-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI MARKETS ANALYSIS: Markets Look For New Keys

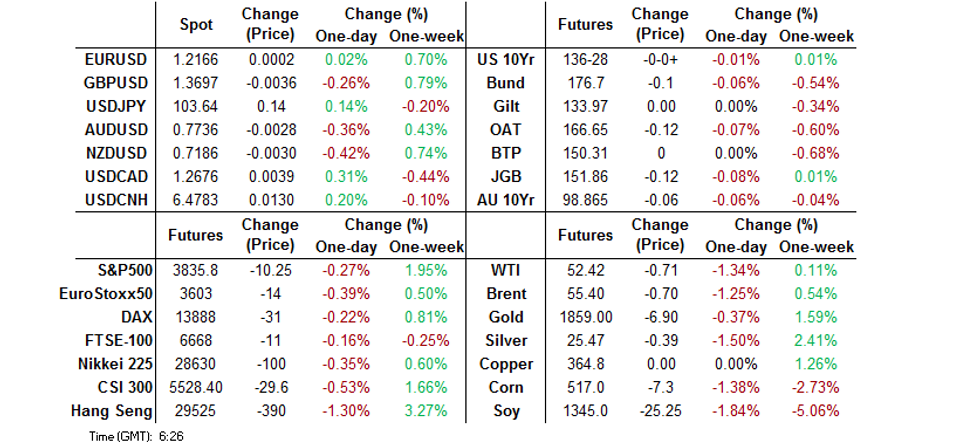

- Option expiries may anchor T-Notes on Friday, while fresh TYJ1 downside interest was observed overnight.

- USD firmer into European hours.

- Markets continued to balance mixed COVID news flow, with a lack of major macro keys to trade off in Asia.

BOND SUMMARY: Flat To Softer For Core FI In Asia

Macro news flow has been mixed since the Tokyo re-open, with some positive vaccine news (albeit some of which was more a case of trials running on schedule) countered by reports of impending partial district lockdowns in Hong Kong. U.S. Tsys held to narrow ranges in Asia-Pac hours, with focus on the large nearby TYG1 option OI at the 137.00 strike ahead of today's February option expiry, with delta hedging plays having the ability to limit price swings on Friday. Elsewhere in the options space, 10-Year Tsy options saw fresh downside interest via a 10K block of the TYJ1 138.00/133.00 risk reversal, buying the puts to sell the calls, targeting a ~32bp uptick in yields over the life of the contract. Remember that we saw a 10K block of the TYJ1 138.00/133.50 risk reversal during Asia hours earlier this week (in the same direction), although today's flow saw 4.0K of the FVH1 futures lifted at the same time. T-Notes last unch. at 136-28+, holding to a 0-03+ range, with cash Tsy yields little changed. We also saw a 20K screen buyer of EDU1/Z1 in Asia, with Eurodollar futures running within 0.5 tick of settlement levels through the reds. Locally, flash PMIs & existing home sales data is due on Friday.

- Mixed performance was seen across the JGB curve, with 7s underperforming surrounding paper as futures sold off. The latter closed 12 ticks softer vs. Thursday settlement. The long end also saw some light cheapening. Little in the way of major news flow has crossed during Tokyo hours, with most of the local focus falling on speculation surrounding the potential cancellation of this year's Tokyo Olympics. Re: that matter, PM Suga has stressed that he wants the event to go ahead, with various officials stating that the games will be held. Elsewhere, the major national CPI metrics moved further into deflationary territory in December.

- Aussie bonds traded on the defensive, adding to overnight weakness, even with a strong ACGB tender and DV01-light weekly issuance slate from the AOFM becoming apparent. There appeared to be some spill over from across the ditch with the NZGB space seeing some cheapening on the back of firmer than expected NZ CPI data and heavy offer/cover ratios in the latest round of RBNZ NZGB purchases. YM -1.0, XM -6.0 at the bell, with the cash curve steepening and swap spreads unchanged to narrower across the curve. A$ supply saw IADB price $A300mn of Aug '28 paper.

FOREX: Risk-Off Feel Pulls Rug From Beneath NZD, Negating Post-CPI Bid

NZD posted a leg higher in the U.S./Asia crossover after a strong Q4 CPI report released out of NZ inspired the unwinding of RBNZ easing bets, with Kiwibank joining Westpac in backpedalling on their earlier calls for OCR reductions this year. Elsewhere, sizeable offers & firm cover ratios at the RBNZ's latest QE operation generated a tailwind for 10-Year NZGB yield, helping keep the kiwi afloat in early Asia-Pac trade. Focus then turned to the RBNZ's Q4 sectoral factor model inflation, which accelerated for the first time in a year, but the kiwi faltered nonetheless as light risk aversion crept in and rendered NZD the worst G10 performer. NZD/USD more than erased its post-CPI jump through the rest of the session, before establishing itself just shy of $0.7200.

