-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Focus on BOE and Norges Bank

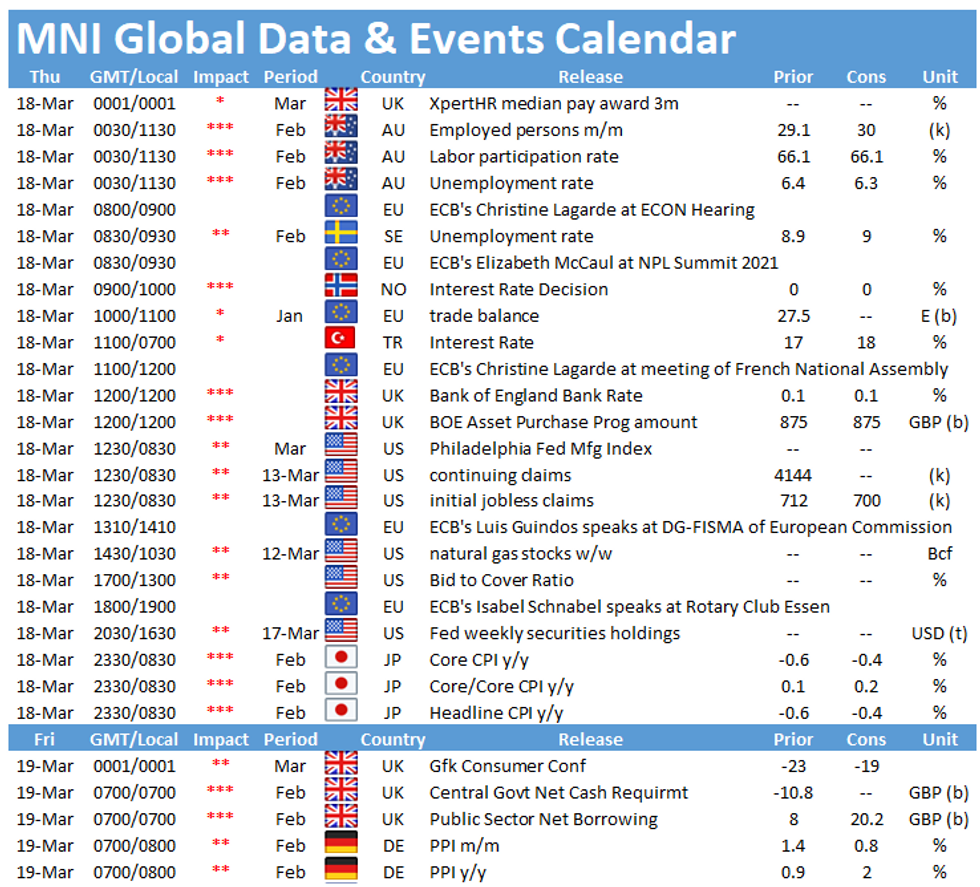

Thursday starts with the publication of the Swedish unemployment rate at 0830GMT, followed by the Norges Bank's interest rate decision at 0900GMT and the BOE's policy decision at 1200GMT. In the US, the release of initial jobless claims will be watched closely again at 1230GMT.

