-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Italy Election Preview

Executive Summary

Italy holds a snap general election on Sunday 25 September, with the vote holding the potential to deliver the most right-wing government to Rome in a generation. The previous ‘grand coalition’ government of Prime Minister Mario Draghi collapsed in July after the largest party withdrew its support. With Italy sitting as the third largest eurozone economy, the identity of its next government will have significant ramifications for EU policy making in areas as varied as energy policy, fiscal policy, and the bloc’s support for Ukraine.

- The centre-right coalition of parties looks set to secure a majority in both chambers of the Italian parliament. The right-wing nationalist Brothers of Italy likely to lead this bloc, with party head Giorgia Meloni on course to become prime minister. The government would be the most avowedly right-wing Italian administration in decades.

- Meloni in particular has sought to calm markets and European observers with more conciliatory rhetoric towards areas such as EU fiscal rules and continued support for Ukraine. There remain concerns that the presence of Matteo Salvini’s League and Silvio Berlusconi’s Forza Italia in government could lead to weaker Italian support for sanctions on Russia and a more combative stance with Brussels.

- Parties of the centre-left, notably the historically dominant Democratic Party, look set for a period on the political sidelines. Meanwhile the 5-Star Movement – which was the largest single party in the last election – risks falling to the status of a minor party.

In this preview we offer a briefing on the amended Italian electoral system, key timings for the vote, a guide on the main parties contesting the election, an opinion polling chartpack, post-election scenario analysis (with assigned probabilities), sell-side research views, and our latest MNI Policy content on the Italian election.

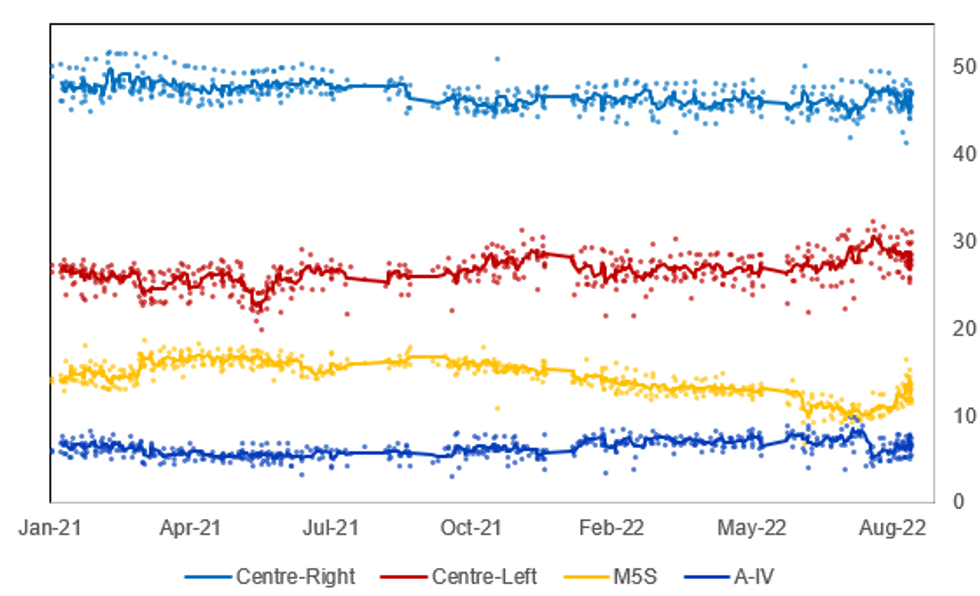

Chart 1. Italian Election Opinion Polling by Coalition, % and 6-Poll Moving Average

Source: Piepoli, BiDiMedia, Quorum-YouTrend, SWG, Lab2101, Cluster17, IZI, Termometro Politico, Tecne, Euromedia, Noto, Index Research, GDC, EMG, Demos & Pi, Demopolis, Ipsos, CISE, Ixe, MNI. N.b. Prior to Aug 2022, Action and Italia Viva data compiled by combining two separate parties’ support.

Source: Piepoli, BiDiMedia, Quorum-YouTrend, SWG, Lab2101, Cluster17, IZI, Termometro Politico, Tecne, Euromedia, Noto, Index Research, GDC, EMG, Demos & Pi, Demopolis, Ipsos, CISE, Ixe, MNI. N.b. Prior to Aug 2022, Action and Italia Viva data compiled by combining two separate parties’ support.

Full article attached below:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.