-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

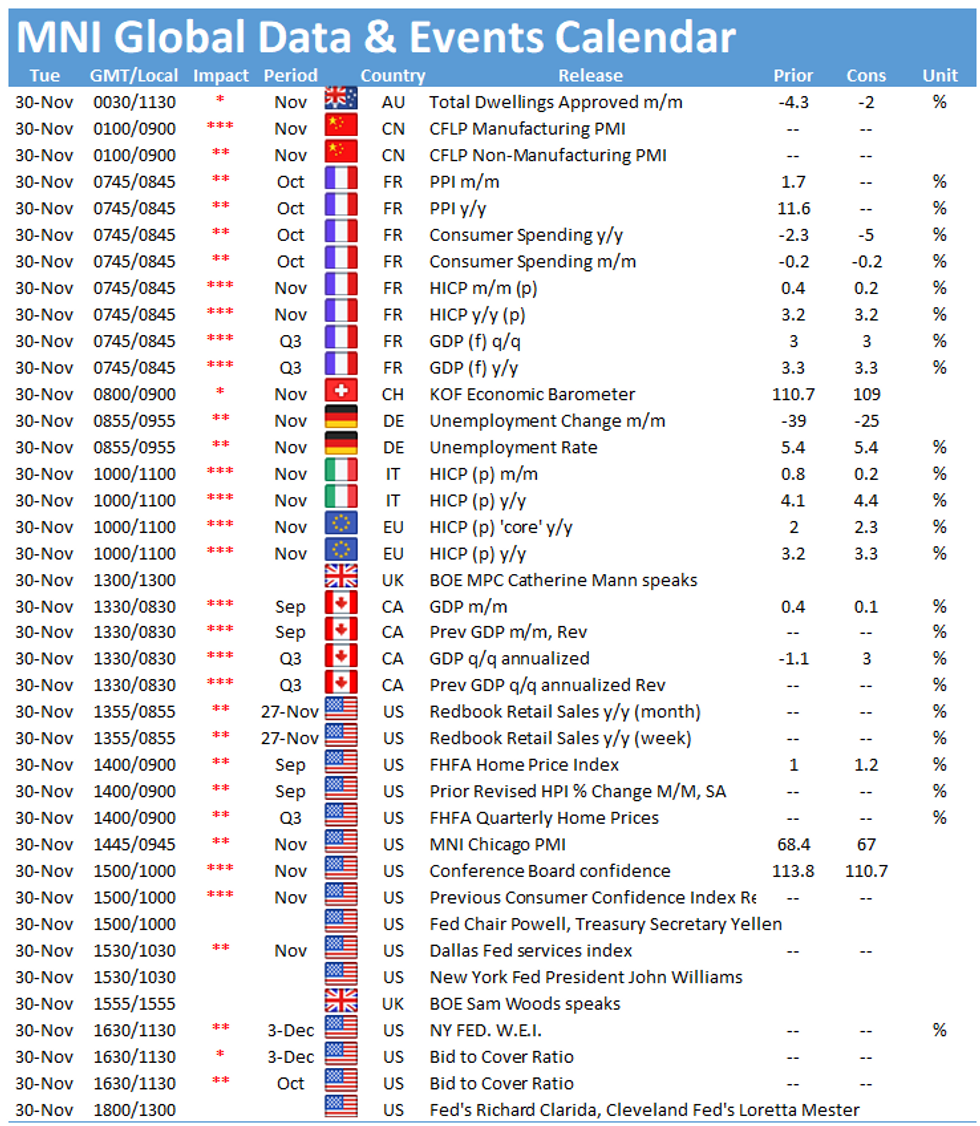

Free AccessMNI GLOBAL MORNING BRIEFING: EZ Inflation Seen Yet Higher

French GDP outlook stable, PPI, consumer spending and CPI not so much (0745 GMT)

It’s a big morning for French data with final GDP, consumer spending, PPI, as well as flash HICP and CPI coming all due.

Analysts forecast French GDP to have remained stable at 3.0% q/q in Q3, unchanged on the flash reading, with the annual reading also seen unchanged at 3.3%, confirming a recovery to above pre-pandemic levels. Consumer spending in October is predicted to have flatlined, at 0.0% m/m compared to a shrinkage of -0.2% in September. Annual consumer spending is predicted to be significantly slower, contracting -5.0% y/y for October.

Analysts see factory gate inflation testing 13% y/y following September’s 11.6% y/y and 1.7% m/m, reflecting the squeeze of high energy prices and input costs. The preliminary numbers for HICP are less volatile, with flash HICP expected to edge downwards from 0.4% m/m in October to 0.2% m/m in November, whilst annual CPI is set to remain unchanged at 3.2% for November.

German labour market recovery slows (0855 GMT)

The German labour market looks to be continuing along the path to recovery in November as consensus estimates an unemployment change of -25.0k in November, a somewhat milder improvement than October which saw 39.0k no longer unemployed. November has proven a difficult month for Germany amidst a high surge in covid transmissions across the region. The unemployment claims rate is expected to remain stable at 5.4%. Last Wednesday we saw the traffic-light coalition confirmed which could see the SPD pushing for an increase in minimum wage on the distant horizon.

EZ Flash Inflation up again (1000 GMT)

Eurozone inflation data points towards a further increase for November, with the prelim headline CPI estimate dampening to 0.0% m/m for November compared to 0.8% m/m last month and the annual readings predicted to hit a high of 4.5% y/y this month, up from 4.1% y/y. The annual November core CPI estimate is forecasted to rise to 2.3% this November from 2.0% last year. Concerns of the new coronavirus variant emerging have cast some doubt upon the ECB’s PEPP being wound down in March 2022 despite persistent inflation boosted by high energy prices. Again there is the risk of an upside surprise following the much stronger-than-expected reading in Germany.

Chicago PMI (1445 GMT)

The Chicago Business Barometer (produced by ISM and MNI) comes out this afternoon, reflecting current trends in US corporate activity. Last month’s reading rose to 68.4, picking up after two consecutive months of decline.

US Consumer Confidence (1500 GMT)

US confidence could dip once again in November, with analysts anticipating a November reading of 110.4 following a brief boost from September to October’s reading of 113.8. Inflation fears and higher prices squeezing consumer’s disposable income are amidst a backdrop of supply chain disruptions are testing consumer confidence this month.

Source: The Conference Board 2021

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.