-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL MORNING BRIEFING: Inflation Day

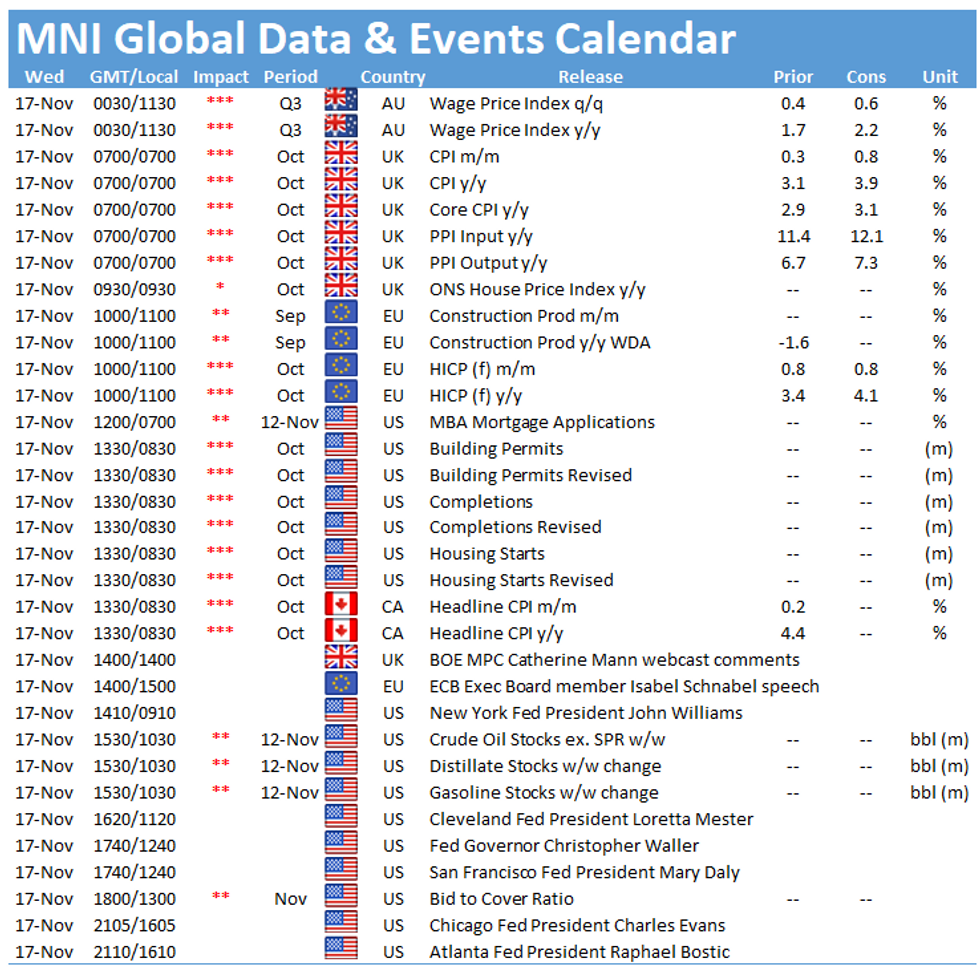

Inflation in the UK, Eurozone and Canada will be the highlights Wednesday.

UK Oct Inflation Seen Rising to Near 2-Decade High

UK inflation likely resumed its inexorable rise in October, surging to an annual rate of 3.9% according to forecasters, taking the CPI index to its highest level since December of 2011, when inflation stood at 4.2%. The prediction matches the forecast of Bank of England economists, who "expect inflation to rise to just under 4% in October, accounted for predominantly by the impact on utility bills of past strength in wholesale gas prices," according to minutes of the Monetary Policy Committee meeting earlier this month.

With energy accounting for much of the expected October rise, core inflation is forecast to rise more modestly, to 3.1% from 2.9% in September, still the biggest increase since early 2012. Despite a fall in headline inflation in September -- largely due to the effects of the Eat Out to Help Out scheme a year earlier -- prices rose in eight of the 12 major categories in September, suggesting broader-based pressures.

Used car prices could provide upward pressure on the index, rising by a record-high annual-rate of 25.6% last month, according to Auto Trader, exceeding September's 21.4% increase. Second-hand car sales added 0.01 percentage point to the change in September CPI.

Policy makers may also be eyeing intermediate inflation, which has surged in recent months. Factory gate prices rose by an-expected 7.3% from 6.7% in September, taking output price inflation to its highest level since January 2011. Input price growth is forecast to accelerate to an annual pace of 12.1% -- the highest level since September 2011 -- from 11.4% a month earlier.

Eurozone final HICP to be confirmed as multi-decade high (1000GMT)

Eurozone annual HICP inflation expectations are expected to be confirmed at the multi-decade highs reported on October 29. Consensus predictions point to final annual inflation coming in at 4.1% for October, remaining on par with last month's Eurostat flash estimate. This is up from 3.4% in September as the Eurozone continues to feel the heat of high energy prices, with some states reaching alarming inflation readings for October including Lithuania and Estonia, reading 8% y/y and 7% y/y respectively.

Nonetheless, eurozone monthly and core CPI data are predicted to remain steady, in line with yesterday's stable quarterly GDP data. Final eurozone monthly CPI is expected to remain at 0.8% in October with core HICP y/y readings seen unchanged at 2.1%.

Despite markets still seeing a possible ECB hike in 2022, ECB President Lagarde reiterated on Monday that this is unlikley, as the central bank holds onto its view that inflation is transitory and expected to ease over 2022. The upcoming months will shed light on this as the pressure of high fuel prices, enduring supply-side shortages and a surge in COVID-19 cases could paint a different picture.

Wednesday throws up a full calendar of speakers, including BOE MPC member Catherine Mann, ECB Executive Board member Isabel Schnabel and Fed Presidents John Williams, Mary Daly, Charles Evans and Loretta Mester.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.