to leave its key lending rate at a record low 0.25% and maintain QE of at least CAD4 billion a week, with commentary that balances the surge in Covid-19 cases with signs a vaccine will be available sooner than policy makers had expected.

The events calendar remains quiet on Wednesday with the only highlights being the press conference following the BOC's interest rate decision and a speech by BOE's Andrew Bailey.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.