-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

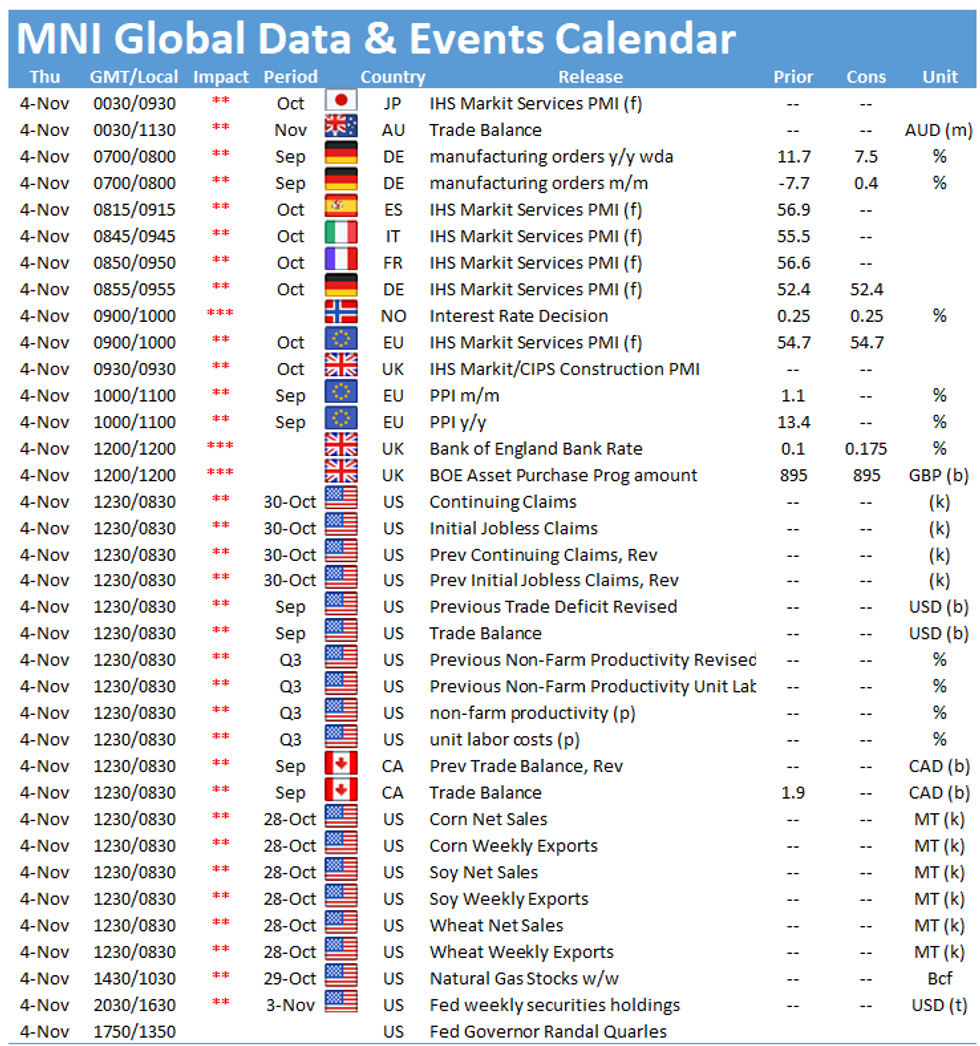

Free AccessMNI Global Morning Briefing: BOE, Norges In Focus

After the Fed's confirmation of a move to taper its bond purchases, the Norges Bank -- who hikes in September -- and the Bank of England announce their latest policy decisions. Ahead of the main central bank outcomes hitting the wires, the euro area services PMI data is set for publication -- a day later than in a normal cycle due to the Nov 1 holiday.

BOE Has Hike In Sights (1200 GMT)

The Bank of England could choose its November meeting to carry out a rate hike it has signalled is coming soon as inflation spikes, but it is also likely to try to dampen market expectations of the pace and magnitude of tightening likely next year when it makes its announcement on Thursday, our London correspondent writes.

While it is possible an expected 15-basis-point hike will wait until December, the difference between acting now or later will be minimal if next month's increase is clearly signalled in the minutes and by Governor Andrew Bailey.

But the Bank's updated forecasts could push back against large-scale repricing of market expectations, which now indicate a very high probability of four hikes by mid-2022, with Bank Rate rising from its current 0.1% to 1.25% by the end of next year. Monetary Policy Report forecasts could show inflation undershooting target two and three years ahead on market rate curves, while overshooting on constant rates, justifying more tightening but not to the extent priced-in.

A split vote for a hike, or arguments from some MPC members expressing reservations about tightening, could also help bring the whole rate curve lower.

Norges Bank set for December hike (0900 GMT)

As policymakers at other central banks fuel market volatility with signals over future tightening Norges Bank looks set to continue along its pre-planned path, with its November meeting this week a stepping-stone to a December hike.

In its announcement on Thursday, the Norwegian central bank's Monetary Policy and Financial Stability Committee is likely to reassert guidance for a 25-basis-point hike in the final month of the year provided in September, when it initiated this cycle's tightening with an equally well-flagged move in the policy rate from zero percent to 0.25%.

Norges Bank's projected rate of tightening foresees a gradual rise in the policy rate to around 1.7% at the end of its three-year horizon. Its next forecast round is in December.

Central bank speakers Thursday include BOE Governor Andrew Bailey, speaking after the central bank's November policy decision announcement. Fed Governor Randy Quarles is also slated to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.