-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

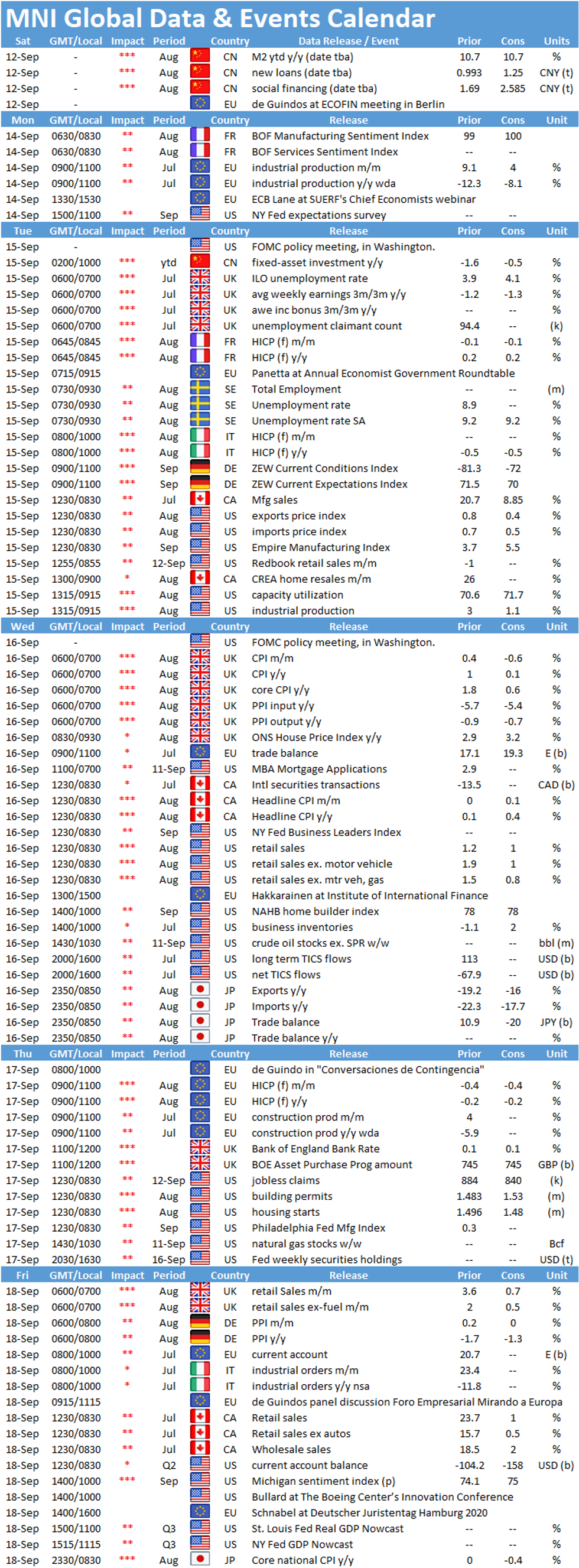

Free AccessMNI Global Week Ahead September 14 - 18

Key Things to Watch For:

- Wednesday, September 16 – U.S. Retail Sales

- U.S. retail sales likely rose 1.2% in August, the same as July, losing momentum from earlier in the summer.

- Vehicle sales should increase in August, evidenced in part by surging used car and truck prices in Friday's CPI report. Gas prices also rose in August, which should give a boost to gas station sales

- Excluding motor vehicle sales, retail sales should increase 1.1%. Excluding both vehicle and gas station sales, retail sales should also rise 1.1%.

- Wednesday, September 16 – FOMC Policy Meeting

- Fed set to issue new forecasts extending out to 2023, making these and estimates for the path of interest rates central to this meeting.

- This month's policy meeting comes with an unusual level of doubt about what else the Fed might deliver--some in markets have argued forward guidance is imminent, but MNI has exclusively reported that policymakers are likely not ready to deliver it.

- Fed watchers will be paying close attention to any changes to the Fed's July statement that economy and employment "picked up somewhat in recent months but remained well below their levels at the beginning of the year."

- Powell will likely face questions on future Fed action, the lack of a new fiscal stimulus and dollar weakness, among other themes, during his press conference.

- Thursday, September 17 – Bank of England Policy Decision

- The Bank of England's Monetary Policy Committee policy decision is due Thursday and expectations are for rates to remain on hold at 0.1%, with the stock of QE maintained at a combined GBP745 billion.

- All focus will be on the minutes and any comments offered by the governor Andrew Bailey following the meeting, although as of now, there is no confirmation of a press briefing post-meet. The messages have been mixed from policymakers in recent weeks, with Chief Economist Andy Haldane leading a fairly upbeat charge on the data that has come through so far after the trough of April and May.

- However, others, including external member Michael Saunders, have appeared less upbeat and certainly see the threat of the growing downside risks building particularly on the employment front.

- So on balance no policy action expected, although any commentary could appear to be on the dovish side, with a possible hint towards further policy action later in the year.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.