-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 4

by Tom Lake

Today's Major COVID-19 Headlines And Latest Data

- India recorded the highest number of COVID-19 fatalities globally on August 3 for the first time, while the country's number of recorded cases rose by over 50,000. The large number of cases means India's mortality rate remains low at around 2.1/100 cases, compared to 3.3 in the US, 5.3 in China, and 15.1 in the UK. Despite the rise in case numbers, gyms and yoga centres are the latest sectors in line to reopen as the government seeks to encourage an economic recovery.

- UN Secretary-General Antonio Guterres has said the closure of schools worldwide due to COVID-19 is a "general catastrophe", and that getting children back in education must be the world's "top priority" once the pandemic is over. Many children in Germany are returning to school today, but over 160 countries have closed schools in recent months, something Guterres says will "undermine decades of progress, and exacerbate entrenched inequalities."

- A minimum of 41 individuals have tested positive for COVID-19 on the Norwegian cruise liner the MS Roald Amundsen, sparking the Norwegian government to stop all cruise ships with 100+ passengers disembarking within 14 days of docking. Cruise operators around the world have been hit hard by the pandemic, with only nascent signs of a recovery emerging. The Diamond Princess gained worldwide attention in February as a location of one of the first outbreaks outside China.

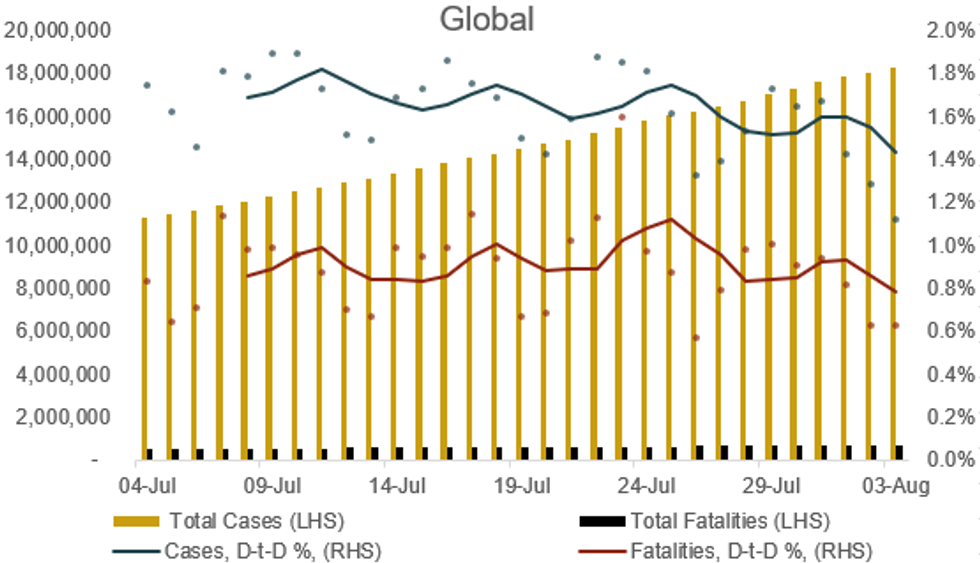

- Global increase in cases (daily) – Yesterday: 1.1%. Seven-day average: 1.5%

- Global increase in fatalities (daily) – Yesterday: 0.6%. Seven-day average: 0.8%

MNI INTERVIEW: Fed Real-Time Labor Index Sees July Jobs +1.5M - The U.S. economy likely recouped just 1.5 million jobs in July as hiring slowed sharply amid a surge in Covid-19 cases, according to a St. Louis Fed real time labor market index that accurately predicted the surprise rebound in employment in May and June, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI. On MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0800BST August 4. N.b. Each dot represents a single day's figures, data for past month

Source: JHU, MNI. As of 0800BST August 4. N.b. Each dot represents a single day's figures, data for past month

Full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 4.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.