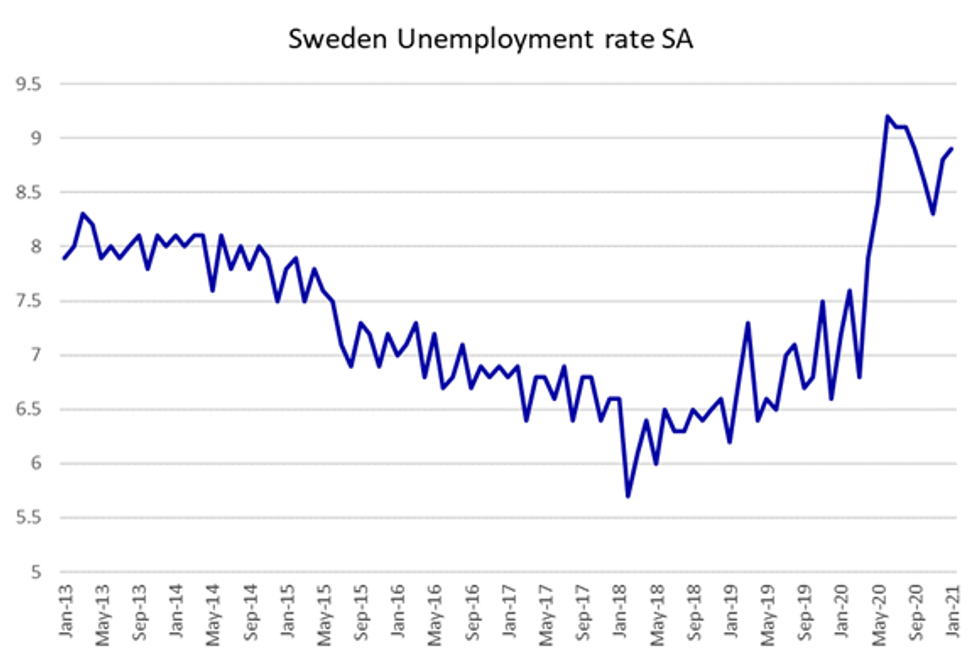

Swedish unemployment seen higher

Markets are looking for a small uptick of the seasonally adjusted unemployment rate to 9.0% in February. This would mark the highest level since August and the third successive increase. The Swedish jobless rate increased after the beginning of the pandemic and peaked in June, where it recorded 9.2%. Thereafter, it recovered to 8.3% in November, before it picked up again at the end of the year. Over 2020, the employment rate declined by 1.1% to 67.2%, marking the first decrease of the employment rate since 2010. The impact of the pandemic was particularly severe on young people in the labour market. Overall, there were 67,000 fewer people in the labour market in 2020 compared to 2019, of whom 51,000 were people aged 15-24. New daily Covid-19 cases are still elevated in Sweden, which led to further containment measures in March. As a result, the pandemic will continue to weigh on the labour market at least in the first quarter.

Source: Statistics Sweden

Focus on tightening path of Norges Bank

Norges Bank, at the front of the central bank pack on the tightening path as the economy emerges more strongly from the Covid pandemic than feared and house prices sizzle, could bring forward the first projected rate hike from the first quarter of 2022 into the final quarter of this year at its March meeting. Market pricing already suggests Norges will start tightening in late 2021 and analysts anticipate it will raise the entire profile to show the policy rate at 1.25% or above at the end of its three-year forecast period.

Norges will also update its quarterly forecasts when it announces its decision on Thursday, with recent data showing that the contraction in 2020 was less sharp than the central bank had anticipated. In December, it had expected the output gap to be almost closed by mid-2022 and the policy rate starting to rise from its current 0% in the first quarter of next year to reach 0.93% at end 2023.

BOE expected to hold

For the BOE's Thursday meeting markets expect unanimous votes for both the total target stock of QE and the rate decision. However, there is disagreement about how the MPC will respond to the fixed income sell-off. There has been very little commentary from MPC members about the sell-off (in contrast to other central banks).

Some analysts expect the MPC could warn that the tightening of financial conditions has been "unwarranted", potentially setting up an announcement of an increase in the target stock of QE in May or the summer. Others think that the MPC will point to the better economic outlook, extra stimulus from the Budget and progress being made on the vaccination front and not sound too concerned about the increase in yields.

US initial jobless claims forecast to slow

U.S. jobless claims filed through March 13 are forecast to have dropped to 700,000 from 712,000 through March 6, according to the Bloomberg consensus. Continuing claims filed through March 6 are expected to fall to 4.03 million from 4.14 million through February 27. The labour market continues to improve, as the economy added 379,000jobs according to the February employment report from the BLS.

The events calendar throws up a busy schedule on Thursday. The speakers to look out for include ECB's Christine Lagarde, Elizabeth McCaul, Luis de Guindos and Isabel Schnabel as well as Fed's Jay Powell.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.