-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UK Inflation Insight: October 2024

MNI UK Inflation Insight: October 2024

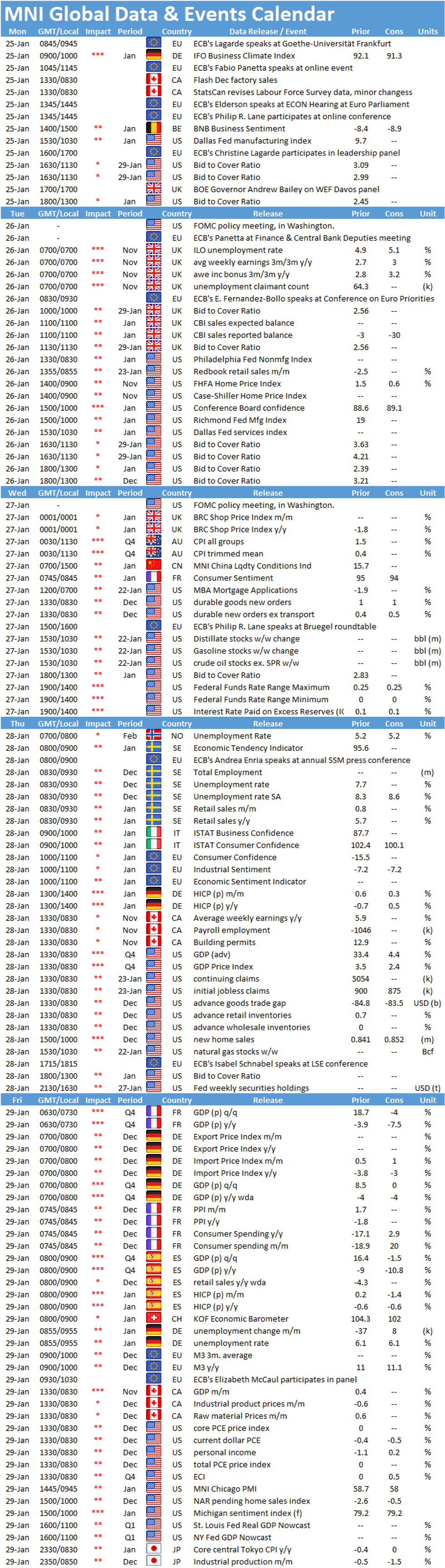

MNI Global Week Ahead January 25 – 29

- Monday, January 25 – German IFO

- Ifo business climate indicator is expected to ease slightly in January after rising modestly the previous month. Markets are looking for a downtick to 91.3, after December's 92.1.

- Last month's survey noted companies are more optimistic about the next six months and are more satisfied with their current situation. Nevertheless, the lockdown is hitting specific sectors hard and the German government recently prolonged its national lockdown until mid-February.

- In January, current conditions are expected to tick down 0.8 points to 90.5, while economic sentiment is seen higher at 93.5, up from December's reading of 92.8. Similar survey evidence suggests an upside risk. The ZEW expectations index rose to the highest level since September, while current conditions improved marginally. Meanwhile, the Senitx expectations index rose to an all-time high.

- Wednesday, January 27 – FOMC Policy Meeting

- The Federal Reserve is expected to leave its policy settings unchanged Wednesday, promising to keep buying USD120 billion in Treasuries and mortgage assets a month until fresh fiscal relief and wide dissemination of Covid vaccines bring palpable improvements to jobs and inflation.

- Since their December policy meeting, risks have shifted to the upside on additional fiscal support and the prospect of millions getting vaccinated by summer even as economic data has taken a turn for the worse.

- Despite a flurry of talk about beginning to taper asset purchases as soon as this year, current and former Fed officials told MNI the Fed would have to see a significant shift in the economy's trajectory for any unwinding of QE.

- Thursday, January 28 – U.S. Q4 GDP (First Estimate)

- U.S. GDP likely grew by an annualized 4.3% in Q4 after rebounding a record 33.4% in Q3, according to the Bloomberg consensus. Although the economy began to lose its footing in the last quarter of 2020 as Covid-19 infection rates picked up again, momentum from earlier months should keep GDP growth positive.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.