-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: FOMC Is The Highlight Of The Day

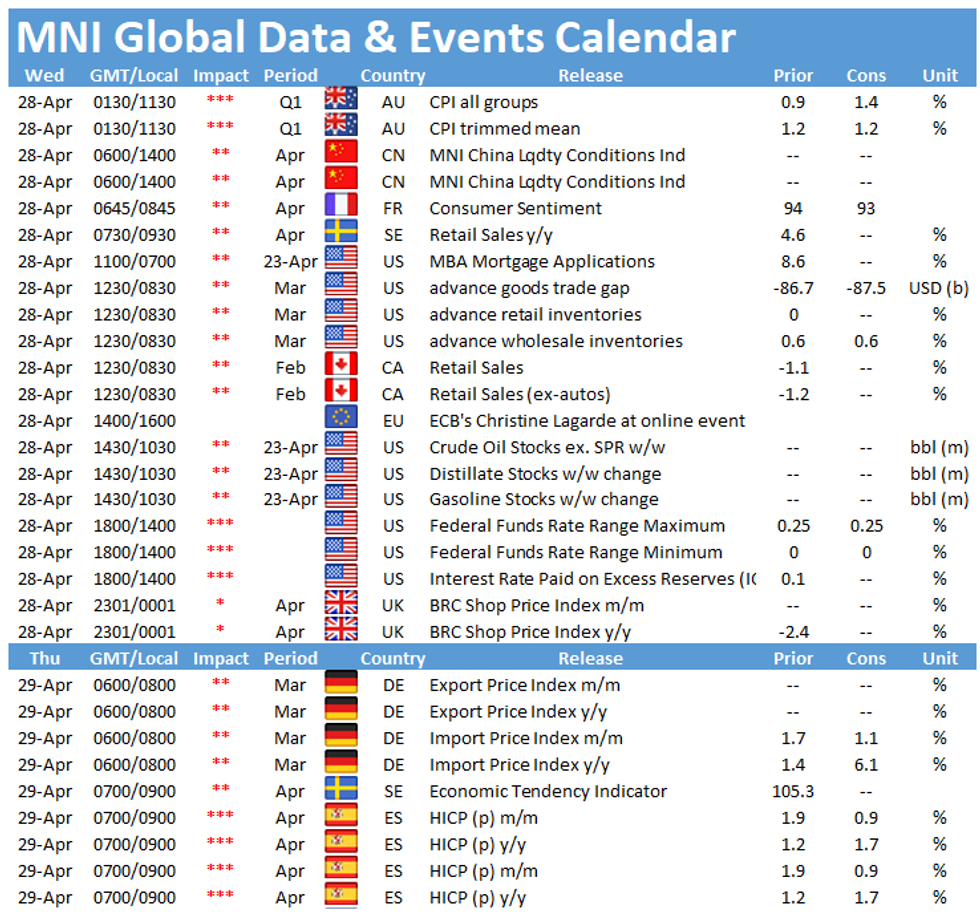

Wednesday kicks off with the release of French consumer sentiment at 0745BST, followed by Swedish retail sales figures at 0830BST. In the US, the release of the FOMC' latest policy statement at 1900BST is the day's showstopper event.

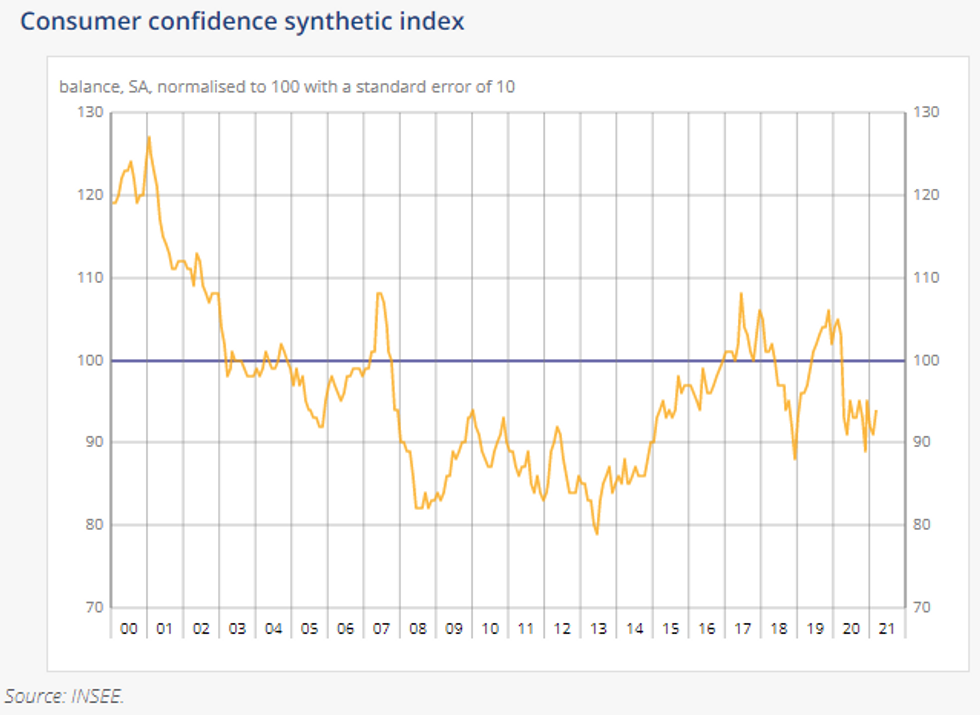

French consumer confidence forecast to ease

Consumer sentiment ticked up 3pt in March to 94, after falling to 91 in February. The index remains well below the long-term average of 100, despite the recent uptick. In April, markets look for a downtick to 93, as restrictions got tightened at the end of March and the covid-situation remains serious - both weighs on consumer confidence. March's survey showed another increase in savings intentions and the fear of unemployment remained elevated. However, household's assessment of their future financial situation and the economic situation in the next 12 months improved in March.

Other survey evidence signals an expansion of business activity, which bodes well with consumer mood. The flash services PMI showed an increase in employment as both new business and output increased in April.

Swedish retail sales eased in February

Monthly retail sales in Sweden slowed to 0.7% in February, after rising by 4.3% in January. Meanwhile, annual sales rose by 4.6% in February, following January's reading of 3.8%. Both durable and consumable goods saw a monthly uptick in sales in February. Infection rates are still high in Sweden and restrictions have been prolonged to mid-May, however shops remain open to a limited number of customers. Sweden's services PMI ticked down slightly in March to 61.3, but continues to signal expansion in the service sector, which bodes well with retail sales going forward.

FOMC Seen on hold

No change is expected to fed funds rate target of 0% to 0.25% or USD120 billion per month in asset purchases. Chair Jay Powell is expected to reaffirm the FOMC's commitment to stay the course on maximum accommodation for the U.S. economy as the recovery takes hold, even as he acknowledges a more upbeat outlook and encouraging data. Some analysts look for a small hike to the interest on excess reserves and overnight reverse repo rates, but the Fed has signalled it would take a patience stance on tweaking its administered rates.

The main event to follow on Wednsday besides the FOMC policy meeting is ECB's Christine Lagarde participating at an online event.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.