-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Global Morning Briefing

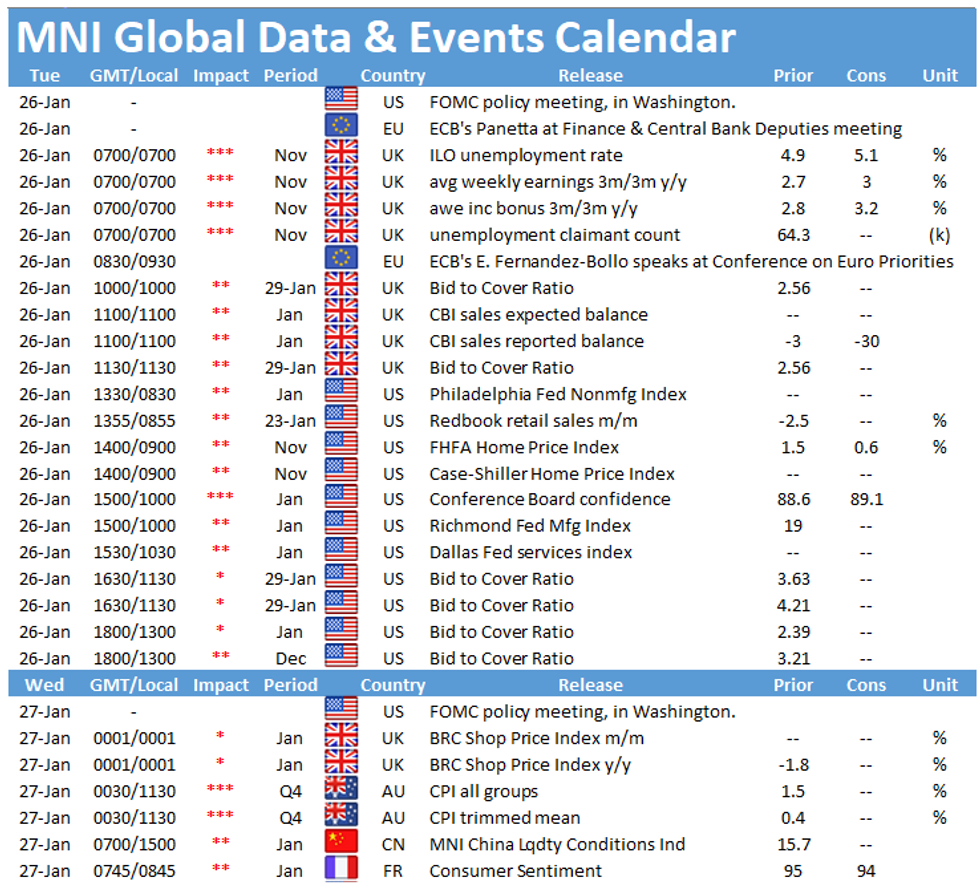

Tuesday kicks off with the release of the UK's labour report at 0700GMT, followed by the CBI distributive trades survey at 1100GMT. The main data event to follow in the US Tuesday is the publication of consumer confidence at 1500GMT.

UK jobless rate seen higher

UK ILO unemployment rate - Source: Bloomberg

The UK's unemployment rate is expected to rise marginally to 5.1% in November, up from 4.9% recorded in October. The last time the unemployment rate was above 5% was in early 2016. However, the jobless rate only provides a limited picture of the labour market as many employees were on furlough again in November during the lockdown. October's survey noted a record increase of redundancies ahead of the former end of the furlough scheme. Since then, the scheme was extended to April, which should keep the unemployment rate in check. The timelier PAYE data in last month's survey showed another fall of payrolled employees by 2.7% in November compared to a year ago. Since February 2020 there are 819,000 fewer people in payrolled employment. The recently released flash PMI reported an increase in the pace of job shedding in January, while the KPMG/REC jobs report noted an increase in the availability of workers due to redundancies.

CBI sales expected to slump

CBI sales are expected to plunge to -30 in January following a strong increase to -3 in December. December's report noted that retailers expect a decrease of sales volumes below seasonal norms, but internet sales are forecast to remain elevated. The third lockdown in January weighs especially on the service sector and on retail sales as non-essential shops remain closed. Recently released consumer confidence data also showed a decline in sentiment and a drop of intentions to make major purchases, while savings intentions rose. Both bodes ill with retail sales going forward.

US consumer confidence projected to edge higher

Consumer confidence declined further in December to 88.6, driven by a sharp drop of the present situations index. Consumer's opinion about the current situation deteriorated significantly as increasing Covid-19 infection rates weigh on confidence. The Expectations index ticked up from 84.3 seen in November to 87.5. In January, markets are looking for a small uptick in consumer confidence to 89.1. On the other hand, the preliminary Michigan consumer sentiment indicator edged slightly lower in January amid the sharp rise in Covid-19 deaths, the insurrection and the impeachment, the survey noted.

The main events to look out for on Tuesday include the FOMC policy meeting and speeches by ECB's Fabio Panetta and Edouard Fernandez-Bollo.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.