-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

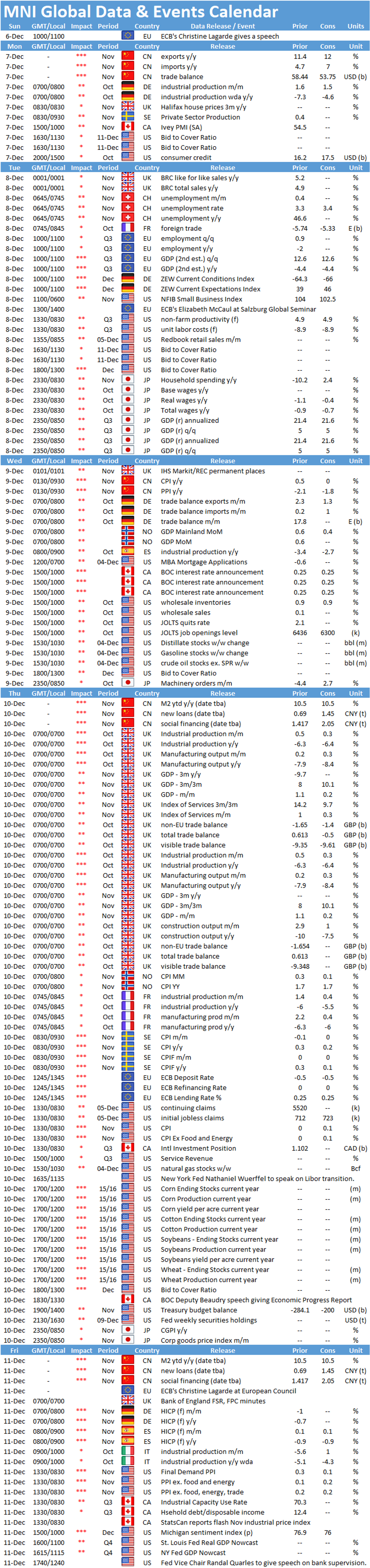

Free AccessMNI Global Week Ahead December 7 - 11

Key Things to Watch:

- Wednesday, December 9 – Bank of Canada Policy Decision

- The Bank of Canada is almost universally expected to hold its benchmark lending rate at 0.25%, leaving more attention on whether policy makers outline any further move to "calibrate" its CAD4 billion a week of asset purchases.

- The BOC scaled back from the CAD5 billion pace at the last meeting in October, and the recent second wave of Covid suggests it would be hard to make another move now.

- Thursday, December 10 – ECB Policy Decision

- The European Central Bank is set to recalibrate policy on Thursday, with all expectations that the main tools of focus for the Governing Council will be on the Pandemic Emergency Purchase Program (PEPP) and the Targeted Long-Term Repo Op (TLTROs).

- It is likely both the size and duration of the PEPP will be boosted, with the total envelope seen at EUR1.85 trillion or more - an increase of at least EUR500 billion. The TLTRO is likely to see changes to duration and possibly even the terms. Other tools could also be amended and used, depending on how the whole working package is seen coming together.

- Alongside the policy decision, the ECB will publish its updated projections. Overall growth for 2020 is seen in line with the September numbers -- with GDP overperforming in Q3 but underperforming in Q4. Inflation expectations will remain well below target all through the projection period through 2023.

- Thursday, December 10 – U.S. Weekly Jobless Claims

- Initial jobless claims filed through December 5 should tick up slightly to 723,000 after slipping to 712,000 through November 28. Initial filings last week were up 506,000 from one year ago, according to the St. Louis Fed.

- Initial claims trended upward through most of last month, but likely overstate the number of actual filings, according to a Government Accountability report released this week. Economists continue to question how accurate the labor department report is as a bellwether of labor market improvement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.