-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI Global Morning Briefing: PMIs Highlight Of The Day

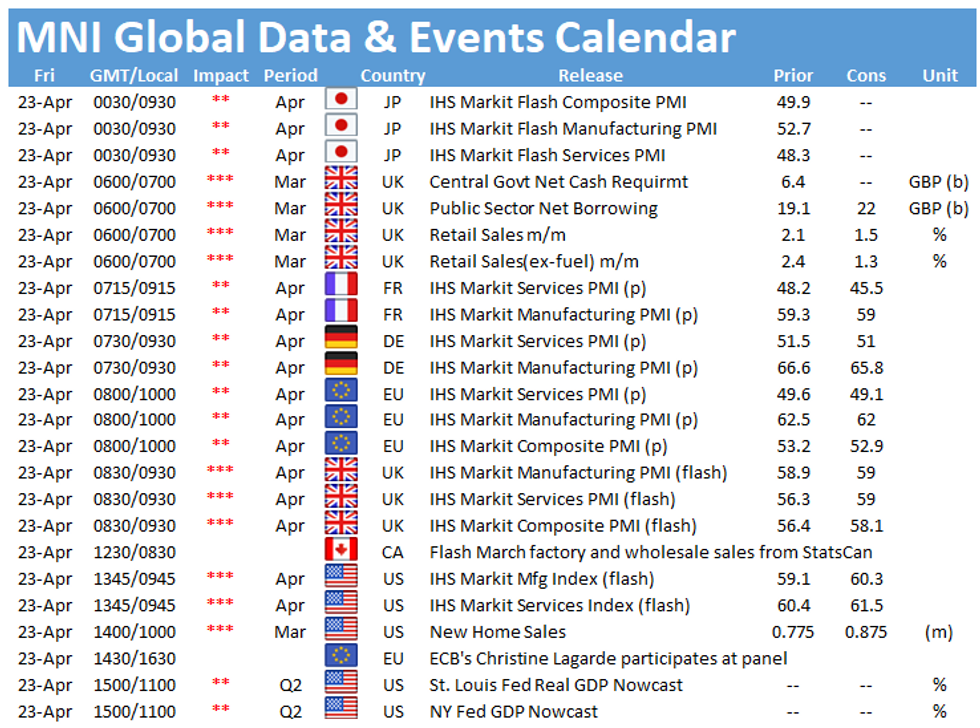

Friday sees a busy schedule in terms of European data events, starting with UK retail sales at 0700BST. Between 0815BST and 0930BST the publications of the flash PMIs for France, Germany, the EZ and the UK will be closely watched. In the US, the release of the flash IHS PMI will also be followed closely at 1445BST.

UK retail sales forecast to rise

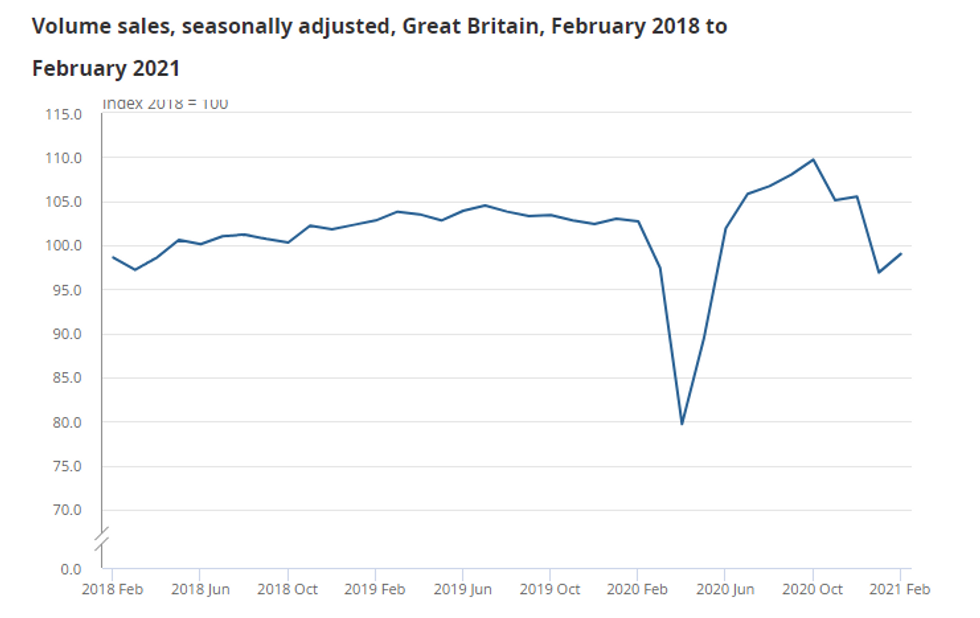

Monthly UK retail sales are expected to rise by 1.5% during the last month of lockdown, while annual sales are seen at 3.5% in March. Sales recovered in February to 2.1% after falling sharply in January. February's report once again confirmed that the worst hit sector during the pandemic was the clothing industry where sales dropped by 50.4% compared to February 2020. Automotive fuels also recorded a large annual decline of 26.5% in February. The latest MNI Reality Check points to the likelihood of an outperformance, helped by a surge in demand for household and garden goods.

Looking ahead, the reopening of non-essential businesses and the hospitality sector should provide a boost to sales in April and the following months. MNI's reality check points to a higher than expected increase in sales already in March as demand for home and garden items surged.

Source: Office for National Statistics

Divergence between manufacturing and service PMIs in EZ forecast to persist

The flash PMIs for France, Germany and the EZ are expected to continue showing a divergence between the manufacturing and the services sector in April. Restrictions recently got tightened in France and Germany which is likely to weigh on the service sector and especially on the consumer facing industries. The flash services PMI for France is forecast to ease to 45.5 in April, while the German index is expected to decline marginally to 51.0. The EZ flash services PMI is projected to drop to 49.1.

The flash manufacturing PMIs on the other hand signal solid expansion with all indices remaining comfortably above the 50-mark. The EZ flash manufacturing PMI is seen at 62.0 in April, while the German index is expected to ease to 65.8 and the French PMI is anticipated to edge slightly lower to 59.0. However, the index points to the direction of where the industry is heading rather than the level of output. Recently released hard data showed a decline of industrial output in February, in contrast to survey evidence suggesting an expansion.

UK's PMIs seen in expansion territory

The UK's flash services and the manufacturing PMIs are forecast to edge higher in April. Both indices remain comfortably above the 50 mark, signalling expansion. The easing of government restrictions provided a boost in March when the services PMI shifted back to expansion territory for the first time since October 2020. Business activity, new orders and employment saw significant gains in March and these indices are likely to post further gains in April. Markets expect the services PMI to rise to 59.0 in April, up from 56.3 seen in March

The manufacturing sector continues to struggle with supply chain disruptions according to March's report which in turn leads to an increase in both input and output prices. The manufacturing PMI is projected to remain broadly unchanged at 59.0 in April.

US flash PMIs projected to rise

The US flash services and manufacturing PMIs are both expected to increase further in April, registering comfortably above the 50-mark which signals expansion. The services PMI is seen higher at 61.5 in April, after rising to an almost 7-year high of 60.4 in March. Last month's report noted a sharp increase in new business, but also export orders saw a boost in March.

The flash manufacturing PMI is forecast to improve further as well April, with markets looking for an uptick to 60.3. The index rose to 59.1 in March, led by the fast increase in new order since June 2014. However, the report also noted that output was hampered by supply shortages with supplier lead times lengthening to the longest on record.

The main events to follow on Friday include ECB's Christine Lagarde participating in a panel and US Treasury Secretary Janet Yellen attending a Bloomberg panel.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.