- Headline flow focused on Covid-19 mitigation measures, including Hong Kong's decision to lock down part of the city and potential UK/French curbs on inbound international travel.

- AUD lost altitude alongside its Antipodean cousin, with a miss in Australian retail sales adding weight to the currency. AUD/USD snapped a three-day winning streak, but struggled to stage a clean break below prior intraday low.

- CAD & GBP also fell prey to broader risk aversion. USD/CAD advanced after charting a bullish Harami cross candlestick pattern yesterday, while cable pulled back from best levels since 2018.

- USD/JPY wavered within a tight Y103.49-61 range, ahead of the expiry of $1.0bn worth of options with strikes at Y103.40-50 at today's NY cut. Local news flow centred around rumours about potential cancellation of the Tokyo Olympics, with organisers to make the decision by end-March.

- The PBOC fixed USD/CNY at CNY6.4617, the banks liquidity injections matched withdrawals today despite repo rates creeping up. A stronger greenback has helped firm USD/CNH despite the lower fix. The fix was once again above sell side estimates, indicating the PBOC asymmetric response function.

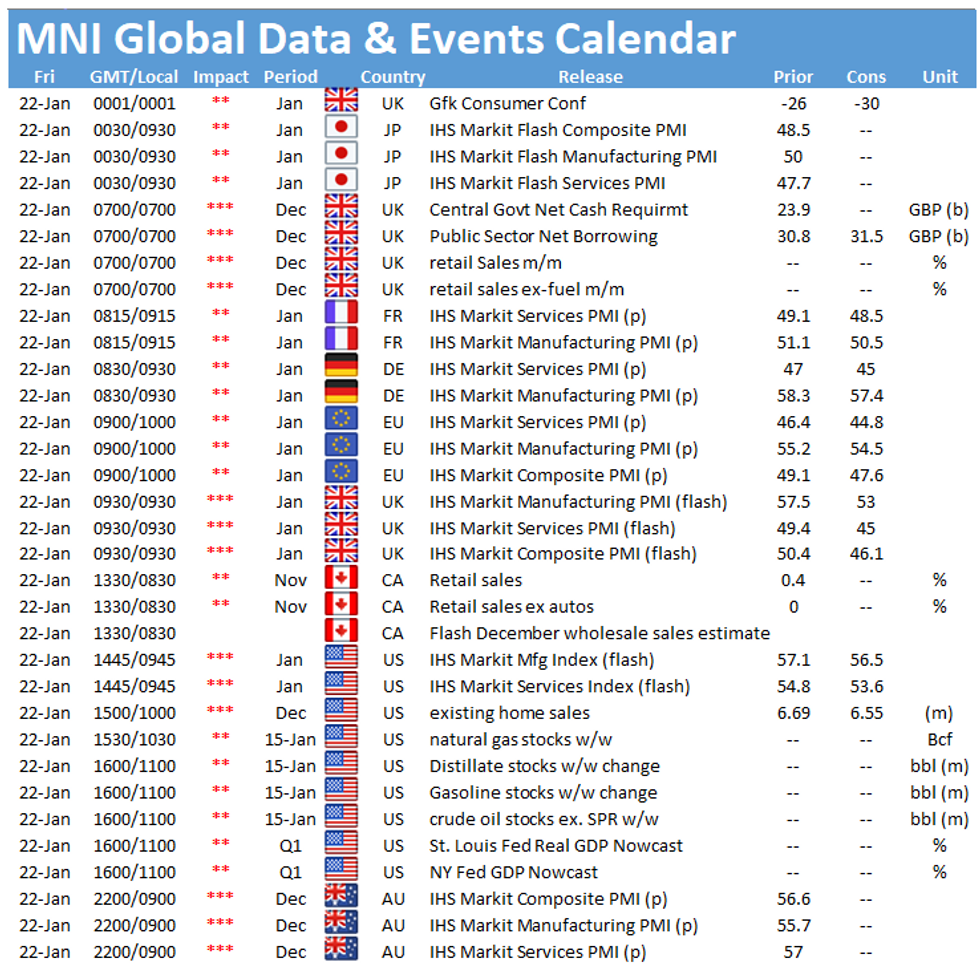

- Focus turns to a slew of PMI surveys, U.S. existing home sales, UK & Canadian retail sales as well as ECB Survey of Professional Forecasters.

