-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

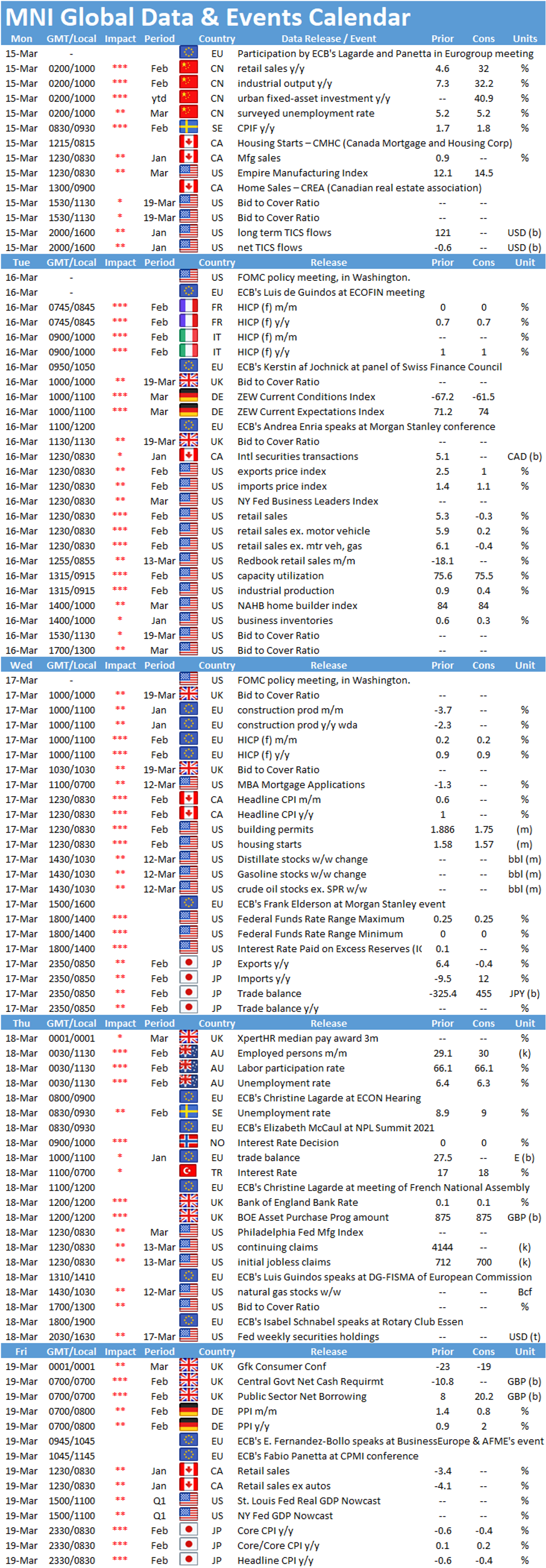

Free AccessMNI Global Week Ahead March 15 - 19: Central Banks In Focus

Key Things to Watch:

- Wednesday, March 17 - FOMC policy decision

- The Fed will likely repeat that it remains far from meeting employment and inflation goals and that it will be some time before it starts winding down QE,

- Investors looking for an "Operation Twist"-style switch to longer-dated bond buying to cap Bond yield are likely to be disappointed, former officials have told MNI,

- The FOMC could raise the rates it pays on excess reserves and overnight repurchase agreements to support short-end rates as the Treasury releases over a trillion dollars in reserves into the financial system.

- Thursday, March 18 - BOE policy decision

- For the BOE's Thursday meeting markets expect unanimous votes for both the total target stock of QE and the rate decision. However, there is disagreement about how the MPC will respond to the fixed income sell-off. There has been very little commentary from MPC members about the sell-off (in contrast to other central banks).

- This could potentially see an announcement that the pace of purchases could be reduced (in contrast to the pickup in purchase pace announced by the ECB last week).

- Some analysts expect the MPC could warn that the tightening of financial conditions has been "unwarranted", potentially setting up an announcement of an increase in the target stock of QE in May or the summer. Others think that the MPC will point to the better economic outlook, extra stimulus from the Budget and progress being made on the vaccination front and not sound too concerned about the increase in yields.

- Friday, March 19 - BOJ Policy Decision

- The Bank of Japan looks set to formalize the trading band currently tolerated for 10-year JGBs.

- The BOJ will also likely clarify its stance on purchases of Exchange Traded Funds at the March meeting, as it prepares to tweak and not radically overhaul its strategy when policymakers finally lay out the conclusions of the policy review set up in November.

- Main policy settings are expected to be left unchanged.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.