-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

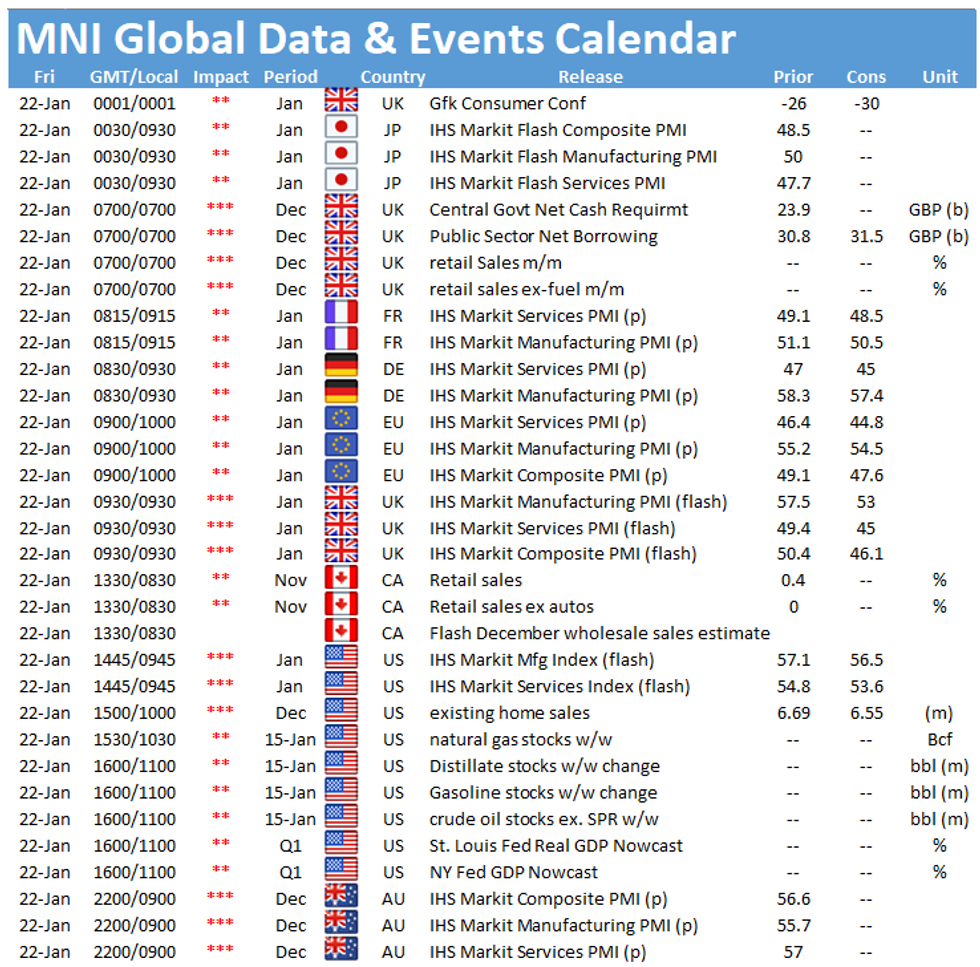

Its a busy end to the week, including UK retail sales and public sector finances, both at 0700GMt. After that, the focus shifts to the flash PMIs for France (0815GMT), Germany (0830GMT), the EZ (0900GMT), the UK (0930GMT) and the US (1445GMT).

UK retail sales seen rising

Retail sales are expected to rebound in December to 1.0% after dropping by 3.8% in November when the lockdown was renewed, as highlighted in the latest MNI Reality Check. Restrictions were eased in early December before they were tightened again ahead of Christmas. Nevertheless, this should have provided a boost to sales ahead of the holidays. The BRC KPMG shop sales monitor saw total sales rise by 1.8% in December, while like-for-like sales ticked up 4.8%. Looking ahead, January sales are likely to have suffered more than in November, as restrictions were tightened.

UK budget deficit seen higher

Public Sector Net Borrowing is expected to increase to GBP 31.5bn in December, up from GBP 30.8bn. Year-to-date borrowing increased to GBP 240.9bn in November, which is GBP 188.6bn higher than in the same period a year ago. The OBR expects PSNB to rise to GBP 394bn at the end of the financial year, although the forecasts were made before the announcement of tighter restrictions over the Christmas period and the full lockdown thereafter.

Europe's flash PMIs expected to ease

Both the services and the manufacturing flash PMIs are expected to decline January for France, Germany, the EZ and the UK. All four manufacturing PMIs are expected to remain above to 50-mark signalling further expansion in the sector, although at a slower pace. France's index is expected to fall to 50.5, the German PMI is seen at 57.4, while the EZ manufacturing PMI is forecast to decline to 54.5 and the UK's index is projected to drop to 53.0.

The services PMIs on the other hand, are expected to fall further into contraction territory with the French index seen at 48.5 and the German at 45.0. Markets look for the EZ services PMI to ease to 44.8, while the UK's PMI is seen at 45.0. Infections rates in almost all European countries remain high and restrictions get tightened rather than released. Most countries are in lockdowns and the vaccination progress is still in the early stage. In most countries bars, restaurants and service providers had to shut down again which weighs heavily on service sector activity.

US flash PMI seen lower

The flash manufacturing PMI as well as the flash services PMI are projected to ease in January, although both indicators are expected to remain in expansion territory. The manufacturing PMI is expected to rise to 56.5 in January after increasing to 57.1. However, December's report noted severe supply chain disruptions which pushed up the headline figure. The flash services PMI eased slightly in December and is forecast to decline further in January to 53.6.

The events calendar remains quiet on Friday with no speeches scheduled for the day.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.