FOREX OPTIONS: Expiries for Jan22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E758mln), $1.2160-70(E432mln-EUR puts), $1.2275(E1.95bln)

- USD/JPY: Y103.25-30($801mln), Y103.40-50($1.0bln-USD puts), Y103.80-00($666mln)

- USD/NOK: Nok8.50($660mln-USD puts), Nok8.90($600mln)

- AUD/USD: $0.7630-35(A$820mln-AUD puts), $0.7765-80(A$770mln-AUD puts)

- AUD/JPY: Y78.75(A$660mln-AUD calls), Y79.00(A$456mln-AUD calls)

- USD/CAD: C$1.2600($569mln), C$1.2700($672mln-USD puts), C$1.2900-10($644mln)

- USD/CNY: Cny6.50($655mln-USD puts)

ASIA FX: Week Ends With A Bout Of Risk Aversion

Risk off flows on renewed coronavirus concerns dominated the session as euphoria around Biden's inauguration as US President faded.

- USD/CNH up 69 pips at 6.4720 despite a lower fix as USD finds a bid. The fix was once again above sell-side estimates, indicating the PBOC asymmetric response function.

- USD/SGD up 14 pips at 1.3241. Despite the pullback SGD is on track for a weekly gain, the first increase in three weeks.

- USD/TWD last at 27.96, matching session lows yesterday, participants eye upcoming employment data with an eye to close below 28.00.

- USD/HKD up 2 pips at 7.7519. Equity markets in Hong Kong took a beating today after reports of a lockdown in Kowloon as the Covid-19 situation deteriorates.

- USD/KRW up 4.35 at 1102.50, the won snapping a 3-day winning streak.

- USD/IDR has crept higher and last trades up 45 pips at 14,045, chewing into yesterday's losses. Participants digested comments from BI Gov Warjiyo, who signalled potential for further policy easing, as well as a record daily tally of deaths from Covid-19.

- USD/PHP up 25 pips at 48.065. The rate is poised to finish the week on a slightly firmer footing, albeit it remains trapped within a familiar range just above the 48.00 mark.

- USD/THB 43 pips at 29.965, data showed exports rose above estimates, while the trade surplus also beat forecasts. The Commerce Ministry said THB was a risk factor this year, and said it could strengthen or stabilize.

- USD/MYR up 83 pips at 4.0365. CPI fell 1.4%, slightly worse than estimates for -1.3%. FinMin Zafrul noted that Malaysia is on the right path to economic recovery, as monetary, fiscal and epidemiological measures working together to support national economy.

EQUITIES: Asia Bourses Finish The Week On A Negative Note

Risk off flows saw equity markets in Asia decline to end the week. The Hang Seng was under pressure, down circa. 1.5% after reports that Hong Kong was to lock down part of the Kowloon district due to a worsening coronavirus outlook. Several other countries in the eastern hemisphere have announced plans to tighten containment measures, even as many in the region prepare to celebrate Lunar New Year.

- Coronavirus concerns are weighing on risk assets globally as Biden inauguration euphoria subsides. There are reports that France will require all visitors to have a negative Covid-19 test, while in the UK ministers are reportedly pushing for Britain's borders to be closed as several countries in Europe report the deadliest day of the pandemic so far. US and European futures have moved lower as risk assets take a beating. E-mini S&P last down around 13 points at 3833.

GOLD: Familiar Levels

Gold has stuck to a tight range over the last 24 hours, cushioned by the latest dip in U.S. real yields and a softer DXY, although bulls have failed to extend on the recent gains, leaving spot dealing around $1,865/oz.

OIL: Risk Off Exerts Downward Pressure On Commodities

Commodities were casualties of a risk off session in Asia; WTI last down $0.66 at $52.47, while brent is down $0.63 at $55.47.

- Coronavirus concerns are weighing on risk assets as Biden inauguration euphoria subsides. There are reports that France will require all visitors to have a negative Covid-19 test, while in the UK ministers are reportedly pushing for Britain's borders to be closed as several countries in Europe report the deadliest day of the pandemic so far.

- The eastern hemisphere has its own set of issues, Hong Kong announced plans to lock down part of the Kowloon district due to a worsening coronavirus outlook. Several cities in mainland China have already imposed travel restrictions ahead of Lunar New Year.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.