-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

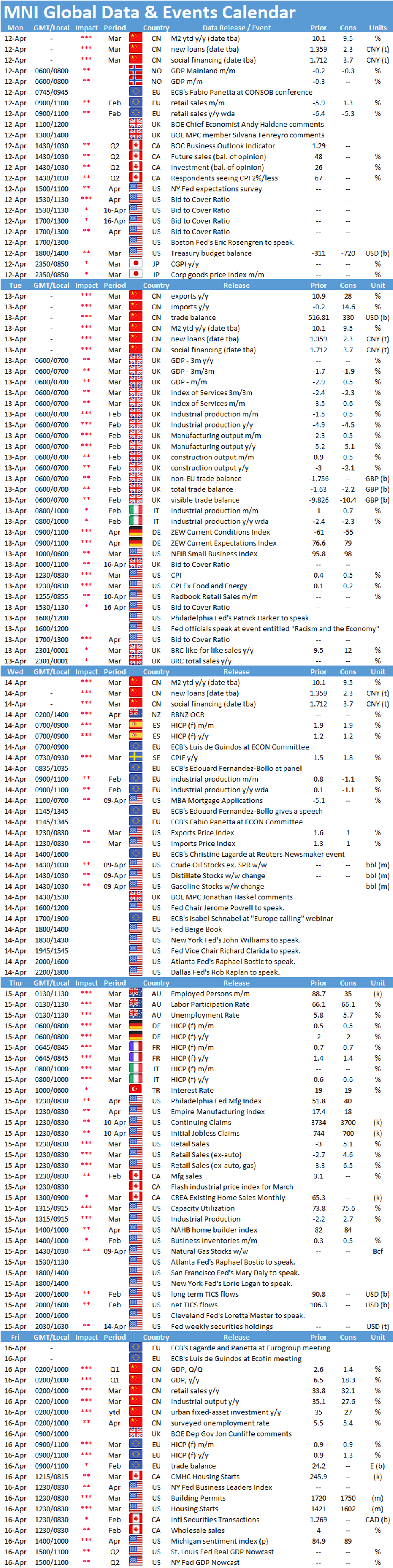

Free AccessMNI Global Week Ahead April 12 - 16

Key Things to Watch:

- Tuesday, April 13 – US CPI

- U.S. CPI is set to increase in March, with markets calling for a gain of 0.5% from 0.4% in February, according to Bloomberg. That'll mostly be driven by surging energy prices.

- Meanwhile, base effects from the start of the pandemic will amplify core inflation, analysts say. Core CPI should rise 0.2% in March following a 0.1% gain in February, and will likely be boosted by increases in travel-related prices like airfare, hotels, and cars.

- Tuesday, April 13 - Friday, April 16 – U.S. Q2 Earnings

- Q2 earnings season kicks off the largest U.S. bank names, with reports from Goldman Sachs, JPMorgan Morgan Stanley, Bank of America, Wells Fargo and Citigroup likely to take focus.

- This keeps the financials sector in focus, with the bulk of the larger reports due on Thursday.

- Wednesday, April 14 – Reserve Bank of New Zealand Policy Decision

- The Reserve Bank of New Zealand's Monetary Policy committee meets Wednesday with no change expected to the official cash rate, which has been held at the historic low of 0.25% since March last year.

- As RBNZ Deputy Governor Geoff Bascand said recently, "economic activity in New Zealand has picked up over recent months," although noting it was still "patchy," suggesting that the central bank will take a cautious approach before moving away from its dovish approach.

- The RBNZ is also mindful that adjusting policy before any of the leading central banks will put upward pressure on the NZD, which has appreciated by just over 15% in the last year to USD70 cents.

- Reflecting the easy policy, policymakers have reintroduced loan to value ratios (LVRs) for mortgages in an attempt to de-risk the booming housing market, which has seen median prices spike 23% in only 12 months.

- Wednesday, April 14 - Speeches from Fed Chair Powell and ECB President Lagarde

- Fed Chair Jerome Powell and ECB's Christine Lagarde speak, at noon EST and 1400 GMT, respectively.

- Investors will look for clues on what "substantial progress" means for the U.S. and comments on the need for fiscal aid and a smoother vaccine rollout in Europe. Powell also has an interview with "60 Minutes" on Sunday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.