-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI Global Morning Briefing: Services PMIs Signal Expansion

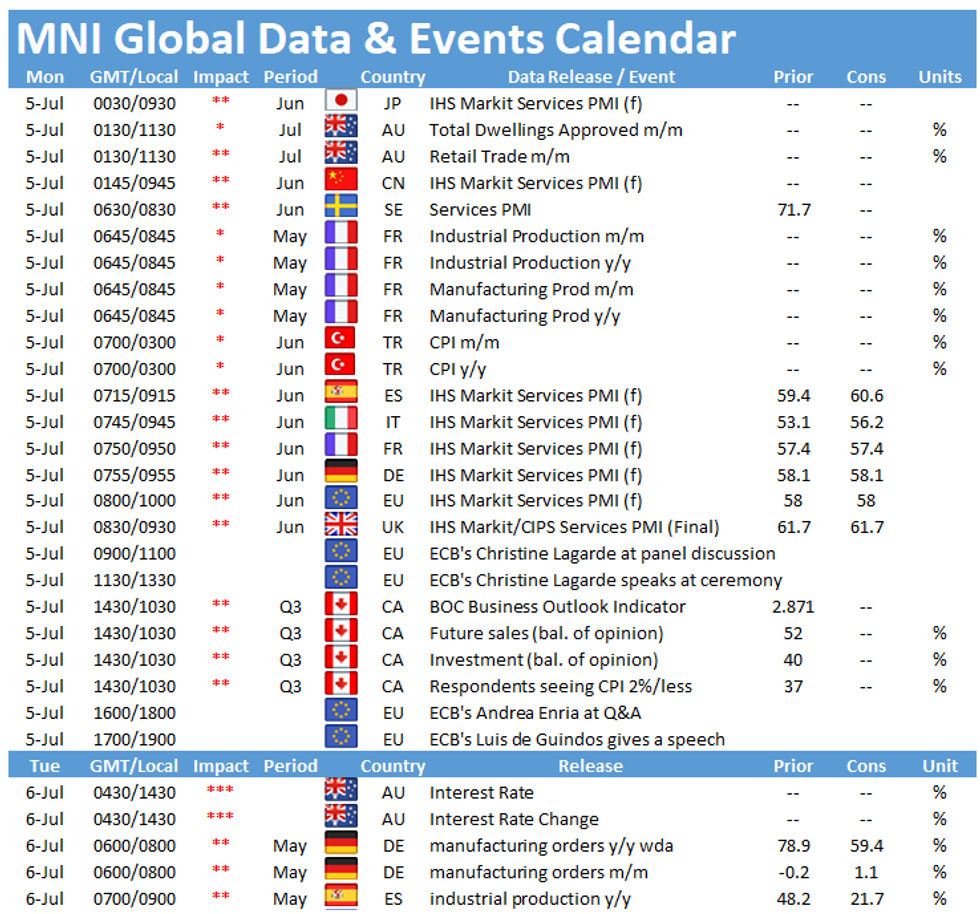

The main data events Monday are the final services PMIs for Spain (0815BST), Italy (0845BST), France (0850BST), Germany (0855BST), the EZ (0900BST) and the UK (0930BST). There are no data events scheduled in the US due to the Independence Day public holiday.

Europe's services PMIs rose markedly in June

The recently released flash services PMIs all showed a significant increase in June for the French, German and the EZ indices. The French flash services PMI jumped to a 38-month high of 57.4, while the German index surged to a 123-month high of 58.1 in June. The EZ index rose to 58.0, its highest level in 41-month. Markets expect the final prints to register in line with flash results. The uptick was mainly driven by the reopening effect including the continued easing of restrictions and the progress of vaccinations. The EZ flash report noted that business activity in the service sector accelerated at the fastest pace since July 2007. At the same time, prices charged for goods and services rose at an unprecedented rate, as demand continued to outstrip supply.

Meanwhile, the Spanish and Italian services PMIs are also forecast to rise in June to 60.6 and 56.2, respectively. The increase is likely driven by the removal of restrictions and the progress in vaccinations, both allow for international travel within the EU, which provides a boost to the service sector.

UK services PMI seen lower in June

According to the flash services PMI business activity growth is slowing in June. The flash services ticked down to 61.7 in June, down from 62.9 recorded in May. Nevertheless, the index still signals strong expansion of the service sector, driven by the easing of restrictions and higher demand. Markets expect the final reading to register in line with the flash estimate.

Employment improved further in June, with the rate of job creation being only slightly below the record registered 7 years ago. Similar to the manufacturing sector, input prices are rising further in June, which also led to a new record high of selling prices.

The main speakers to follow on Monday include ECB's Christine Lagarde, Andrea Enria and Luis de Guindos.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.